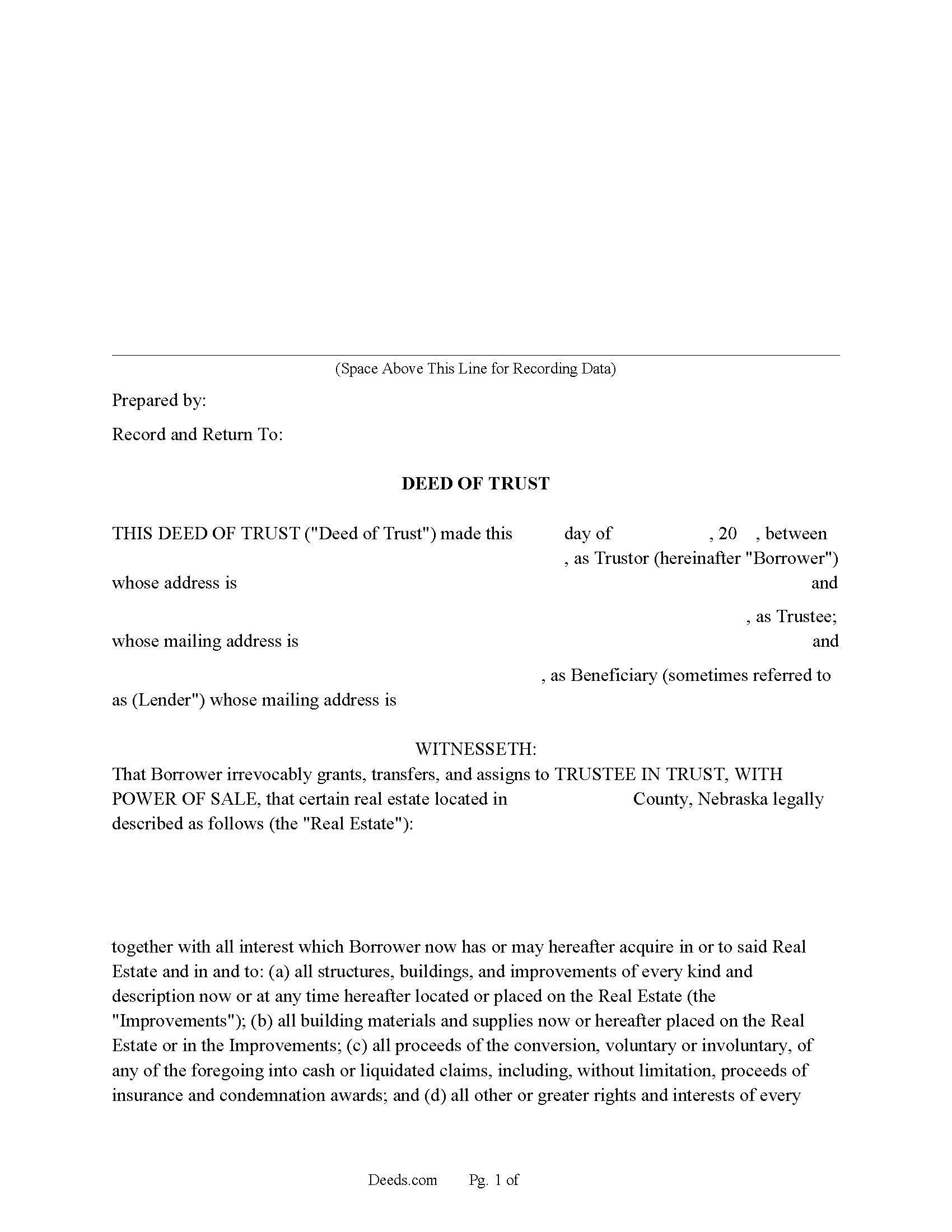

Keya Paha County Deed of Trust Form

Keya Paha County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

