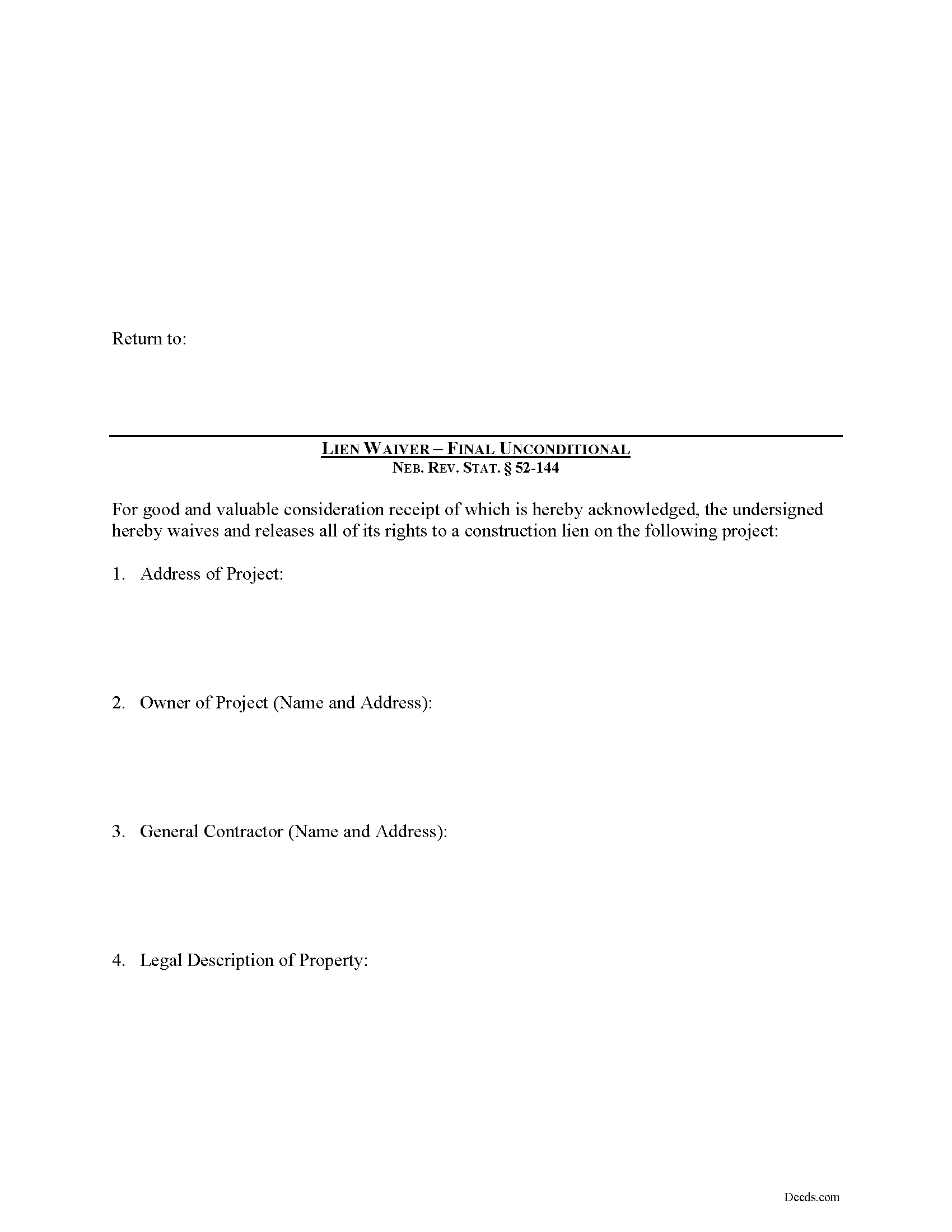

Mcpherson County Final Unconditional Lien Waiver Form

Mcpherson County Final Unconditional Lien Waiver Form

Fill in the blank Final Unconditional Lien Waiver form formatted to comply with all Nebraska recording and content requirements.

