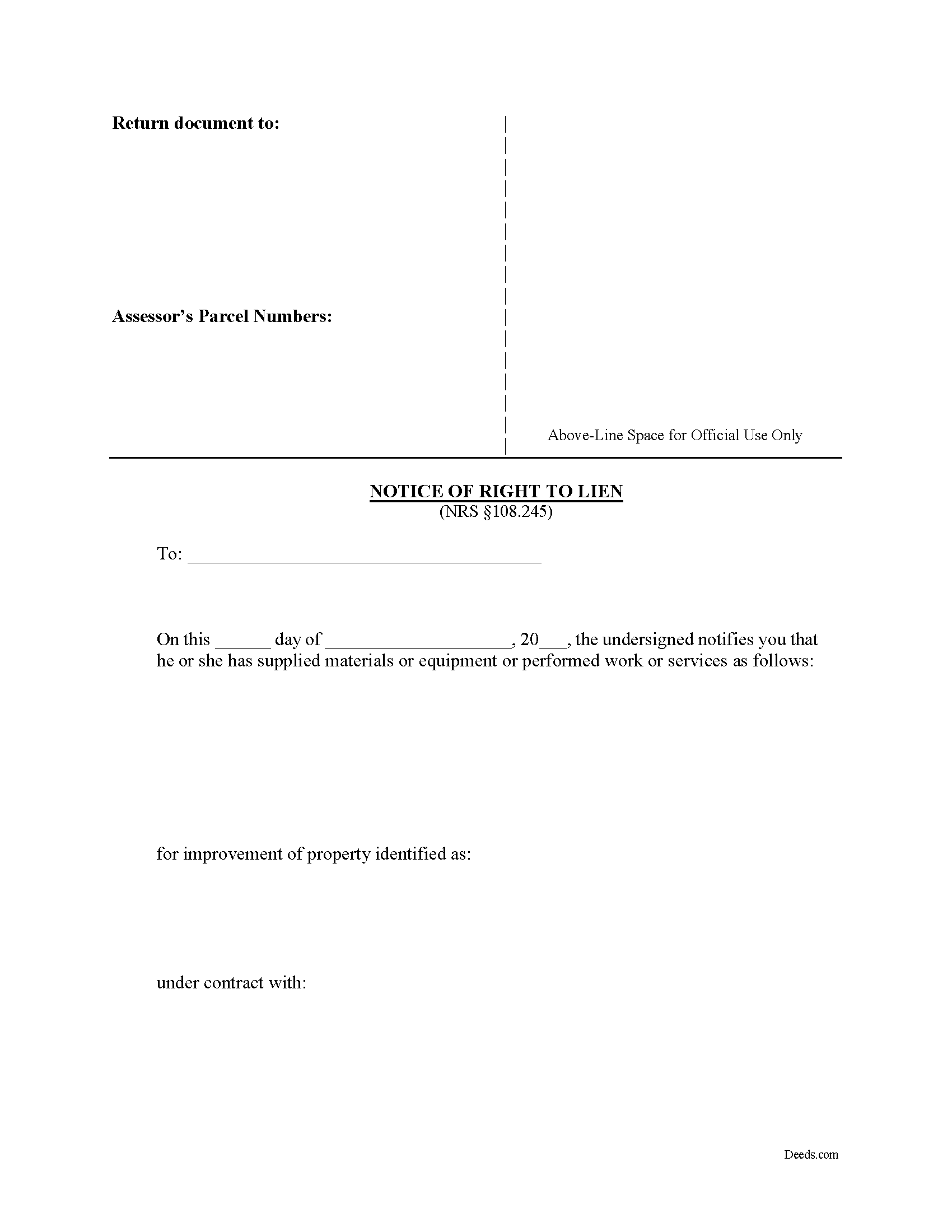

Lander County Notice of Right to Lien Form

Lander County Notice of Right to Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

