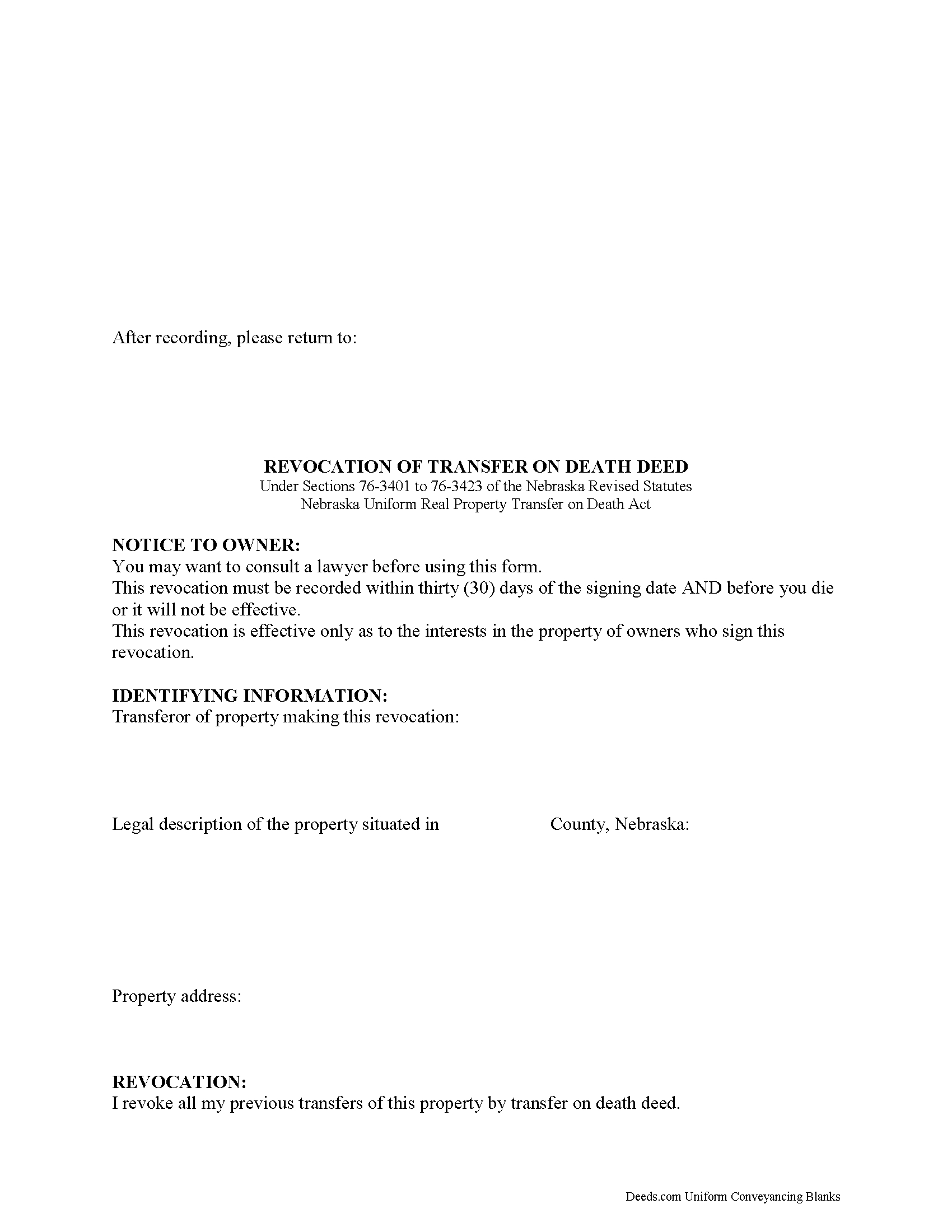

Kearney County Transfer on Death Revocation Form

Kearney County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

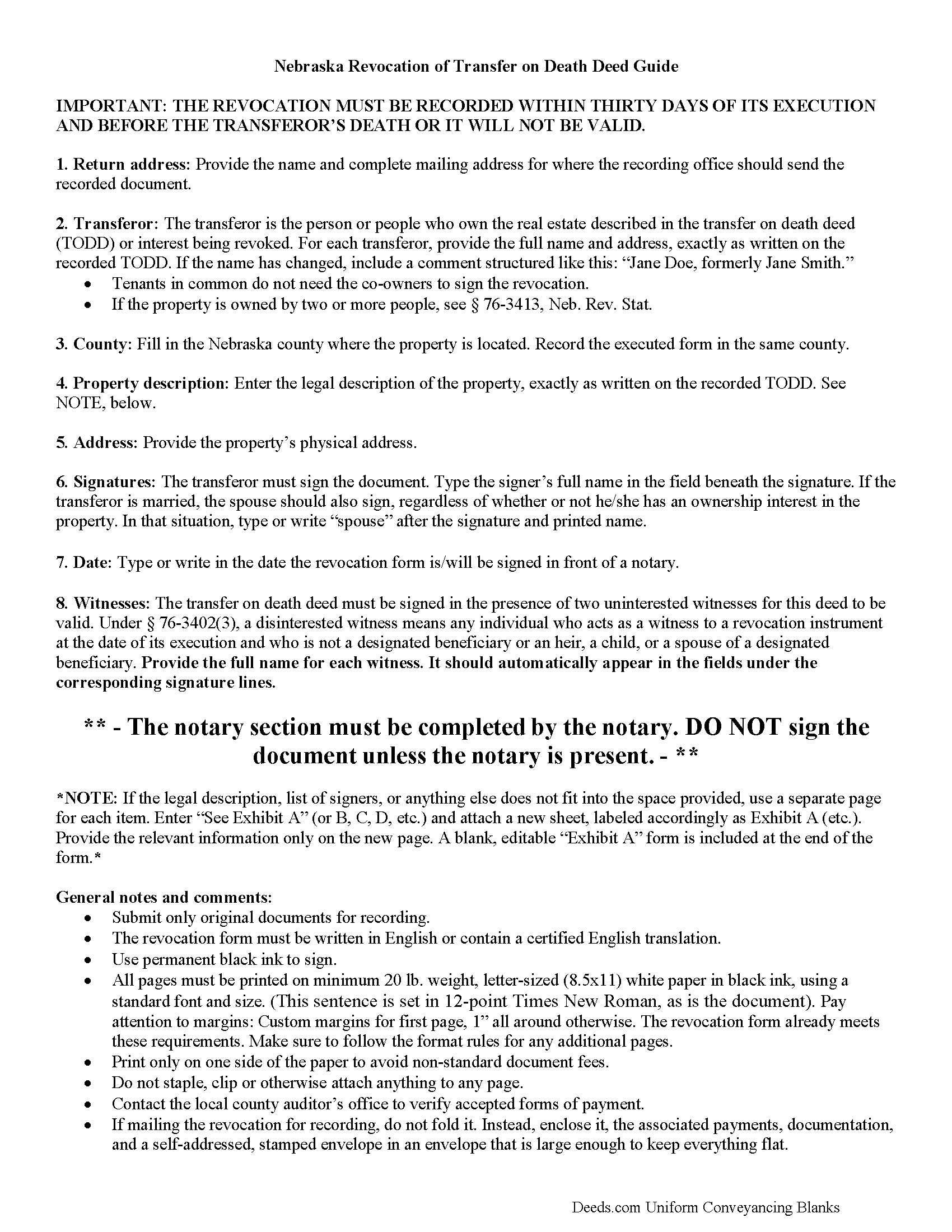

Kearney County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

