Greeley County Quitclaim Deed Form

Last validated November 18, 2025 by our Forms Development Team

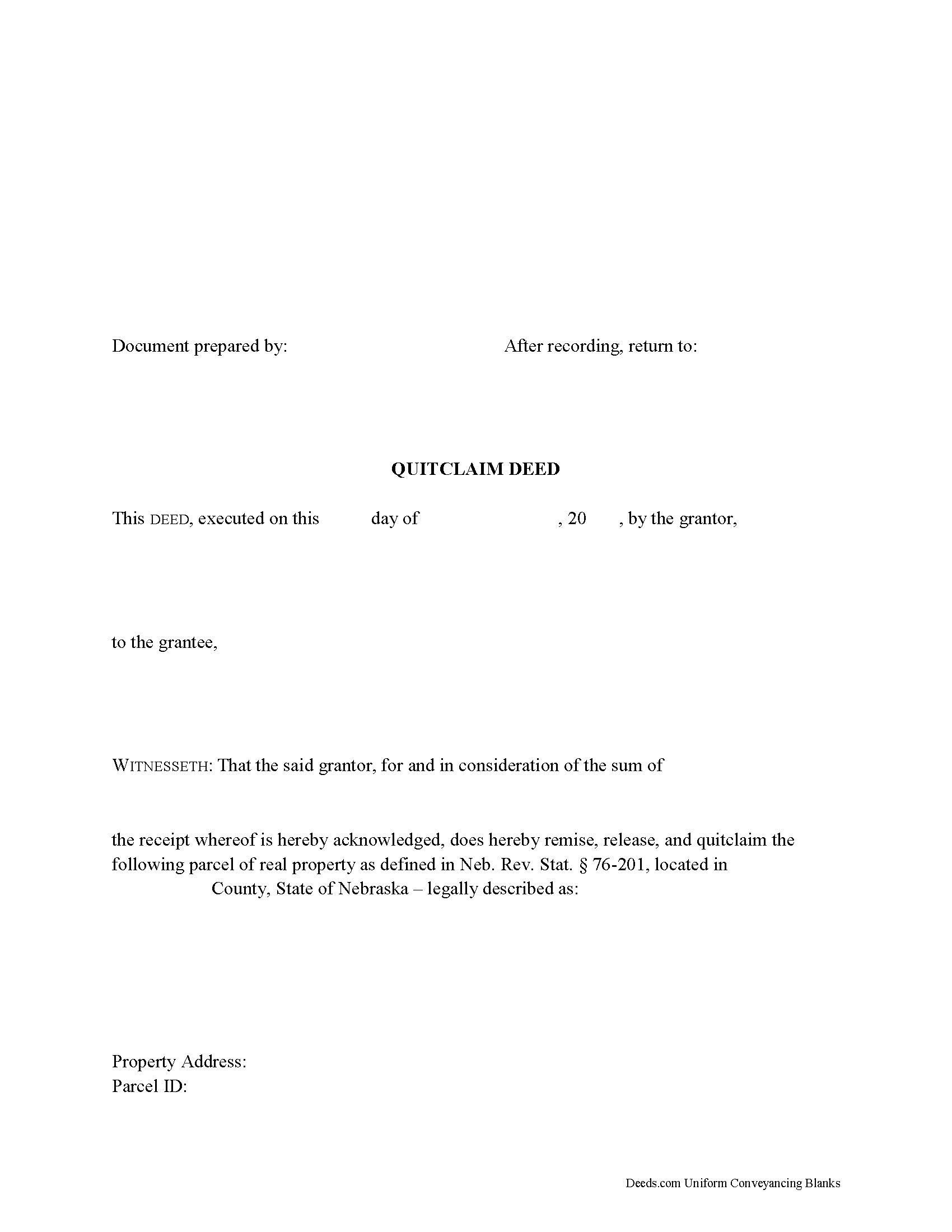

Greeley County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Nebraska recording and content requirements.

