Adams County Transfer on Death Revocation Form

Adams County Transfer on Death Revocation Form

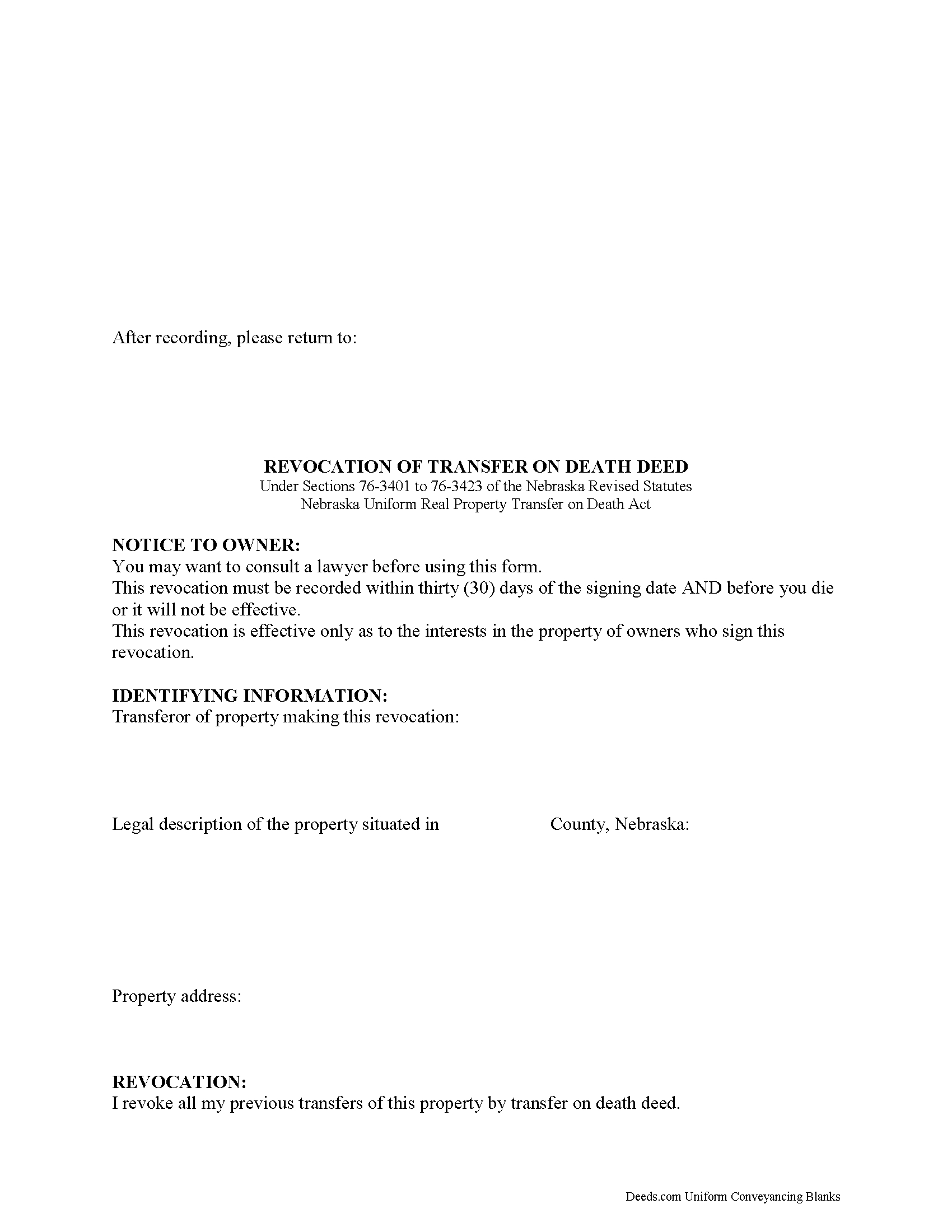

Fill in the blank form formatted to comply with all recording and content requirements.

