Kearney County Deed of Full Reconveyance for Deed of Trust Form

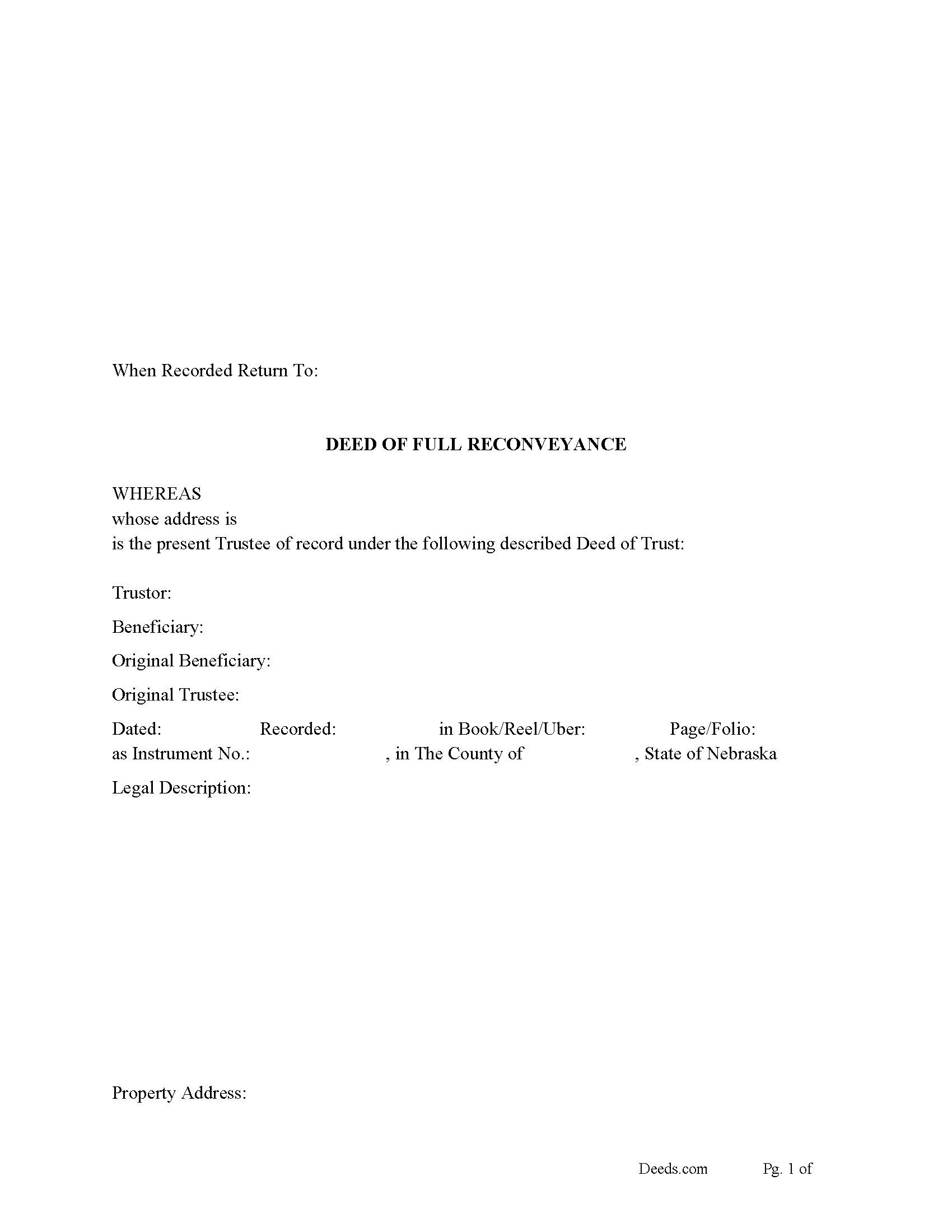

Kearney County Deed of Full Reconveyance Form

Fill in the blank form formatted to comply with all recording and content requirements.

