Franklin County Transfer on Death Deed Form

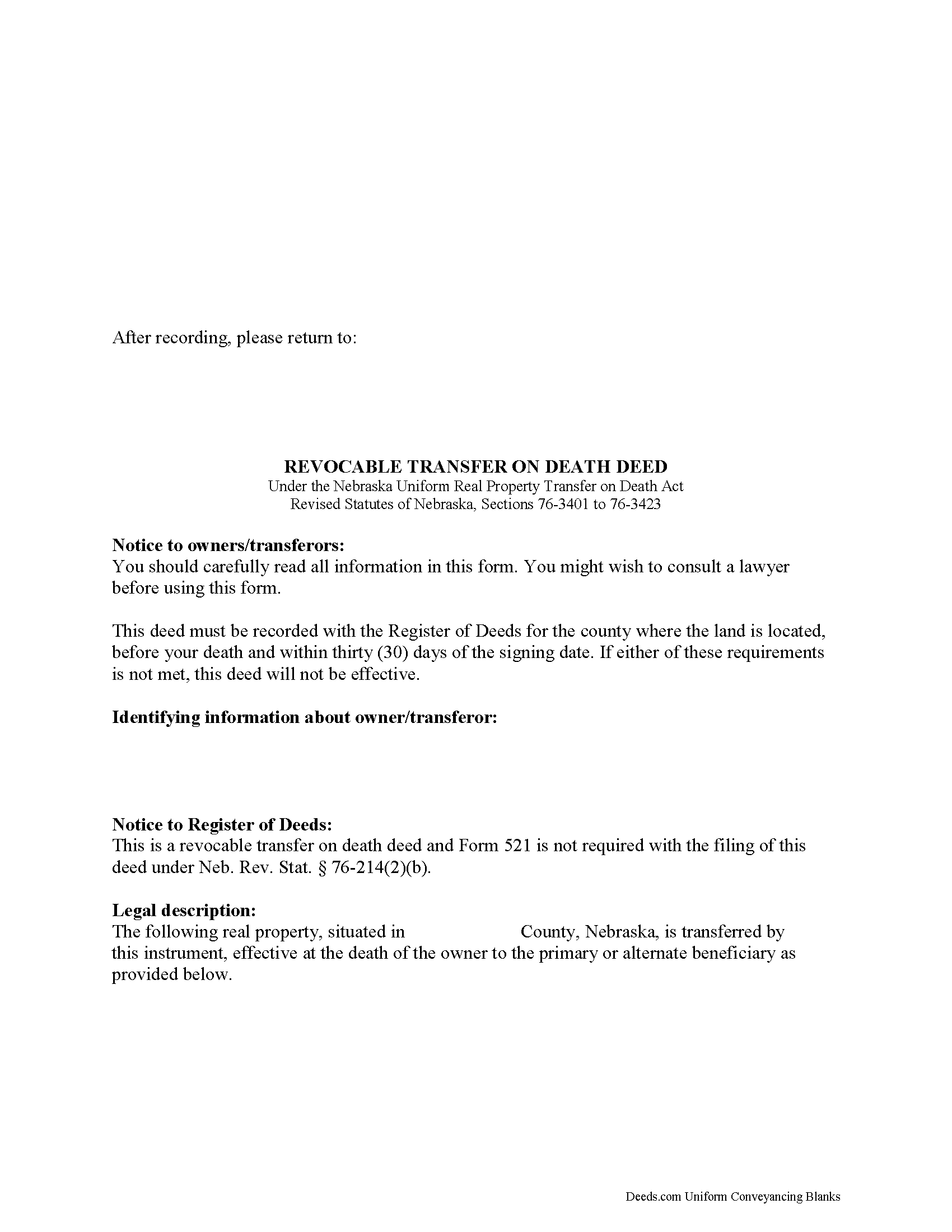

Franklin County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

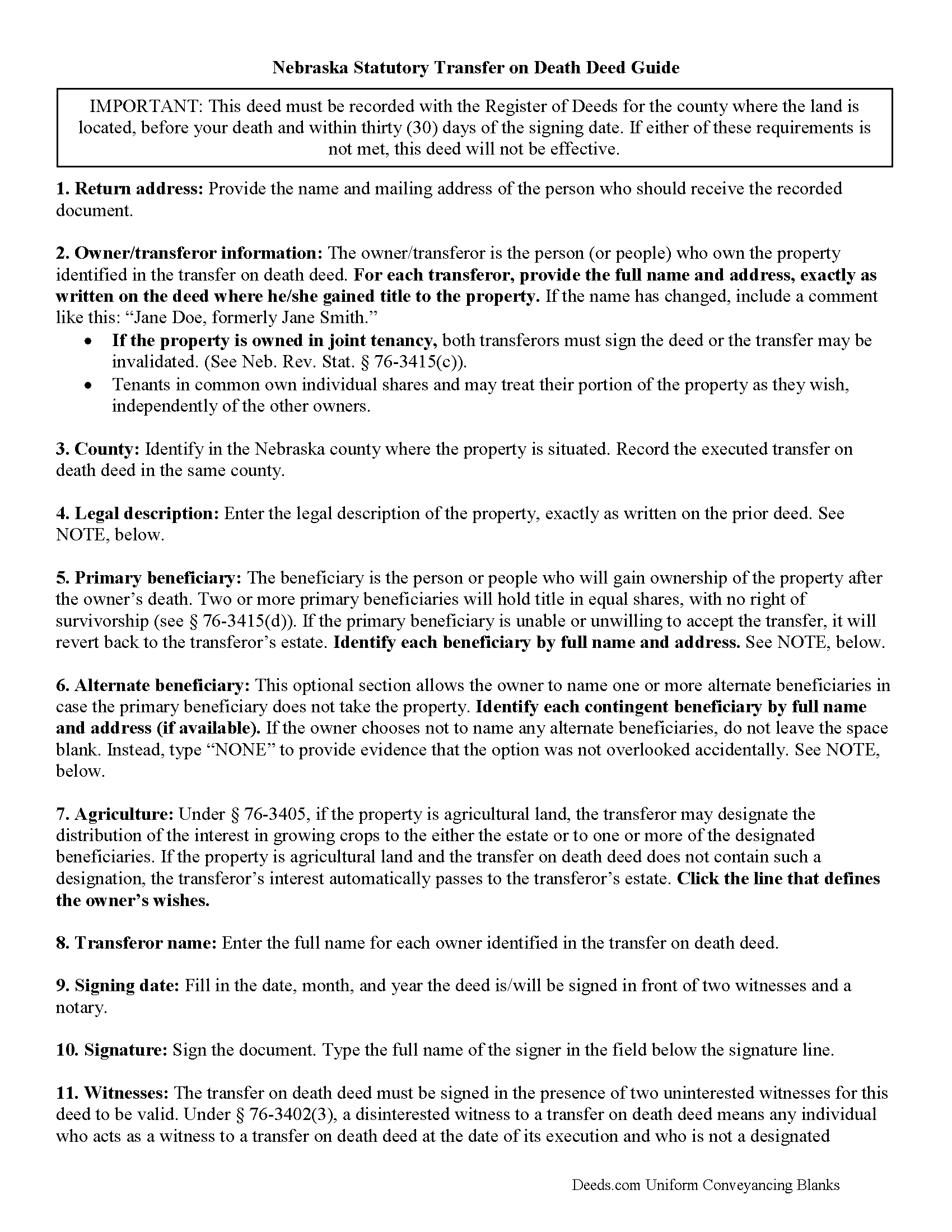

Franklin County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

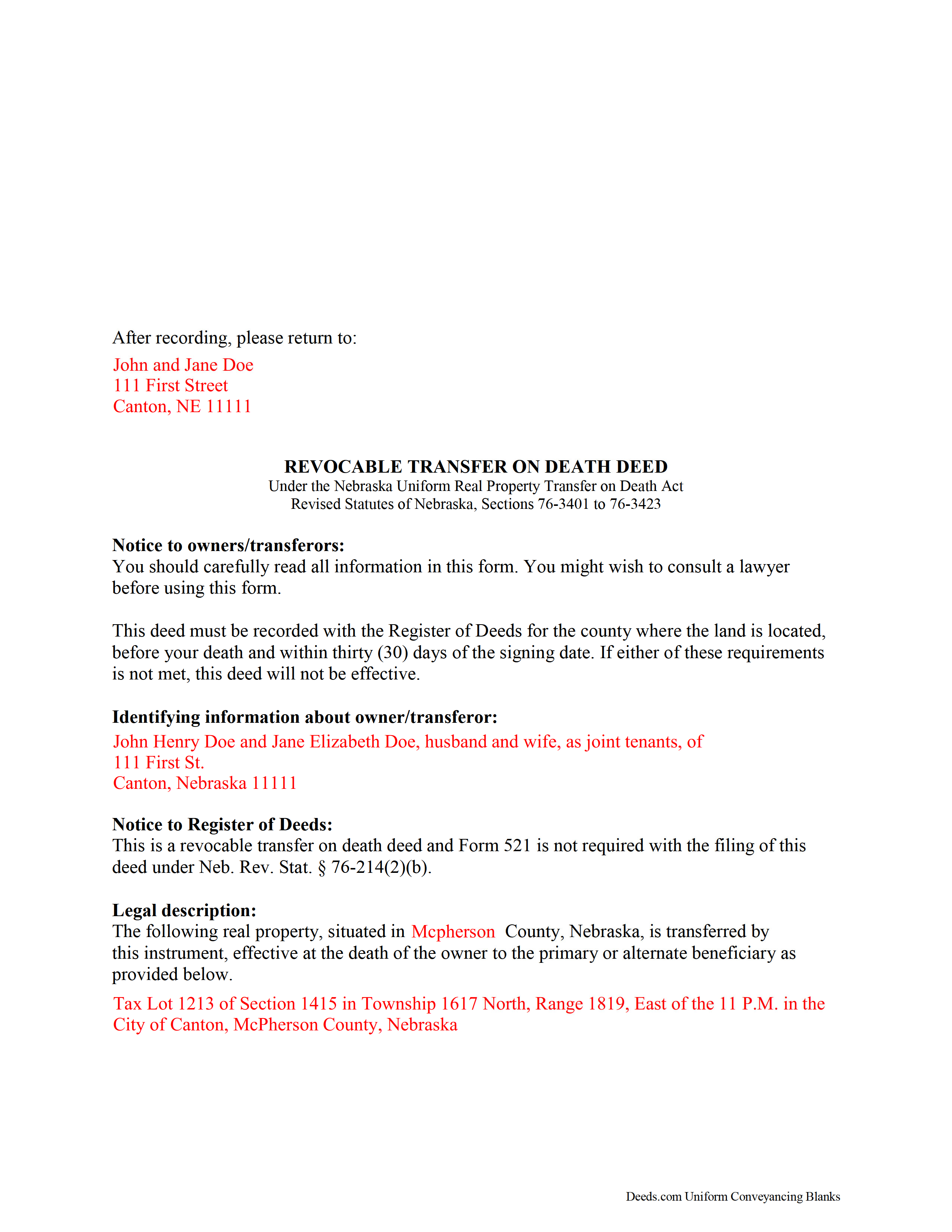

Franklin County Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Register of Deeds

Franklin, Nebraska 68939

Hours: 8:30 to 4:30 Monday through Friday

Phone: (308) 425-6202

Recording Tips for Franklin County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Bloomington

- Campbell

- Franklin

- Hildreth

- Naponee

- Riverton

- Upland

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (308) 425-6202 for current fees.

Questions answered? Let's get started!

The Nebraska Uniform Real Property Transfer on Death Act is found at Sections 76-3401 to 76-3423 of the Nebraska Revised Statutes. This useful law provides an option for land owners to convey their real estate after their death, but without the need to include it in a will.

A transfer on death deed (TODD), when lawfully executed, allows property owners to retain absolute title to and control over their land during their lives ( 76-3414). The deeds are also revocable (76-3413). In part, these features are possible because unlike traditional deeds (warranty deeds, quitclaim deeds, etc.), TODDs do not require consideration from or notice to the beneficiary ( 76-3411).

