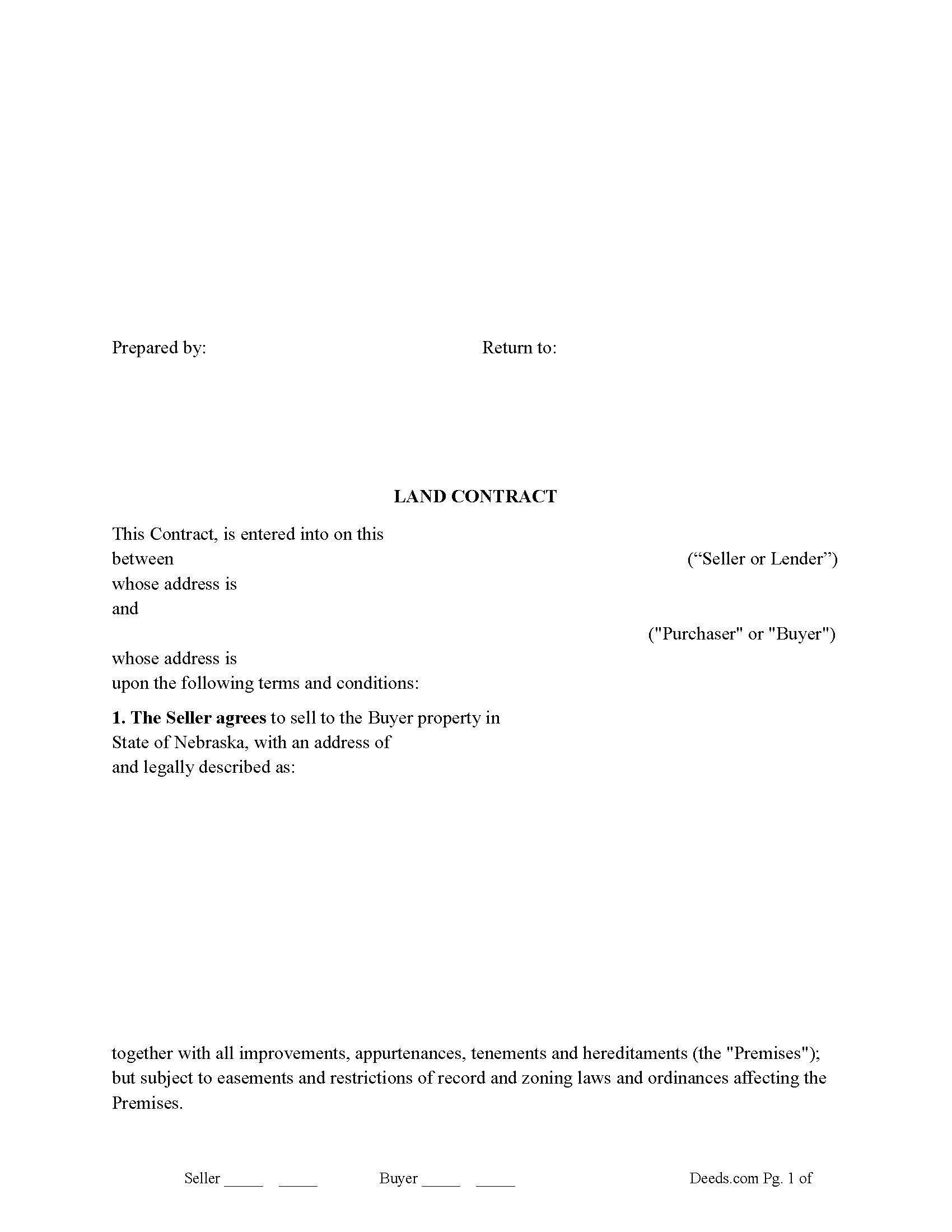

Franklin County Land Contract Form

Franklin County Land Contract Form

Fill in the blank Land Contract form formatted to comply with all Nebraska recording and content requirements.