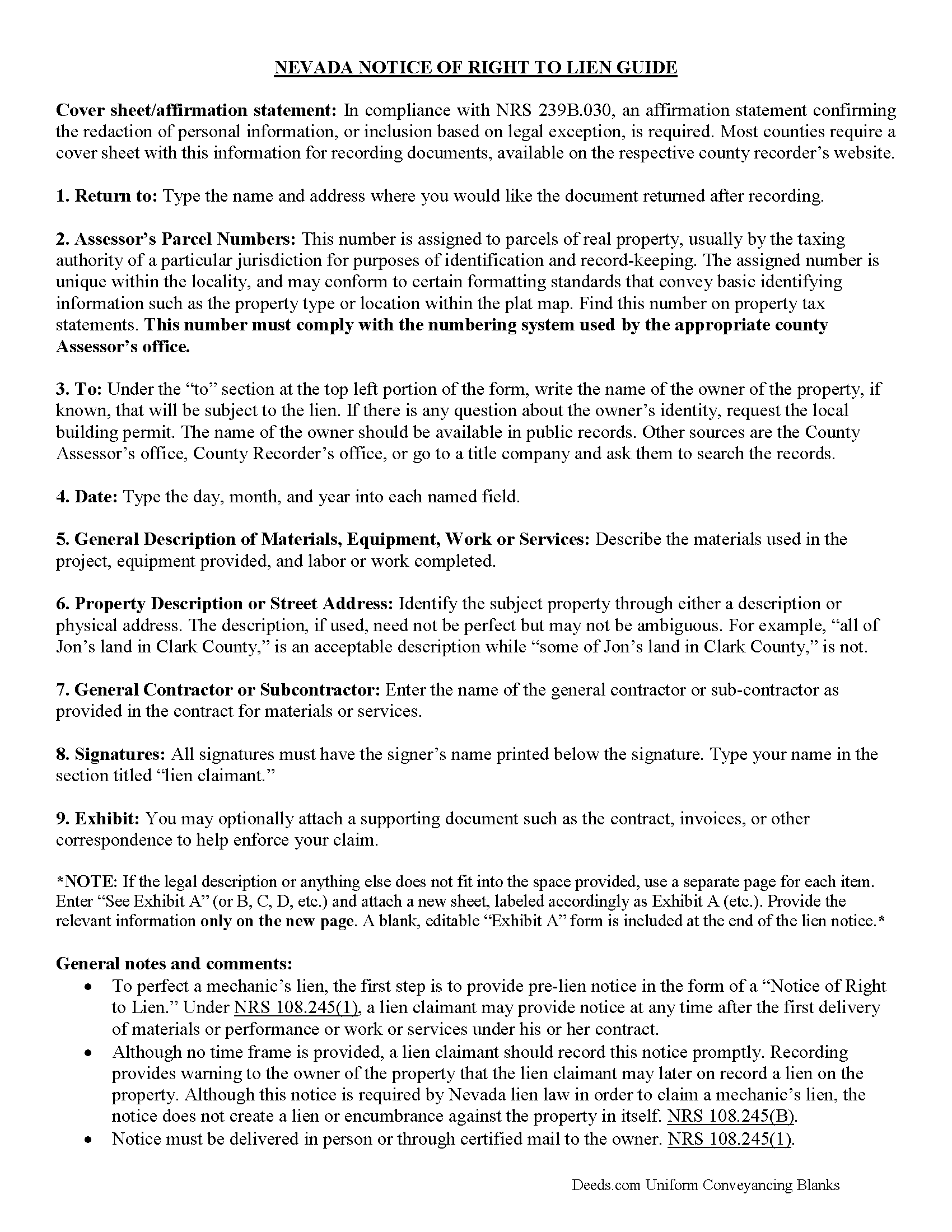

Lander County Notice of Right to Lien Guide

Line by line guide explaining every blank on the form.