In addition to meeting the content requirements of traditional deeds, people who use or revoke TODDs must meet the same competency standards as for creating a will (76-3408). The statute also demands the signatures of two disinterested witnesses (76-3409). Further, the document must contain specific warnings and must be recorded before the owner's death and within thirty days of signing ( 76-3410).

The rules for revoking a recorded TODD are set out at 76-3413. They include executing and recording a document that specifically revokes the TODD ( 76-3413(1)(B)); a new TODD that revokes the previous deed and changes the beneficiary or details about the transfer (76-3413(1)(A)); or transferring the real estate with a traditional deed (76-3413 (1)(C)).

When the owner dies, the beneficiary may accept the transfer by recording the appropriate documentation (76-3412, 76-3415) or disclaim the interest as provided by section 30-2352 (76-3416).

Overall, transfer on death deeds are flexible tools to consider as part of a comprehensive estate plan, but each circumstance is unique. Please contact an attorney for complex situations or with specific questions.

(Nebraska TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Yunyan B.

November 12th, 2019

Great website, fraction of the price if doing title research elsewhere

Thank you for your feedback. We really appreciate it. Have a great day!

Ken B.

August 9th, 2022

Instructions were easy to follow

Thank you!

ANGELIA E.

December 23rd, 2020

Thanks for your expedite process

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

AJ H.

April 30th, 2019

What a wonderful service to offer! Very impressed, and grateful for the forms and instructions!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina D.