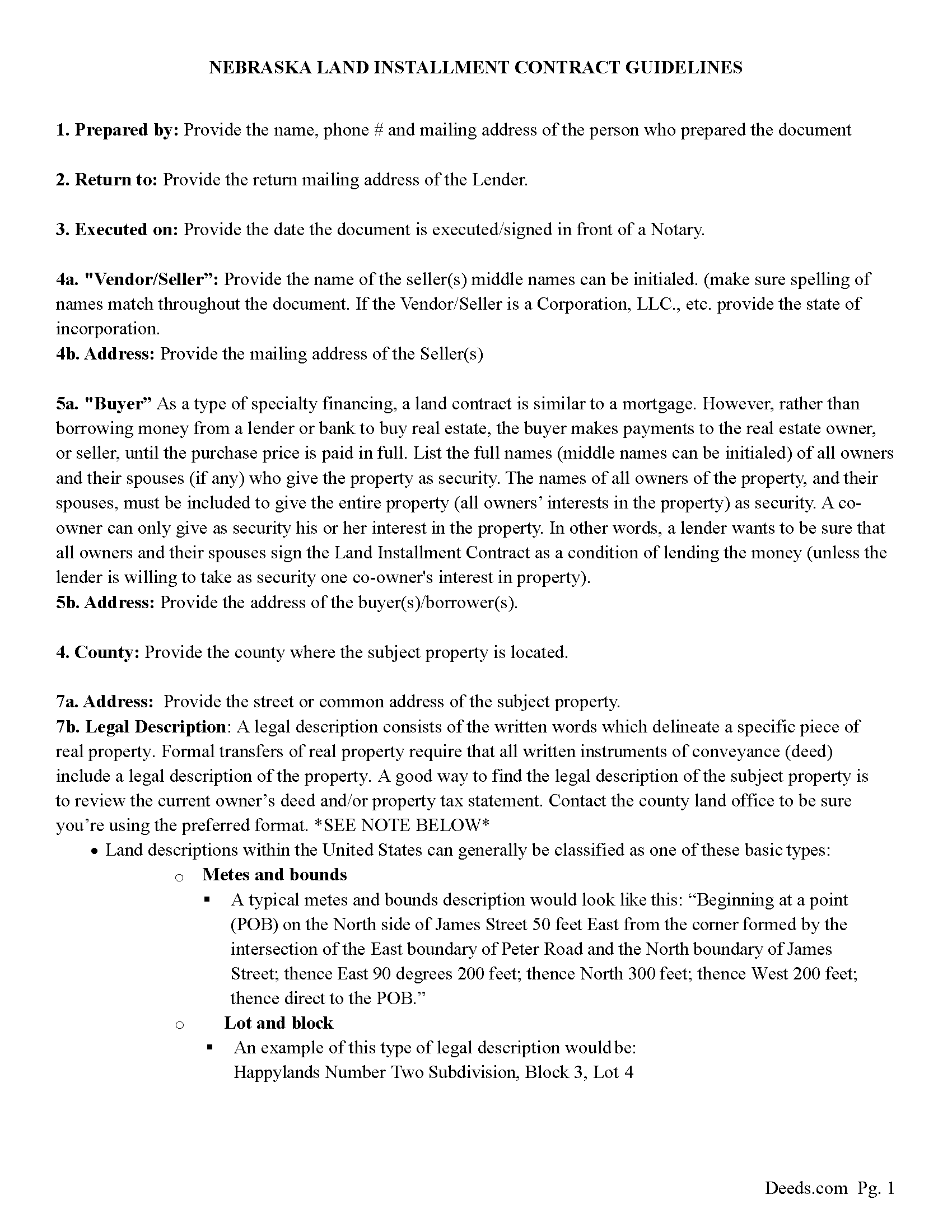

Franklin County Land Contract Guide

Line by line guide explaining every blank on the Land Contract form.

