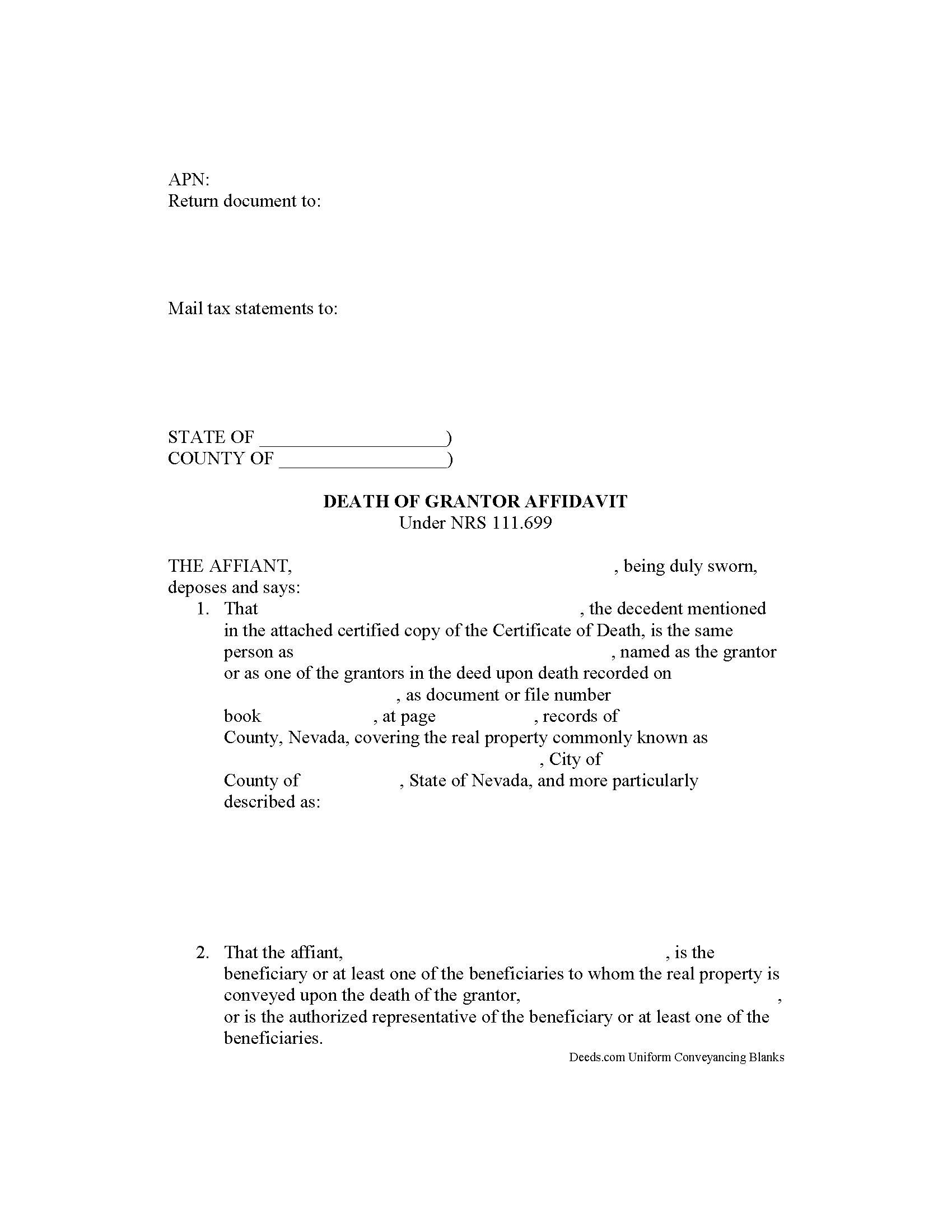

Lander County Transfer on Death Affidavit Form

Lander County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

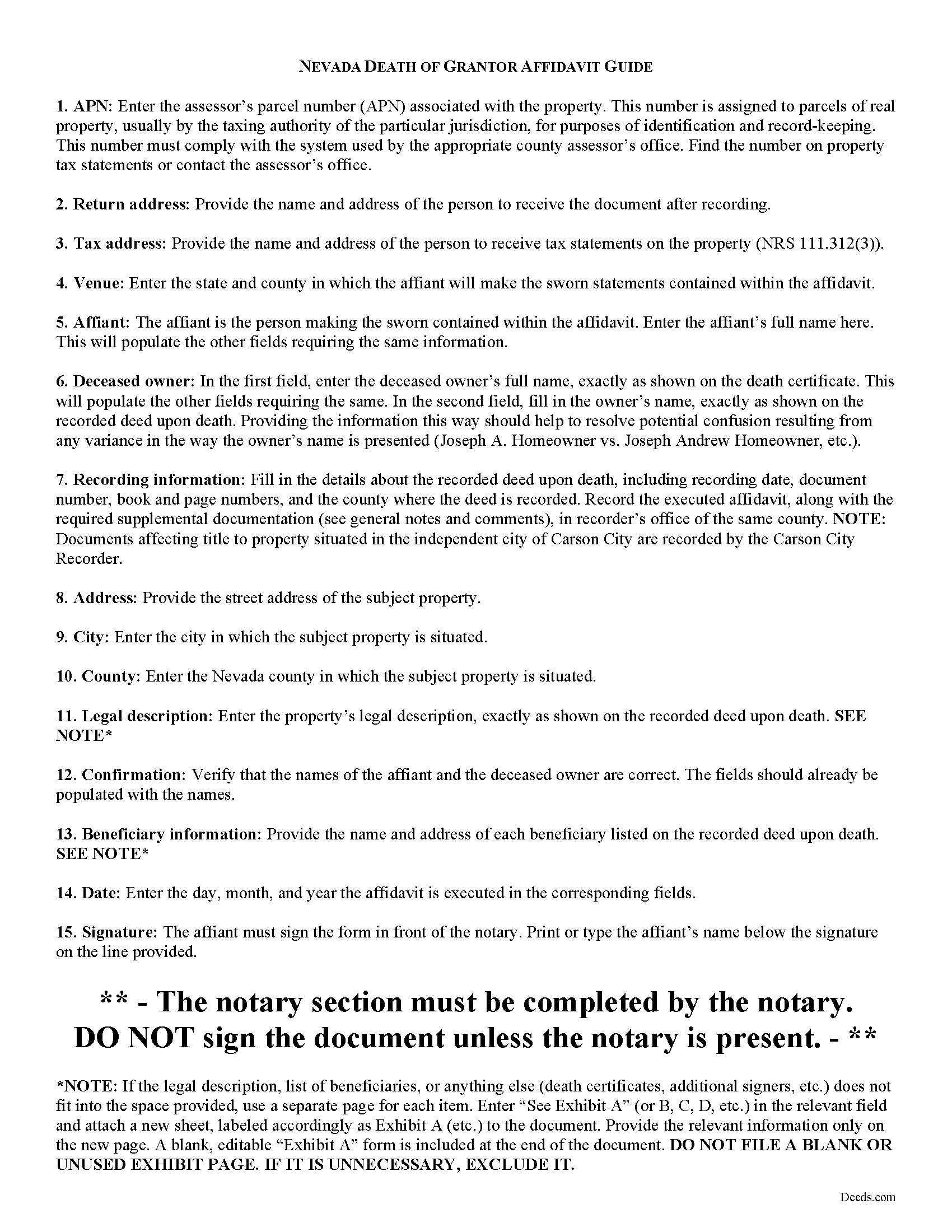

Lander County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

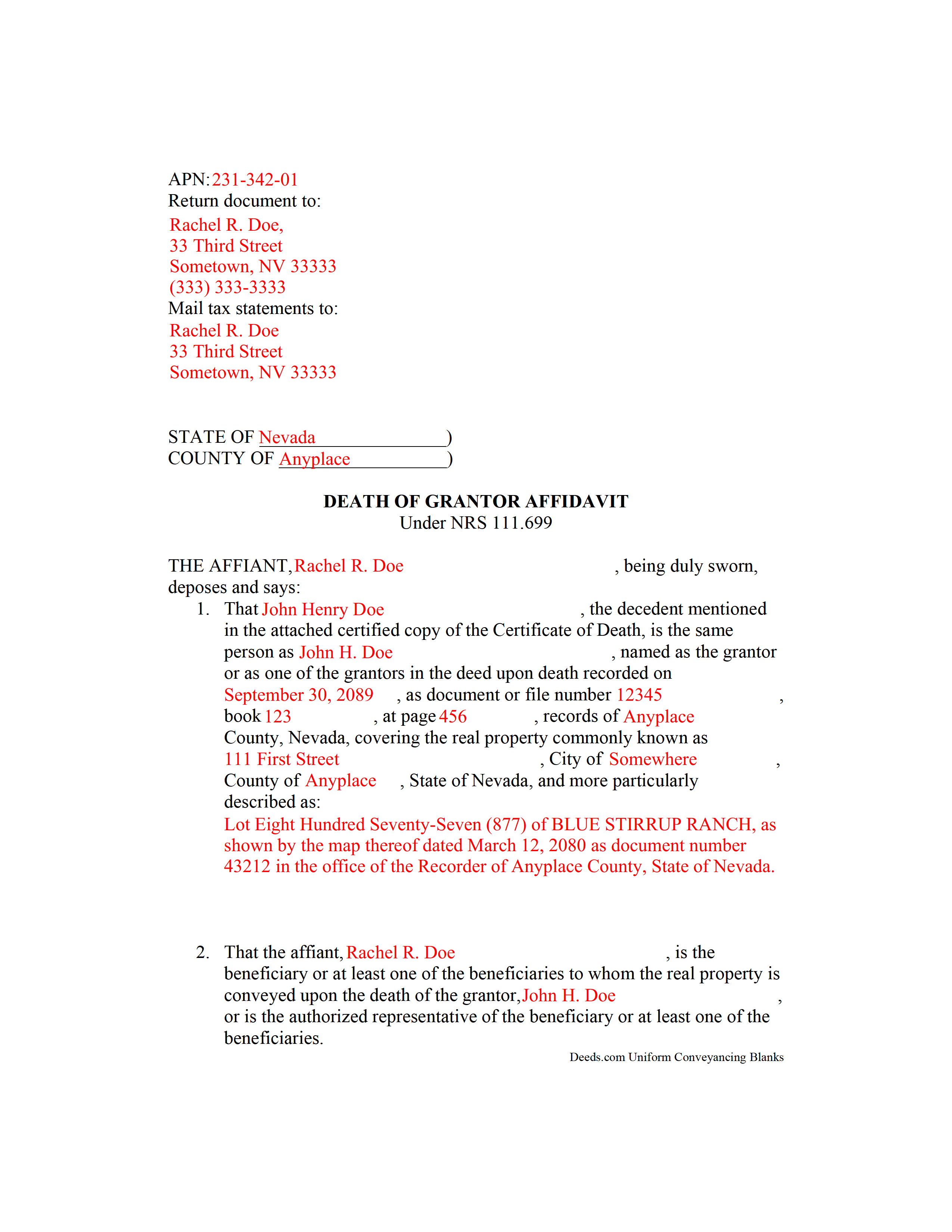

Lander County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Nevada and Lander County documents included at no extra charge:

Where to Record Your Documents

Lander County Recorder

Battle Mountain, Nevada 89820

Hours: 8:00 to 5:00 M-F / Recording until 4:50

Phone: (775) 635-5173

Recording Tips for Lander County:

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Mornings typically have shorter wait times than afternoons

Cities and Jurisdictions in Lander County

Properties in any of these areas use Lander County forms:

- Austin

- Battle Mountain

Hours, fees, requirements, and more for Lander County

How do I get my forms?

