Custer County Trustee Deed for Inter Vivos Trust Form

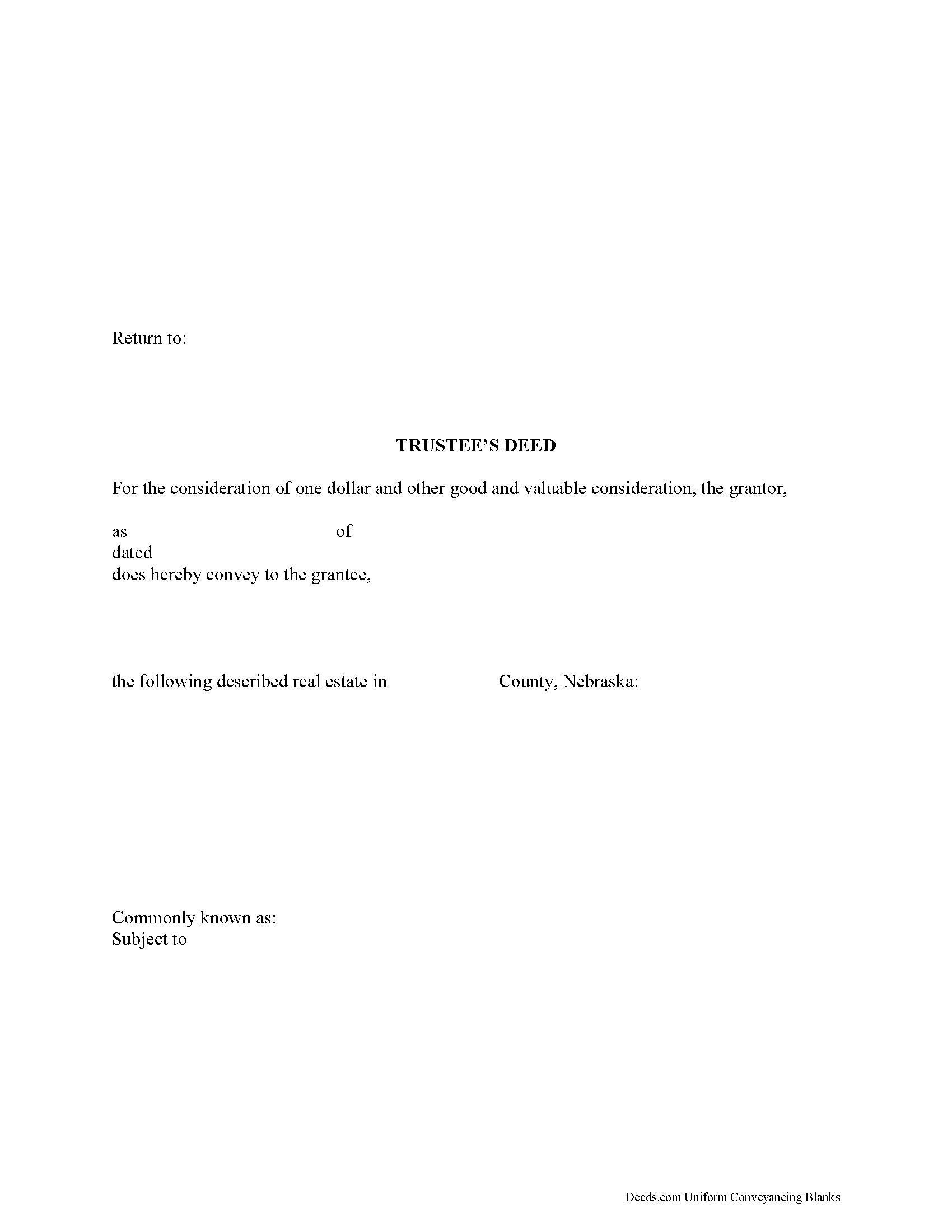

Custer County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

