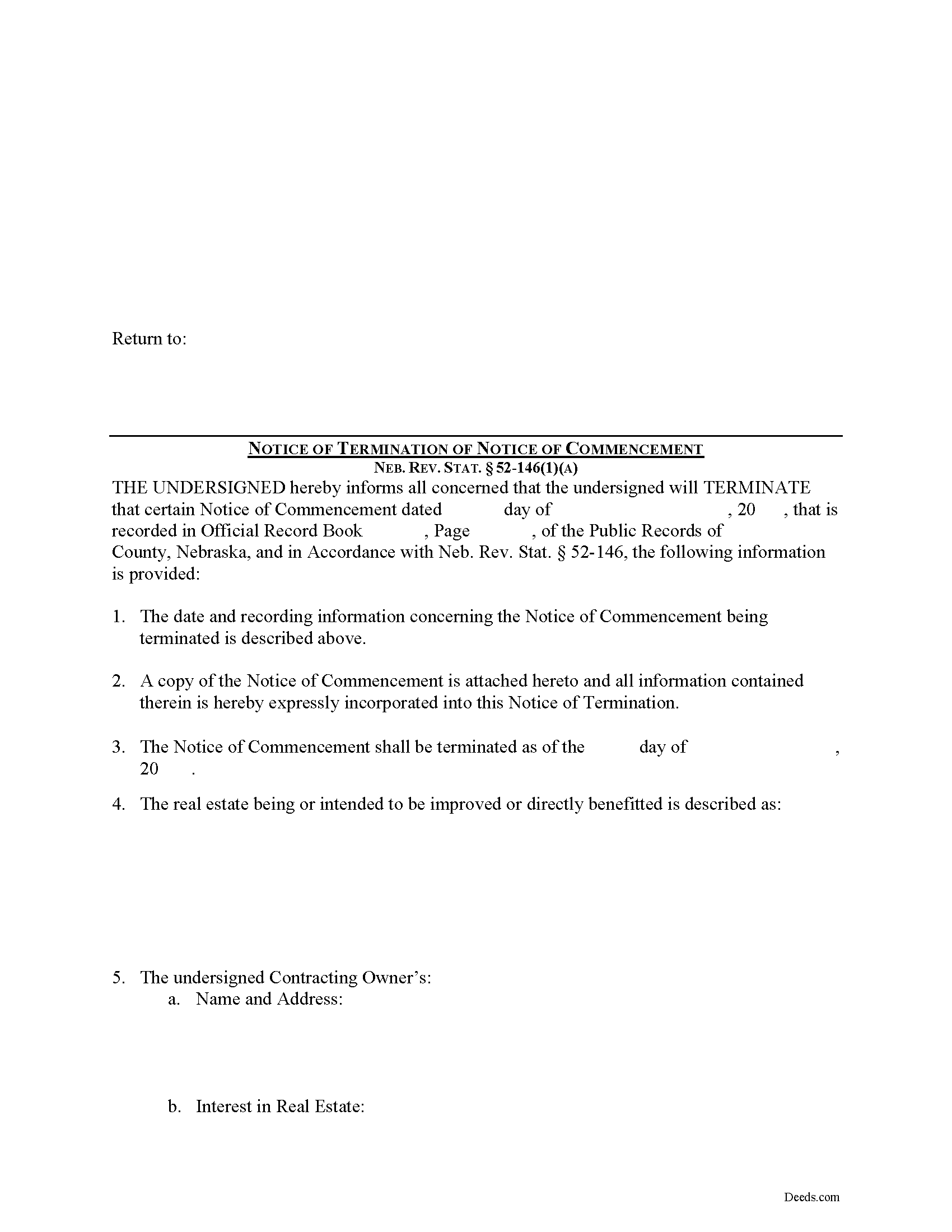

Deuel County Notice of Termination Form

Deuel County Notice of Termination Form

Fill in the blank Notice of Termination form formatted to comply with all Nebraska recording and content requirements.