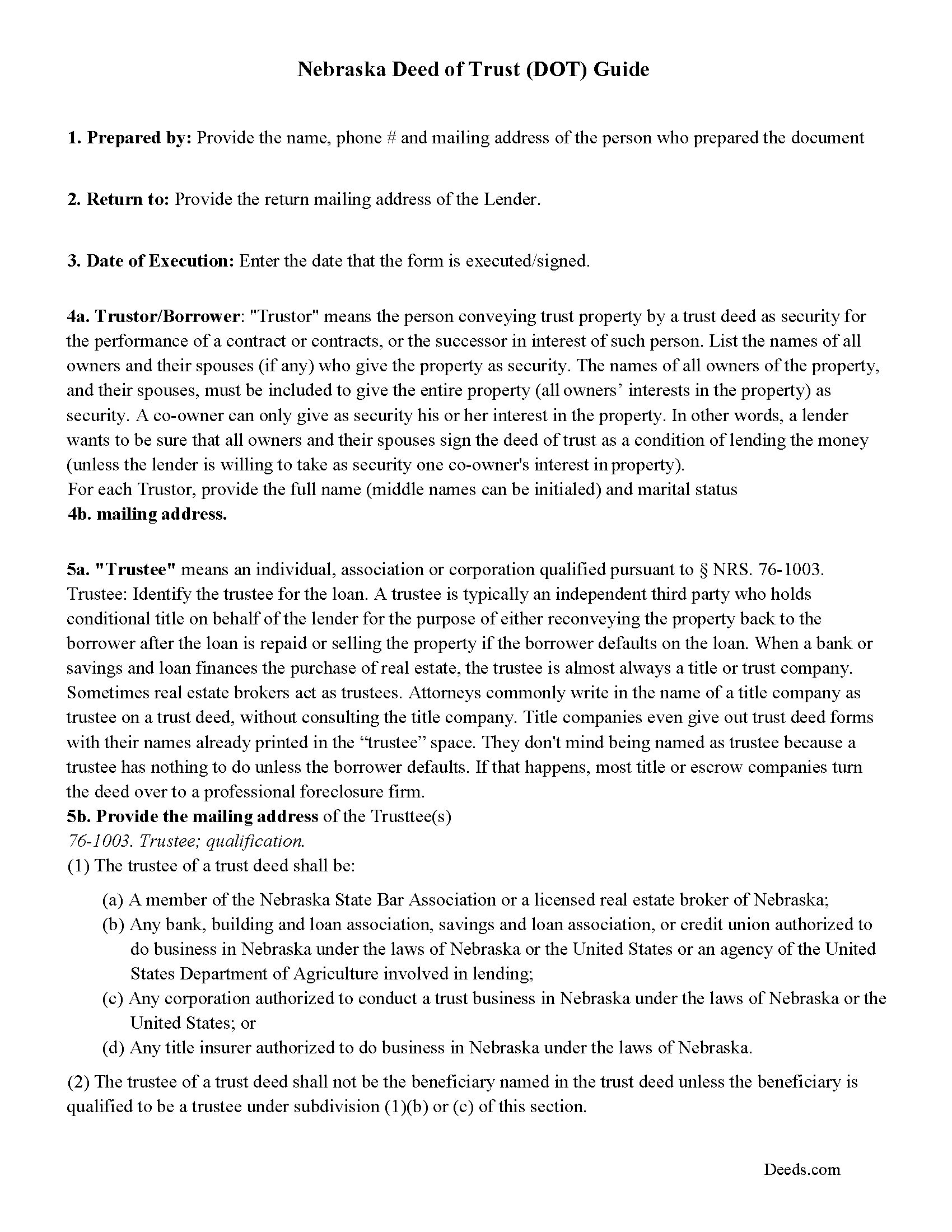

Keya Paha County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

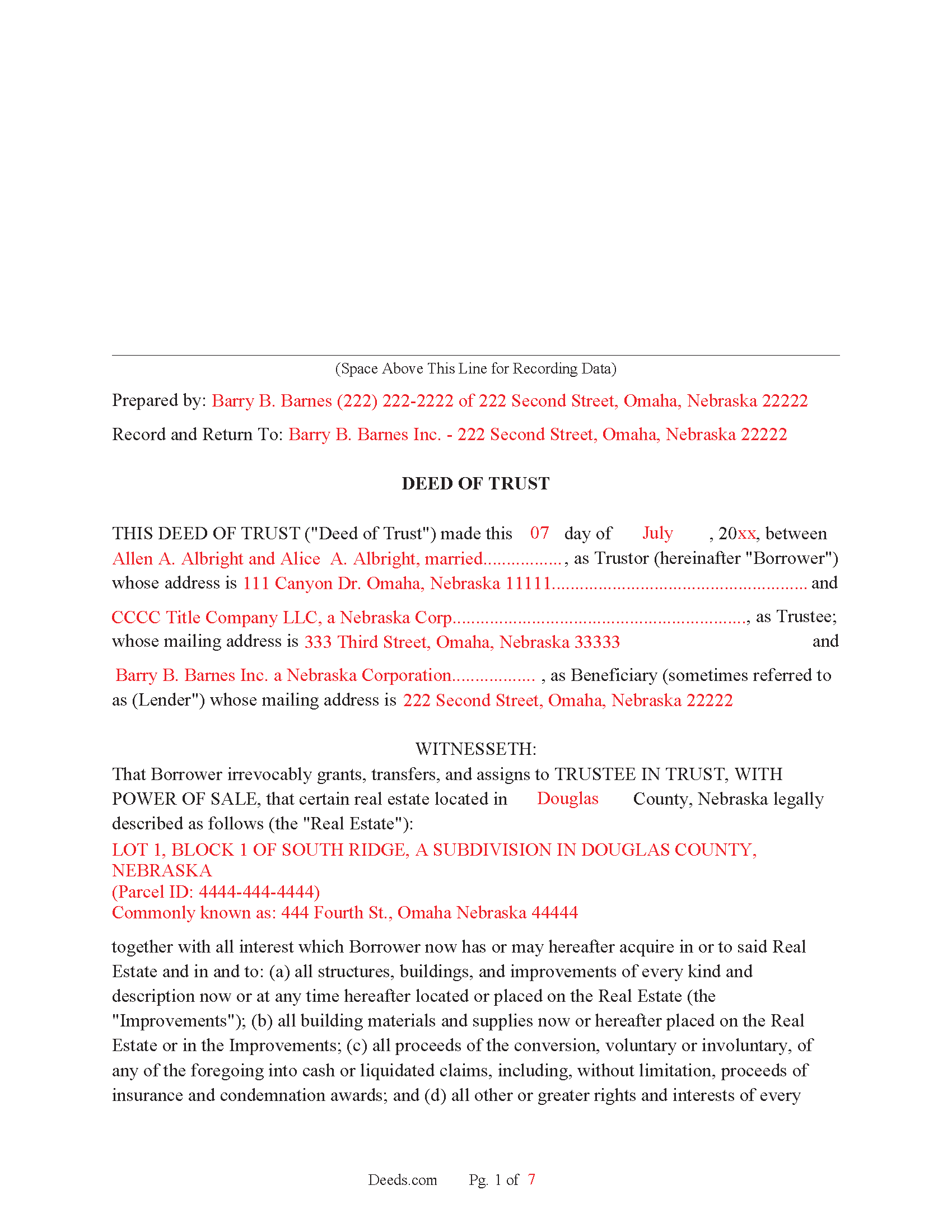

