Download Nevada Transfer on Death Affidavit Legal Forms

Nevada Transfer on Death Affidavit Overview

Gaining Title to Nevada Real Estate with a Death of Grantor Affidavit

Nevada's statutory transfer on death instrument for real property is called a deed upon death. It is governed by NRS 111.655-111.699 (2013), inclusive, and incorporates the Uniform Real Property Transfer on Death Act into its text.

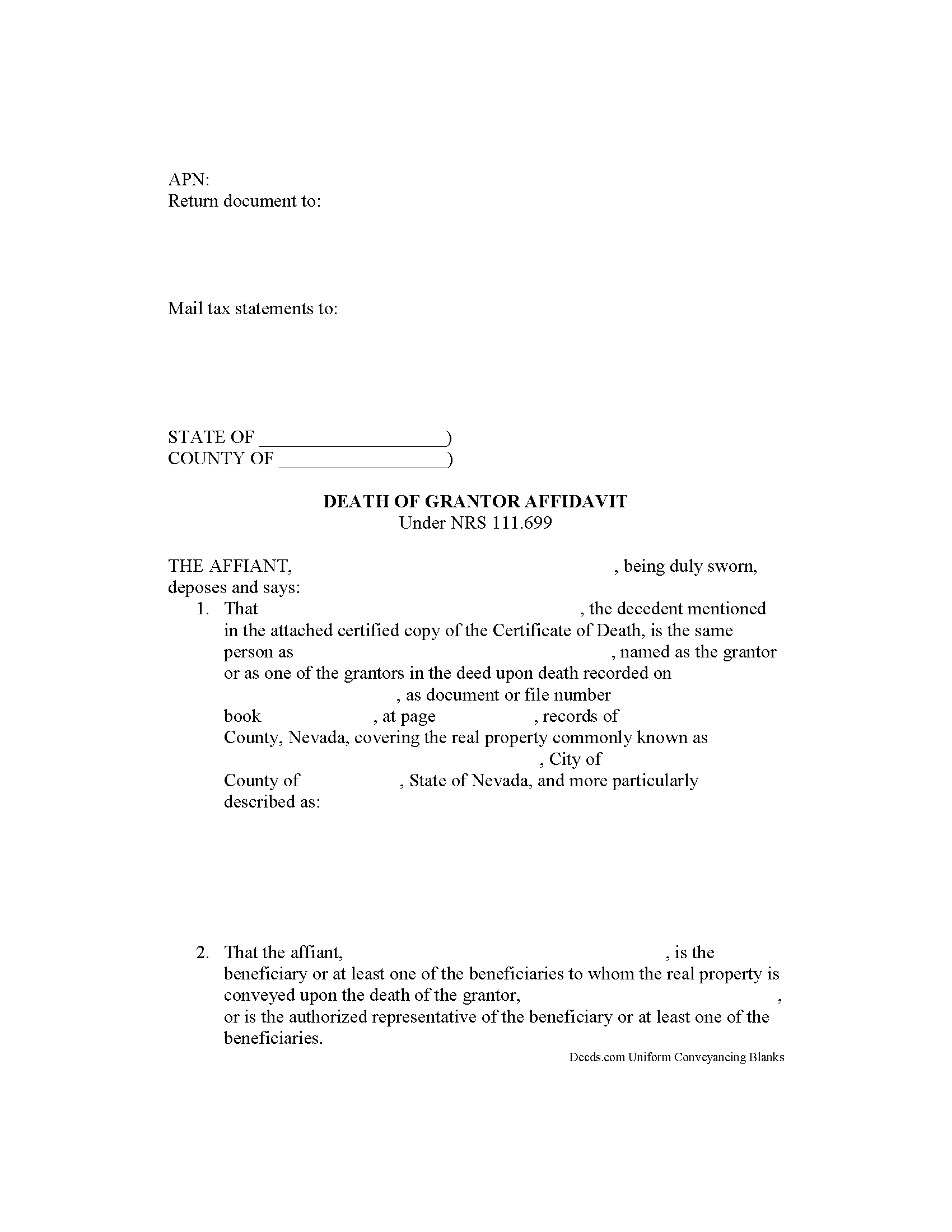

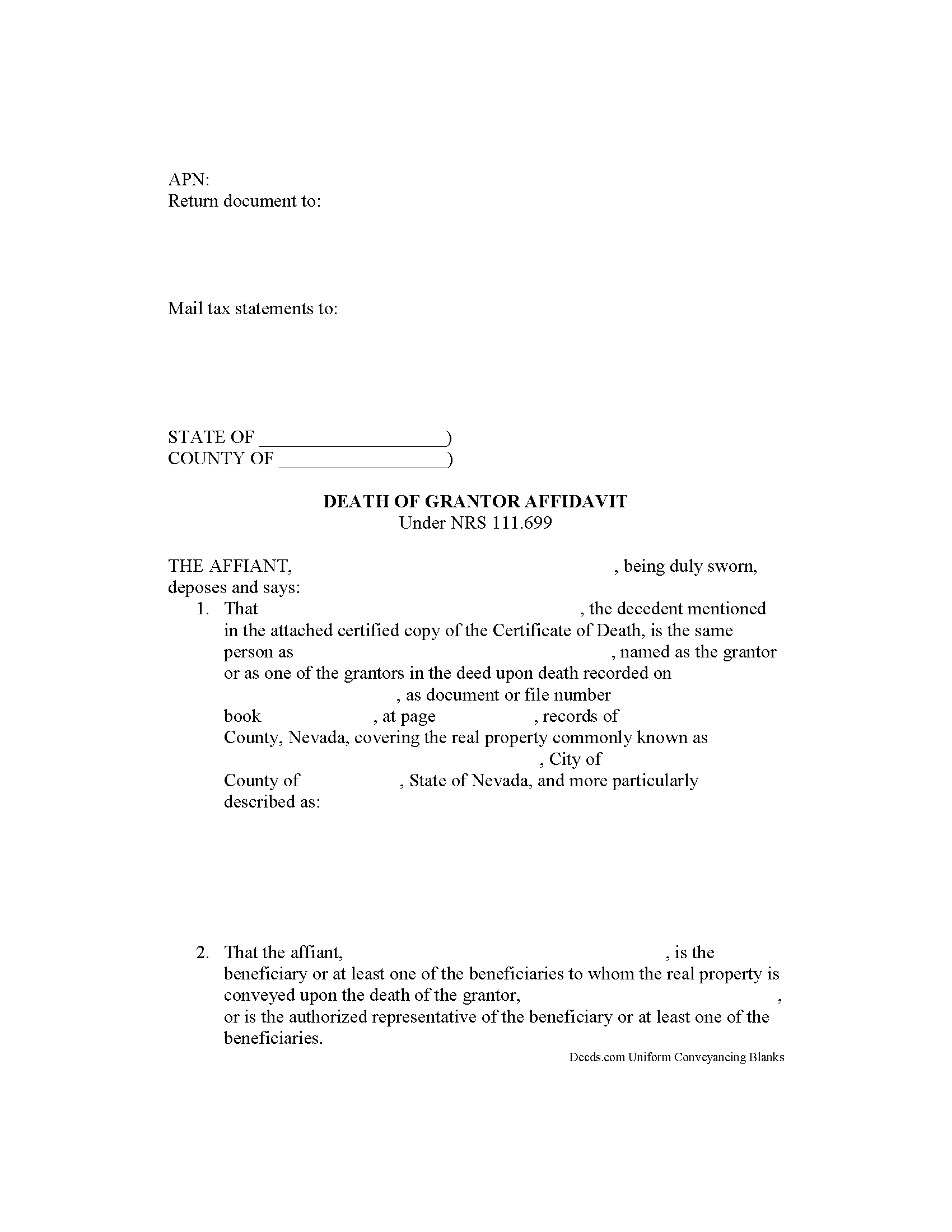

NRS 111.699 provides the requirements and procedure for transferring ownership of real property related to a deed upon death. This process is important because allows the recorder to maintain accurate ownership records and update taxpayer information. When the last grantor of a deed upon death dies, the surviving beneficiary should:

1. Execute a death of grantor affidavit;

2. Attach a certified copy of the death certificate for each grantor/owner; and

3. Complete a declaration of value of property pursuant to NRS 375.060;

4. Record the documents in the office of the county recorder where the deed was recorded.

Note, though, that under NRS 111.691, property transferred by a deed upon death is subject to any liens on the property in existence on the date of the death of the grantor. For example, if there is a mortgage on the property, the new owner becomes responsible for paying it. Also see NRS 111.689 for cautions about outstanding obligations from the deceased owner's estate.

Each situation is unique, so contact a local attorney with specific questions.

(Nevada TODA Package includes form, guidelines, and completed example)