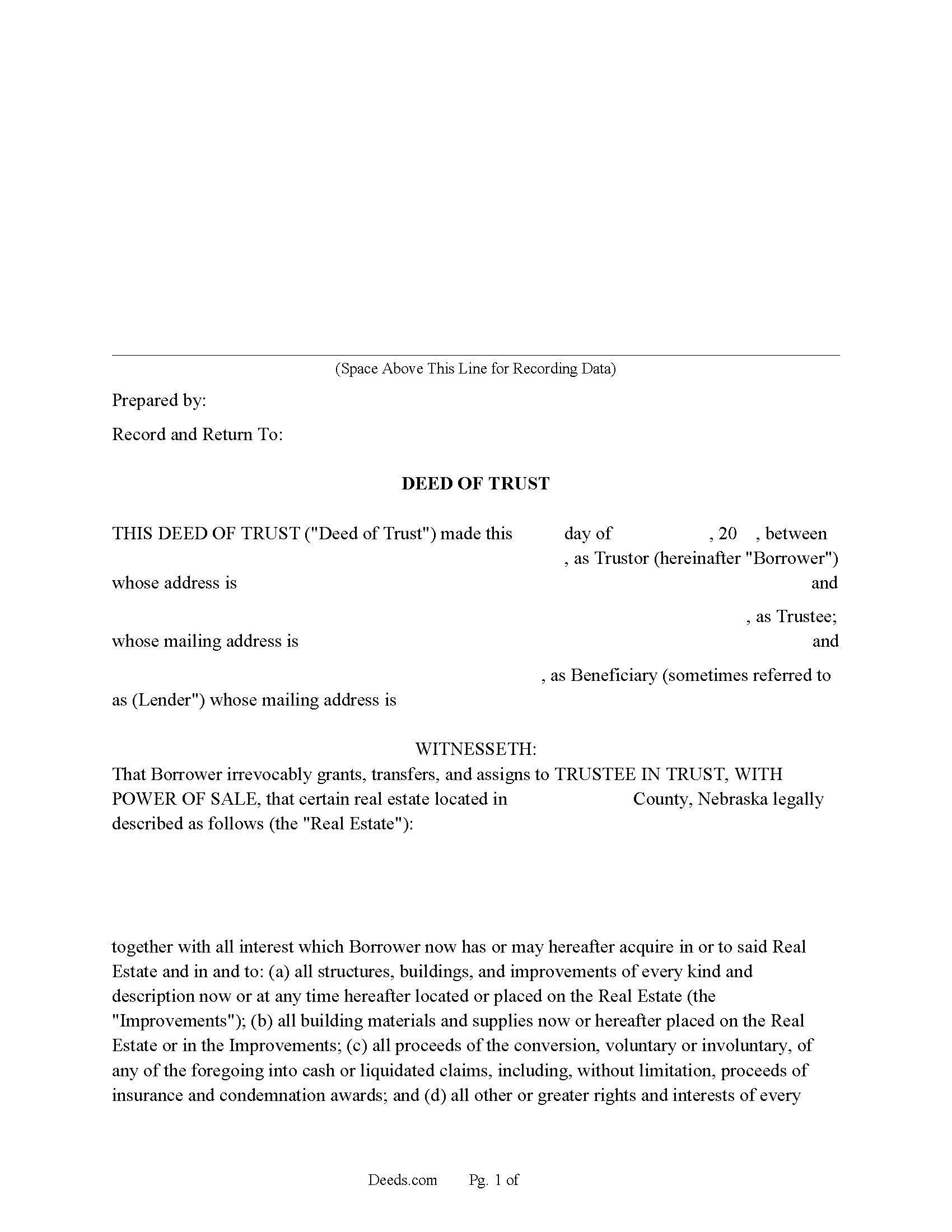

Richardson County Deed of Trust Form

Richardson County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