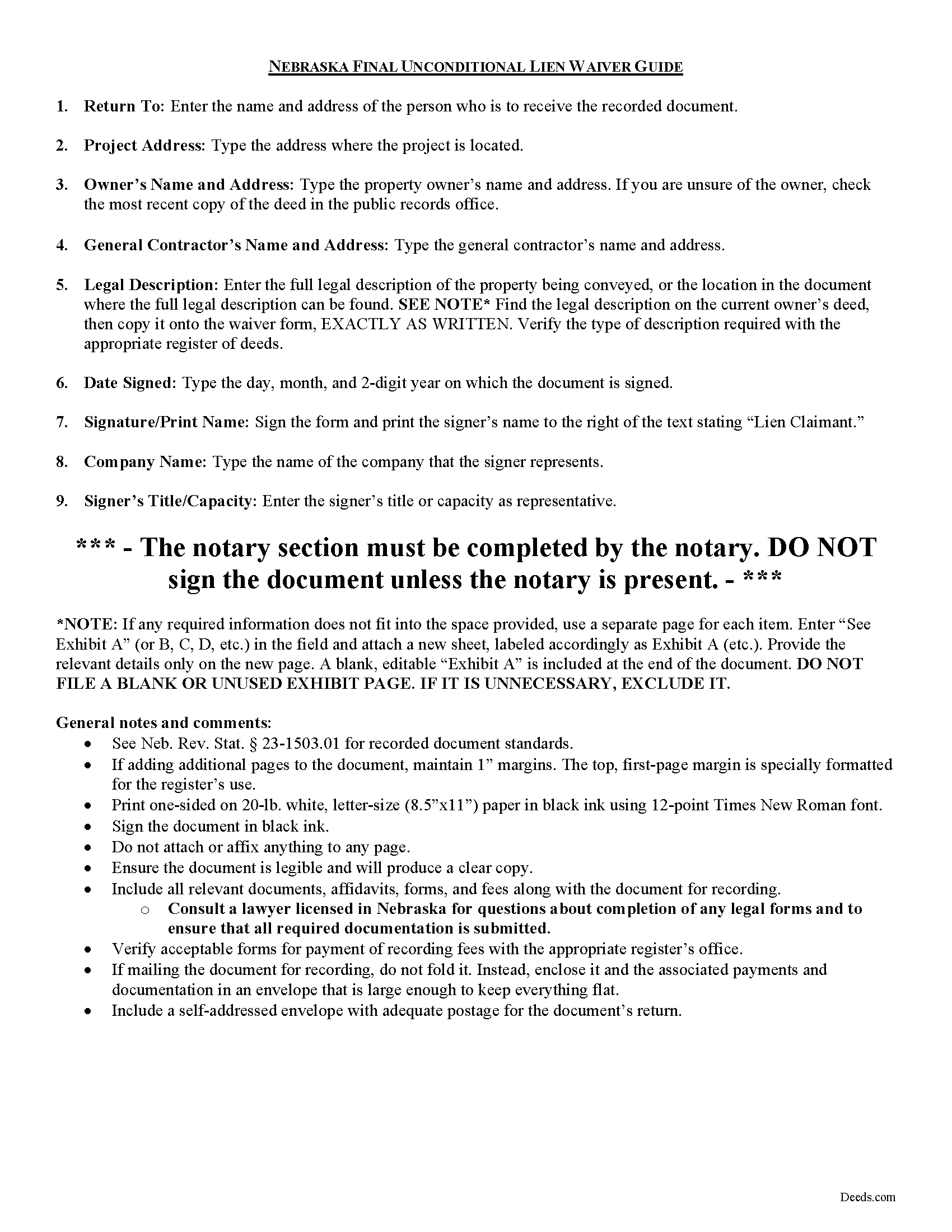

Mcpherson County Final Unconditional Lien Waiver Guide

Line by line guide explaining every blank on the form.