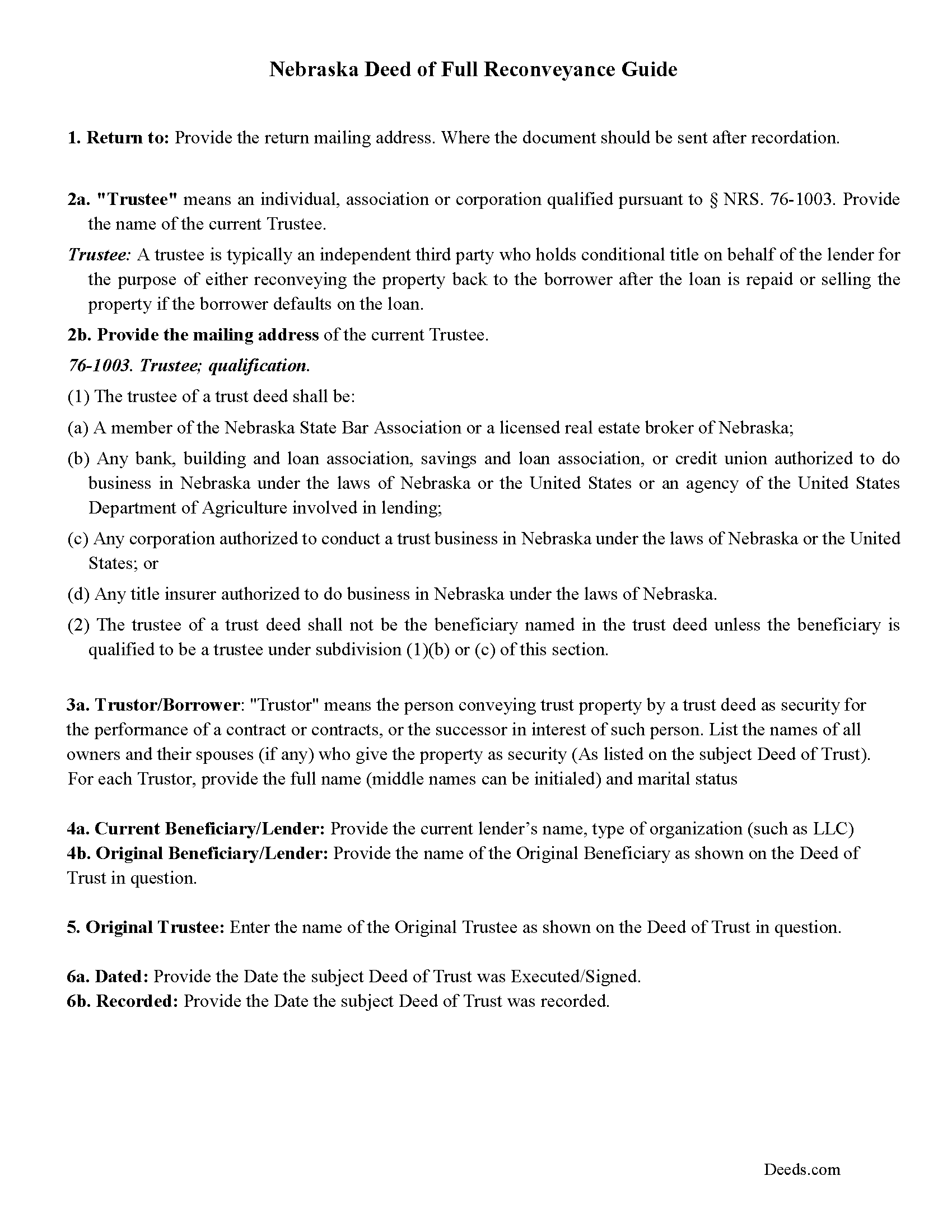

Kearney County Deed of Full Reconveyance Guide

Line by line guide explaining every blank on the form.