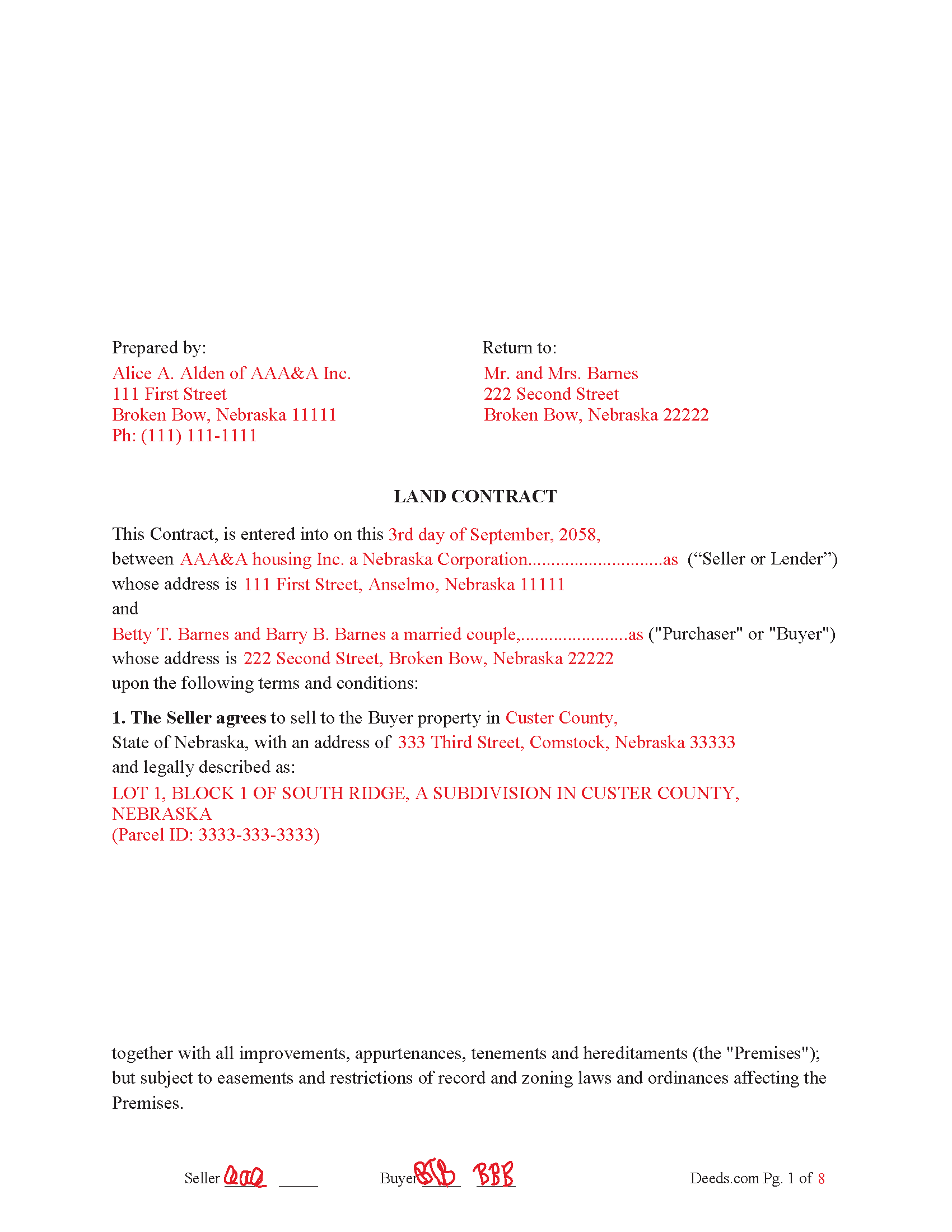

Franklin County Completed Example of the Land Contract Document

Example of a properly completed Nebraska Land Contract document for reference.