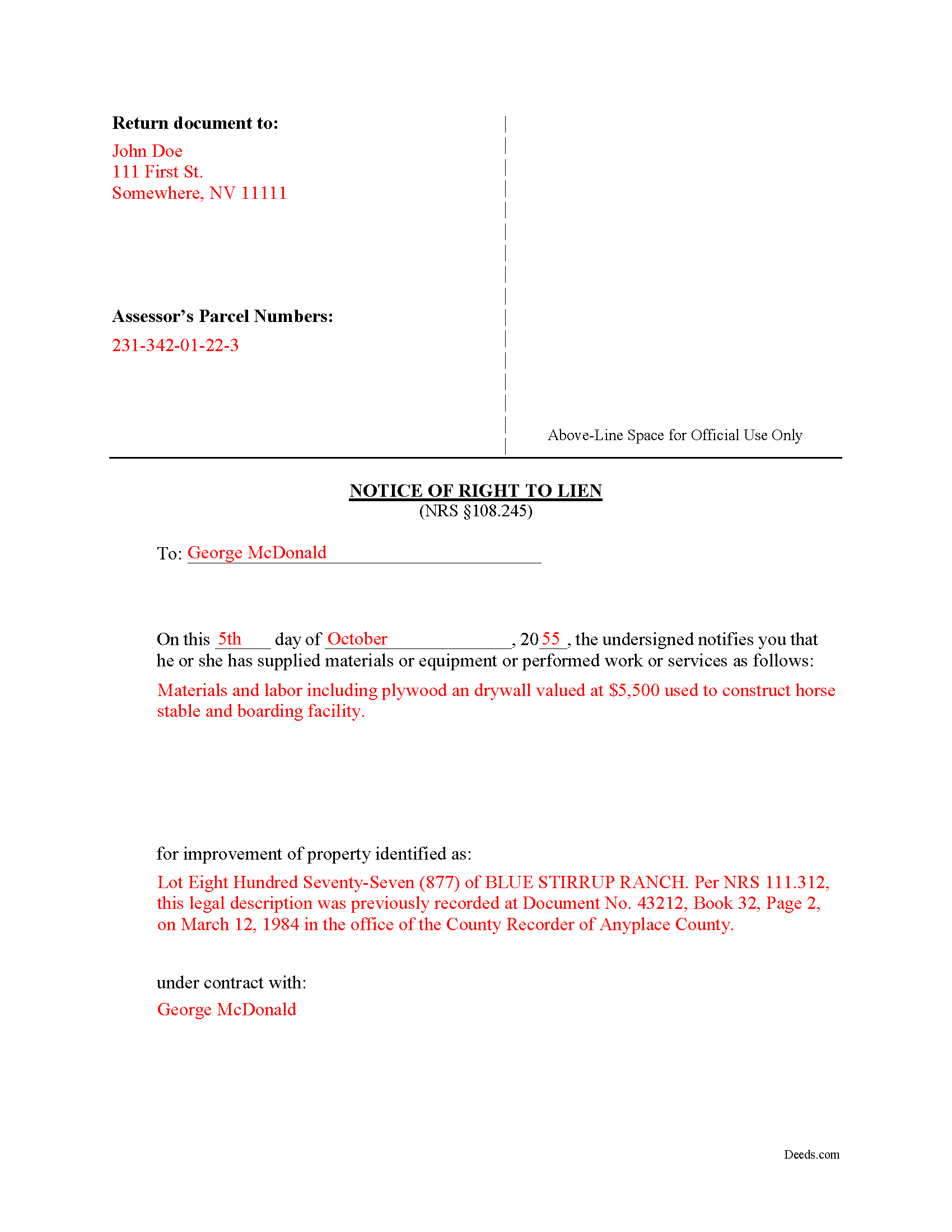

Lander County Completed Example of the Notice of Right to Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Lander County documents included at no extra charge:

Where to Record Your Documents

Lander County Recorder

Battle Mountain, Nevada 89820

Hours: 8:00 to 5:00 M-F / Recording until 4:50

Phone: (775) 635-5173

Recording Tips for Lander County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Bring extra funds - fees can vary by document type and page count

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Lander County

Properties in any of these areas use Lander County forms:

- Austin

- Battle Mountain

Hours, fees, requirements, and more for Lander County

How do I get my forms?