Keya Paha County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

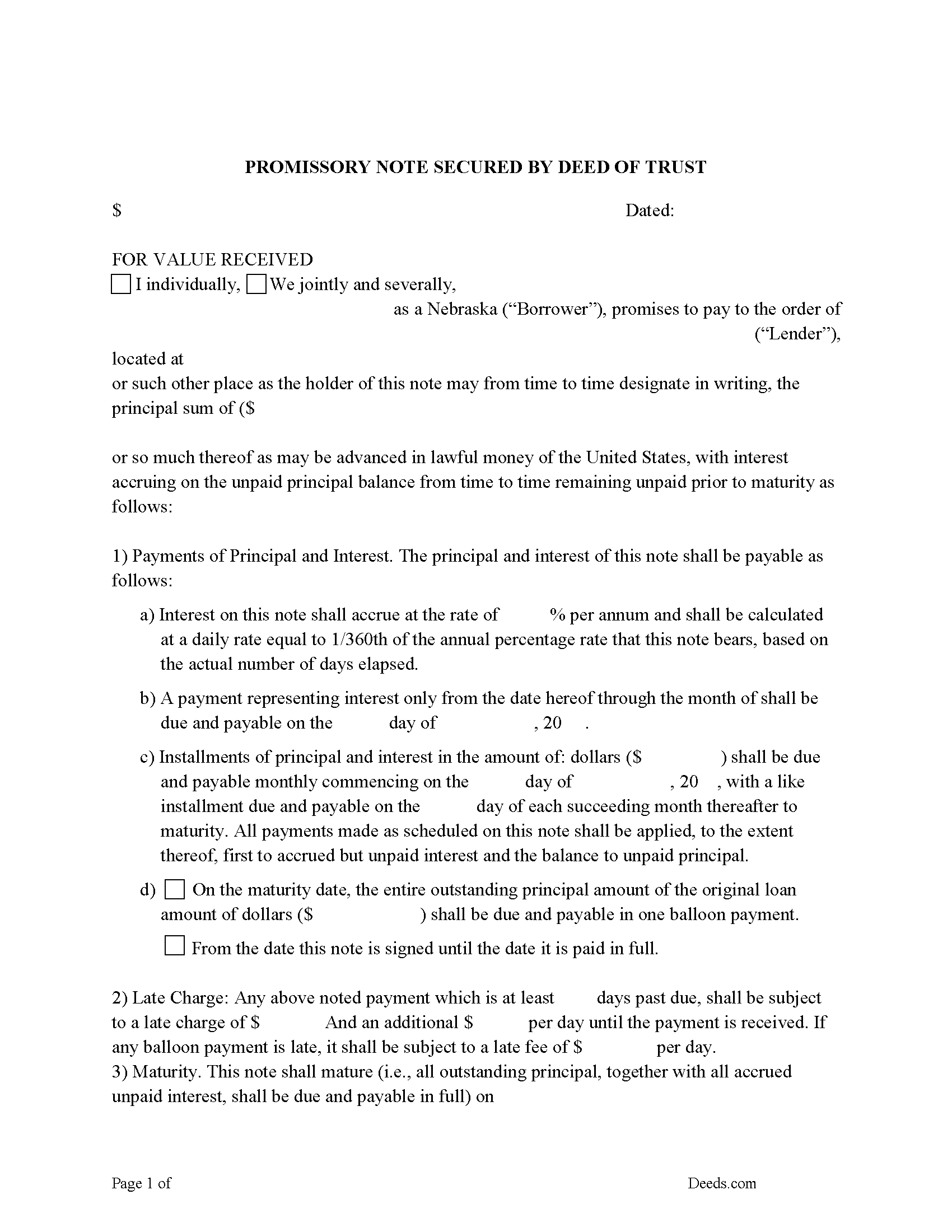

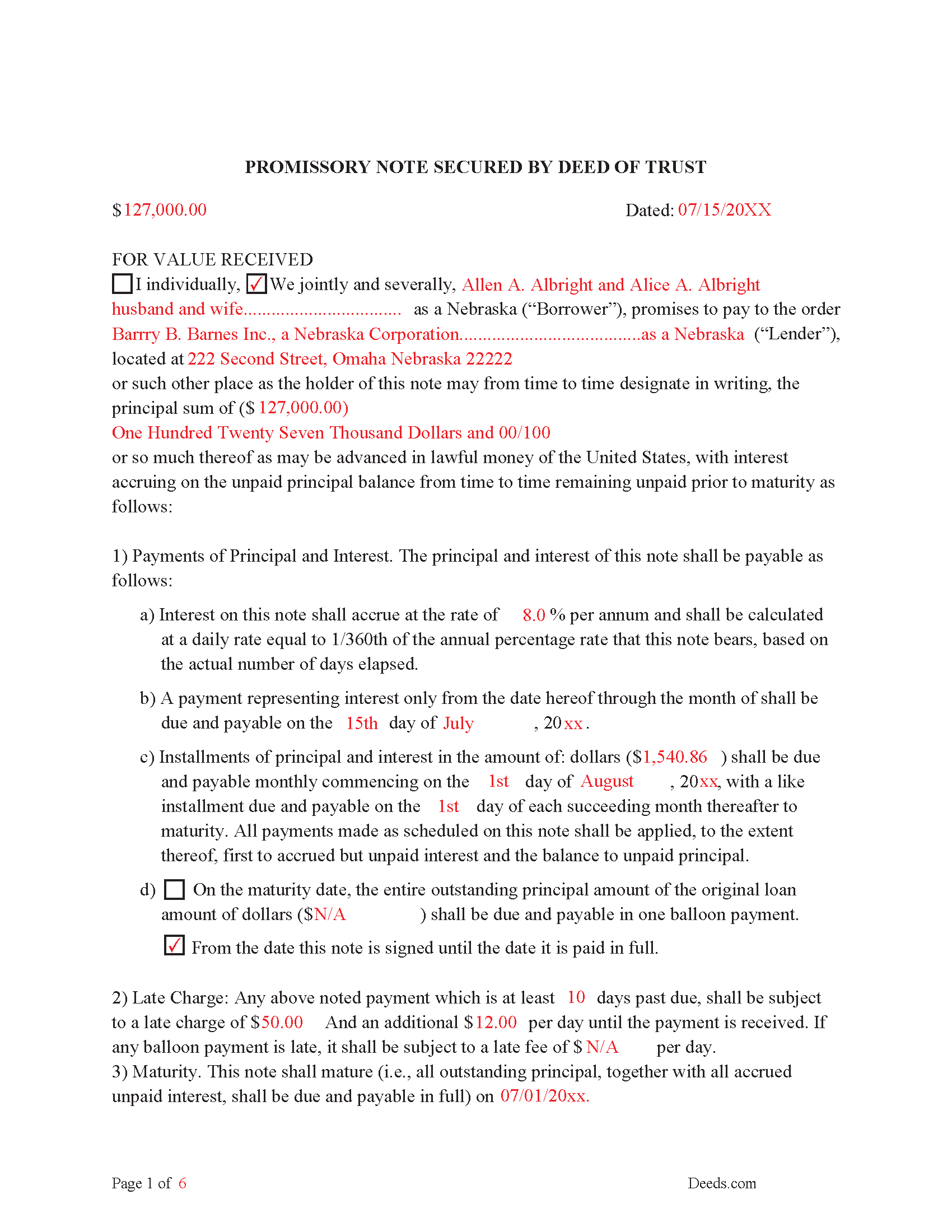

Keya Paha County Promissory Note Form

Note that is secured by the Deed of Trust. Can be used for traditional installments or balloon payment.