Forms are available for immediate download after payment. The Lander County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lander County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lander County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lander County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lander County?

Recording fees in Lander County vary. Contact the recorder's office at (775) 635-5173 for current fees.

Questions answered? Let's get started!

Gaining Title to Nevada Real Estate with a Death of Grantor Affidavit

Nevada's statutory transfer on death instrument for real property is called a deed upon death. It is governed by NRS 111.655-111.699 (2013), inclusive, and incorporates the Uniform Real Property Transfer on Death Act into its text.

NRS 111.699 provides the requirements and procedure for transferring ownership of real property related to a deed upon death. This process is important because allows the recorder to maintain accurate ownership records and update taxpayer information. When the last grantor of a deed upon death dies, the surviving beneficiary should:

1. Execute a death of grantor affidavit;

2. Attach a certified copy of the death certificate for each grantor/owner; and

3. Complete a declaration of value of property pursuant to NRS 375.060;

4. Record the documents in the office of the county recorder where the deed was recorded.

Note, though, that under NRS 111.691, property transferred by a deed upon death is subject to any liens on the property in existence on the date of the death of the grantor. For example, if there is a mortgage on the property, the new owner becomes responsible for paying it. Also see NRS 111.689 for cautions about outstanding obligations from the deceased owner's estate.

Each situation is unique, so contact a local attorney with specific questions.

(Nevada TODA Package includes form, guidelines, and completed example)

Important: Your property must be located in Lander County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Lander County.

Our Promise

The documents you receive here will meet, or exceed, the Lander County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lander County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Christine L.

April 18th, 2019

I would like the ability to edit the document.

Thank you for your feedback Christine.

Richard G.

August 28th, 2022

I was not able to add more linea to the deed and add up to four people and their addresses. The document should be able to be expanded.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody L.

November 8th, 2020

Beware, you cannot save the information you typed and change it later. It will be a PDF upon saving. So if you need corrections...you have to start all over!

Thank you for your feedback. We really appreciate it. Have a great day!

Reida S.

September 29th, 2020

Have used two times. Smooth transaction both times. Fast, simple and easy to use system. Would use them again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Vernon A L.

March 23rd, 2022

They are forms....no magic there. I still have to round up the details.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael S.

January 23rd, 2024

Great Price & Really Easy To Download

We are motivated by your feedback to continue delivering excellence. Thank you!

Title H.

July 27th, 2023

THIS SERVICE IS DIFFICULT TO USE AND TROUBLESOME, IN MY PROFESSIOBAL OPINION; a true NUGHTMARE! As a Title / Petroleum Land Professional (Landman), I use a wide variert of online title research tools and services. Mist are EXTREMELY COMPREHENSIVE, and relatively easy to perform one’s research. I am beginning to beliece that there is no search intrrfaxe here; just a long list of instructions full of circular references that simply tuns the researcher around and around to the same pages repeatedly. This service takes users NOWHERE. Good luck to those seeking to waste their time reading a vast set of redundant words and NO INTERFACE FOR CREATING OR EXECUTING AN AXTUAL SEARCH.

Thank you for sharing your feedback with us. We're genuinely sorry to hear about the difficulties you faced while using our service. As a Title / Petroleum Land Professional, your experience is invaluable to us, and we regret that our website did not meet your expectations.

We are committed to making the necessary changes to enhance our platform and provide a better experience for all users, including professionals like yourself.

Richard R.

April 16th, 2021

Deeds.com got the job done. My deed was successfully recorded.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

November 22nd, 2019

Quick and easy download. Got everything I needed. I would recommend deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cruz C.

December 8th, 2020

L-o-v-e your site. Great over-all usable docs. thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Byron M.

March 10th, 2022

This is a great service and a time saver for the company. We get fast responses and a detailed explanation if something additional is needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

THOMAS K.

August 17th, 2020

Very pleased with all info and forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!