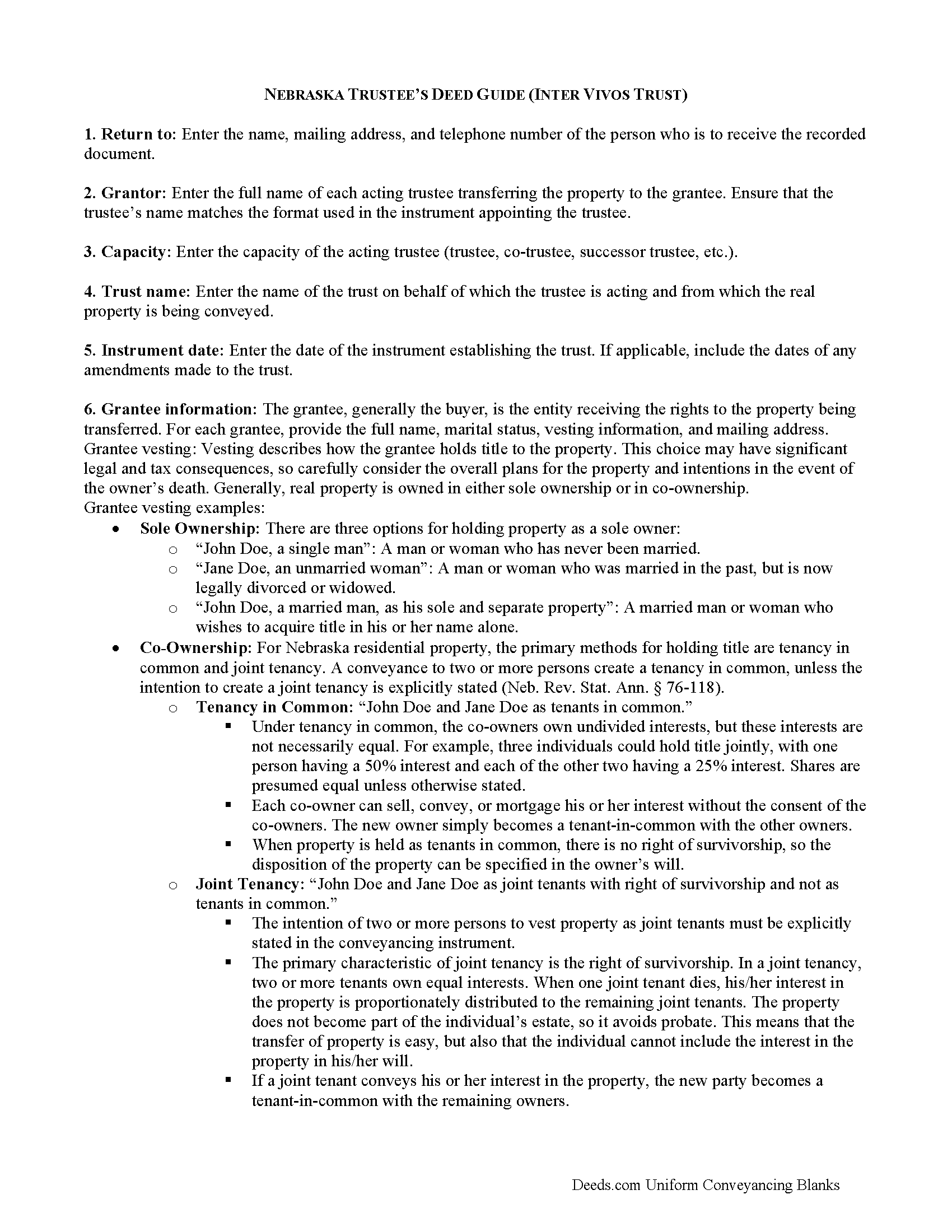

Custer County Trustee Deed Guide

Line by line guide explaining every blank on the form.