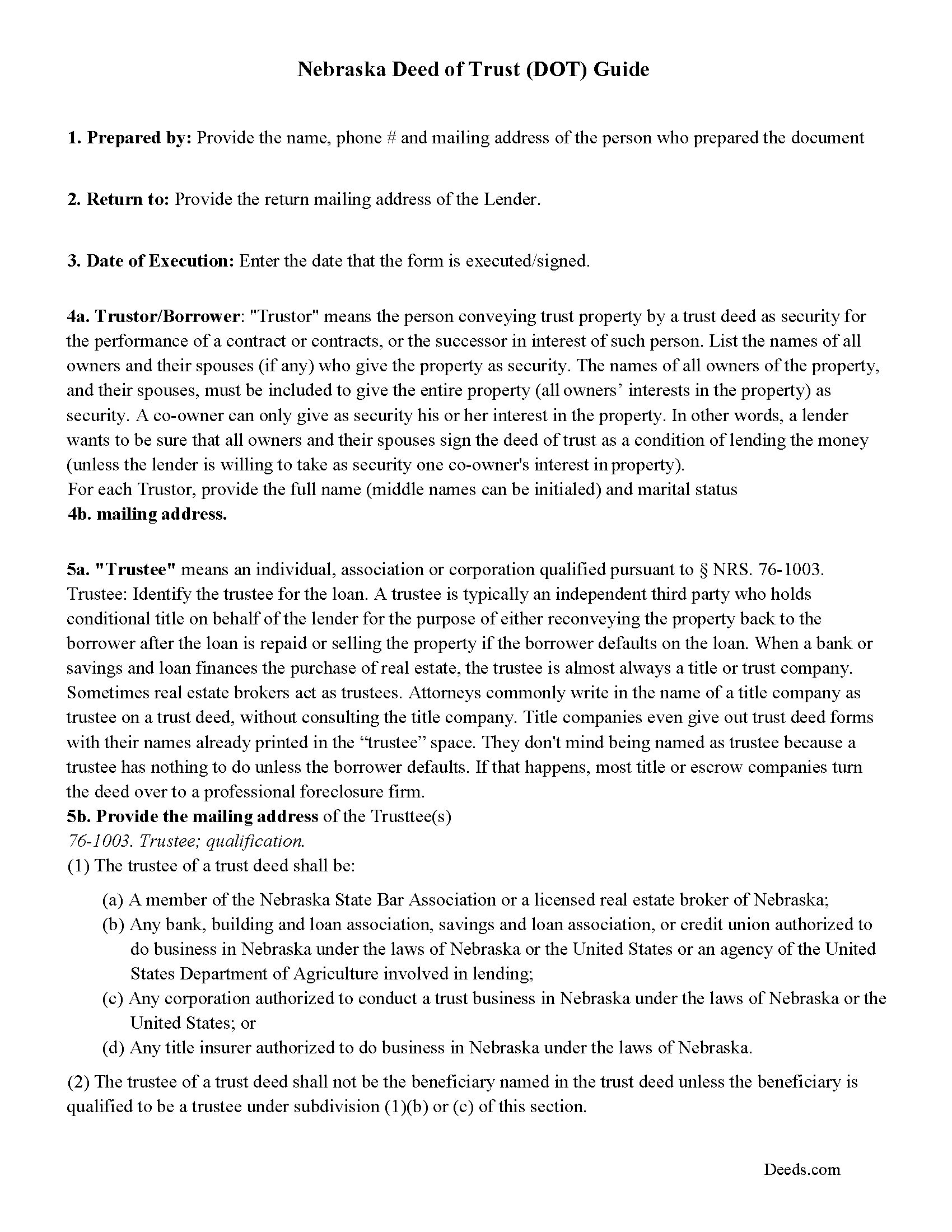

Richardson County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

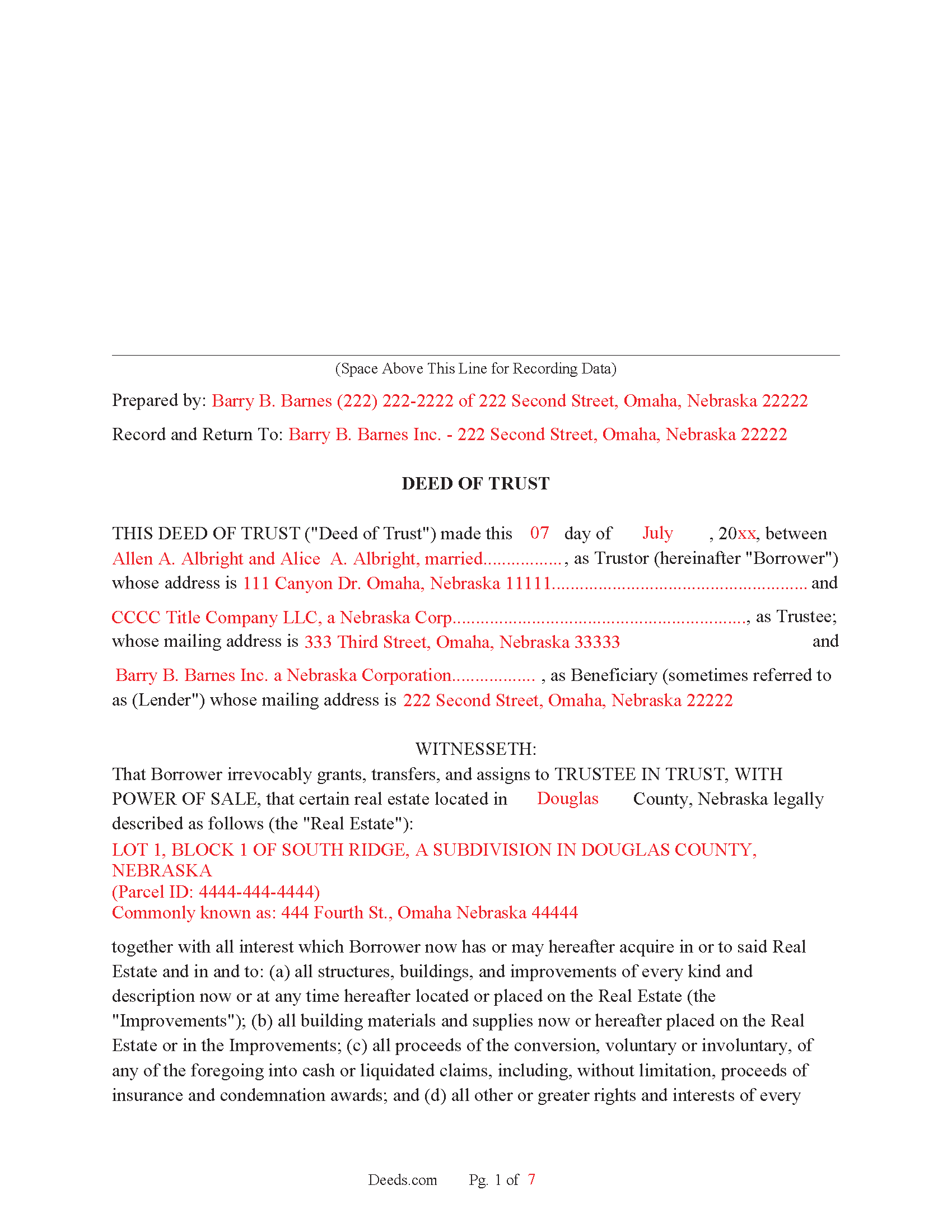

