Buffalo County Disclaimer of Interest Form (Nebraska)

All Buffalo County specific forms and documents listed below are included in your immediate download package:

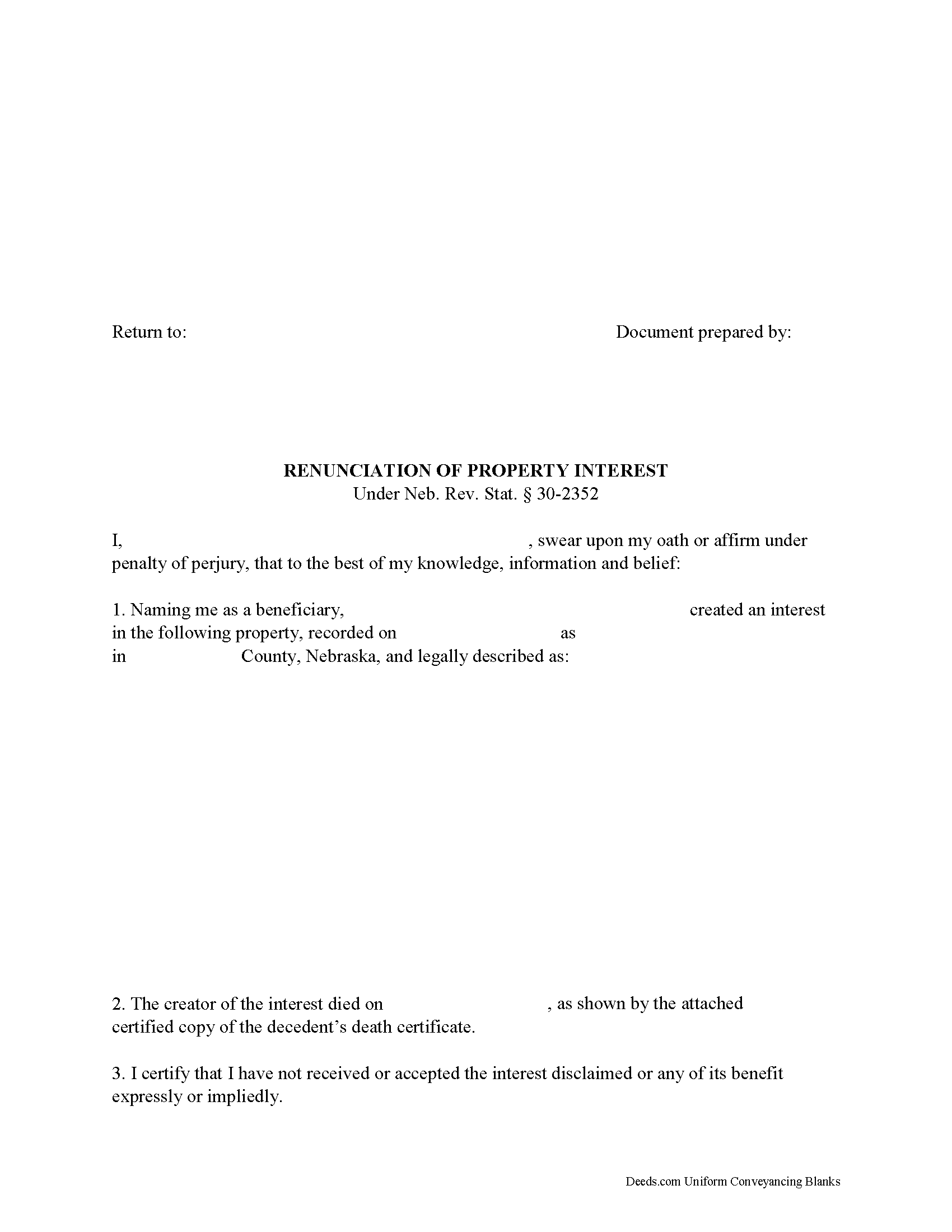

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Buffalo County compliant document last validated/updated 7/8/2025

