Nye County Transfer on Death Affidavit Form (Nevada)

All Nye County specific forms and documents listed below are included in your immediate download package:

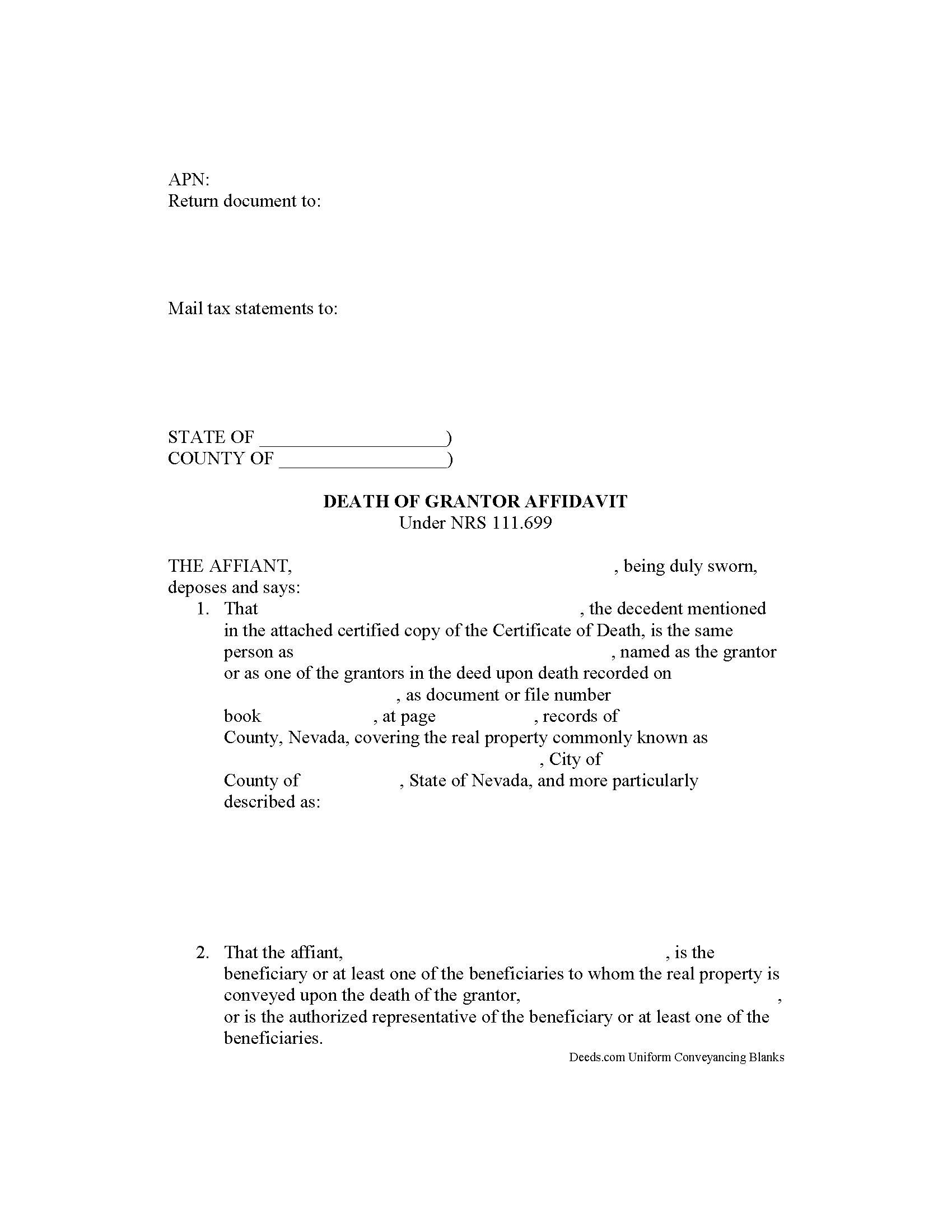

Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Nye County compliant document last validated/updated 6/18/2025