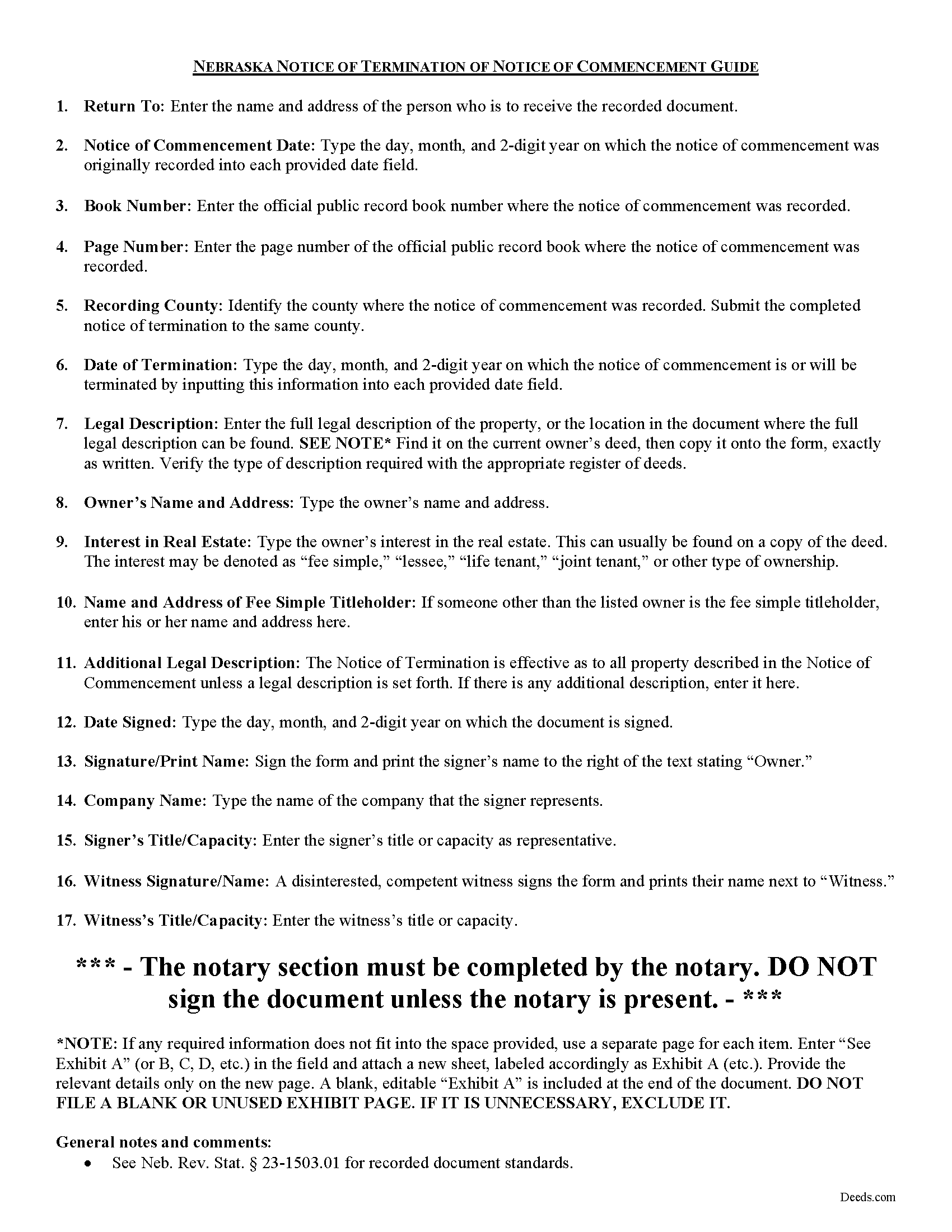

Deuel County Notice of Termination Guide

Line by line guide explaining every blank on the form.

