Download Nebraska Trustee Deed for Inter Vivos Trust Legal Forms

Nebraska Trustee Deed for Inter Vivos Trust Overview

A trust is an arrangement created when one person (the settlor) conveys property to a second person (the trustee) for the benefit of a third (the beneficiary). The settlor executes a trust instrument to establish the terms of the trust, and funds the trust with assets. In Nebraska, express trusts, or trusts "created with the settlor's express intent, usually declared in writing," according to Black's Law Dictionary, 8th ed., are governed by the Uniform Trust Code, codified at Neb. Rev. Stat. Ann. 30-3801.

A non-testamentary trust, more commonly referred to as a living trust or an inter vivos trust, is used for estate planning purposes; it allows a settlor to plan for his assets, including real property interests, in the event of death. A settlor may appoint himself as the trustee and designate a successor trustee (the settlor may not be the sole beneficiary, however).

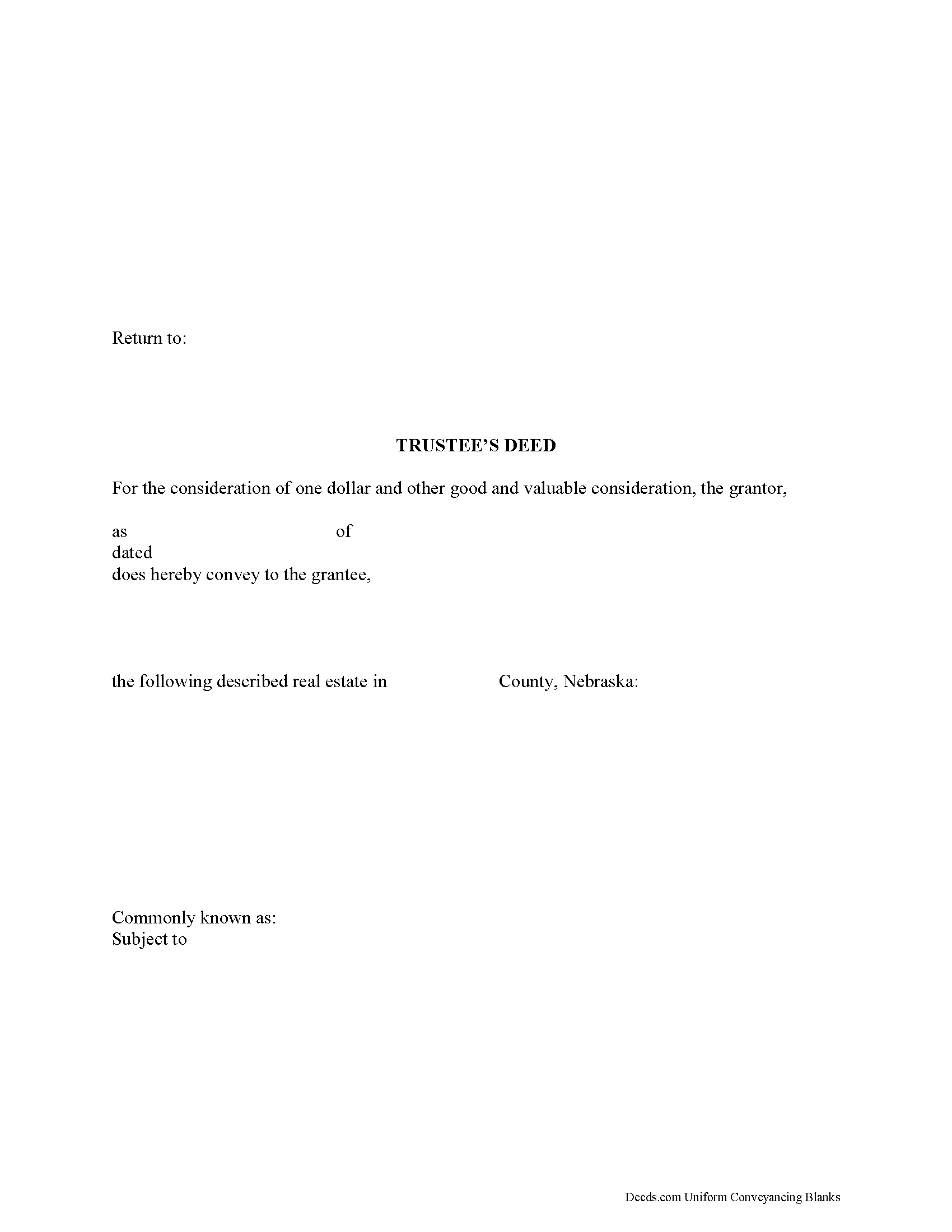

Specific powers confirmed upon the trustee under 30-3881 include the power to sell trust property. In Nebraska, the trustee's deed is used to convey real property from a living trust. As the administrator of the trust and because the trustee holds legal title to the property, it is the trustee's job to execute the trustee's deed. The deed should reference the trustee's name, as well as the name and date of the trust on behalf of which the trustee is acting. Additional documentation, such as a certificate of trust, may be required from the trustee.

The trustee's deed must meet all requirements for form and content for instruments affecting real property in Nebraska, including the name and vesting information of the grantee and a legal description of the property being transferred.

The covenants contained within the Nebraska trustee's deed make it a special warranty deed. The language of the form contains a covenant of seisin and a covenant against encumbrances (unless otherwise named in the form of conveyance), while warranting that the grantor defends the title against any claims arising by or through the grantor.

Each acting trustee's signature is required and must be acknowledged before the deed is recorded with the register of deeds in the Nebraska county where the property is located. Nebraska requires the grantee to complete a real estate transfer statement (available through the Department of Revenue as Form 521) for all transfers of real property. Contact the county's register of deeds to see if any additional supporting documentation is necessary, as each situation is unique.

Consult a lawyer with any questions regarding trust law and trustee's deeds in Nebraska.

(Nebraska TD Package includes form, guidelines, and completed example)