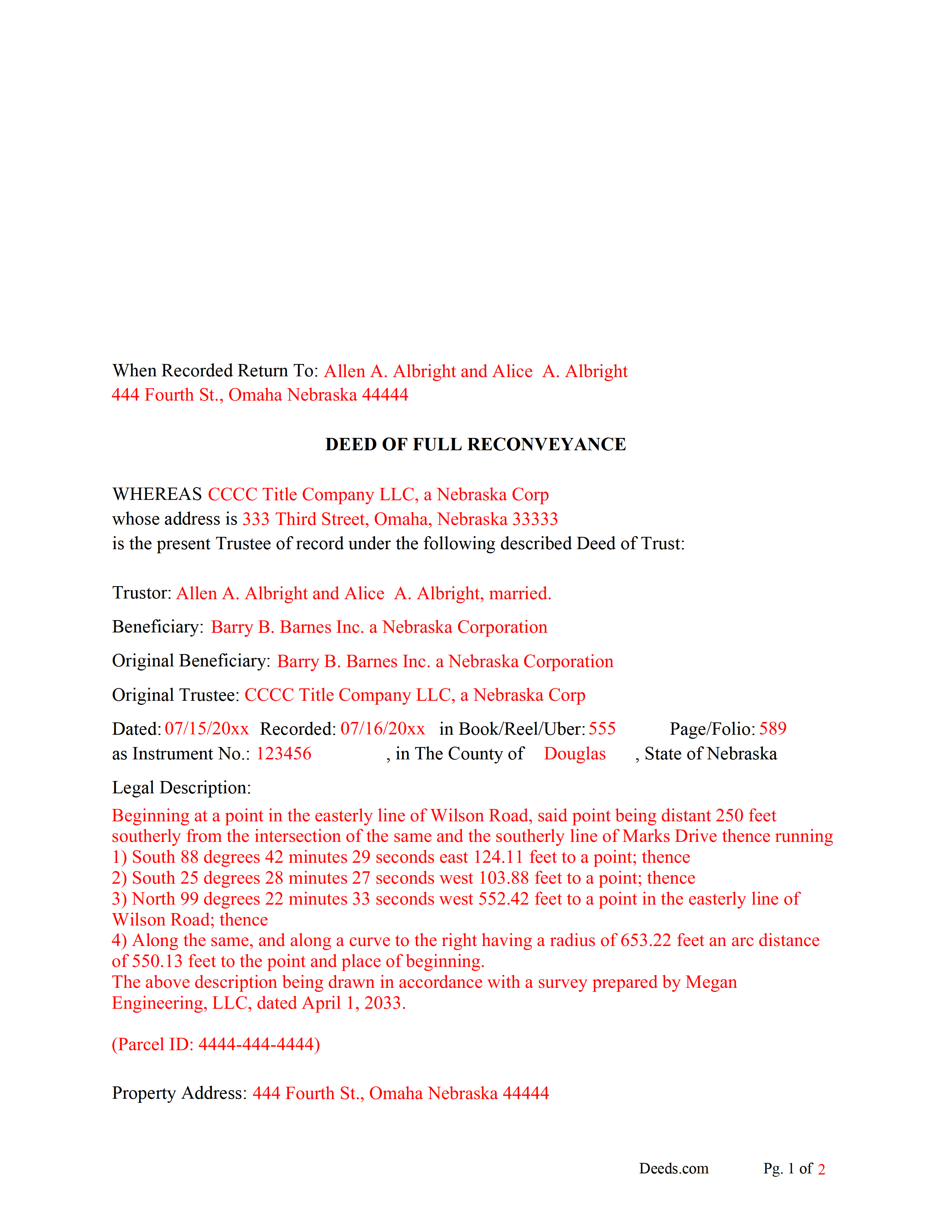

Kearney County Completed Example of the Deed of Full Reconveyance Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Kearney County documents included at no extra charge:

Where to Record Your Documents

Kearney County Register of Deeds

Minden, Nebraska 68959

Hours: 8:30 to 5:00 M-F

Phone: (308) 832-2723

Recording Tips for Kearney County:

- Bring your driver's license or state-issued photo ID

- Ask about their eRecording option for future transactions

- Avoid the last business day of the month when possible

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Kearney County

Properties in any of these areas use Kearney County forms:

- Axtell

- Heartwell

- Minden

- Wilcox

Hours, fees, requirements, and more for Kearney County

How do I get my forms?