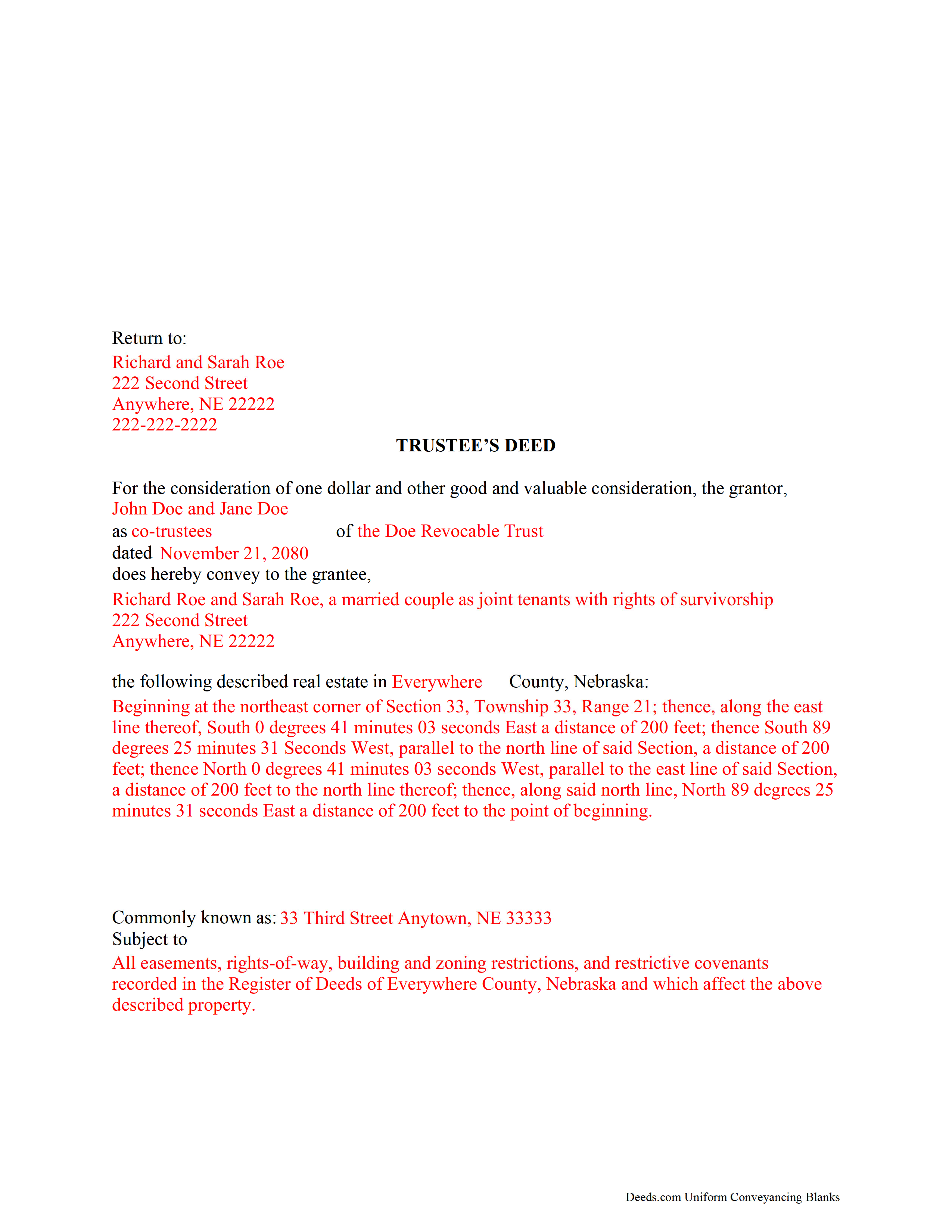

Custer County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nebraska and Custer County documents included at no extra charge:

Where to Record Your Documents

Custer County Register of Deeds

Broken Bow, Nebraska 68822

Hours: 9:00am to 5:00pm M-F

Phone: (308) 872-2221

Recording Tips for Custer County:

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Custer County

Properties in any of these areas use Custer County forms:

- Anselmo

- Ansley

- Arnold

- Broken Bow

- Callaway

- Comstock

- Mason City

- Merna

- Oconto

- Sargent

- Westerville

Hours, fees, requirements, and more for Custer County

How do I get my forms?

Forms are available for immediate download after payment. The Custer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Custer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Custer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Custer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Custer County?

Recording fees in Custer County vary. Contact the recorder's office at (308) 872-2221 for current fees.

Questions answered? Let's get started!

A trust is an arrangement created when one person (the settlor) conveys property to a second person (the trustee) for the benefit of a third (the beneficiary). The settlor executes a trust instrument to establish the terms of the trust, and funds the trust with assets. In Nebraska, express trusts, or trusts "created with the settlor's express intent, usually declared in writing," according to Black's Law Dictionary, 8th ed., are governed by the Uniform Trust Code, codified at Neb. Rev. Stat. Ann. 30-3801.