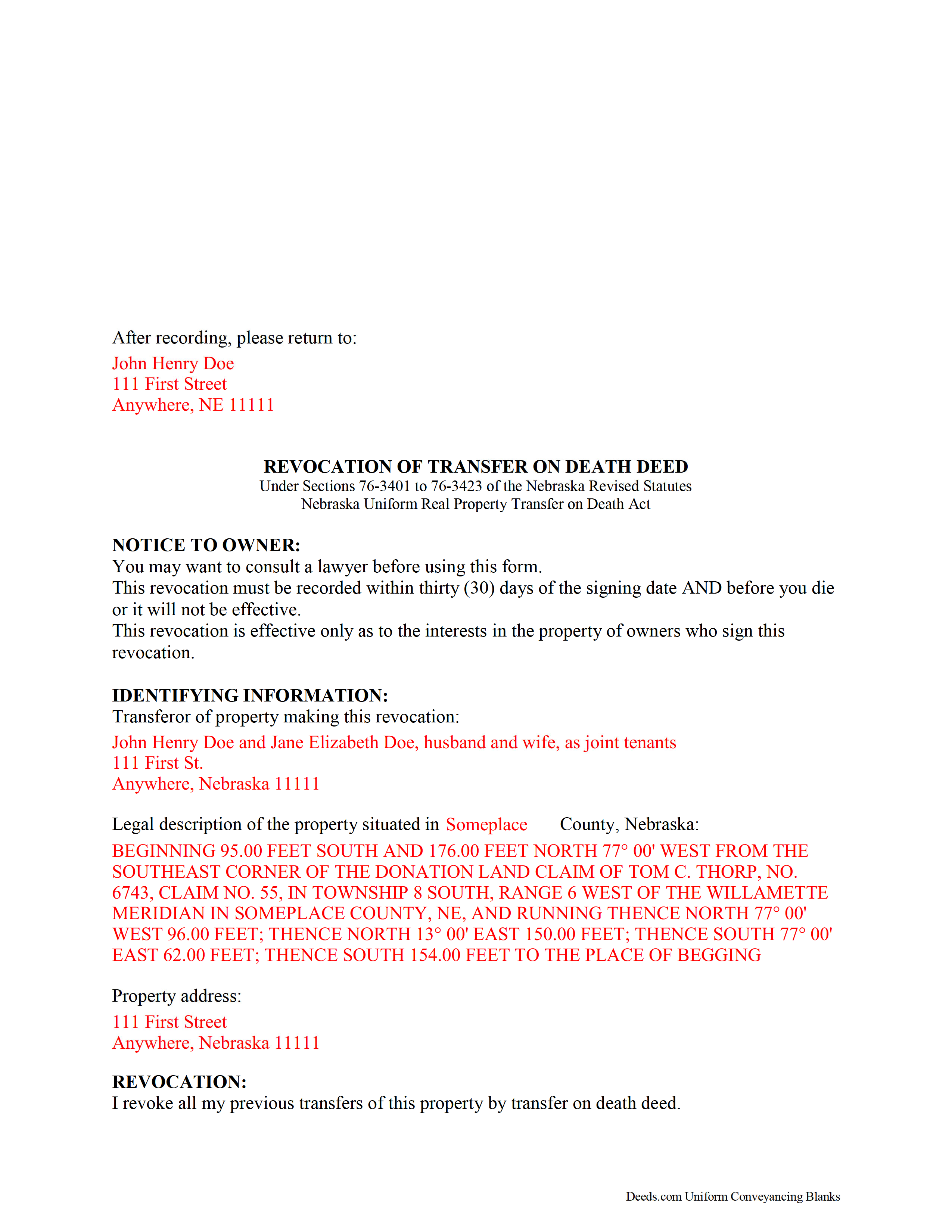

Kearney County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Kearney County documents included at no extra charge:

Where to Record Your Documents

Kearney County Register of Deeds

Minden, Nebraska 68959

Hours: 8:30 to 5:00 M-F

Phone: (308) 832-2723

Recording Tips for Kearney County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Kearney County

Properties in any of these areas use Kearney County forms:

- Axtell

- Heartwell

- Minden

- Wilcox

Hours, fees, requirements, and more for Kearney County

How do I get my forms?