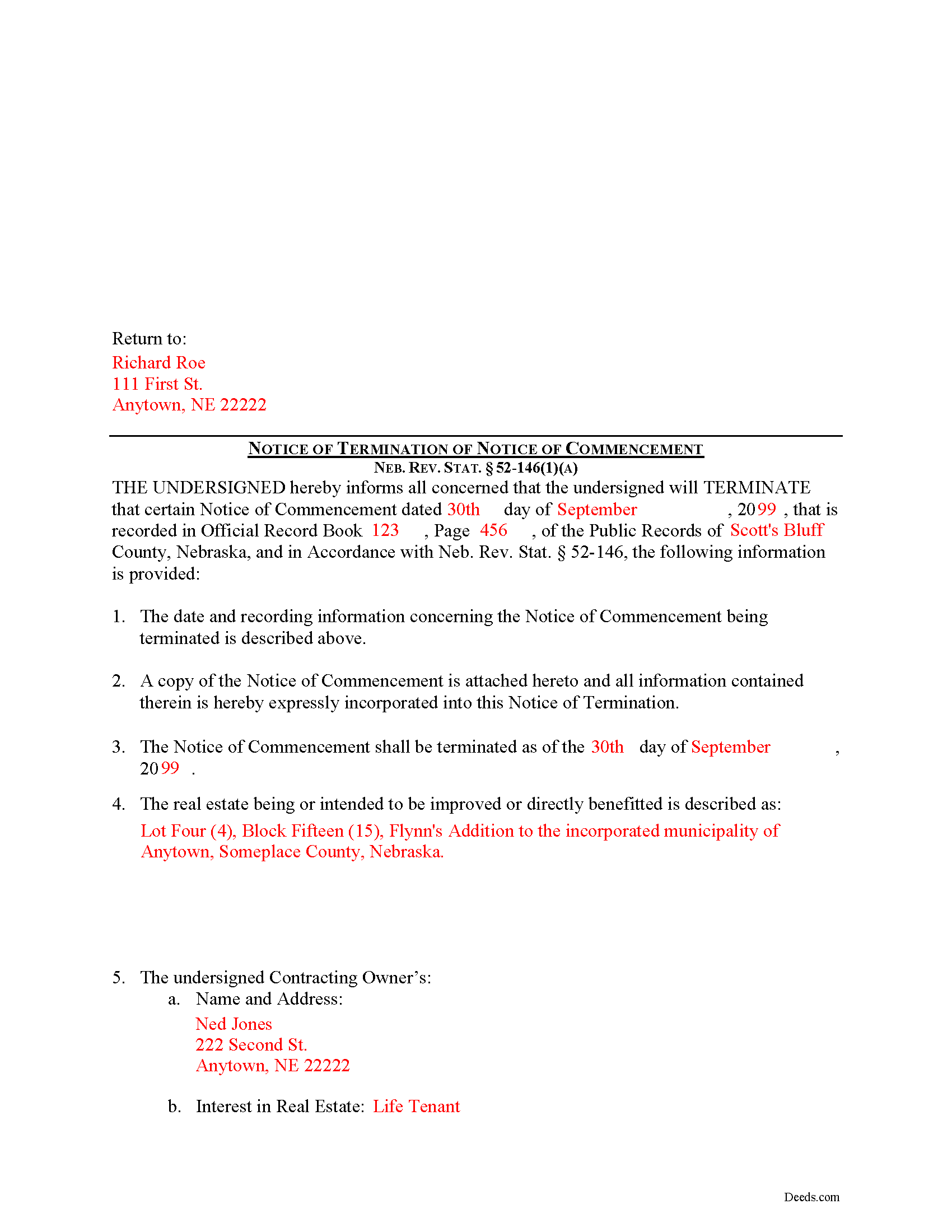

Deuel County Completed Example of the Notice of Termination Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Deuel County documents included at no extra charge:

Where to Record Your Documents

Deuel County Register of Deeds

Chappell, Nebraska 69129

Hours: 8:00 to 4:00 Monday through Friday

Phone: (308) 874-3472

Recording Tips for Deuel County:

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Deuel County

Properties in any of these areas use Deuel County forms:

- Big Springs

- Chappell

Hours, fees, requirements, and more for Deuel County

How do I get my forms?

Forms are available for immediate download after payment. The Deuel County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Deuel County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Deuel County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Deuel County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Deuel County?

Recording fees in Deuel County vary. Contact the recorder's office at (308) 874-3472 for current fees.

Questions answered? Let's get started!

Construction liens are governed under the Nebraska Construction Lien Act, found at Sections 52-125 to 52-159 of the Nebraska Revised Statutes.