Richardson County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

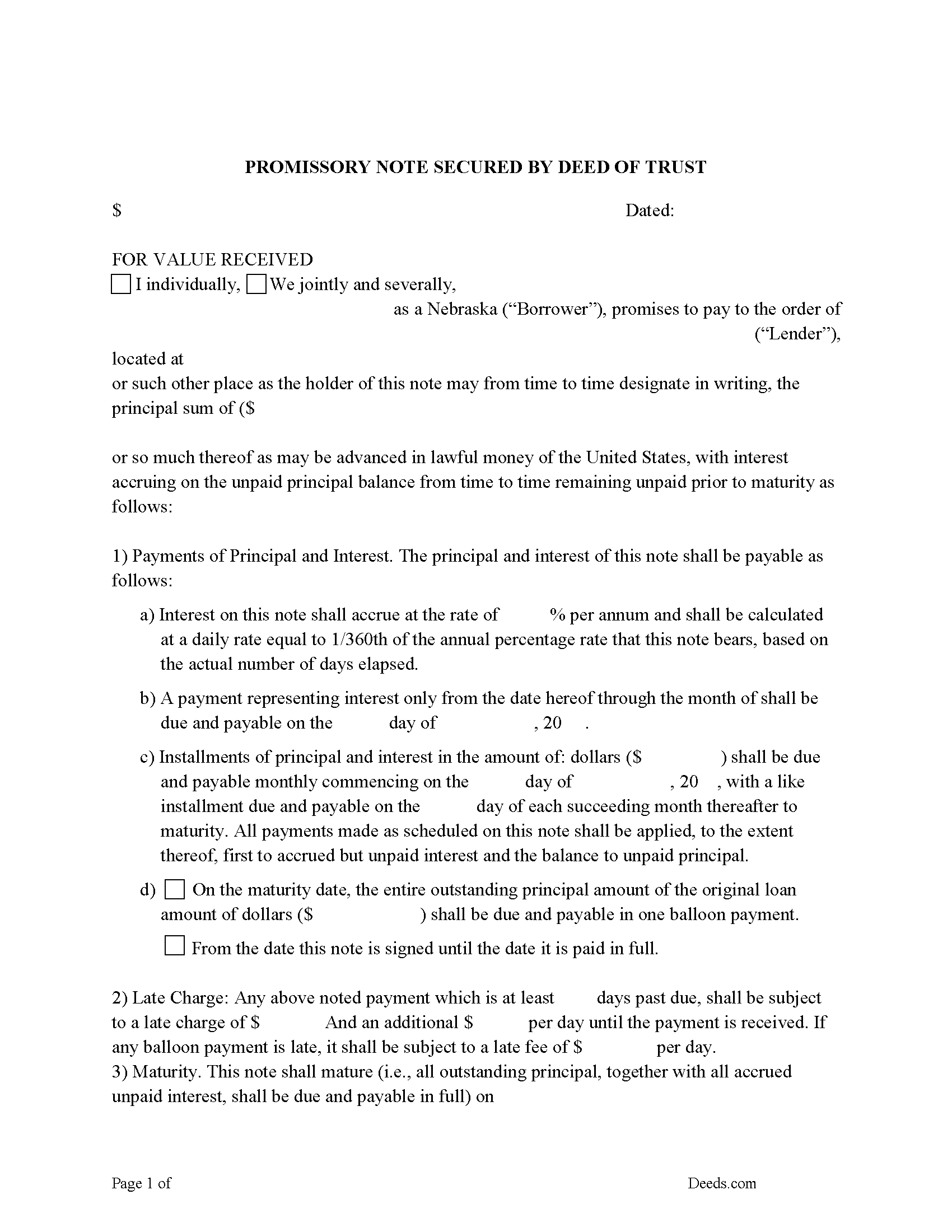

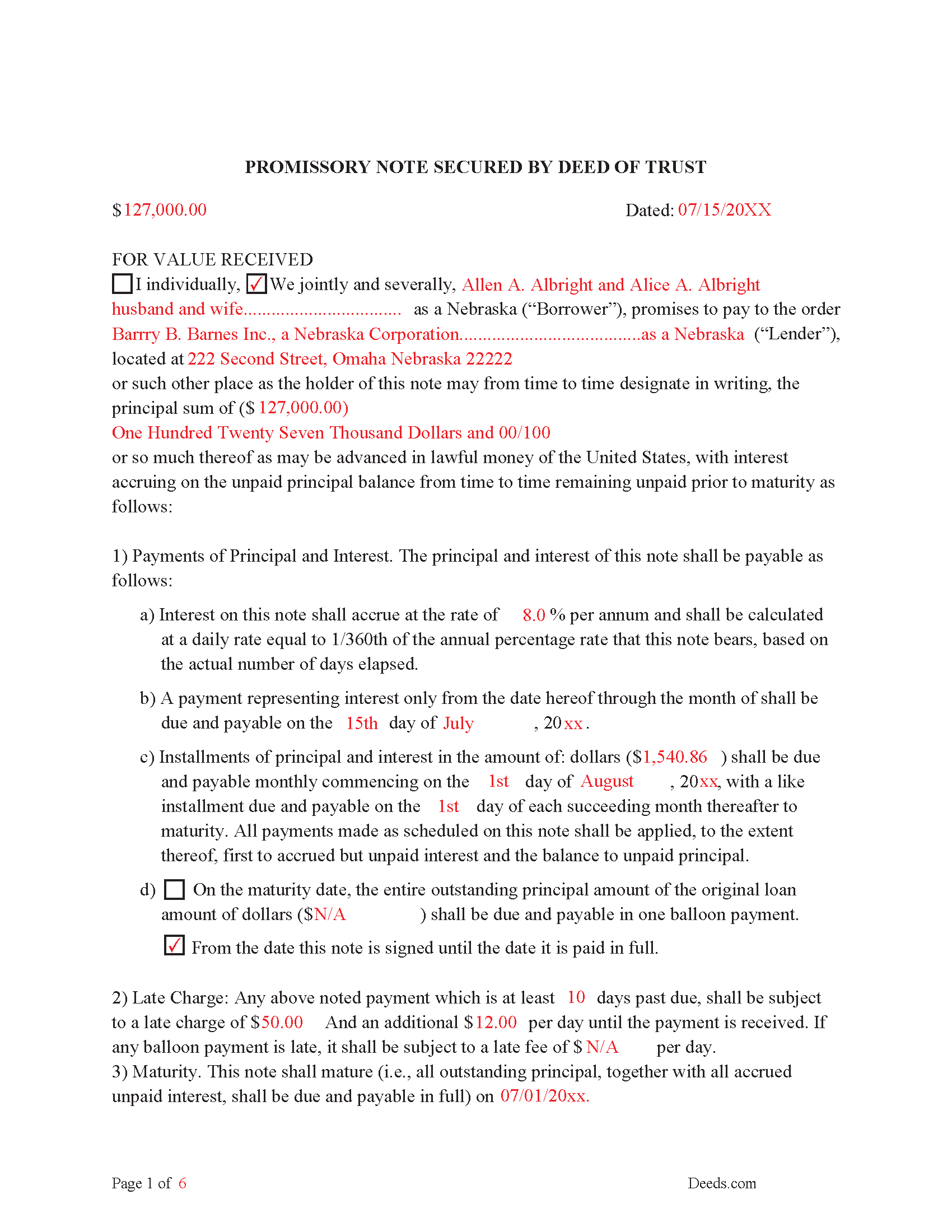

