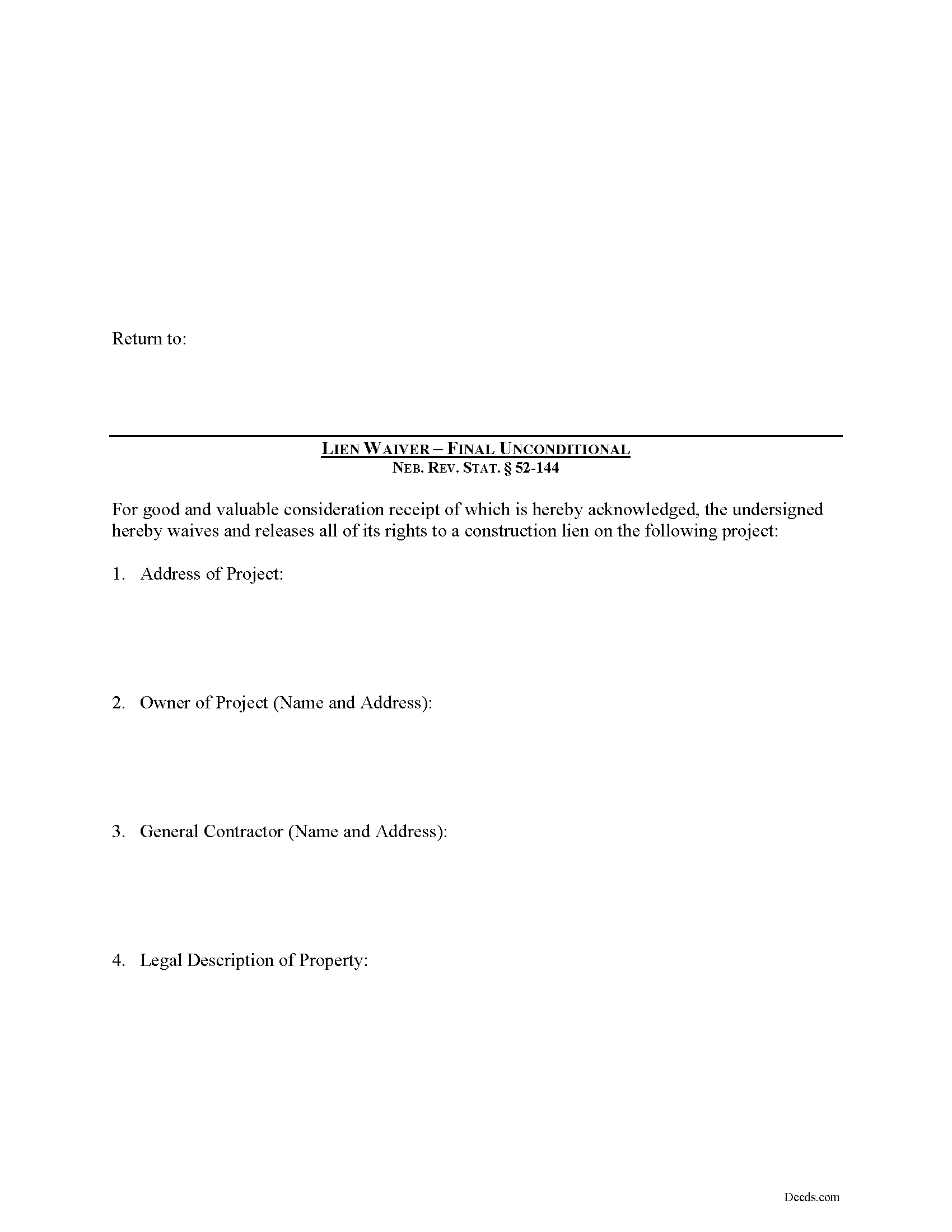

Jefferson County Final Unconditional Lien Waiver Form

Jefferson County Final Unconditional Lien Waiver Form

Fill in the blank Final Unconditional Lien Waiver form formatted to comply with all Nebraska recording and content requirements.

