Grant County Warranty Deed Form (Nebraska)

All Grant County specific forms and documents listed below are included in your immediate download package:

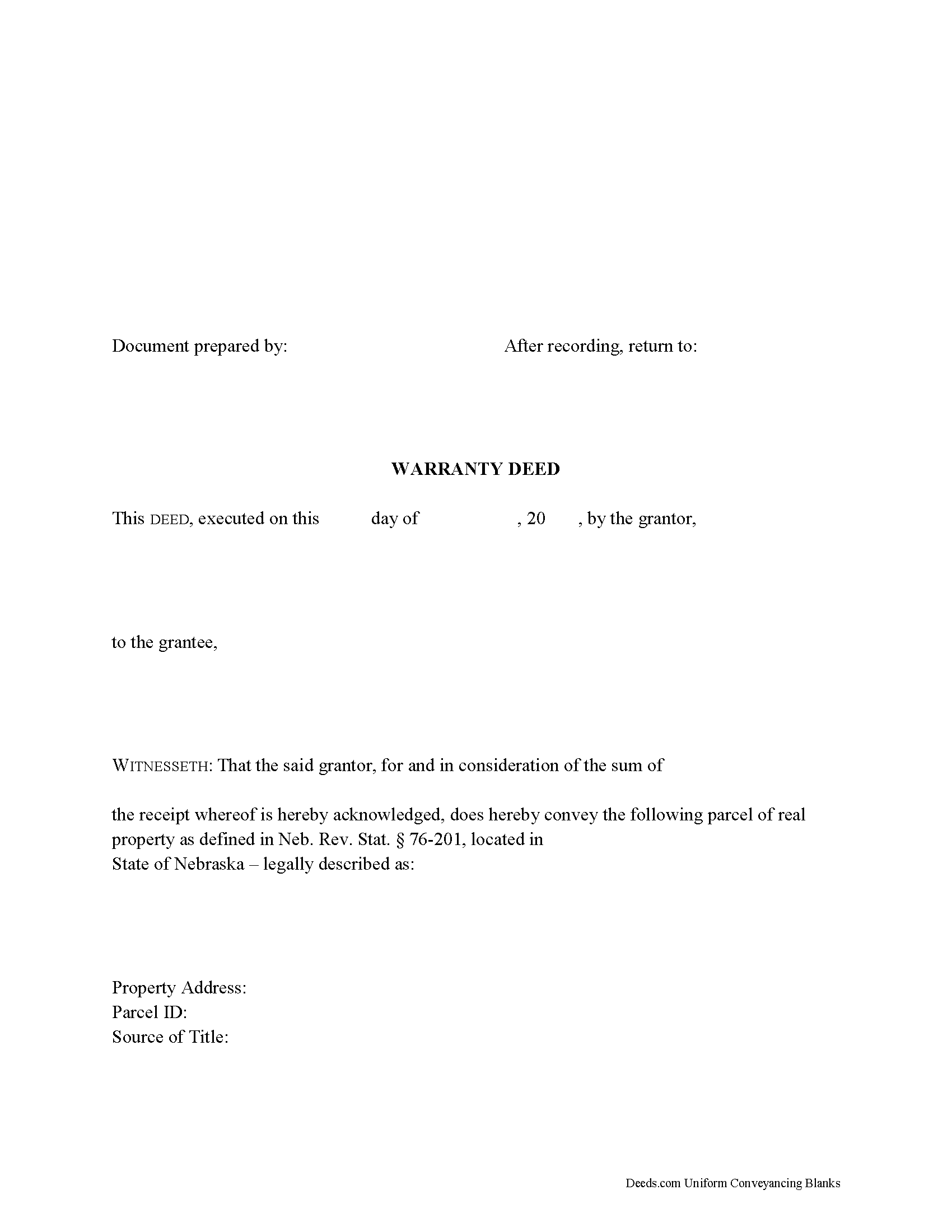

Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Grant County compliant document last validated/updated 5/16/2025