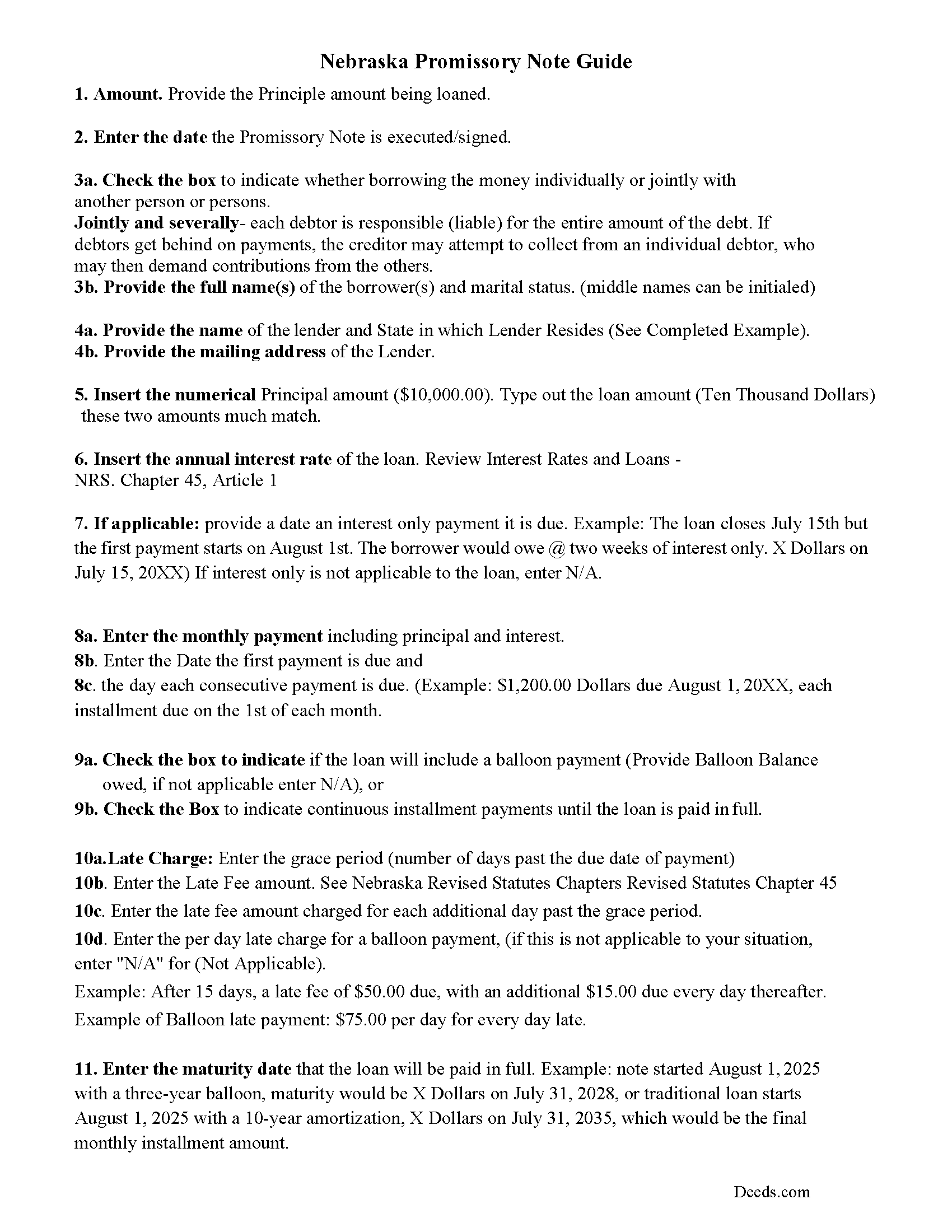

Keya Paha County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Keya Paha County Completed Example of the Promissory Note Document