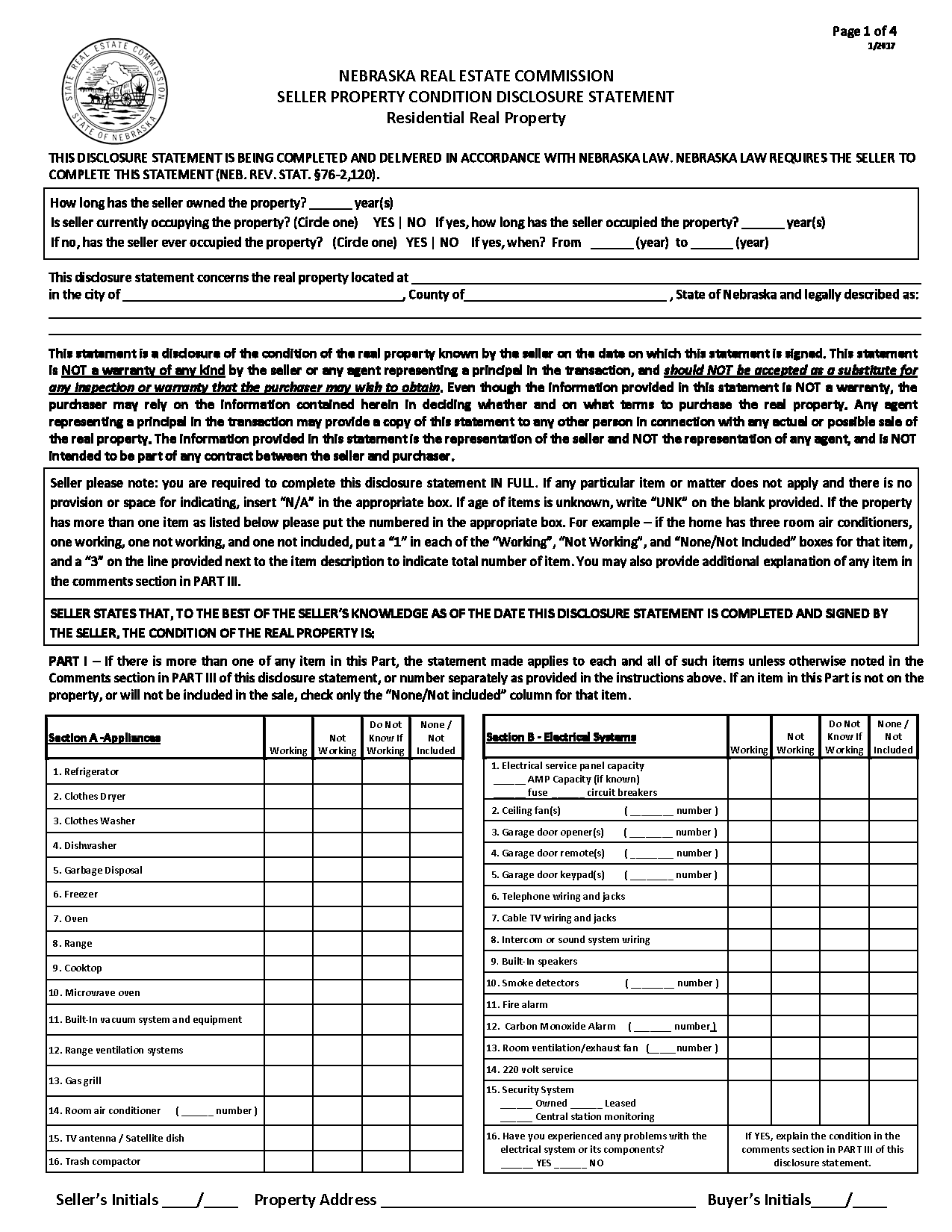

Franklin County Residential Sellers Property Disclosure Statement

Seller's disclosure form applicable for residential property.

Franklin County Lead Based Paint Disclosure Form

Applicable to property built before 1978.

Franklin County Lead Based Paint Brochure

Brochure for buyers if applicable.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Register of Deeds

Franklin, Nebraska 68939

Hours: 8:30 to 4:30 Monday through Friday

Phone: (308) 425-6202

Recording Tips for Franklin County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Bloomington

- Campbell

- Franklin

- Hildreth

- Naponee

- Riverton

- Upland

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (308) 425-6202 for current fees.

Questions answered? Let's get started!