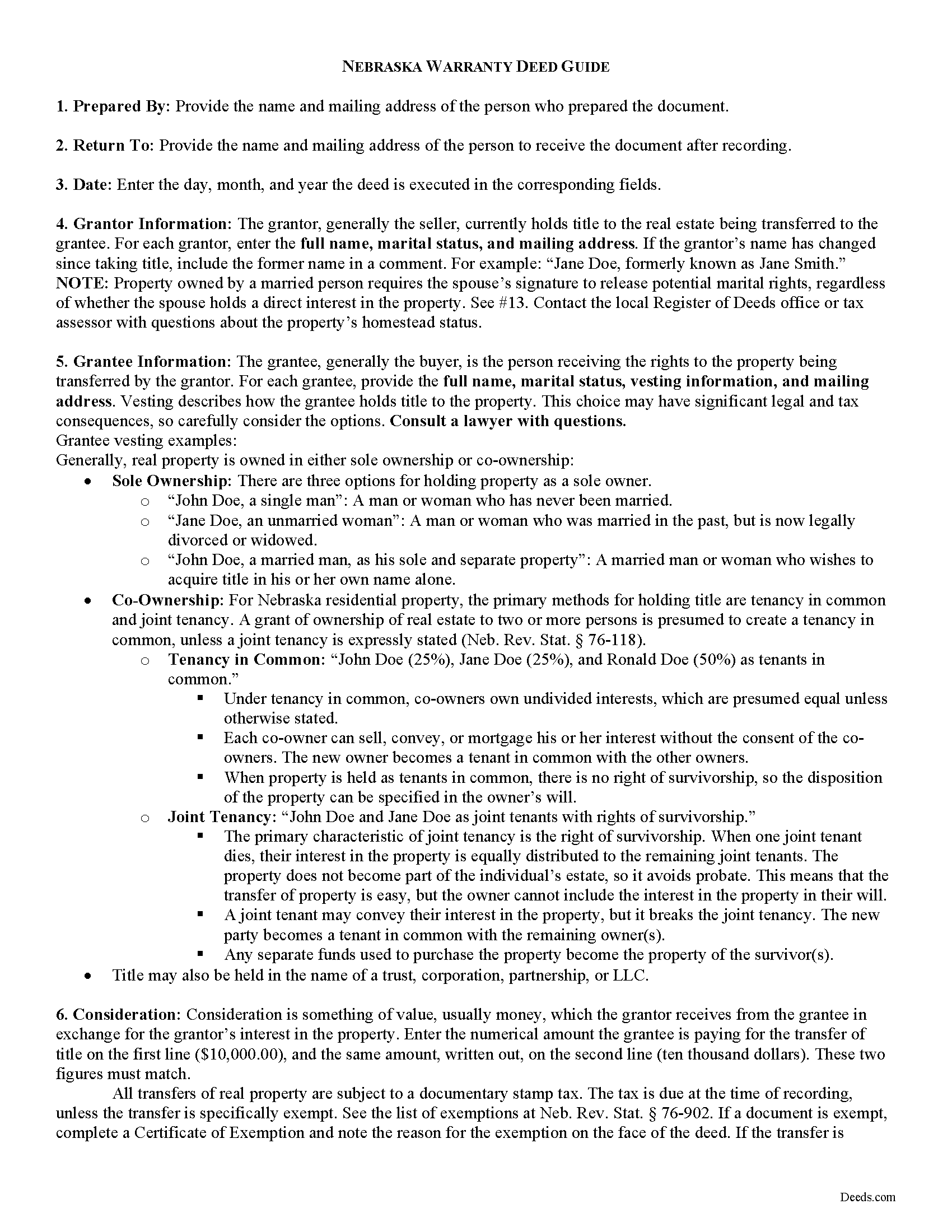

Warranty Deed Guide

Line by line guide explaining every blank on the form.