This Nebraska Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

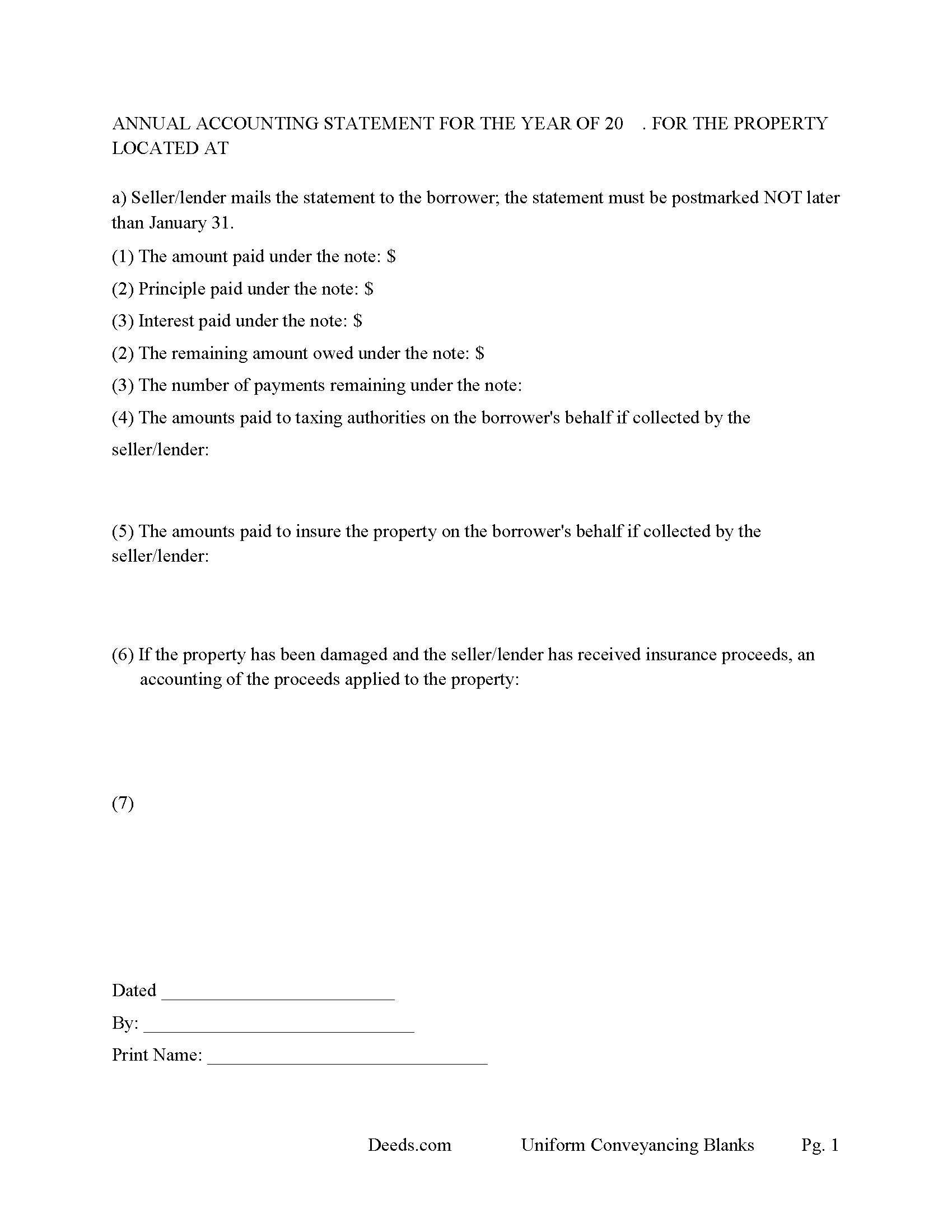

Keya Paha County Annual Accounting Statement Form

Mail to borrower as required for fiscal year reporting.