Richardson County Promissory Note Form

Note that is secured by the Deed of Trust. Can be used for traditional installments or balloon payment.

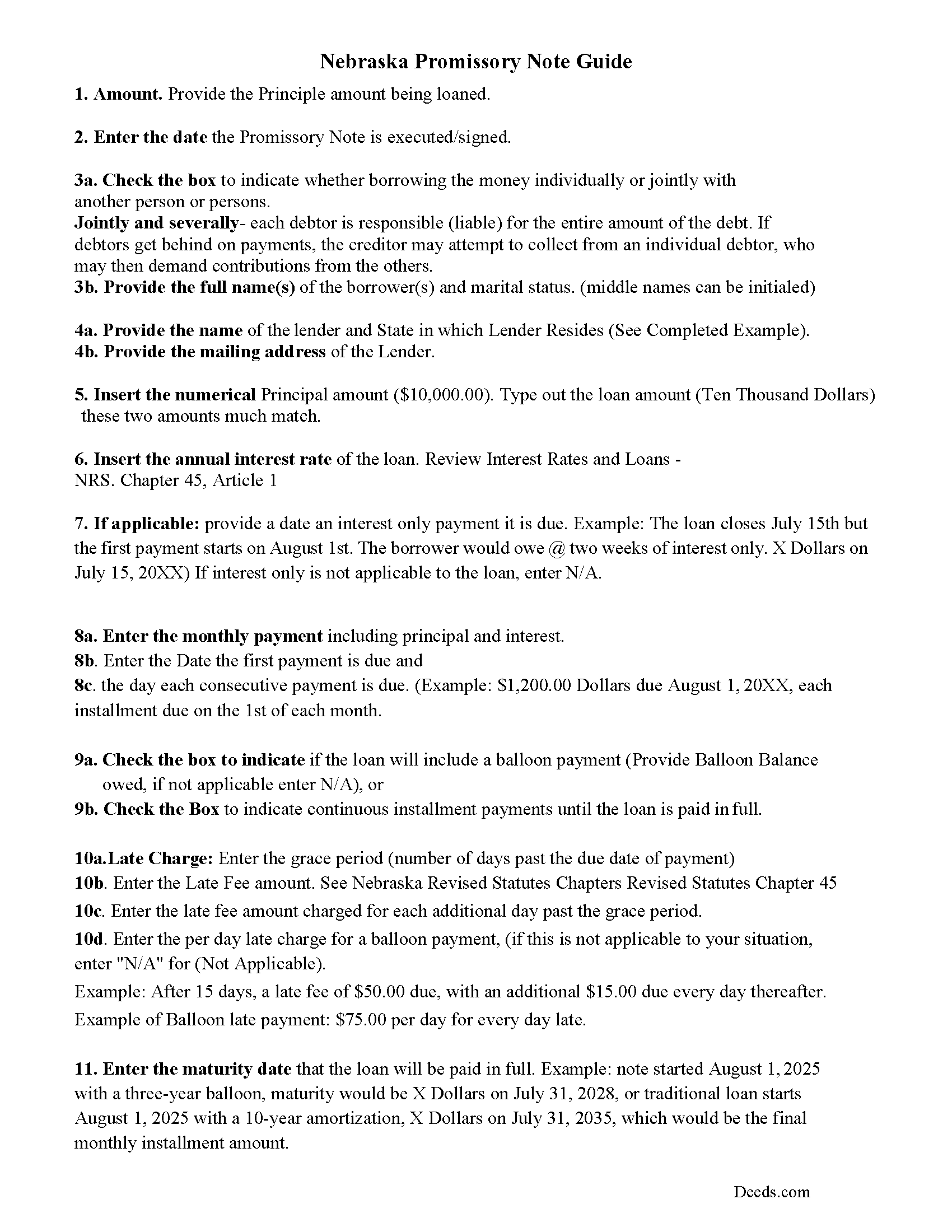

Richardson County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Richardson County Completed Example of the Promissory Note Document

