Hudson County Quitclaim Deed Form

Hudson County Quitclaim Deed Form

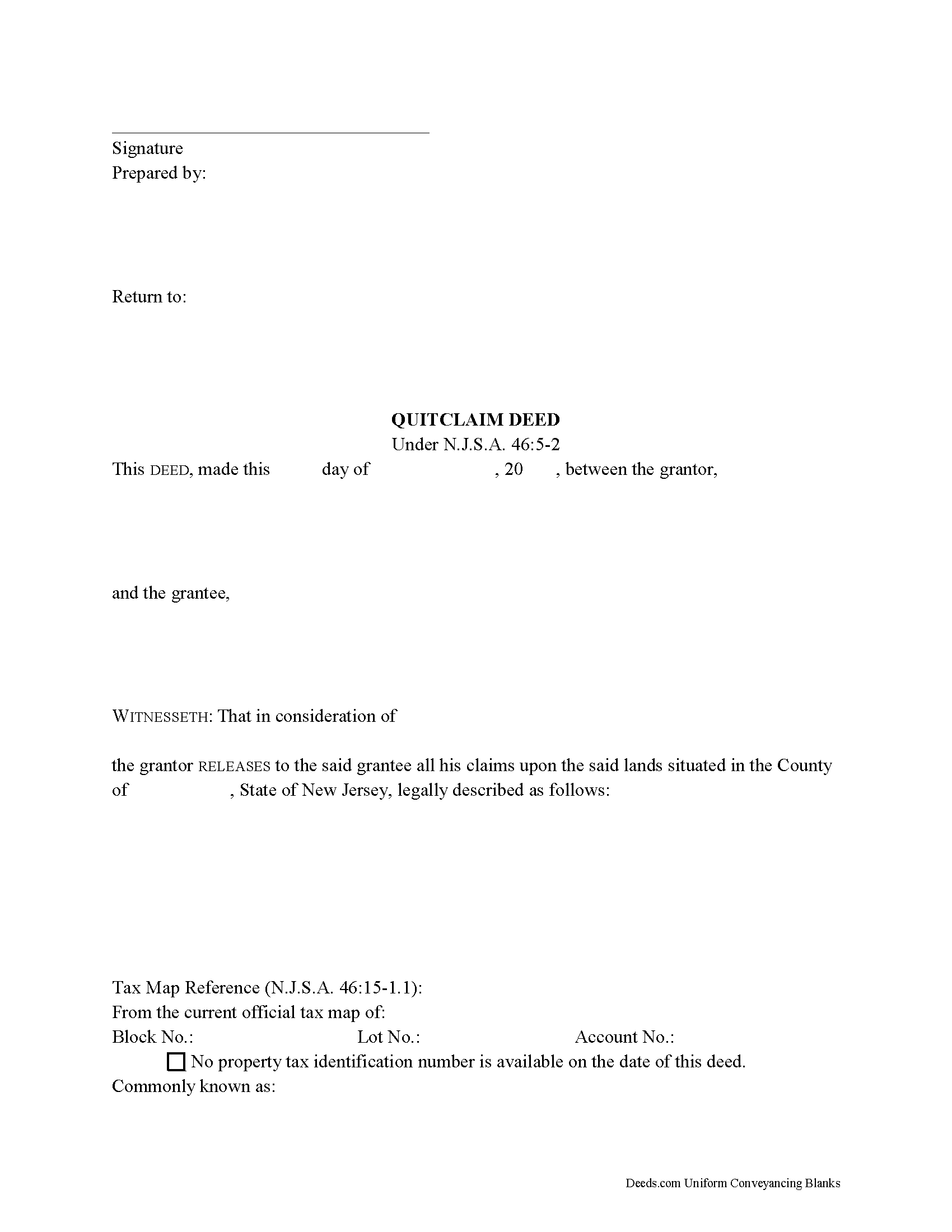

Fill in the blank Quitclaim Deed form formatted to comply with all New Jersey recording and content requirements.