Common Uses for a Nebraska Land Installment Contract

1. Alternative to Traditional Financing

For buyers who can’t qualify for a bank loan due to poor credit, limited credit history, or self-employment.

For sellers who want to expand their buyer pool by offering owner-financing.

2. Purchasing Rural or Agricultural Land

Used for sales of farmland, ranch land, or vacant rural lots where traditional lending may be harder to secure.

Useful in family transfers of agricultural property where a younger generation buys the land over time.

3. Investment or Seller Financing Strategy

Sellers use land contracts to earn interest on installment payments and retain legal control of the property until paid in full.

May allow for a higher sale price or more favorable terms compared to cash sales.

4. Real Estate Flipping

A useful tool for real estate investors who buy, improve, and resell properties to buyers with limited access to financing.

5. Estate Planning or Intra-Family Transfers

Parents selling property to children using installment terms.

Allows for gradual transfer of ownership without requiring full payment upfront.

6. Land Development Deals

Used by developers selling individual lots in a subdivision on contract while retaining control until each buyer completes payment.

Legal and Practical Considerations in Nebraska

Title remains with the seller until the final payment is made.

Buyer holds equitable title, gaining certain property rights and obligations (like maintenance, taxes, insurance).

Use this land contract form for residential, condominiums and vacant land properties. Includes Installment payments schedule with or without a balloon payment.

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Land Contract meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Land Contract form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Kevin R.

August 22nd, 2023

I have been using Deeds.com for the last 2 years and find them very easy to use and expedient on all my recordings. Highly recommend.

Thank you for the kind words Kevin. We appreciate you.

Maree W.

August 5th, 2022

I am so impress with the forms that is needed for your state. It makes your task so easy and no worries. This was a big help in taking care of business. Thank you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

catherine c.

August 22nd, 2020

very efficient with communication and follow-up(s) will be using again, thank you!:)

Thank you!

Terri A B.

July 17th, 2025

The process was easy and cost was reasonable. My only suggestion is to allow user the ability to shorten the space between the county and state and the space after the month. I needed to draw a line at the courthouse before they would file it.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Brenn C.

April 11th, 2022

These products would be more useful if they final deed could be copied and pasted into a word document for proper formatting. Because most of the document is protected against selecting and copying, I did not find it useful. I would not purchase again.

Thank you for your feedback. We really appreciate it. Have a great day!

Petre A.

April 9th, 2022

Easy @ useful

Thank you!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STANLEY K.

February 3rd, 2022

I AM DELIGHTED TO BE PARTY TO DEEDS.COM. THE PROCESS IS DOWN-TO-EARTH AND VERY USER FRIENDLY. I MUST SAY THAT JUST THE SAVINGS IN TRAVEL TIME AND MONEY IS IN ITSELF VERY REFRESHING. THIS ON LINE PROCESS IS SO CONVENIENT FOR MY OVERALL EFFORT AND OF COURSE FOR OUR CLIENTS AS WELL. I GOT BACKED UP IN RECORDING WHEN THE VIRUS BEGAN RAGING AND PERSONAL VISITS TO LAND RECORDS BECAME A THING OF THE PAST.I FOUND THE SITE WITH A SUGGESTION FROM DC LAND RECORDS' ASSISTANT BY PHONE. I ONLY WISH I'D KNOWN ABOUT THIS AWESOME SERVICE BEFORE 2020. HATS OFF TO DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

PAMELA D.

March 28th, 2022

great response!! Thank you

Thank you!

LAWRENCE P.

December 7th, 2021

How about a single button zip download of the files displayed instead of downloading them one at a time?

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen D.

January 15th, 2019

Very good hope to use in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim H.

August 13th, 2020

Well written form, and the guidance document and example supplied were very helpful.

Thank you!

Steve R.

April 28th, 2023

Quick, clean, easy. A hat trick.

Thank you!

Joshua M.

March 15th, 2023

Fast service, very responsive. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

E. Louise S. M.

April 5th, 2019

Your site is simple, easy to use, and an outstanding service.

Thank you for your feedback. We really appreciate it. Have a great day!