Included Grant County compliant document last validated/updated 6/13/2025

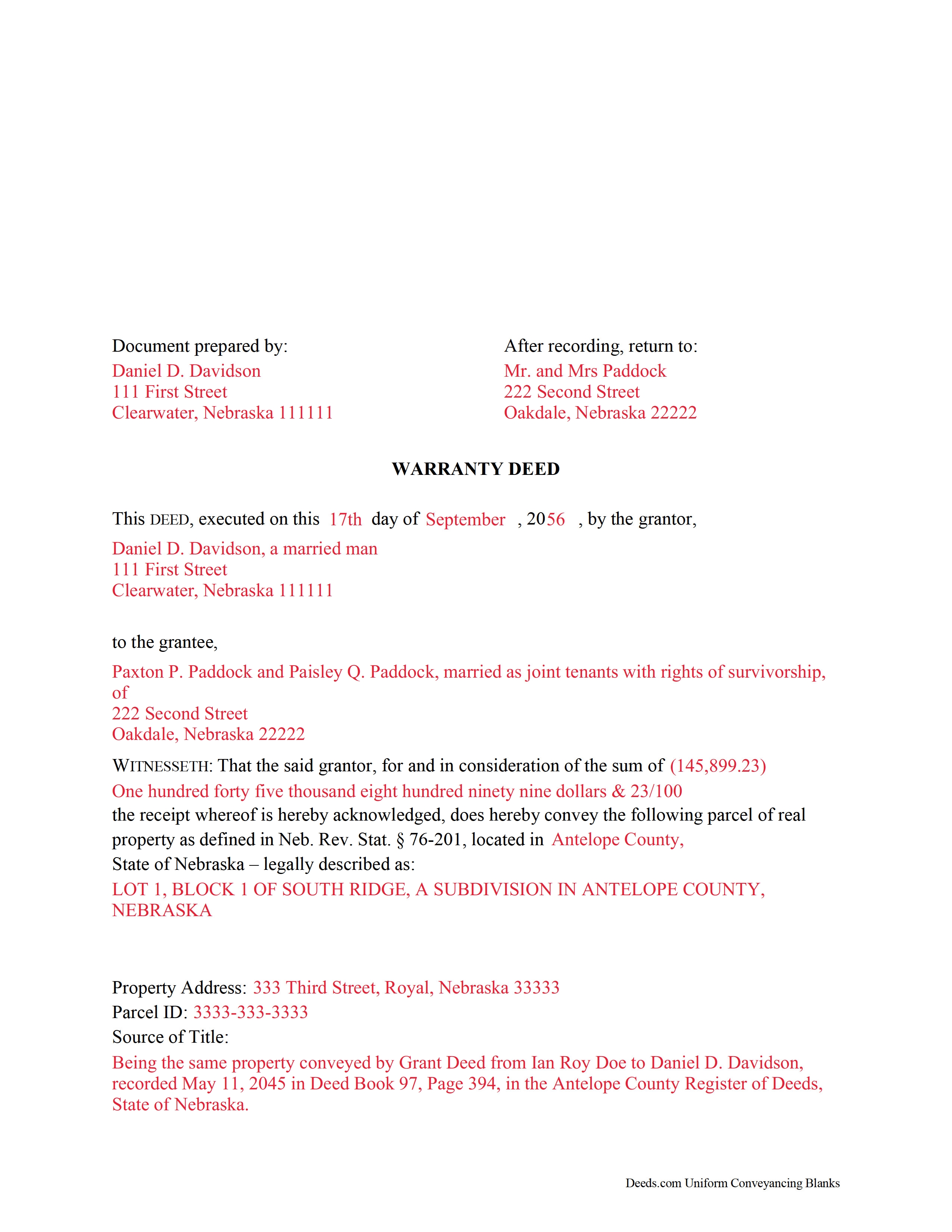

Completed Example of the Warranty Deed Document

Example of a properly completed form for reference.