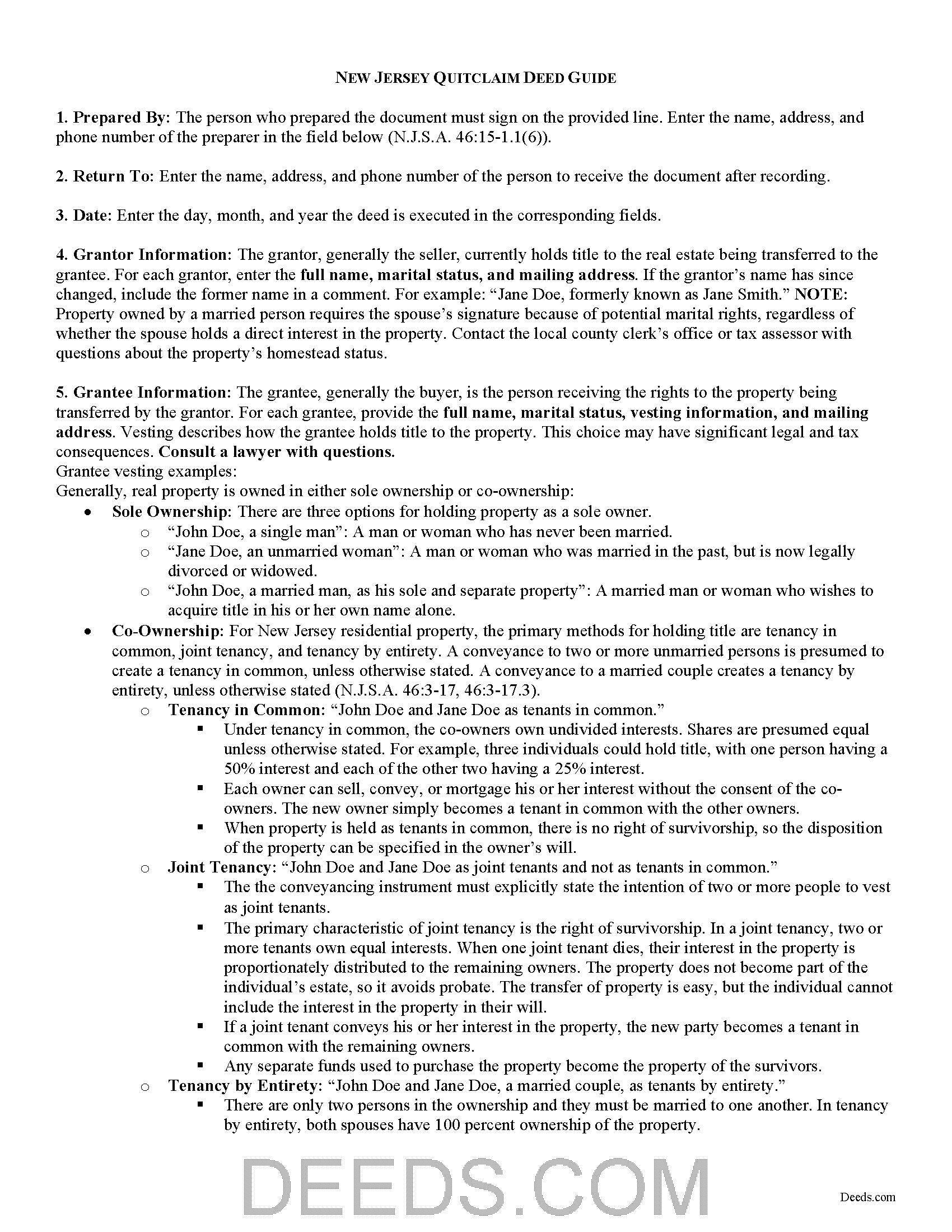

Hudson County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

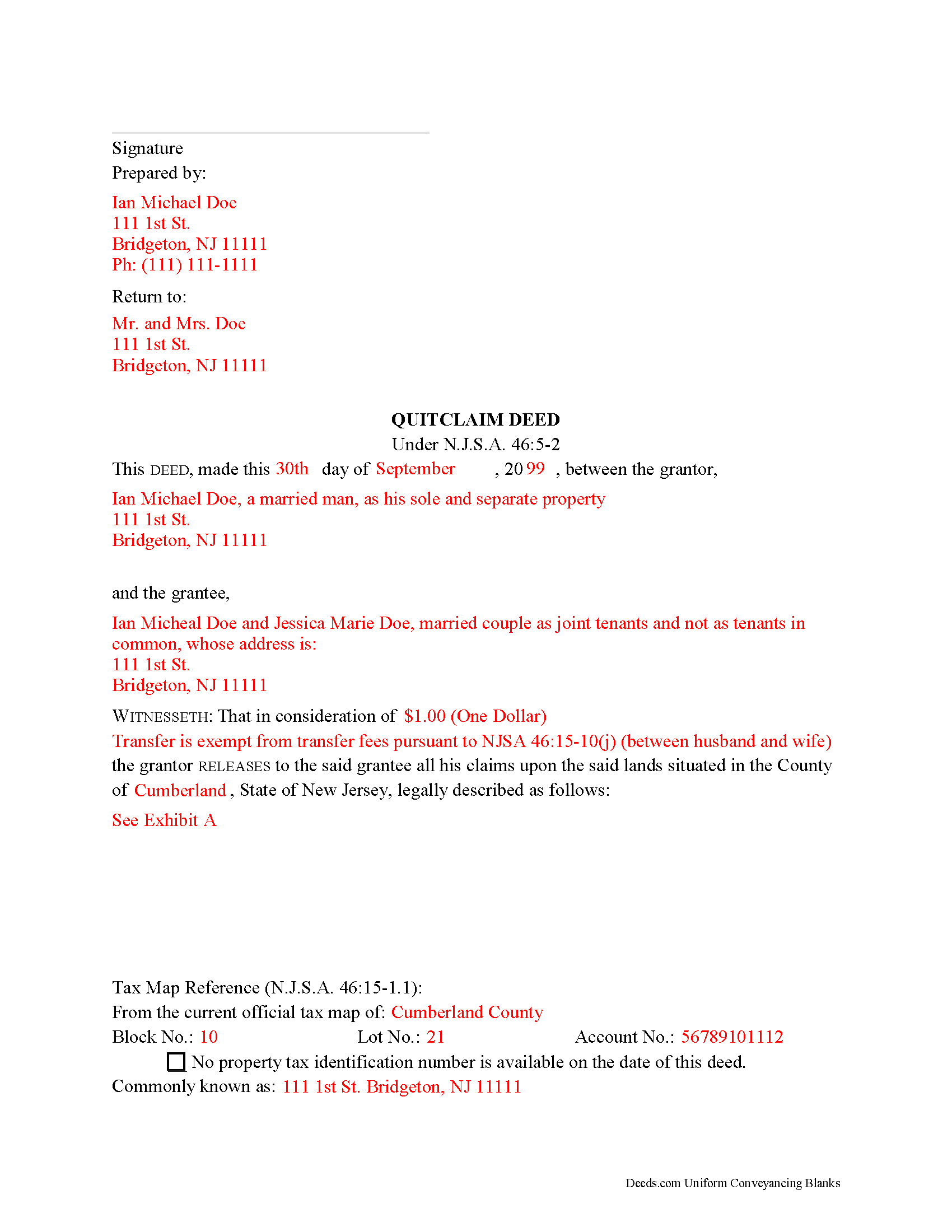

Hudson County Completed Example of the Quitclaim Deed Document

Example of a properly completed New Jersey Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Jersey and Hudson County documents included at no extra charge:

Where to Record Your Documents

Hudson County Register

Jersey City, New Jersey 07302

Hours: 8:00am to 4:00pm M-F

Phone: (201) 395-4760

Recording Tips for Hudson County:

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Hudson County

Properties in any of these areas use Hudson County forms:

- Bayonne

- Harrison

- Hoboken

- Jersey City

- Kearny

- North Bergen

- Secaucus

- Union City

- Weehawken

- West New York

Hours, fees, requirements, and more for Hudson County

How do I get my forms?

Forms are available for immediate download after payment. The Hudson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hudson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hudson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hudson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hudson County?

Recording fees in Hudson County vary. Contact the recorder's office at (201) 395-4760 for current fees.

Questions answered? Let's get started!

In New Jersey, real property can be transferred from one party to another by executing a quitclaim deed.