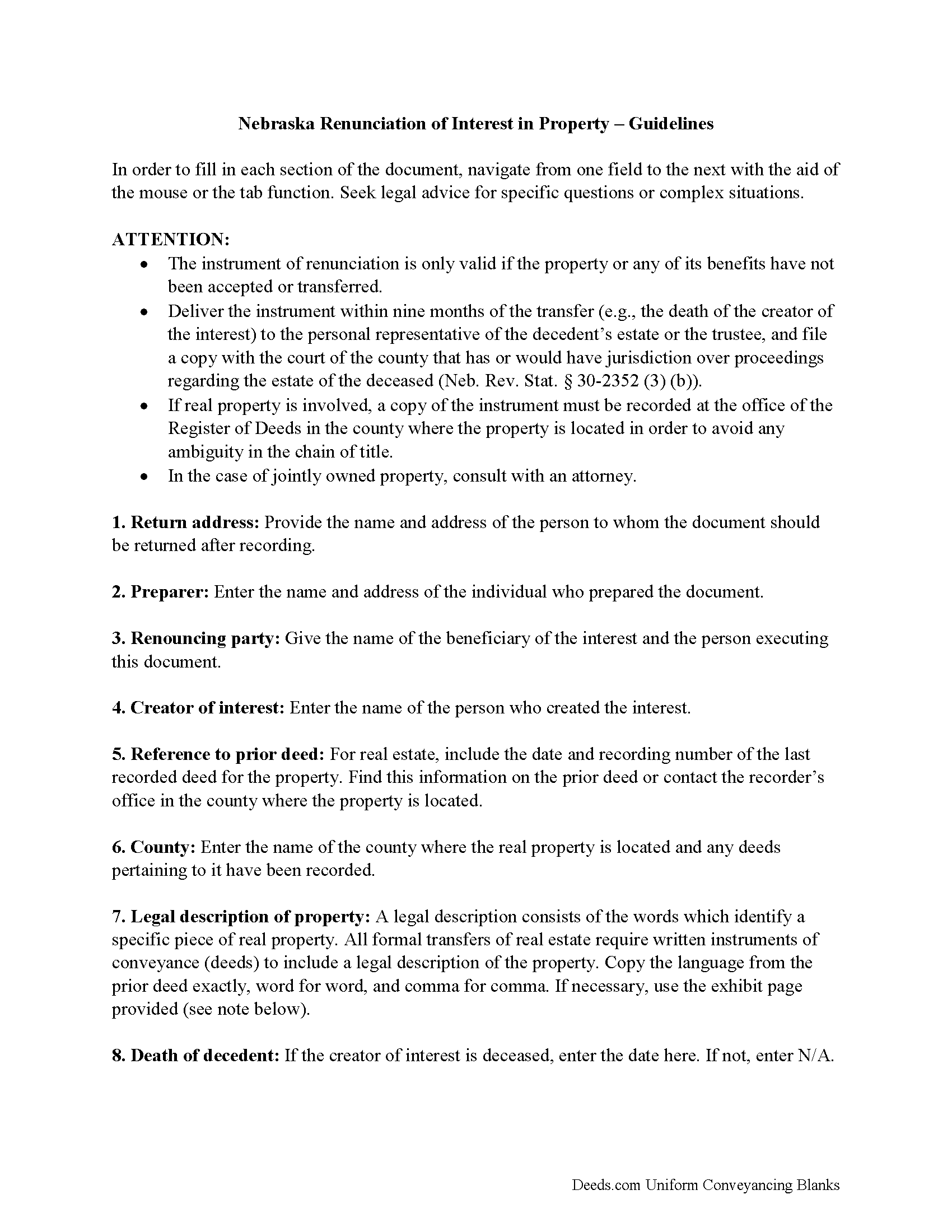

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included Buffalo County compliant document last validated/updated 5/20/2025