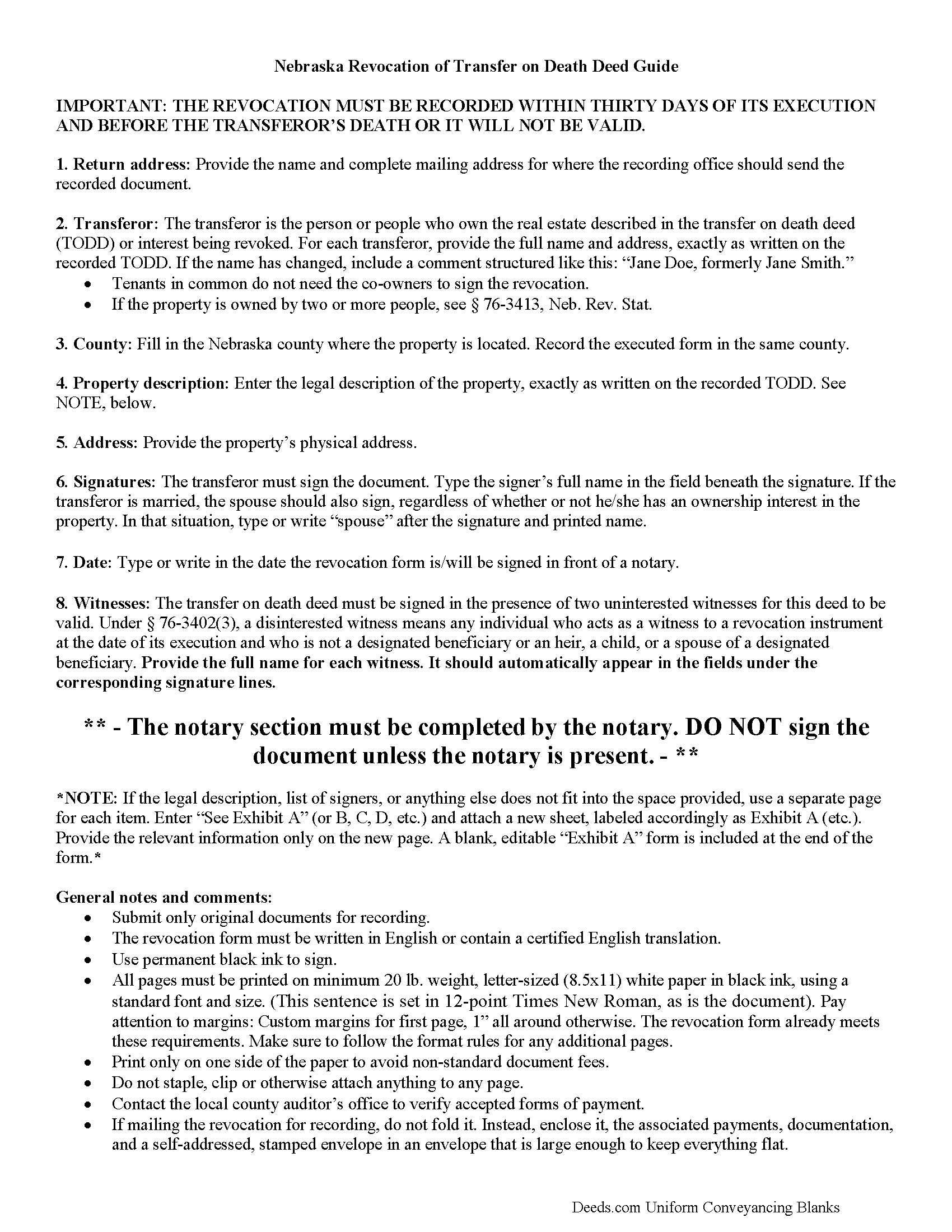

Adams County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

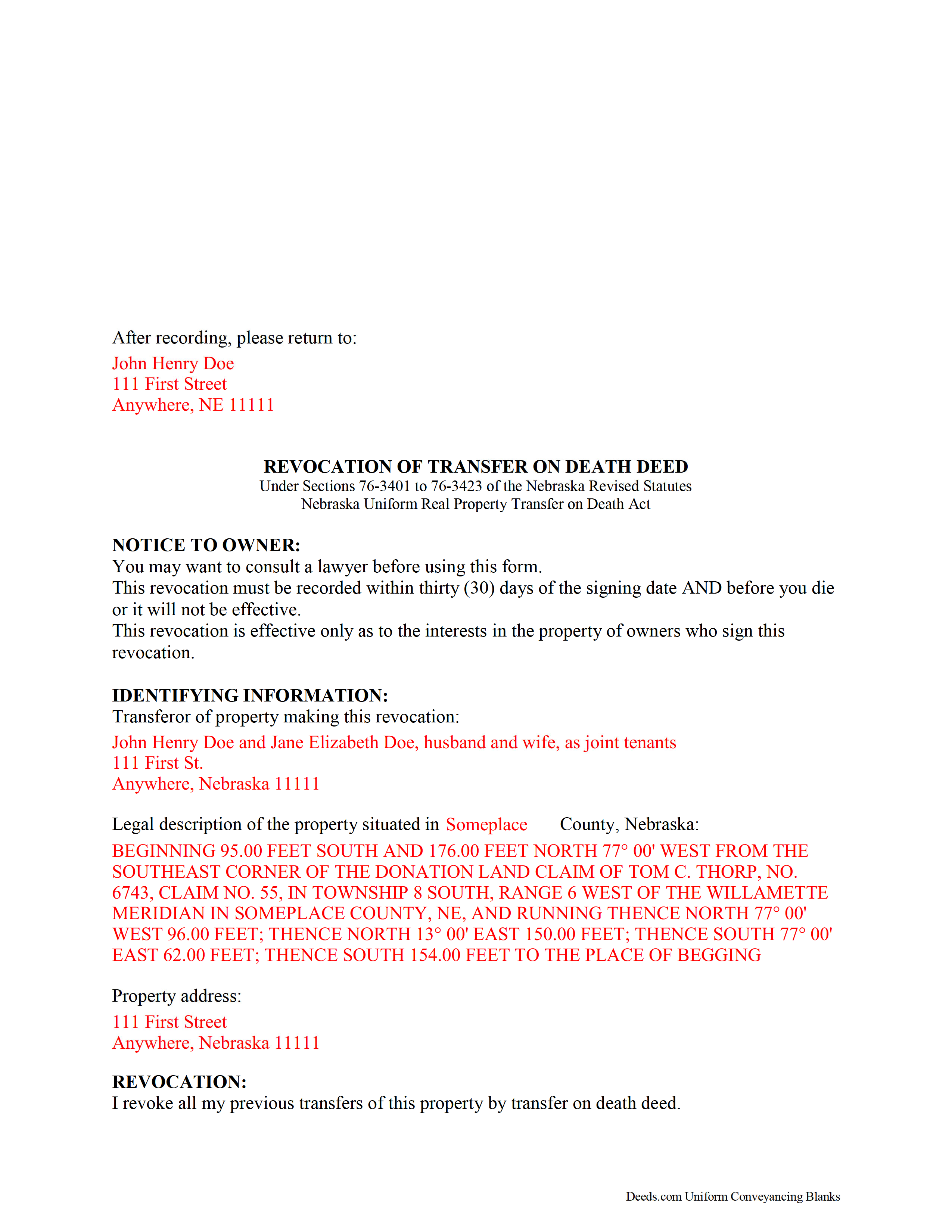

Adams County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Adams County documents included at no extra charge:

Where to Record Your Documents

Adams County Register of Deeds

Hastings , Nebraska 68901

Hours: 9:00am to 5:00pm M-F

Phone: (402) 461-7148

Recording Tips for Adams County:

- Double-check legal descriptions match your existing deed

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Adams County

Properties in any of these areas use Adams County forms:

- Ayr

- Hastings

- Holstein

- Juniata

- Kenesaw

- Roseland

Hours, fees, requirements, and more for Adams County

How do I get my forms?

Forms are available for immediate download after payment. The Adams County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Adams County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Adams County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Adams County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Adams County?

Recording fees in Adams County vary. Contact the recorder's office at (402) 461-7148 for current fees.

Questions answered? Let's get started!

Revoking a Nebraska Transfer on Death Deed

The Nebraska Uniform Real Property Transfer on Death Act is found at Sections 76-3401 to 76-3423 of the Nebraska Revised Statutes. This useful law provides an option for land owners to convey their real estate after their death, but without the need to include it in a will.