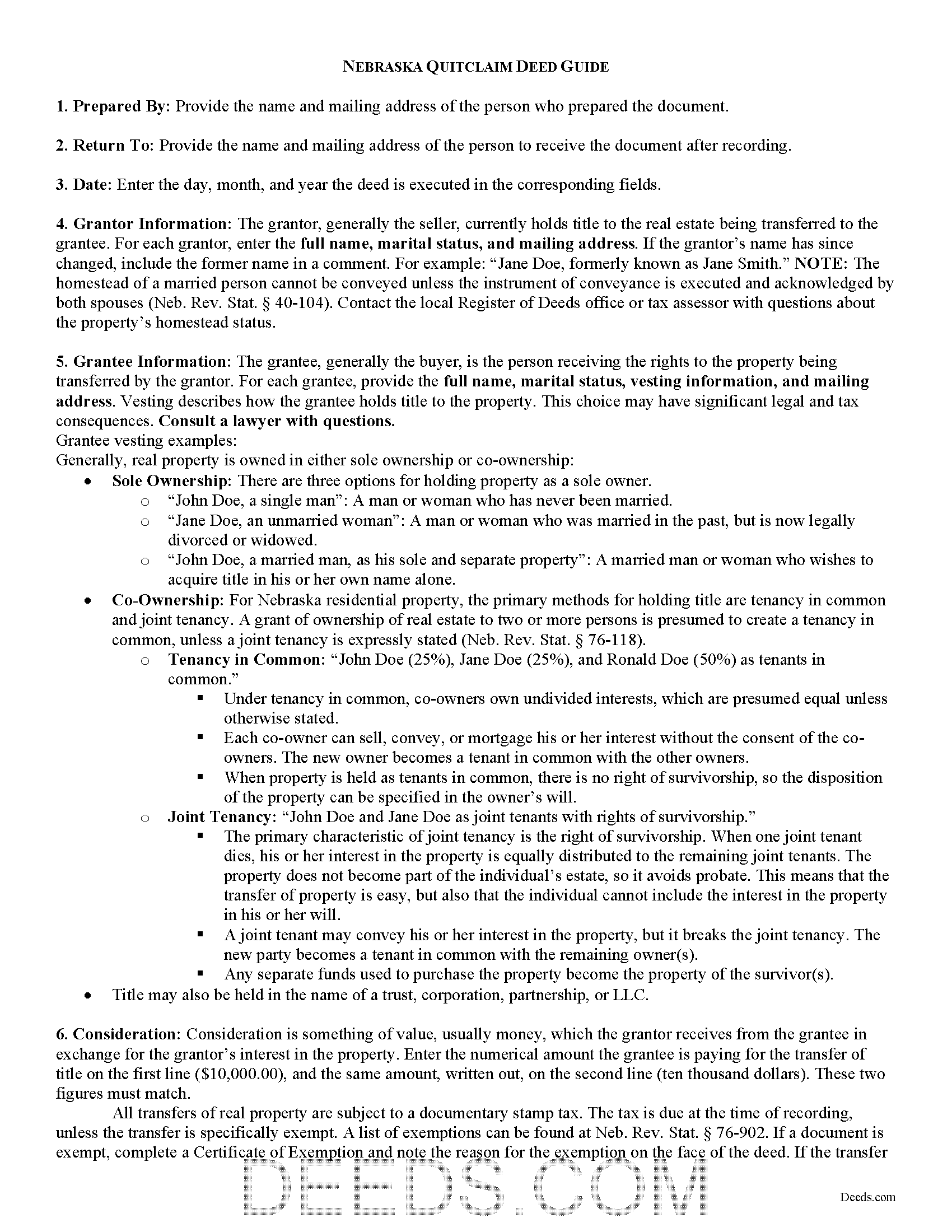

Greeley County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

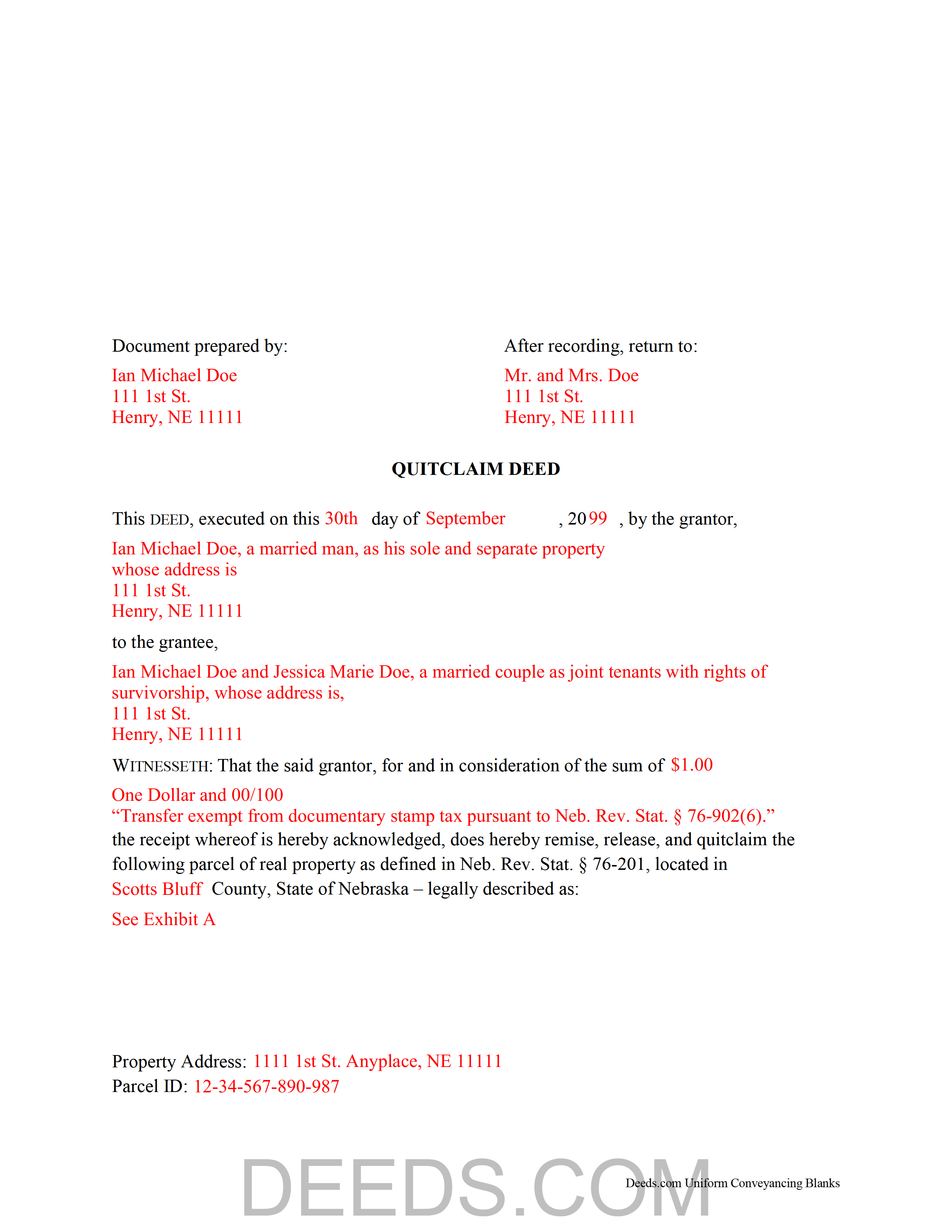

Greeley County Completed Example of the Quitclaim Deed Document

Example of a properly completed Nebraska Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Greeley County documents included at no extra charge:

Where to Record Your Documents

Greeley County Register of Deeds

Greeley, Nebraska 68842

Hours: 8:00 to 4:00 M-F

Phone: (308) 428-3625

Recording Tips for Greeley County:

- Bring your driver's license or state-issued photo ID

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Greeley County

Properties in any of these areas use Greeley County forms:

- Greeley

- Scotia

- Spalding

- Wolbach

Hours, fees, requirements, and more for Greeley County

How do I get my forms?

Forms are available for immediate download after payment. The Greeley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Greeley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Greeley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Greeley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Greeley County?

Recording fees in Greeley County vary. Contact the recorder's office at (308) 428-3625 for current fees.

Questions answered? Let's get started!

In Nebraska, real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are accepted, but not statutory in Nebraska.

A quitclaim deed offers no warranties of title. It does not guarantee that the grantor has good title or ownership of the property, and only transfer the grantor's interest, if any, at the time of execution. They are typically used for transfers between family members, in divorce proceedings or other transfers of property pursuant to court order, or to clear title.

A lawful quitclaim deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Nebraska residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly stated (Neb. Rev. Stat. 76-118).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed should meet all state and local standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. In Nebraska, both spouses must sign the deed to release any marital rights, regardless of whether or not the spouse holds a direct interest in the property (Neb. Rev. Stat. 40-104). For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

All transfers of real property are subject to a documentary stamp tax. The tax is due at the time of recording. If the transfer is exempt under Neb. Rev. Stat. 76-902, note the reason on the face of the deed and fill out a certificate of exemption.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about quitclaim deeds, or for any other issues related to transfers of real property in Nebraska.

(Nebraska QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Greeley County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Greeley County.

Our Promise