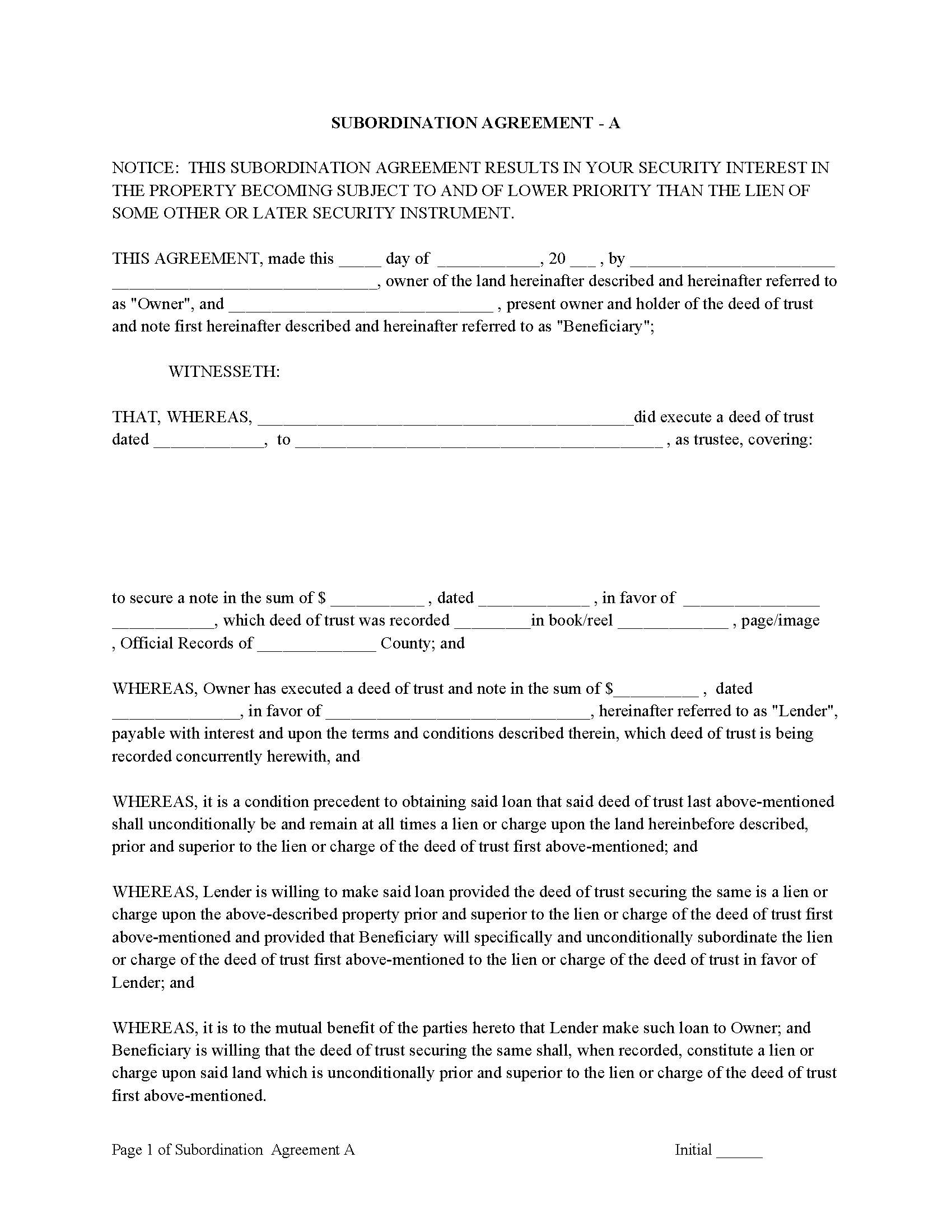

Keya Paha County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to D.O.T. as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Keya Paha County documents included at no extra charge:

Where to Record Your Documents

Keya Paha County Register of Deeds

Springview, Nebraska 68778

Hours: 8:00am-5:00pm M-F

Phone: (402) 497-3791

Recording Tips for Keya Paha County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Keya Paha County

Properties in any of these areas use Keya Paha County forms:

- Mills

- Newport

- Springview

Hours, fees, requirements, and more for Keya Paha County

How do I get my forms?