Forms are available for immediate download after payment. The Lander County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lander County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lander County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lander County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lander County?

Recording fees in Lander County vary. Contact the recorder's office at (775) 635-5173 for current fees.

Questions answered? Let's get started!

The notice of right to lien form is used to put a property owner on notice that the person providing labor or materials for a construction project might have a lien claim against the property. In accordance with NRS 108.245, the notice of right to lien must be filed by every lien claimant, besides a prime contractor or other person who contracts directly with an owner or sells materials directly to an owner or one who performs only labor.

The notice shall be filed at any time after the first delivery of material or performance of work or services under a contract. The notice must also be served by delivering it in person or through certified mail to the owner of the property.

The notice is not a lien and does not provide actual or constructive notice of a lien for any purpose. The notice is merely a required step to notify a property owner of a potential future lien on his or her property.

Unless the notice form is filed and notice has been given, Nevada law will not permit a lien for materials or equipment furnished or for work or services performed, except for labor only. The notice does not need to be verified, sworn to or acknowledged by a notary public.

A lien claimant who is required under NRS 108.245 to give a notice of a right to lien to an owner and who gives such a notice has a right to lien for materials or equipment furnished or for work or services performed in the 31 days before the date the notice of right to lien is given. A claimant also has a right to a lien for the materials or equipment furnished or for work or services performed anytime thereafter until the completion of the work of improvement.

The notice should be recorded promptly in a public records office. Although Nevada law does not state a timeframe for recording the notice, it should be recorded as soon as practicable without any delay.

Although this guide and accompanying forms are prepared substantially in accordance with Nevada lien law, they are not a complete substitute for the advice of a competent, licensed attorney familiar with statutory and case law. Each case is unique and penalties for missing a deadline or misstating facts can be severe, so contact an attorney with specific questions or for complex situations.

Important: Your property must be located in Lander County to use these forms. Documents should be recorded at the office below.

This Notice of Right to Lien meets all recording requirements specific to Lander County.

Our Promise

The documents you receive here will meet, or exceed, the Lander County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lander County Notice of Right to Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Danny H.

May 15th, 2020

You should list the address of where to mail the forms, so we don't have to look it up. It would make things a little easier.Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Boyd B.

June 16th, 2025

I had an issue because of what I was doing, thanks to these guys. I received an email and lickety-split done no more problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karin G.

January 28th, 2021

All went well. Forms easy to download and instructions were super. Very pleased with the service.

Thank you!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

Armando B.

October 23rd, 2021

This was so simple to get around your web site. Guide was easy to follow. Great experience. Would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Patrick R.

August 25th, 2023

I was satisfied and would refer this website to others.

Thank you for your feedback. We really appreciate it. Have a great day!

Rita T.

November 30th, 2022

This is the first time I use this site, and it was very easy and user friendly. I was able to fill out what i needed with the help of their example. quick download. like it. The price was reasonable. Definitely will use again. Highly recommend!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kim P.

July 23rd, 2021

I want to thank you so much. You made a stressful process easy. The customer service was amazing. There is no doubt I will use your service again.

Thank you!

Vernon H.

March 3rd, 2020

Great process and very easy to complete

Thank you!

Martin M.

November 14th, 2020

This site is great. Simple to use with excellent instructions. Will recommend to others.

Thank you!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

James R.

September 1st, 2021

Useful and quick.

Thank you!

Pamela W.

April 11th, 2019

Signing up was easy and the form was amazing. The ability to type on it (I am on a MAC) was beyond my expectations, the ability to save a blank, save my two documents, save the instructions and sample was excellent. The documents are in the mail and we are hopefully they will be approved. Blessings,

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki C.

March 10th, 2023

I purchased a Deed on Death for Washington State. Very user friendly site. Thank you 5star

Thank you for your feedback. We really appreciate it. Have a great day!

Steve B.

December 31st, 2021

Awesome. Last time I needed to f Ile a document it cost $300.00 gor a lawyer. This time $53.00.

Thank you!