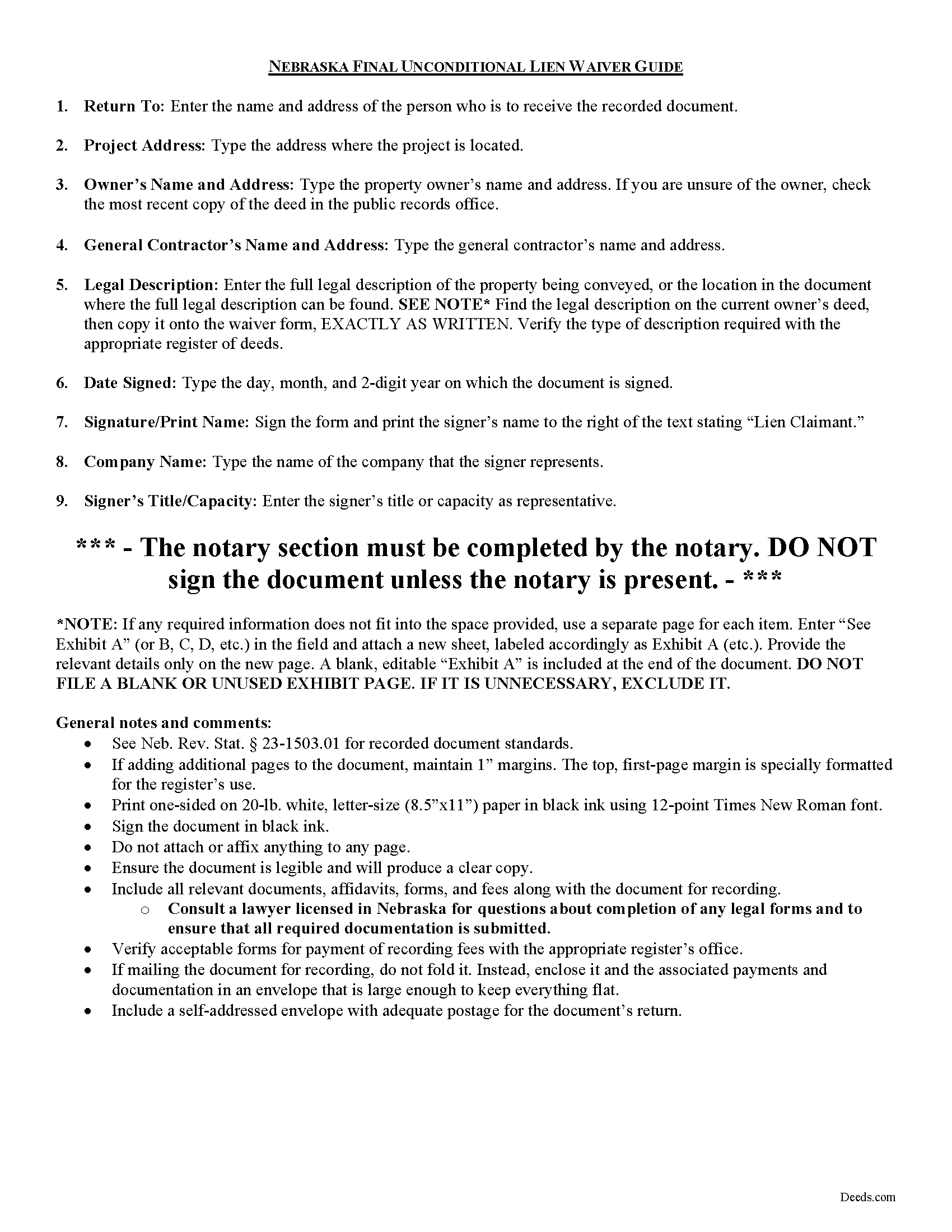

Jefferson County Final Unconditional Lien Waiver Guide

Line by line guide explaining every blank on the form.