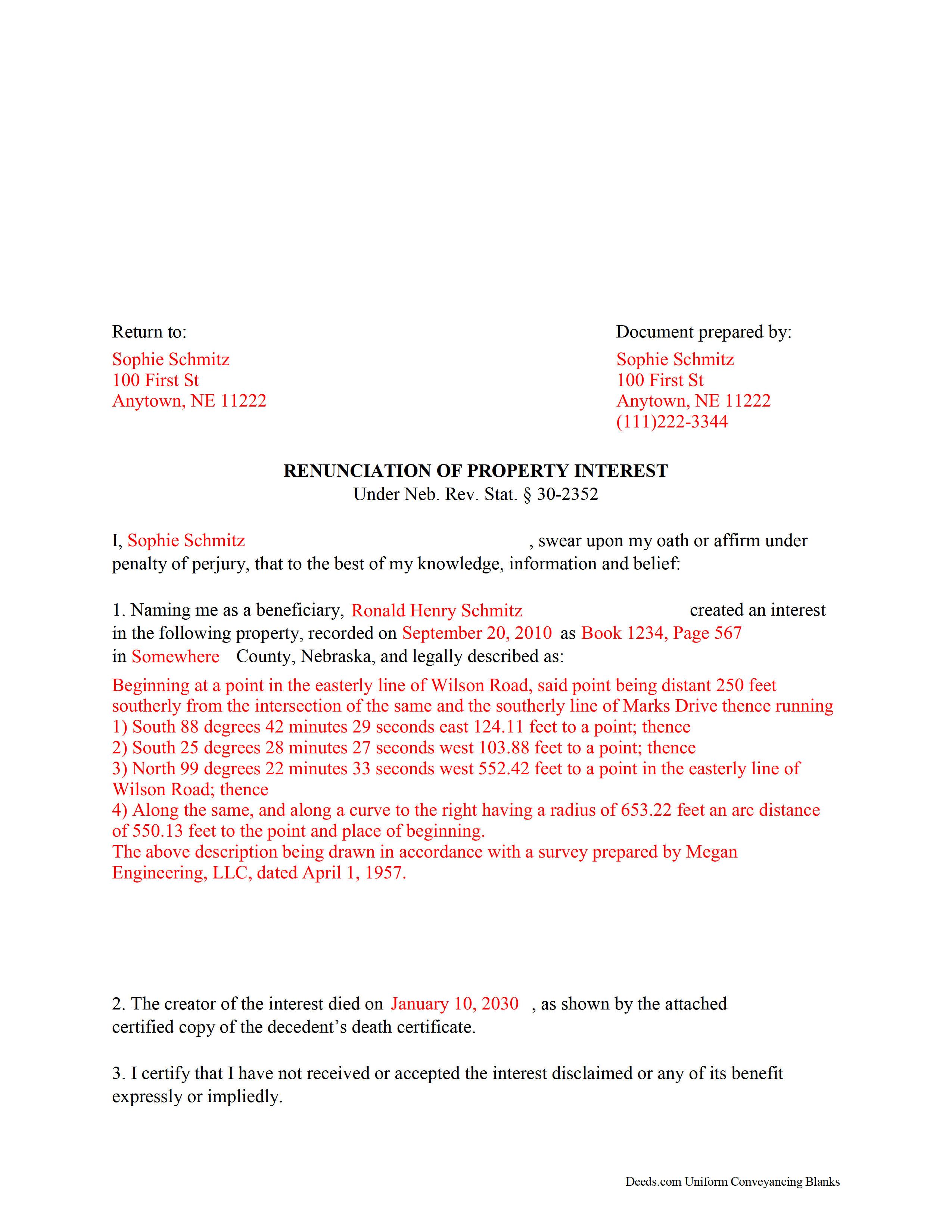

Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

Included Buffalo County compliant document last validated/updated 5/5/2025

The following Nebraska and Buffalo County supplemental forms are included as a courtesy with your order:

When using these Disclaimer of Interest forms, the subject real estate must be physically located in Buffalo County. The executed documents should then be recorded in the following office:

Buffalo County Register of Deeds

Courthouse - 1512 Central Ave / PO Box 1270, Kearney, Nebraska 68848

Hours: 8:00am-5:00pm M-F

Phone: (308) 236-1239

Local jurisdictions located in Buffalo County include:

- Amherst

- Elm Creek

- Gibbon

- Kearney

- Miller

- Odessa

- Pleasanton

- Ravenna

- Riverdale

- Shelton

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Buffalo County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Buffalo County using our eRecording service.

Are these forms guaranteed to be recordable in Buffalo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Buffalo County including margin requirements, content requirements, font and font size requirements.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Buffalo County that you need to transfer you would only need to order our forms once for all of your properties in Buffalo County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nebraska or Buffalo County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Buffalo County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Under the Nebraska Statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (Neb. Rev. Stat. 30-2352). Note that the option to renounce is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest.

The instrument of renunciation must be in writing and include a description of the interest, a declaration of intent to renounce all or a defined portion of the interest, and be signed by the renouncing party ( 30-2352 (2)).

Deliver the instrument within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the trustee, and file a copy with the court of the county that has or would have jurisdiction over proceedings regarding the estate of the deceased. If real property is involved, a copy of the instrument must be recorded at the office of the Register of Deeds in the county where the property is located in order to avoid any ambiguity in the chain of title ( 30-2352 (3) (b)).

A renunciation is irrevocable and binding for the renouncing party and his or her creditors, so be sure to consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited or gifted property. If the renounced interest arises out of jointly-owned property, seek legal advice as well.

(Nebraska DOI Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Buffalo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Buffalo County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Gretchen B.

June 22nd, 2021

I wanna give more stars because the required information is there, but the character spacing is disjointed on the first page, rendering a gap-filled, awkward-looking document. Also, the opening parenthesis for the first field on the first page is on the wrong line and is backwards, which sets the wrong tone especially since it's the first thing you have to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Curley L F.

May 1st, 2019

The deed form I downloaded was easy to use

and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eileen D.

August 5th, 2020

Very easy to use. The example form was a big help in making sure I had the forms filled out correctly.

Thank you!

Larry L.

July 12th, 2022

Great product, worked as it advertised.

Thank you!

DIANE S.

June 6th, 2020

I received my report pretty quick!

Had info that I needed.

Thank you!

Thank you!

Connie J L.

August 26th, 2020

Fast and easy to use. Easy to print.

Thank you!

Jayne B.

July 1st, 2020

This makes it so easy and I'm so glad I found you.

I visited two other sites before I found this one. They were cumbersome to use to the point where I abandoned them and kept on looking. Then I found yours, and it was a breeze. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deneene C.

April 17th, 2020

Was a great help to me. I'm very pleased .

Thank you!

Rosa D.

June 18th, 2019

Obtaining a quick claim deed from this website was easy and friendly I must say. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Altaray S.

January 14th, 2019

Really fast turn around time, and was provided exactly what I was looking for this time. This is my first experience with this site. It would have been cool to also get a document depicting/describing a property line, but like I said before, exactly what I was looking for this time.

Thank you so much for your feedback Altaray, we really appreciate it.

Nancy B.

August 6th, 2020

This was the easiest, quickest, most understandable way I've seen yet to retrieve deeds from various counties.

The government websites are "clunky" and each one seems different than the other.

I like this service and will use them again in the future.

NANCY

Thank you for your feedback. We really appreciate it. Have a great day!

DENNIS M.

January 18th, 2023

very simple and complete

We appreciate your business and value your feedback. Thank you. Have a wonderful day!