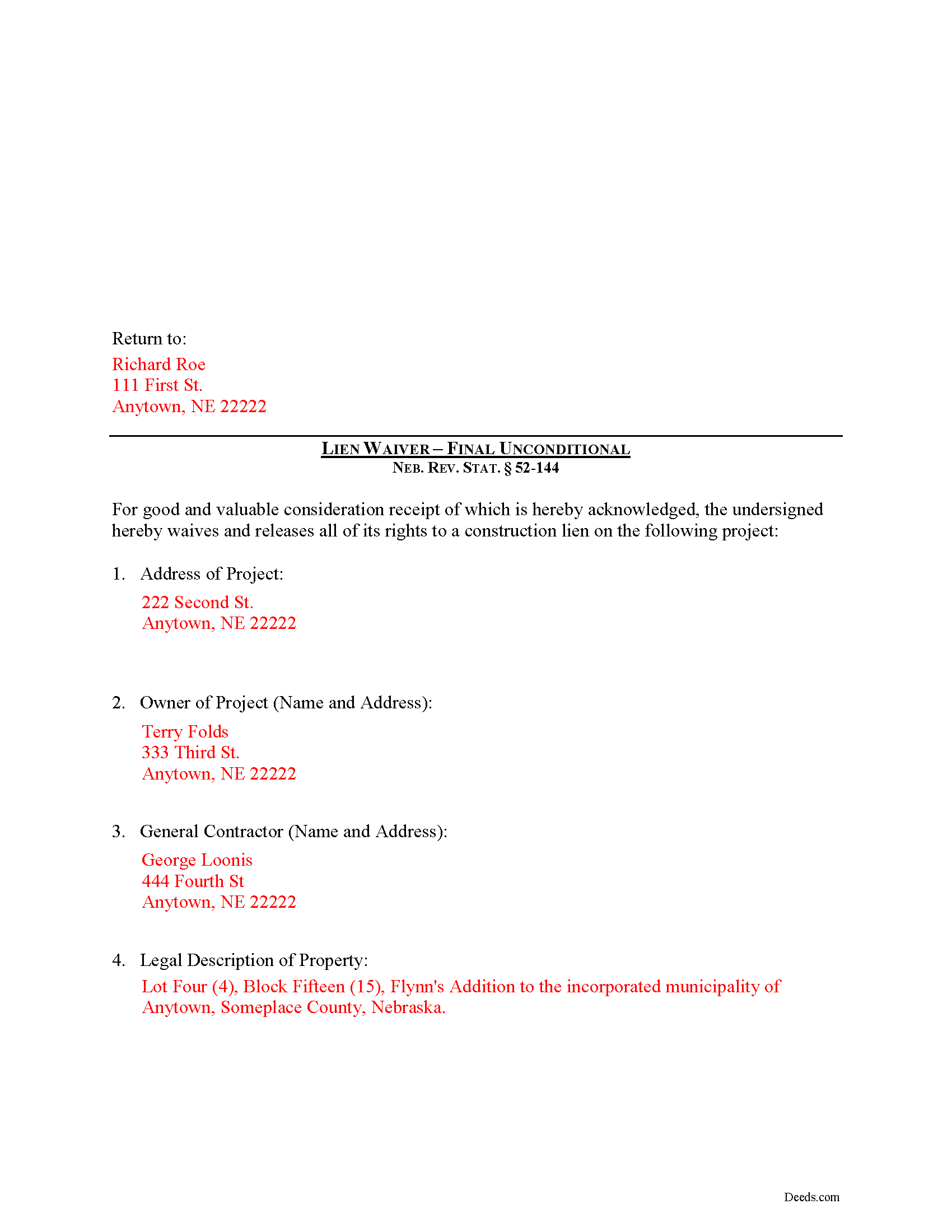

Mcpherson County Completed Example of the Final Unconditional Lien Waiver Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Mcpherson County documents included at no extra charge:

Where to Record Your Documents

McPherson County Register of Deeds/Clerk

Tryon, Nebraska 69167

Hours: Call for hours

Phone: (308) 942-6035

Recording Tips for Mcpherson County:

- Double-check legal descriptions match your existing deed

- Avoid the last business day of the month when possible

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Mcpherson County

Properties in any of these areas use Mcpherson County forms:

- Tryon

Hours, fees, requirements, and more for Mcpherson County

How do I get my forms?

Forms are available for immediate download after payment. The Mcpherson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mcpherson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mcpherson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mcpherson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mcpherson County?

Recording fees in Mcpherson County vary. Contact the recorder's office at (308) 942-6035 for current fees.

Questions answered? Let's get started!

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

The term "waiver" means a voluntary surrender of a legal right. In this case, the person granting the waiver gives up the right to seek a construction lien for all or part of the amount due on an improvement to real property. This assurance is often enough to encourage the other party to pay the outstanding debt.