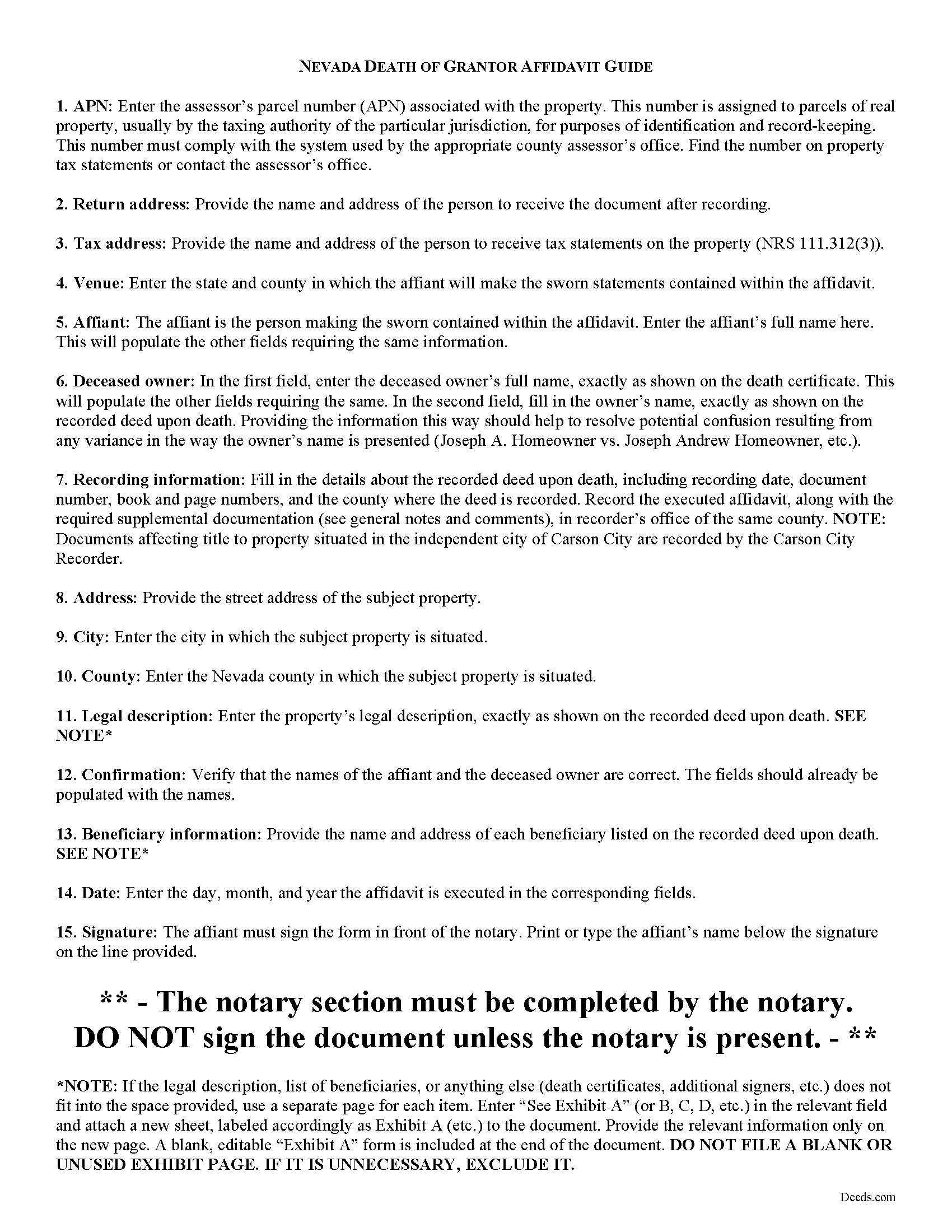

Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

Included Nye County compliant document last validated/updated 5/8/2025

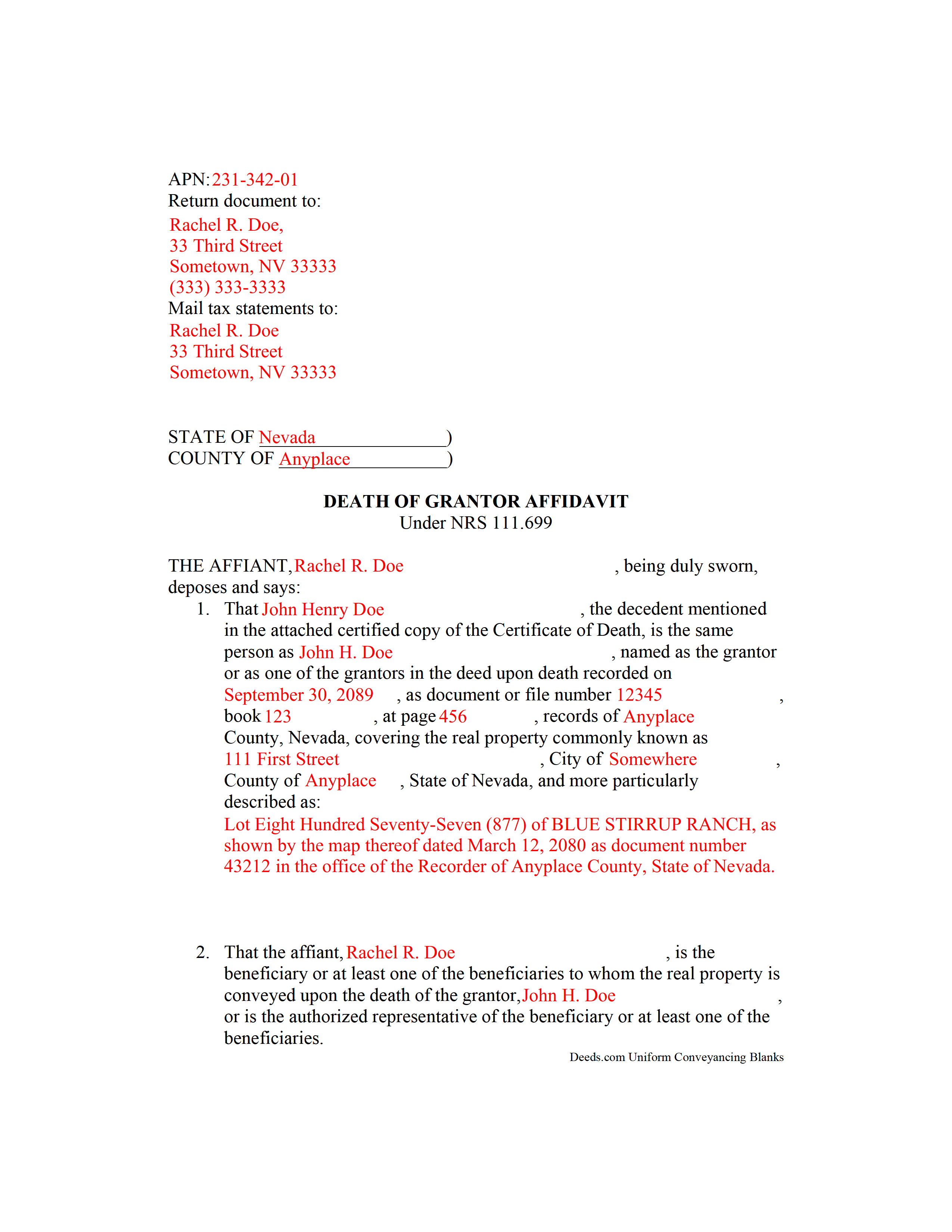

Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

Included Nye County compliant document last validated/updated 6/24/2025

The following Nevada and Nye County supplemental forms are included as a courtesy with your order:

When using these Transfer on Death Affidavit forms, the subject real estate must be physically located in Nye County. The executed documents should then be recorded in one of the following offices:

Nye County Recorder

101 Radar Rd / PO Box 1111, Tonopah, Nevada 89049

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Fri

Phone: (775) 482-8116

Satellite Office

170 N Floyd St, Suite 1, Pahrump, Nevada 89060

Hours: 8:00 to 12:00 & 1:00 to 5:00 Mon-Thu

Phone: (775) 751-6340

Local jurisdictions located in Nye County include:

- Amargosa Valley

- Beatty

- Gabbs

- Manhattan

- Mercury

- Pahrump

- Round Mountain

- Tonopah

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Nye County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Nye County using our eRecording service.

Are these forms guaranteed to be recordable in Nye County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Nye County including margin requirements, content requirements, font and font size requirements.

Can the Transfer on Death Affidavit forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Nye County that you need to transfer you would only need to order our forms once for all of your properties in Nye County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Nevada or Nye County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Nye County Transfer on Death Affidavit forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Gaining Title to Nevada Real Estate with a Death of Grantor Affidavit

Nevada's statutory transfer on death instrument for real property is called a deed upon death. It is governed by NRS 111.655-111.699 (2013), inclusive, and incorporates the Uniform Real Property Transfer on Death Act into its text.

NRS 111.699 provides the requirements and procedure for transferring ownership of real property related to a deed upon death. This process is important because allows the recorder to maintain accurate ownership records and update taxpayer information. When the last grantor of a deed upon death dies, the surviving beneficiary should:

1. Execute a death of grantor affidavit;

2. Attach a certified copy of the death certificate for each grantor/owner; and

3. Complete a declaration of value of property pursuant to NRS 375.060;

4. Record the documents in the office of the county recorder where the deed was recorded.

Note, though, that under NRS 111.691, property transferred by a deed upon death is subject to any liens on the property in existence on the date of the death of the grantor. For example, if there is a mortgage on the property, the new owner becomes responsible for paying it. Also see NRS 111.689 for cautions about outstanding obligations from the deceased owner's estate.

Each situation is unique, so contact a local attorney with specific questions.

(Nevada TODA Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Nye County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Nye County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marilyn G.

June 21st, 2020

Easy to follow instructions

Thank you for your feedback. We really appreciate it. Have a great day!

Blanche S.

March 25th, 2022

Thank you I hope I've done it all right!!

Thank you!

Lutalo O.

December 26th, 2019

Great tool for finding the best real estate forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Garrett R.

May 24th, 2022

I am a real estate attorney in CA. These Wyoming model deeds look too basic and barely adequate: no usual name and address at the top for tax statements and who recorded it. Some old fashioned legalese that only obfuscates. I won't use them. Your background info was good though.

Thank you for your feedback. We really appreciate it. Have a great day!

Maura M.

January 15th, 2020

Easy user friendly website

Thank you!

Henry J.

July 15th, 2021

Worked out Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charlotte M.

April 1st, 2024

Absolutely perfect! Quitclaim deed form was easy to complete and the recorder had no issues with it whatsoever, a rarity around here! Thanks sooo much!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Susan Mary S.

August 24th, 2020

Thank you for the thorough assortment of forms!

Thank you for your feedback. We really appreciate it. Have a great day!

John C.

January 28th, 2021

These forms are easy to use and a lot cheaper than going to an attorney. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lynn H.

January 12th, 2023

A very informative WEB site. It was simple to access the forms I needed for my specific situation. I would highly recommend Deeds.com.

I will be back with future needs when they arise! I was left with a very positive impression.

Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sylvia H.

February 8th, 2024

Thank you so very much for such an easy experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara S.

January 8th, 2021

Deed.com was very user friendly, made recording convenient and fast responses. I do recommend.

Thank you for your feedback. We really appreciate it. Have a great day!