Forms are available for immediate download after payment. The Kearney County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kearney County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kearney County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kearney County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kearney County?

Recording fees in Kearney County vary. Contact the recorder's office at (308) 832-2723 for current fees.

Questions answered? Let's get started!

When a Deed of Trust has been paid in full the beneficiary/lender is responsible to deliver (a reconveyance in recordable form duly executed by the trustee) to the trustor/borrower. (Any beneficiary who fails to deliver such a reconveyance within sixty days after receipt of such written request shall be liable to the trustor or his or her successor in interest, as the case may be, for five thousand dollars or actual damages resulting from such failure, whichever is greater.) (76-1014.01)

(If a trustee fails or refuses to execute a reconveyance required by the beneficiary, the beneficiary shall appoint a successor trustee that will execute a reconveyance.) (76-1014.01)

This form can be used by the original beneficiary/lender or current beneficiary/lender- original trustee or current trustee,

(Nebraska DOFR Package includes form, guidelines, and completed example) For use in Nebraska only.

Important: Your property must be located in Kearney County to use these forms. Documents should be recorded at the office below.

This Deed of Full Reconveyance for Deed of Trust meets all recording requirements specific to Kearney County.

Our Promise

The documents you receive here will meet, or exceed, the Kearney County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kearney County Deed of Full Reconveyance for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Jesse B.

December 23rd, 2018

Bought a quit claim deed form. Came with great instructions that were easy to follow and allowed me to do it over a couple of times until I got it right. Was also cheaper than most other options I found online.

Thank you for your feedback. We really appreciate it. Have a great day!

Stuart C.

April 29th, 2019

Quit, clear, simple...just the way it shouldbe! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan S.

July 28th, 2020

The actual transfer of deed form seems to be the only one not fillable in Adobe. Seems odd.

Thank you!

janna C.

January 11th, 2023

Great site! I found everything I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judy C.

February 13th, 2019

Both sets of deeds were complete and easy to understand. Both states accepted the forms to transfer property.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dave S.

May 1st, 2019

Easy to use and get forms I needed. Corporate need for an invoice/receipt could be a bit easier - have to print screen to get any info.

Thank you for your feedback Dave, we really appreciate it.

Sherri P.

May 6th, 2020

I thought it was easy, but I wish it were faster. I uploaded my document Monday night (after 5pm) and got my invoice the next morning Tuesday paid it right away. and my document was not sent to me as recorded until Wednesday morning even though it was recorded the day earlier at 8:30am. So there was a delay of almost 24 hours letting me know that my document was recorded. So if they could speed that up so that we knew exactly when it got recorded immediately I would give it a million stars

Thank you!

Vallie D.

February 22nd, 2021

Very easy to navigate website. Quick filing, great communication. Saved me hundreds of dollars vs. filing through the escrow service

Thank you for your kind words Vallie, glad we could help. Have an amazing day!

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Christine L.

May 17th, 2020

I was very pleased with your service. You got me the information I required within one day. Thank you!

Thank you!

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Lori N.

August 16th, 2022

I ordered the document I needed and it was available for download within a half hour. Very pleased, thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa C.

July 2nd, 2020

Great. Thank you. Received information quickly. Helped out a lot.

Thank you!

Donna O.

March 6th, 2020

Quick and easy to use. I was able to download the Transfer on Death Deed form to my computer so that I can read through and fill them out at a later time. That made it convenient and "no pressure". The complimentary guide and completed example that came with the form was also very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!