The documents you receive here will meet, or exceed, the Greeley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Greeley County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4614 Reviews )

Patsy H.

January 10th, 2022

I had trouble at first printing out the forms but once I figured out what to do, all went well. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melissa L.

August 26th, 2022

Exactly what I was looking for and easy to fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

Kim B.

June 21st, 2024

The package was extremely helpful and provided everything I needed to complete this for my mom- I highly recommend their service!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Diane P.

July 22nd, 2022

Form was very easy to use and was processed/ recorded with no issue. Thank you it saved me from having to contact an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

richard E.

April 23rd, 2020

First time I used service. It was simple to use. The response time was excellent. I look forward to using them in the future.

That's awesome Richard, glad we could help!

Craig W.

August 18th, 2019

This is a great way to get paper work to the land love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy B.

April 19th, 2019

Used this service in 2016 and had NO problems with getting all the correct paperwork submitted and I would definitely recommend this company

Thank you for your feedback. We really appreciate it. Have a great day!

David M.

August 9th, 2023

A real boon to those of us who are not attorneys but wish to protect our assets and avoid probate court issues. Thank you for a great service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

Duane S.

June 5th, 2019

Really glad to find your site. Made filing so much easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard H.

October 14th, 2022

It was a waste of time. I asked a question via your chat service. I received an acknowledgement that you received the question, that you might or might not answer it, and don't bother to reply to you email, as no one would read it. Confirming my belief that customer service is an oxymoron for most companies. (I doubt this review will ever appear on the site, or anyuhere else.)

Thank you!

Samantha B.

December 9th, 2020

Awesome service! This took care of my needs 10x faster than I thought possible. I even bought an extra service that wasn't needed to accomplish my end goal and they refunded me without me even asking. Highly recommend!

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret S.

February 19th, 2025

Your service is second to none. Your website is user-friendly, easy to navigate and within minutes I had the forms I needed. Keep up the good work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela L.

July 18th, 2023

Fast efficient informative. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara B.

February 17th, 2019

Great forms and instructions!

Thank you Barbara.