Forms are available for immediate download after payment. The Kearney County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kearney County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kearney County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kearney County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kearney County?

Recording fees in Kearney County vary. Contact the recorder's office at (308) 832-2723 for current fees.

Questions answered? Let's get started!

Revoking a Nebraska Transfer on Death Deed

The Nebraska Uniform Real Property Transfer on Death Act is found at Sections 76-3401 to 76-3423 of the Nebraska Revised Statutes. This useful law provides an option for land owners to convey their real estate after their death, but without the need to include it in a will.

A transfer on death deed (TODD), when lawfully executed, allows property owners to retain absolute title to and control over their land during their lives ( 76-3414). The deeds are also revocable (76-3413). In part, these features are possible because unlike traditional deeds (warranty deeds, quitclaim deeds, etc.), TODDs do not require consideration from or notice to the beneficiary ( 76-3411).

Revocability is a valuable feature of transfer on death deeds. With it, land owners can quickly and easily respond to changes in their lives or the lives of their beneficiaries, and redirect any future transfer toward a more appropriate outcome.

The options for revoking a recorded TODD are set out at 76-3413. They include executing and recording one or more of the following: a document that specifically revokes the TODD ( 76-3413(1)(B)); a new TODD that revokes the previous deed and changes the beneficiary or details about the transfer (76-3413(1)(A)); or transferring the real estate with a traditional deed (76-3413 (1)(C)).

Because there is more than one way to revoke a TODD, an instrument of revocation can also provide an endpoint for a recorded (but cancelled) transfer on death deed. Executing and recording such a document before selling the property or simply transferring it to another beneficiary ensures that future title searches will not show the potential for claims against the title from the earlier TODD. The resulting clear chain of title (ownership history) should help to simplify future transactions involving the same real estate.

Overall, transfer on death deeds are flexible tools to consider as part of a comprehensive estate plan, but each circumstance is unique. Please contact an attorney for complex situations or with specific questions.

(Nebraska TOD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Kearney County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Kearney County.

Our Promise

The documents you receive here will meet, or exceed, the Kearney County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kearney County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Mary K.

September 28th, 2019

Awesome site. Looking for a way to save hiring an attorney. Family doesn't have the money for that so this site is much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Eric L.

June 28th, 2021

Great service, but still needs some knowledge to complete. Also missing Michigan right to farm paragraph.

Thank you!

Beverly H.

February 13th, 2019

Thanks!!

Thank you!

Jackie C.

April 10th, 2022

It was easy to access the documents for a minimal fee.

Thank you for your feedback. We really appreciate it. Have a great day!

TERRY E.

August 19th, 2020

VERY EASY TO USE !

Thank you!

Lynette D.

July 29th, 2020

I planned to use an attorney for this process but deeds.com made it so easy I was able to do it myself and I saved $330 in the process. I really appreciated the instructions and example provided on the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy C.

April 3rd, 2024

Easy to use, found what I was looking for.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Karen P.

March 19th, 2021

Very easy to use.

Thank you!

Catherine J S.

November 17th, 2022

Did not like that the lines aren't lining up smoothly to make the document look more professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan C.

January 20th, 2024

The Transfer on Death Deed paperwork was easy to complete, as it included a detailed guide and a completed example. We encountered no issues recording the document with our County. Thanks to Deeds.com, we were also able to save time and money by utilizing a DIY approach for our situation.

We are delighted to have been of service. Thank you for the positive review!

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

John D.

June 3rd, 2019

Forms were easy to complete, with the instructions that were provided. Very satisfied!

Thank you!

Anthony C.

September 20th, 2019

I am filing a Personal Representative Deed. Haven't used the forms yet but the package sent is comprehensive and appears easy to follow. A bit help to someone who has never done this.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher G.

July 23rd, 2019

Great service and very easy to complete

Thank you for your feedback. We really appreciate it. Have a great day!

Jerome R.

July 26th, 2023

Deeds.com handled my needs quickly and very economically. I would recommend them to anyone needing the services they offer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!