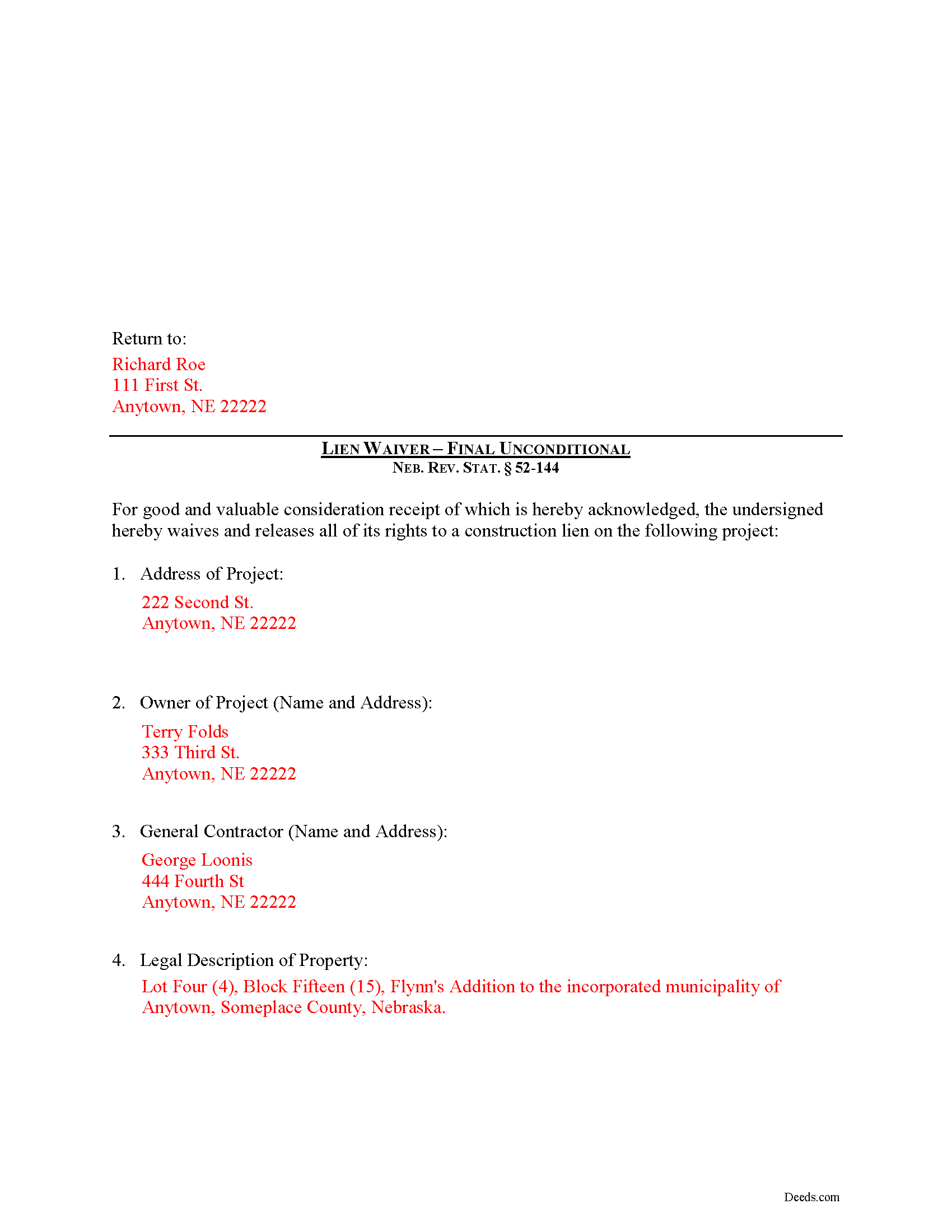

Jefferson County Completed Example of the Final Unconditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Register of Deeds

Fairbury, Nebraska 68352

Hours: 9:00am to 5:00pm M-F

Phone: (402) 729-6819

Recording Tips for Jefferson County:

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Daykin

- Diller

- Endicott

- Fairbury

- Jansen

- Plymouth

- Steele City

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (402) 729-6819 for current fees.

Questions answered? Let's get started!

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

The term "waiver" means a voluntary surrender of a legal right. In this case, the person granting the waiver gives up the right to seek a construction lien for all or part of the amount due on an improvement to real property. This assurance is often enough to encourage the other party to pay the outstanding debt.

As set forth by Neb. Rev. Stat. 52-144(2), a written waiver relinquishes all construction lien rights of the claimant as to the improvement to which the waiver relates unless the waiver is specifically limited to a particular lien right or a particular portion of the services or materials furnished. A waiver of lien rights does not affect any contract rights of the claimant otherwise existing. 52-144(3). Acceptance of a promissory note or other evidence of debt is not a waiver of lien rights unless the note or other instrument expressly so declares. 52-144(4).