Forms are available for immediate download after payment. The Keya Paha County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Keya Paha County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Keya Paha County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Keya Paha County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Keya Paha County?

Recording fees in Keya Paha County vary. Contact the recorder's office at (402) 497-3791 for current fees.

Questions answered? Let's get started!

In Nebraska, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale. There is no automatic stay of a trustee's sale under the Nebraska Trust Deeds Act, whereas in a typical judicial foreclosure a borrower would be entitled to a stay of the sheriff's sale for anywhere from three to nine months depending upon the maturity date of the real estate mortgage

There are three parties in this Deed of Trust:

1- The Trustor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

76-1003. Trustee; qualification.

(1) The trustee of a trust deed shall be:

(a) A member of the Nebraska State Bar Association or a licensed real estate broker of Nebraska;

(b) Any bank, building and loan association, savings and loan association, or credit union authorized to do business in Nebraska under the laws of Nebraska or the United States or an agency of the United States Department of Agriculture involved in lending;

(c) Any corporation authorized to conduct a trust business in Nebraska under the laws of Nebraska or the United States; or

(d) Any title insurer authorized to do business in Nebraska under the laws of Nebraska.

(2) The trustee of a trust deed shall not be the beneficiary named in the trust deed unless the beneficiary is qualified to be a trustee under subdivision (1)(b) or (c) of this section.

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary can take an action against any person for damages. Use this Deed of Trust for financing vacant land, residential property, small commercial property, rental property (up to 4 units), condominiums and planned unit developments.

(Nebraska DOT Package includes forms, guidelines, and completed examples) For use in Nebraska only.

Important: Your property must be located in Keya Paha County to use these forms. Documents should be recorded at the office below.

This Deed of Trust meets all recording requirements specific to Keya Paha County.

Our Promise

The documents you receive here will meet, or exceed, the Keya Paha County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Keya Paha County Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

LINDA S.

November 11th, 2020

This was SO much easier than having to go down to the county recorder's office. I would definitely use this company again!

Thank you for your feedback. We really appreciate it. Have a great day!

Gene J.

September 6th, 2019

Easy to pay for, hard to download. A zip file containing all the forms would be a great addition. Your warning under the Review box needs help: see Your review may displayed publicly so please do not include any personal information.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda B.

January 6th, 2019

Excellent transaction.

Thank you Brenda.

Annelie A.

April 22nd, 2020

Unfortunately the forms were not useful to me, I still had to go pay a lawyer to create a deed for me.

Thank you for your feedback. We really appreciate it. Have a great day!

Josephine A.

June 9th, 2020

Being a first timer, I was hesitant at first to use the service. I was genuinely surprised at how easy it is to set up an account, upload my document, and pay the invoice. The next day I downloaded my document duly recorded. Good work, guys!

Thank you for your feedback. We really appreciate it. Have a great day!

Mary D.

March 29th, 2021

LOVE this site.. easy to use and very very quick to record

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqui G.

April 8th, 2020

Excellent system and serviced!

Thank you!

Mark & Linda W.

December 18th, 2020

Quite simple and easy. Only one critique: It would be easier if the names of the PDF would reflect the name of the deed/form such as 'Controlling tax return' rather than '1579101185SF56863.pdf'. However I love downloading forms rather than mail.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseph B.

December 24th, 2021

Multiple attempts to straight answers to very simple straight forward questions about why my submission is not being accepted have gone unanswered. It's been two days and no answer that solves my problem.

Sorry we were unable to assist you Joseph. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Kenneth C.

August 24th, 2020

Great forms, easy to use if you have at least a sixth grade education.

Thank you!

Carol W.

September 6th, 2020

The guide and example provided made it so easy to complete the form. All was in order when I took it to the Register of Deeds. No hassles at all! Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine W.

May 7th, 2019

I appreciate your prompt and honest response. You did not find what I was looking for but You also did not charge Me. It was a pleasure working with You.

Thank you for your feedback Catherine, sorry we were unable to find what you needed. Have a wonderful day.

Penelope V.

June 21st, 2019

This website was very handy and had everything I needed. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine S.

December 19th, 2019

Description of document could have been better

Thank you!

Monica D. N.

April 8th, 2019

The Web site is very intuitive, organized well and forms are easily found. The instructions provided are very helpful. Value in terms of price is very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!