This Nebraska Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

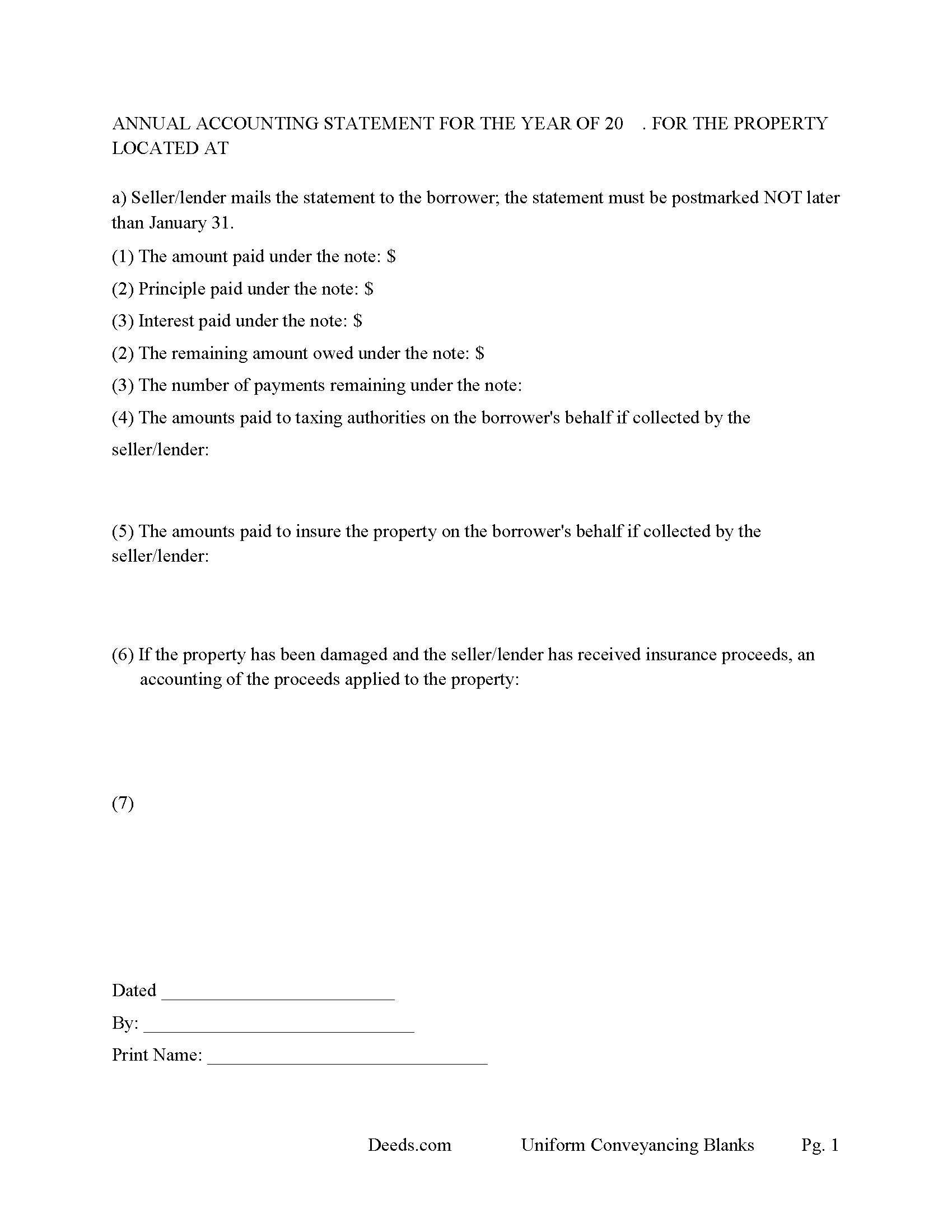

Richardson County Annual Accounting Statement Form

Mail to borrower as required for fiscal year reporting.