Expanding on the statute above, Nebraska law generally recognizes four types of lien waivers. These include partial and final waivers. Each waiver can be conditional or unconditional. A partial waiver covers a progress payment and the waiver only applies to that payment amount, range of dates, or another agreed-upon checkpoint, while a final waiver covers the entire balance. If the waiver is conditional, it is only valid if the payment is made or clears the bank. Unconditional waivers become effective when they are signed, regardless of payment status.

Thus, a final unconditional waiver is appropriate only when a final payment is made for all money owed to the claimant for providing labor, services, materials or equipment and payment is immediately verifiable (meaning the check has cleared or there are no doubts about payment clearing the bank). This places significant risk on the claimant, as a final unconditional waiver signifies a complete forfeiture of any future lien rights in connection with this claim.

A valid waiver identifies the parties, the property where the claimant performed the work or improvement, and any other information necessary for the specific situation. The claimant must sign the document in front of a notary, then submit the completed waiver to the recording office for the county where the property is situated.

This article is provided for informational purposes only and is not legal advice. Please contact an attorney with questions about lien waivers or any other issues related to Nebraska lien laws.

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Final Unconditional Lien Waiver meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Final Unconditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

William C.

March 31st, 2020

Excellent service. Reasonably priced. Highly recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles D.

July 22nd, 2023

Good product!! I highly recommend.

Thank you!

Larry L.

July 12th, 2022

Great product, worked as it advertised.

Thank you!

Larry M.

August 19th, 2021

Everything went well except that any information that I typed in on the computer download moves upward so that the letters or numbers are somewhat elevated above the line that should be even with the words on the form. I think it will be acceptable to the county recorder, but I don't especially like to submit things that appear uneven. I asked for help but just received a robotic reply that said to take steps that I already had done. So unless you know a way to correct this I likely won't use your forms again.

Thank you!

SueAnn V.

July 22nd, 2021

Thanks so much for the TOD Beneficiary Deed with the explanation, supplementary forms and great example! I just filed it today for the state of Colorado, in my county and it was accepted by the Clerk/Recorder. I really appreciate the thorough work that Deeds.com does. I definitely will use this site again and also recommend it to family and friends. Thanks again.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

January 15th, 2019

Very good hope to use in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen F.

September 3rd, 2020

Easy to use. Outstanding interface.

Thank you!

Daniel C.

May 30th, 2024

This is a wonderful service and your staff is very responsive through the chat. My one suggestion is that there be an added sentence to your instructions that sates that once you upload there is nothing more to do as in a "submit" or "Finished uploading" button. After uploading instinct says there is something to click to let you all know that we have finished with our uploads.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

John B.

December 23rd, 2020

Thorough. Thanks!

Thank you!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan T.

January 21st, 2019

This was perfect for my county I will be recommending your forms to all my clients thank you.

Thank you Susan, have a great day!

Sherilynne P.

May 21st, 2019

I am delighted with the form. I just had to go through so much time and expense in order to use it. First, from your site I downloaded Adobe Acrobat. It totally compromised my computer. I had to get a computer expert to walk me through deleting adobe, and put a substitute on in order to use the form. That was an expense of $60.00. Then after that I still had a hard time getting the program to work, as the substitute program would not accept my e-mail address and I finally had to get someone on line to help me access that. I found it was a $$30.00 charge for the substitute. After fighting these lovely roadblocks, I was finally able to fill in the only form I needed and print it off. Took me two days to accomplish that. Why on earth do you offer adobe when it can compromise a computer so badly? Dealing with my husbands death and then having to deal with this, just one of many deterrents, well let's put it this way, it did not make my two days.

Thank you for your feedback. Sorry to hear of your experience. Our documents are Adobe PDFs because PDF is the standard for digital documents, most computers have Adobe Reader installed, and it (Adobe Reader) is free.

Michael L.

April 6th, 2022

Thumbs up. Very pleased with service. Easy process.

Thank you!

Lesa F.

May 14th, 2021

Excellent service for recovering a couple of deeds that had been misplaced. They were fast and efficient at a fair price. I would definitely use them again.

Thank you!