In Nebraska, a contracting owner may terminate a notice of commencement as to all or any identified portion of the real estate subject to the notice of commencement by recording a notice of termination. Neb. Rev. Stat. 52-146(1).

The notice of termination must contain the following:

1) The information required for a notice of commencement (See Neb. Rev. Stat. 52-145);

2) A reference to the recorded notice of commencement by its record location and a statement of its date of recording;

3) A statement of the date as of which the notice of commencement is terminated which date may not be earlier than thirty (30) days after the notice of termination is recorded; and

4) If the notice of termination is to apply only to a portion of the real estate subject to the notice of commencement, a statement of that fact and a description of the portion of the real estate to which the notice of termination applies. Id.

Note that, in addition to the content requirements, the form must meet all state and local standards for recorded documents. File the completed notice with the county recorder's office within the bounds of the county where the property is located.

To fully end the recorded notice of commencement, the owner must also complete and publish or record the following in addition to recording the notice of termination:

1) Send, at least three weeks before the effective date of the notice of termination, a copy of the notice of termination, showing the date it was recorded, to all claimants who have requested that the owner notify them of the recording of a notice of termination;

2) Publish a notice of the recording of the notice of termination, at least once a week for three consecutive weeks in a newspaper having general circulation in the county where the recording occurs, the last publication of which must be at least five days before the stated termination date; and

3) Record an affidavit stating that notice of the recorded notice of termination has been sent to all claimants who have requested notice and that publication has been made. The affidavit must state the newspaper and dates of publication and include a copy of the published notice. Id.

This article is offered for informational purposes only and is not legal advice. This information not be relied upon as a substitute for speaking with an attorney. Please speak with an attorney familiar with construction lien laws for any questions regarding the Notice of Termination or any other issues related to liens in Nebraska.

Important: Your property must be located in Deuel County to use these forms. Documents should be recorded at the office below.

This Notice of Termination meets all recording requirements specific to Deuel County.

Our Promise

The documents you receive here will meet, or exceed, the Deuel County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Deuel County Notice of Termination form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Michael S.

July 11th, 2019

So far, I'm happy with my experience. I'm still reviewing the guide for the docs I downloaded. Including the guide for the docs is indeed a plus.

Thank you Michael, we really appreciate your feedback.

Angela W.

March 12th, 2022

Very helpful and very quick to respond. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas W.

September 15th, 2019

A great way to access form knowledge

Thank you!

David L.

January 13th, 2021

Deeds.com makes recording quick and easier than driving a half an hour each way and needing to leave home! The fees are reasonable for the convenience, and while Covid is closing doors. Dave

Thank you!

Debbie M.

August 21st, 2019

Everything that I needed was included. I appreciate that there was a sample as well as the step-by-step directions included in the download. I would definitely recommend this site to anyone that needs it.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Russell N.

March 16th, 2021

Very simple process to purchase and download. Made it easy to understand the different forms and their uses and how to select the right form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew M.

January 21st, 2024

Awesome service, I don’t know how much it saved me but I know it was a lot cheaper than going to a lawyer.

We are delighted to have been of service. Thank you for the positive review!

Cheryl D.

August 24th, 2020

How easy was this. I was pleasantly surprised by the speed and price. Saved me several days of snail mail :) thanks deeds.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joan P.

March 18th, 2020

Thank you for combining all necessary documents in one simple location.

Thank you!

Thomas C.

April 12th, 2023

I got the right form but I waited too long to use it and Oregon changed the formatting. I should have checked and made sure the form was still good. Deeds responded quickly.

Thank you!

Joseph B.

December 24th, 2021

Multiple attempts to straight answers to very simple straight forward questions about why my submission is not being accepted have gone unanswered. It's been two days and no answer that solves my problem.

Sorry we were unable to assist you Joseph. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

AHMED E.

August 23rd, 2019

5 stars

Thank you!

Lisa C.

December 5th, 2023

Thank you. Very easy!

We are delighted to have been of service. Thank you for the positive review!

Paul V.

January 10th, 2022

Easy to use , so far

Thank you!

Megan L.

July 25th, 2022

Explanation of all forms is simple and easy to understand. The forms are made in accordance to my state. This website is easy to use and navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!