Included Grant County compliant document last validated/updated 6/18/2025

The following Nebraska and Grant County supplemental forms are included as a courtesy with your order:

When using these Warranty Deed forms, the subject real estate must be physically located in Grant County. The executed documents should then be recorded in the following office:

Grant County Register of Deeds/Clerk

105 E Harrison St / PO Box 139, Hyannis, Nebraska 69350

Hours: Call for hours

Phone: (308) 458-2488

Local jurisdictions located in Grant County include:

- Ashby

- Hyannis

- Whitman

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Grant County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Grant County using our eRecording service.

Are these forms guaranteed to be recordable in Grant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Grant County including margin requirements, content requirements, font and font size requirements.

Can the Warranty Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Grant County that you need to transfer you would only need to order our forms once for all of your properties in Grant County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nebraska or Grant County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Grant County Warranty Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In Nebraska, real property can be transferred from one party to another by executing a warranty deed. These instruments are accepted, but not statutory in Nebraska, and are commonly used for sales of residential real estate.

Warranty deeds provide a high level of protection for the buyer (grantee). In addition to the covenants of a grant deed as set forth at Neb. Rev. Stat. 76-206, (that the grantor has good title to the estate in quantity and quality which he purports to convey), the grantor asserts that the title is free of any encumbrances (except for those stated in the deed); and that the grantor will warrant and defend the title against the lawful claims of all persons, even if the claim originates from a time before the current grantor owned the property.

A lawful warranty deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Nebraska residential property, the primary methods for holding title are tenancy in common and joint tenancy. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is expressly stated (Neb. Rev. Stat. 76-118).

As with any conveyance of realty, a warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed must meet all state and local standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. Both spouses need to sign the deed to release any marital rights, regardless of whether or not the spouse holds a direct interest in the property. For a valid transfer, file the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

All transfers of real property are subject to a documentary stamp tax. The tax is due at the time of recording. If the transfer is exempt under Neb. Rev. Stat. 76-902, note the reason on the face of the deed and fill out a certificate of exemption.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about warranty deeds, or for any other issues related to transfers of real property in Nebraska.

(Nebraska WD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Grant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Grant County Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Julia M.

March 9th, 2019

Your PDF form Personal Representative's Deed was exceedingly helpful.

Thank you Julia. Have a fantastic day!

Kenneth H.

January 9th, 2020

Easy download, informative examples. Very good experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger W.

June 11th, 2023

Documents were provided quickly and as promised. Very Satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody P.

December 15th, 2021

Thanks for such great service!

Thank you for your feedback. We really appreciate it. Have a great day!

Theresa M.

October 25th, 2021

This company was very thorough in having all the forms that I needed.

Thank you!

April L.

March 21st, 2020

It was easy and I will use it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gertrude F.

April 24th, 2022

I like that DEEDS.com has a variety of forms tht I may need. However, I was disappointed that I am not able to save the PDF forms after I fill in the spaces. If I need to edit anything, I have to go back to the blank form and redo the whole thing. Perhap I am doing something wrong.

Thank you!

tao a.

June 23rd, 2021

excellent. I will this service again.

Thank you!

Nancy J.

February 14th, 2019

Forms were not to hard to fill out,

Will go to Douglas County Oregon

Recorders office in a few weeks and hope I filled them out correctly.

Thank you for your feedback. We really appreciate it. Have a great day!

Lesa F.

May 14th, 2021

Excellent service for recovering a couple of deeds that had been misplaced. They were fast and efficient at a fair price. I would definitely use them again.

Thank you!

Gary K.

November 15th, 2019

Straightforward and pretty easy to use. The only downside is that there is no way to contact them directly. The number on the website is answered only by a voicemail with no return calls.

Pricing seems fair compared to other services and much more efficient that filing "over the counter."

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!