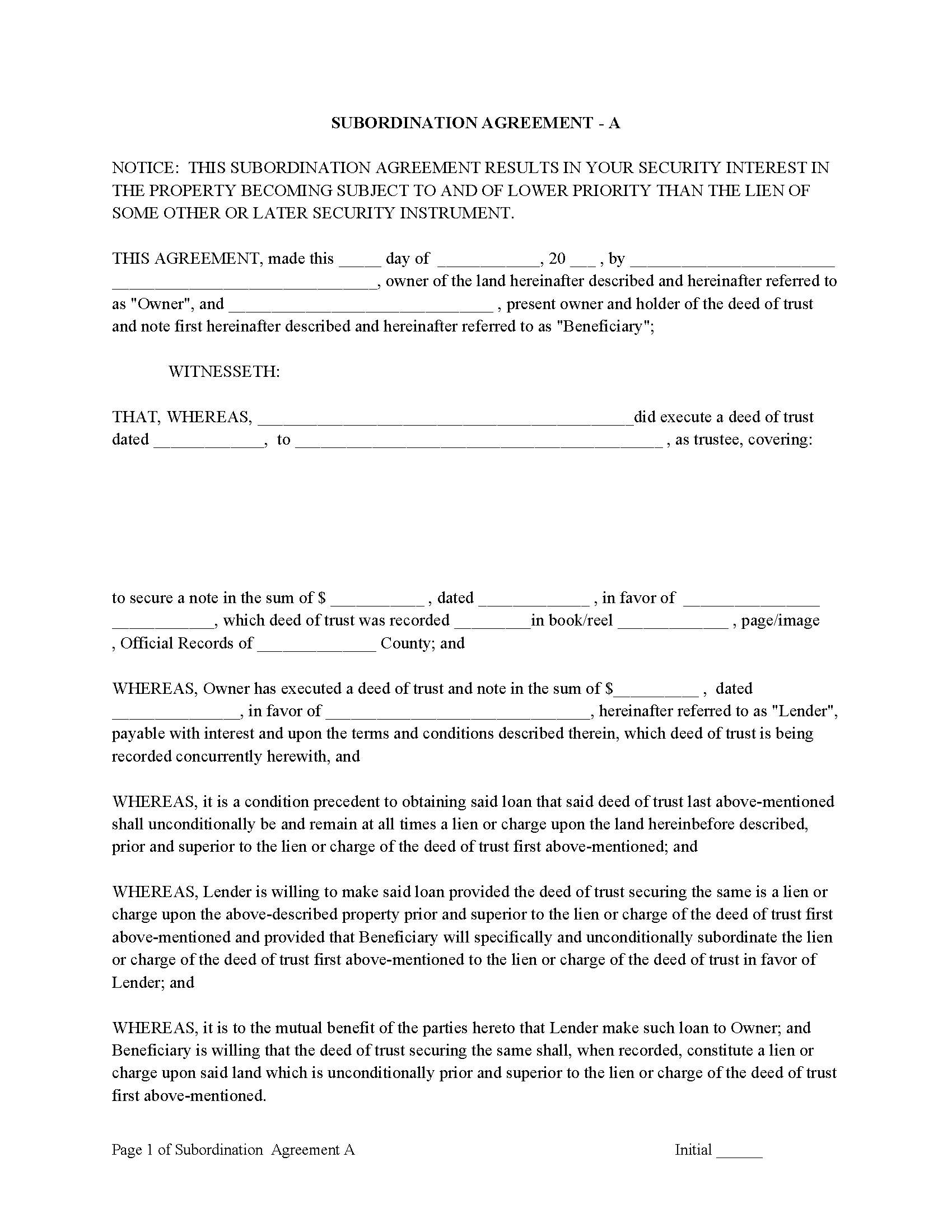

Richardson County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to D.O.T. as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Richardson County documents included at no extra charge:

Where to Record Your Documents

Richardson County Register of Deeds

Falls City, Nebraska 68355

Hours: 8:30 to 5:00 M-F

Phone: (402) 245-2535

Recording Tips for Richardson County:

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Richardson County

Properties in any of these areas use Richardson County forms:

- Dawson

- Falls City

- Humboldt

- Rulo

- Salem

- Shubert

- Stella

- Verdon

Hours, fees, requirements, and more for Richardson County

How do I get my forms?

Forms are available for immediate download after payment. The Richardson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Richardson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Richardson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Richardson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Richardson County?

Recording fees in Richardson County vary. Contact the recorder's office at (402) 245-2535 for current fees.