Quitclaim deeds are identifiable by the word "release" in the granting clause, and they function to terminate whatever interest the grantor holds at the time of the transfer (N.J.S.A. 46:5-2). In New Jersey, conveyances in which the grantor remises, releases, or quitclaims interest in real property to the grantee without reservations "pass all the estate which the grantor could lawfully convey by deed of bargain and sale" (N.J.S.A. 46:5-3). This means that a quitclaim deed transfers the same quality of title as a bargain and sale deed. Quitclaim deeds differ from bargain and sale deeds, however, in that they do not include a promise from the grantor that he or she has not encumbered the property (N.J.S.A. 46:4-6).

A lawful quitclaim deed includes the grantor's full name, mailing address, and marital status, and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New Jersey residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance to two or more unmarried persons is presumed to create a tenancy in common, unless otherwise stated. A conveyance to a married couple creates a tenancy by entirety, unless otherwise stated (N.J.S.A. 46:3-17, 46:3-17.3).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The deed should meet all state and local standards of form and content for recorded documents.

Sign the deed in the presence of a notary public or other authorized official. For a valid transfer, record the deed at the recording office in the county where the property is located. Contact the same office to confirm accepted forms of payment.

Deeds transferring new construction as the term is defined in N.J.S.A. 46:15-5(1)(g) should contain the words "NEW CONSTRUCTION" in all caps on the first page (N.J.S.A. 46:15-6(2)(c)).

If the conveyance is exempt from transfer taxes, explain why on the face of the deed. See N.J.S.A. 46:15-10 for transfer tax exemptions. Include a completed Affidavit of Consideration with deeds claiming exemption or partial exemption.

Record a Gross Income Tax Form (GIT/REP) with a deed when transferring real property in New Jersey. Ask the local assessor or recording office for help in choosing the correct version of the GIT/REP.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about using quitclaim deeds, or for any other issues related to transfers of real property in New Jersey.

(New Jersey QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Hudson County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Hudson County.

Our Promise

The documents you receive here will meet, or exceed, the Hudson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hudson County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Patrick K.

September 1st, 2020

Fast and easy to use. Great update communications

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance G.

December 13th, 2018

You did not include the Notice of Intent to File a Lien Statement form which is necessary to properly file a mechanic's lien in Colorado. If you are going to charge people $20 to download the forms, you should include all of them not half of them.

Thank you for your feedback. We really appreciate it. Have a great day!

Candace K.

April 1st, 2021

I was able to find the Certificate of Trust after a little searching. Once found, the remainder of the process was easy. My task was done in no time. It's a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Cynthia W.

August 19th, 2022

I like the support documents that go along with the easement template and the fact that the format is specific to a state and county.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roy S.

January 5th, 2022

The website is easy to maneuver and information needed was readily available. Thanks so much!

Thank you!

Jane R.

November 17th, 2019

Forms were easy to complete and print.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Yvette D.

January 15th, 2021

Excellent service and customer support. Thank you for your help and time.

Thank you!

ROBERT B.

November 6th, 2020

The staff of DEEDS.COM is in a class of excellence all by themselves! From my own personal experience, I had multiple problems with some documents I was submitting. DEEDS.COM stayed with me and held my hand through the project until it was completed! I have never met the staff at DEEDS, but their personal service & professionalism make me feel like part of the DEEDS Family! If I ever need legal documents submitted to government agencies nationwide ever again, THE ONLY STOP ONLINE I WILL MAKE WILL BE DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

July 30th, 2019

Received the documents as ordered in a timely fashion. Can't ask for much better than that!

Thank you!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger M.

January 22nd, 2021

EASY. WORKED WITH PROBLEMS.

Thank you!

Elbert M.

July 19th, 2021

I found The blank documents easy to use and the instructions informative and simple to follow. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Earnest K.

January 8th, 2025

I used the "personal representative's deed." There were a few errors, after I went to record it at the county recorder's office. For #7, it should've stated "The estate of Joe Schmoe, hereby grants Mr. Personal Representative....." instead of, "I Mr. Personal Representative, as personal representative, hereby grant to personal representative...." The person at the recorder's office said you cannot state "you are granting property to yourself." Just fix that, and everything else is fine.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Lorraine J.

April 6th, 2023

Thank-you.

Thank you!

Alex Q.

July 26th, 2023

The best people to work with! Thank you for all you do. We send documents from all states to Deeds.com to record for us. They are professional, keep us updated and always notify us if there is an issue with one of our documents prior to sending to recording and that saves us money and time! Thank you!!

Thanks for the kind words Alex. We appreciate you!