As set forth by Neb. Rev. Stat. 52-144(2), a written waiver relinquishes all construction lien rights of the claimant as to the improvement to which the waiver relates unless the waiver is specifically limited to a particular lien right or a particular portion of the services or materials furnished. A waiver of lien rights does not affect any contract rights of the claimant otherwise existing. 52-144(3). Acceptance of a promissory note or other evidence of debt is not a waiver of lien rights unless the note or other instrument expressly so declares. 52-144(4).

Expanding on the statute above, Nebraska law generally recognizes four types of lien waivers. These include partial and final waivers. Each waiver can be conditional or unconditional. A partial waiver covers a progress payment and the waiver only applies to that payment amount, range of dates, or another agreed-upon checkpoint, while a final waiver covers the entire balance. If the waiver is conditional, it is only valid if the payment is made or clears the bank. Unconditional waivers become effective when they are signed, regardless of payment status.

Thus, a final unconditional waiver is appropriate only when a final payment is made for all money owed to the claimant for providing labor, services, materials or equipment and payment is immediately verifiable (meaning the check has cleared or there are no doubts about payment clearing the bank). This places significant risk on the claimant, as a final unconditional waiver signifies a complete forfeiture of any future lien rights in connection with this claim.

A valid waiver identifies the parties, the property where the claimant performed the work or improvement, and any other information necessary for the specific situation. The claimant must sign the document in front of a notary, then submit the completed waiver to the recording office for the county where the property is situated.

This article is provided for informational purposes only and is not legal advice. Please contact an attorney with questions about lien waivers or any other issues related to Nebraska lien laws.

Important: Your property must be located in Mcpherson County to use these forms. Documents should be recorded at the office below.

This Final Unconditional Lien Waiver meets all recording requirements specific to Mcpherson County.

Our Promise

The documents you receive here will meet, or exceed, the Mcpherson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mcpherson County Final Unconditional Lien Waiver form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Michael O.

January 9th, 2023

Great experience. Pre-printed forms, line explanations and samples - solve a lot of problems, eliminate many headaches and research. Thank You!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen C.

April 6th, 2020

Very easy site to use and reasonably priced. My document was received by the county and filed within 1/2 hour.

Thank you for your feedback. We really appreciate it. Have a great day!

Holly K.

November 4th, 2022

This is the simplest way to record a deed ever. Just uploaded the deed and the professionals at deed.com did the rest. Within 8 hours, I had my recorded deed back. The price is fantastic. It would have cost me more in gas to drive to the county where I had to record the deed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine N.

May 22nd, 2019

Very easy to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Irene G.

January 26th, 2021

Excellent service for anyone doing their own deed filing without the use of a title company or an attorney. I will definitely recommend deeds.com to my notary clients and will be personally using this service again! ;)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony L.

February 15th, 2020

I recently needed an affidavit of death. The form and help tools made it easy to fill out and file. the Recorder accepted this form . Which made the experience painless and easy . All things considered..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelly J.

May 23rd, 2022

There's nothing to say except it couldn't be easier.

Thank you for your feedback. We really appreciate it. Have a great day!

irene w.

February 11th, 2021

Just found this site, what a great resource ! Thank you so much for providing affordable help to those of us navigating estate planning mazes. The forms were all very easy to download, even on our rather ancient computer, and the accompanying explanations were in clear, understandable English designed to explain, with appropriate cautions to avoid problems.

Thank you for your feedback. We really appreciate it. Have a great day!

Tod F.

August 9th, 2019

In 15 minutes I had my out of state documents. I am very pleased with the ease of acquiring them. I will definitely be using Deeds.com again if the need arises.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

AHMED E.

August 23rd, 2019

5 stars

Thank you!

Scott W.

February 5th, 2024

Quick and simple.

Thank you!

Xochitl B.

November 30th, 2021

Excellent website, thanks so much.

Thank you!

Brian M.

March 7th, 2024

The document had all the information needed but could have been presented with a more professional look for the price.

We appreciate you highlighting the balance between compliance and presentation. While our main focus is on the legal correctness and statutory compliance of the documents, we also strive to present this information in a clear and accessible manner.

James D.

January 2nd, 2019

good product, but would prefer an editable document, such as word

Thanks for your feedback James.

Tony W.

May 27th, 2022

I have not completed the forms yet but they appear to be exactly what I need for the purpose they are intended. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!