Questions answered? Let's get started!

In Nebraska, a Deed of Trust is the most commonly used instrument to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale. There is no automatic stay of a trustee's sale under the Nebraska Trust Deeds Act, whereas in a typical judicial foreclosure a borrower would be entitled to a stay of the sheriff's sale for anywhere from three to nine months depending upon the maturity date of the real estate mortgage

There are three parties in this Deed of Trust:

1- The Trustor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

76-1003. Trustee; qualification.

(1) The trustee of a trust deed shall be:

(a) A member of the Nebraska State Bar Association or a licensed real estate broker of Nebraska;

(b) Any bank, building and loan association, savings and loan association, or credit union authorized to do business in Nebraska under the laws of Nebraska or the United States or an agency of the United States Department of Agriculture involved in lending;

(c) Any corporation authorized to conduct a trust business in Nebraska under the laws of Nebraska or the United States; or

(d) Any title insurer authorized to do business in Nebraska under the laws of Nebraska.

(2) The trustee of a trust deed shall not be the beneficiary named in the trust deed unless the beneficiary is qualified to be a trustee under subdivision (1)(b) or (c) of this section.

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary can take an action against any person for damages. Use this Deed of Trust for financing vacant land, residential property, small commercial property, rental property (up to 4 units), condominiums and planned unit developments.

(Nebraska DOT Package includes forms, guidelines, and completed examples) For use in Nebraska only.

Important: Your property must be located in Richardson County to use these forms. Documents should be recorded at the office below.

This Deed of Trust meets all recording requirements specific to Richardson County.

Our Promise

The documents you receive here will meet, or exceed, the Richardson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Richardson County Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

David L.

November 19th, 2021

Good quick service. The forms helped guide and explain each section and question.

Thank you for your feedback. We really appreciate it. Have a great day!

Dreama R.

May 7th, 2019

Awesome! I had to correct a quit claim deed and the form on your site made it very easy. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven H.

July 12th, 2019

Great Product!!! Used the more commonly known websites before, but never again. It was easy, great examples to follow so that I was sure and confident that I completed the document correctly. Thank You!

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah M.

June 24th, 2021

Absolutely great. The staff is responsive and knowledgeable. The online interface is excellent. The total cost for finalizing the sale on our property (minus state filing fees) was $39. A wonderful experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Lesley B.

May 6th, 2022

It was so quick and easy to access.. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Sierra S.

November 30th, 2020

Thank you so much for making this process seemless. We are very pleased with the service.

Thank you!

Kate J.

January 10th, 2022

Easy to use.

Thank you!

Dana R.

February 20th, 2021

This site is Awesome! So easy to use and they really work fast. I will use this for all my Maricopa County Recorder items or deeds, etc. Love this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Marcus W.

May 16th, 2024

The Service was excellent the county recorder’s can sometimes cause issues and or delays because of certain filing requirements , but overall I am more than satisfied with DEEDS.com fast friendly services.

Thank you Marcus, we appreciate you.

Michael H.

April 8th, 2020

Very responsive and thorough. Glad to have found such a great company for our recording needs.

Thank you!

Tammy L.

August 20th, 2025

Very Poor and useles, a scam, don't waste your money, those templates are useless and do Not give you Any valid,proper, meeningful wording to use, did Not Help me, nothing more than what a 5th grader can come up with as far as wording or example..I feel I was riped off and this is a total scam... nothing useful

We appreciate all feedback, even when it’s critical. Thousands of customers have successfully used our documents, but they are not for everyone. These are reviewed, fill-in-the-blank templates that provide the wording and structure required by law. Some situations call for more personalized guidance or hand-holding than templates alone can provide, and in those cases an attorney may be the better option.

Pamela F.

March 24th, 2019

Very easy to use and had my forms paid for and downloaded very quickly.

Thank you for your feedback Pamela. Have a fantastic day!

John v.

April 7th, 2020

Process is well laid out, clear and concise. Check out is easy. Recommendations: * Assign names to the downloadable files that are meaningful, such as: WARRANTY DEED instead of the useless and cryptic 1420490866F11417.pdf. * Provide a ONE BUTTON DOWNLOAD for all forms ordered. It's aggravating to have to click on each of the 20 documents and download them individually.

Thank you for your feedback. We really appreciate it. Have a great day!

Maria S.

February 26th, 2021

The website made it very easy to navigate and order what I needed. Thank you.

Thank you!

Nigel S.

June 24th, 2025

Very simple to use. The 'completed examples' are very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!