A non-testamentary trust, more commonly referred to as a living trust or an inter vivos trust, is used for estate planning purposes; it allows a settlor to plan for his assets, including real property interests, in the event of death. A settlor may appoint himself as the trustee and designate a successor trustee (the settlor may not be the sole beneficiary, however).

Specific powers confirmed upon the trustee under 30-3881 include the power to sell trust property. In Nebraska, the trustee's deed is used to convey real property from a living trust. As the administrator of the trust and because the trustee holds legal title to the property, it is the trustee's job to execute the trustee's deed. The deed should reference the trustee's name, as well as the name and date of the trust on behalf of which the trustee is acting. Additional documentation, such as a certificate of trust, may be required from the trustee.

The trustee's deed must meet all requirements for form and content for instruments affecting real property in Nebraska, including the name and vesting information of the grantee and a legal description of the property being transferred.

The covenants contained within the Nebraska trustee's deed make it a special warranty deed. The language of the form contains a covenant of seisin and a covenant against encumbrances (unless otherwise named in the form of conveyance), while warranting that the grantor defends the title against any claims arising by or through the grantor.

Each acting trustee's signature is required and must be acknowledged before the deed is recorded with the register of deeds in the Nebraska county where the property is located. Nebraska requires the grantee to complete a real estate transfer statement (available through the Department of Revenue as Form 521) for all transfers of real property. Contact the county's register of deeds to see if any additional supporting documentation is necessary, as each situation is unique.

Consult a lawyer with any questions regarding trust law and trustee's deeds in Nebraska.

(Nebraska TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Custer County to use these forms. Documents should be recorded at the office below.

This Trustee Deed for Inter Vivos Trust meets all recording requirements specific to Custer County.

Our Promise

The documents you receive here will meet, or exceed, the Custer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Custer County Trustee Deed for Inter Vivos Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

THOMAS K.

August 17th, 2020

Very pleased with all info and forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joan P.

March 18th, 2020

Thank you for combining all necessary documents in one simple location.

Thank you!

Anthony J S.

July 30th, 2022

It was nice to find a form to use for leaving my house without having my kids deal with Probate Court. The price was a lot cheaper than paying for a Lawyer to set up a transfer of ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn C.

February 14th, 2022

The transfer deed documents are laid out the way county offices need, but I don't like the requirements so I'm going to leave a bad review.

Well, thanks we guess.

Matthew L.

September 15th, 2022

I would make just two suggestions. (1) Create and example showing multiple grantor(s) and (2) In the same example, show where and estate is conveyed to two or more people. It would help in knowing the correct format.

Thank you for your feedback. We really appreciate it. Have a great day!

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

Nora B.

April 15th, 2019

VERY NICE SERVICE

Thank you for your feedback. We really appreciate it. Have a great day!

susanne y.

July 13th, 2020

wonderful service, docs recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Freddy S.

August 2nd, 2019

great job

Thank you!

edward d.

March 19th, 2023

used before awesome forms

Thank you!

Charlene H.

July 22nd, 2025

Deeds.com is a wonderful website. I highly recommend them and would use them again in the future.

Thank you, Charlene! We're so glad to hear you had a great experience. We truly appreciate your recommendation and look forward to helping you again in the future.

Wanda B.

July 22nd, 2022

Great prompt and efficient service!

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

April 17th, 2025

Deeds.com consistently provides excellent service at a fair price, and we rely and are thankful them for assisting with our recording needs.

Thank you, Mary! We truly appreciate your kind words and continued trust in Deeds.com. It means a lot to us to be part of your recording process, and we’re always here to help whenever you need us.

jennifer e.

September 1st, 2020

EXCELLENT, PROMPT SERVICE. I will definitely use again .HIGHLY RECOMMEND.

Thank you for your feedback. We really appreciate it. Have a great day!

Robyn R.

May 14th, 2020

Deeds.com was so simple and easy to use! My local recorders office is closed due to COVID-19 and their recording said to use Deeds.com. I thought it was going to either be very complicated or very expensive and it was neither!!! The site walked me through step by step and the price of their service was very fair and affordable. They were very timely and efficient and my documents were recorded almost immediately! Thank you Deeds.com!!!

Thank you Robyn, glad we could help.