March 31st, 2025

The papers allowed me to get done what I needed. But for the price I would expect a spell check. There were spelling errors when there should not have been any. Please proof read

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!

Frank G B.

December 21st, 2019

site is very helpful and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Timothy K.

April 7th, 2021

Excellent service. Fast turnaround within one day. Reasonable pricing for services.

Thank you!

Gjnana D.

April 23rd, 2022

These guidelines and form helped me lot in preparing quit deed to add my spouse's name in tittle property

Thank you for your feedback. We really appreciate it. Have a great day!

ZENOBIA D.

November 11th, 2021

I Love Deeds.com. They have all of the documents you need to take care of your needs. IT is also safe and convenient way to send your documents safely and secure.

Thank you!

Robbin J.

June 1st, 2020

Really great website!! Easy to use!! Very helpful!!

Thank you!

Rochelle C.

July 8th, 2020

Very prompt service. Thank you.

Thank you!

Ronald M.

April 18th, 2019

Easy to use but can't seem to find LOGOUT control????

Thank you for the feedback Ronald. (The Sign Out control is on the top right of the account page)

Mary H.

July 27th, 2022

Great source for forms acceptable to the county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert B.

January 18th, 2019

Liked the fact that the forms were fill in the blank. Good to have the option of re-doing them if needed, and I needed ;)

Thank you for your feedback. We really appreciate it. Have a great day!