A transfer on death deed (TODD), when lawfully executed, allows property owners to retain absolute title to and control over their land during their lives ( 76-3414). The deeds are also revocable (76-3413). In part, these features are possible because unlike traditional deeds (warranty deeds, quitclaim deeds, etc.), TODDs do not require consideration from or notice to the beneficiary ( 76-3411).

Revocability is a valuable feature of transfer on death deeds. With it, land owners can quickly and easily respond to changes in their lives or the lives of their beneficiaries, and redirect any future transfer toward a more appropriate outcome.

The options for revoking a recorded TODD are set out at 76-3413. They include executing and recording one or more of the following: a document that specifically revokes the TODD ( 76-3413(1)(B)); a new TODD that revokes the previous deed and changes the beneficiary or details about the transfer (76-3413(1)(A)); or transferring the real estate with a traditional deed (76-3413 (1)(C)).

Because there is more than one way to revoke a TODD, an instrument of revocation can also provide an endpoint for a recorded (but cancelled) transfer on death deed. Executing and recording such a document before selling the property or simply transferring it to another beneficiary ensures that future title searches will not show the potential for claims against the title from the earlier TODD. The resulting clear chain of title (ownership history) should help to simplify future transactions involving the same real estate.

Overall, transfer on death deeds are flexible tools to consider as part of a comprehensive estate plan, but each circumstance is unique. Please contact an attorney for complex situations or with specific questions.

(Nebraska TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Adams County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Adams County.

Our Promise

The documents you receive here will meet, or exceed, the Adams County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Adams County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Thomas K.

July 25th, 2020

I never did this before and I found the service easy however confusing about the process and expectations. I had a trust prepared and needed to record our home deed to the trust. Now that I am almost finished waiting for the Maricopa county record the deed it seems so easy.

Thank you!

Frank K.

July 27th, 2023

One thing I suggest is use the nomenclature Borrower / Lender / instead of Mortgatator / Mortgatee… Had to google which is which ? !

Thank you for your feedback. We really appreciate it. Have a great day!

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

Judy F.

December 29th, 2018

I thought your site was focused on my specific county, but it wasn't. Therefore, I did not complete a transaction.

Thank you for your feedback Judy. Our site is national, we focus on all jurisdictions. Have a great day.

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

Marjorie K.

August 13th, 2021

This was super easy to use, especially if you remember to look for a downloaded PDF file, not a Word file. Found the files right away after the light bulb went on! Thank you!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

WILLIAM M.

February 11th, 2021

After a long search this site is the best all inclusive service. Contacting Customer Service received an timely reply. Highly recommened.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra C.

December 30th, 2020

Quick and easy. Would recommend this site to everyone. Deed was sent to the site and recorded at my local county within 24 hours. Website could be set up better. Not labeled well for us that is not computer savvy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen F.

June 6th, 2022

The documents' format contained information needed to complete the necessary paperwork for filing with Georgia. However, the fields were not large enough to put the legal description in, and there was no way to enlarge the area. These were only semi-helpful in providing what I needed per Georgia's filing requirement.

Thank you!

David E.

May 19th, 2023

What a great set of documents, including instructions and examples. Also has a set of bonus documents. Very nice for a do-it-yourselfer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry P.

February 23rd, 2019

Love your site. I found just what I needed and it was so easy. Saved me countless time and effort. Worth every penny.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Randy B.

February 3rd, 2019

The form was exactly what we needed and the directions were spot on and perfectly clear. Filling out government forms can be an experience filled with anxiety but deeds.com made it easy and practically worry free.

Thanks Randy, we really appreciate your feedback.

Pamela L.

July 18th, 2023

Fast efficient informative. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna W.

November 7th, 2023

This is an amazing place to come for all your deed help. I had looked on several other sites without luck, but deeds.com got everything I needed quickly and they are very inexpensive! Love this site and will be recommending it to anyone needing this type of help.

Thank you for your positive words! We’re thrilled to hear about your experience.

Carmen R.

November 14th, 2021

I was able to get the form I needed but it would not adjust properly on the page.

Thank you!