Harding County Affidavit of Deceased Joint Tenant Form

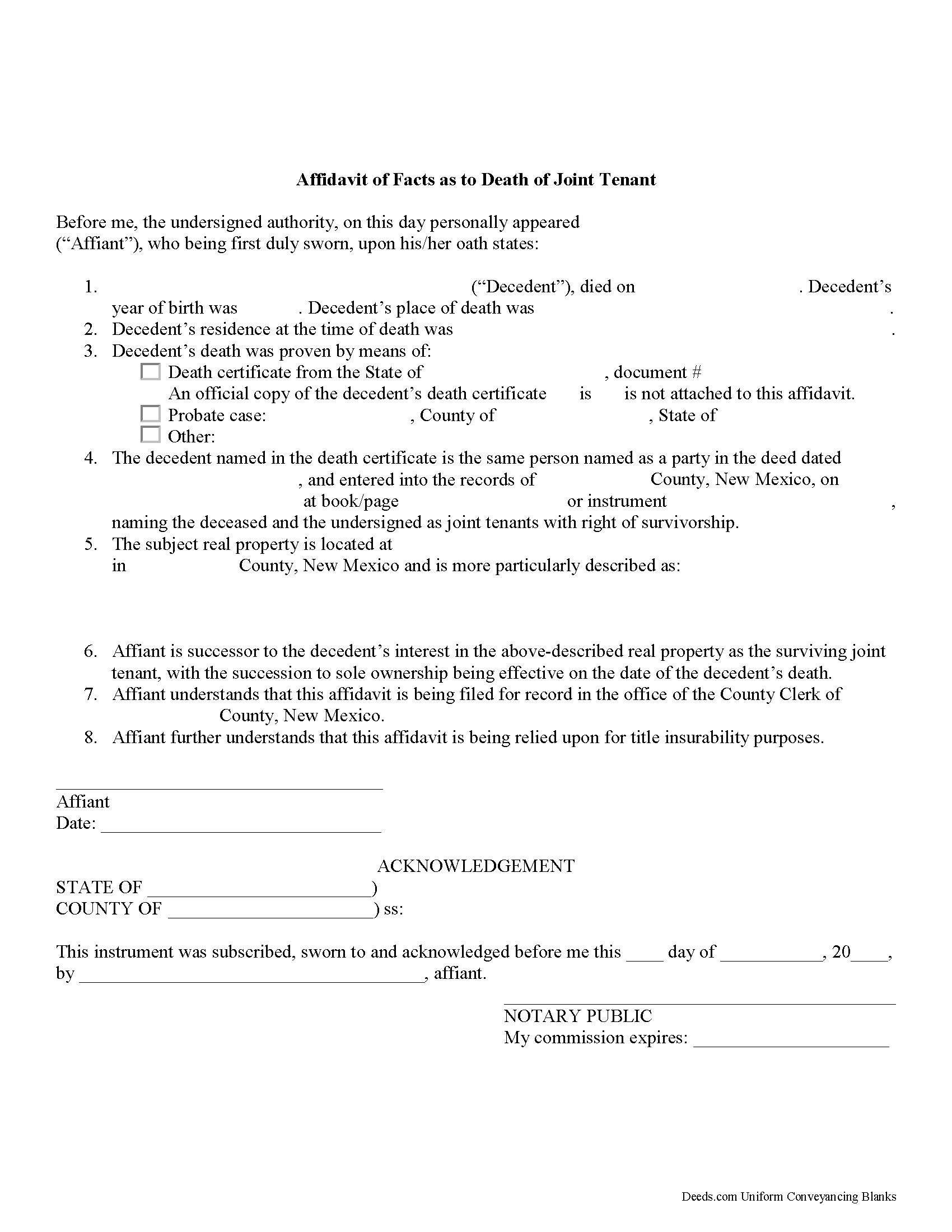

Harding County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

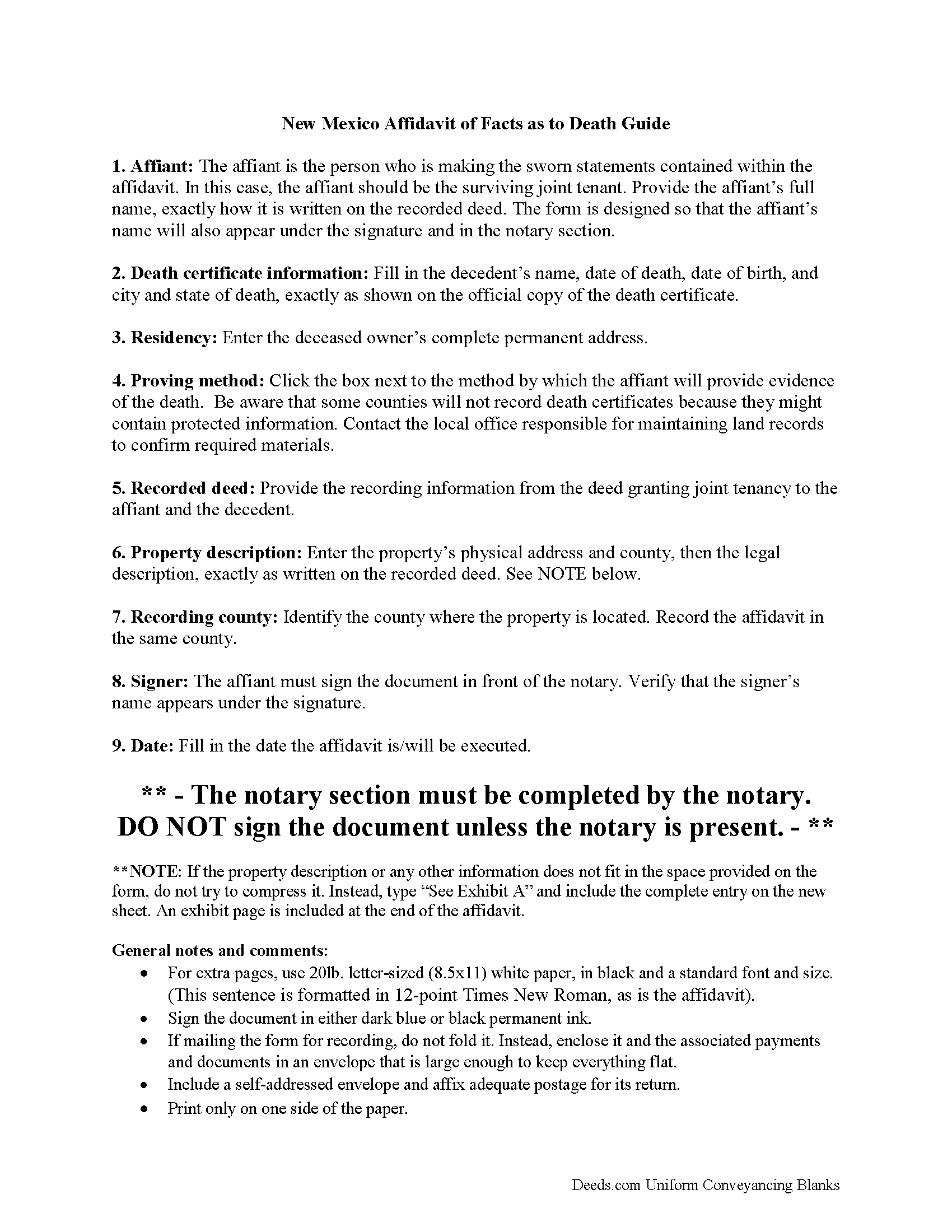

Harding County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

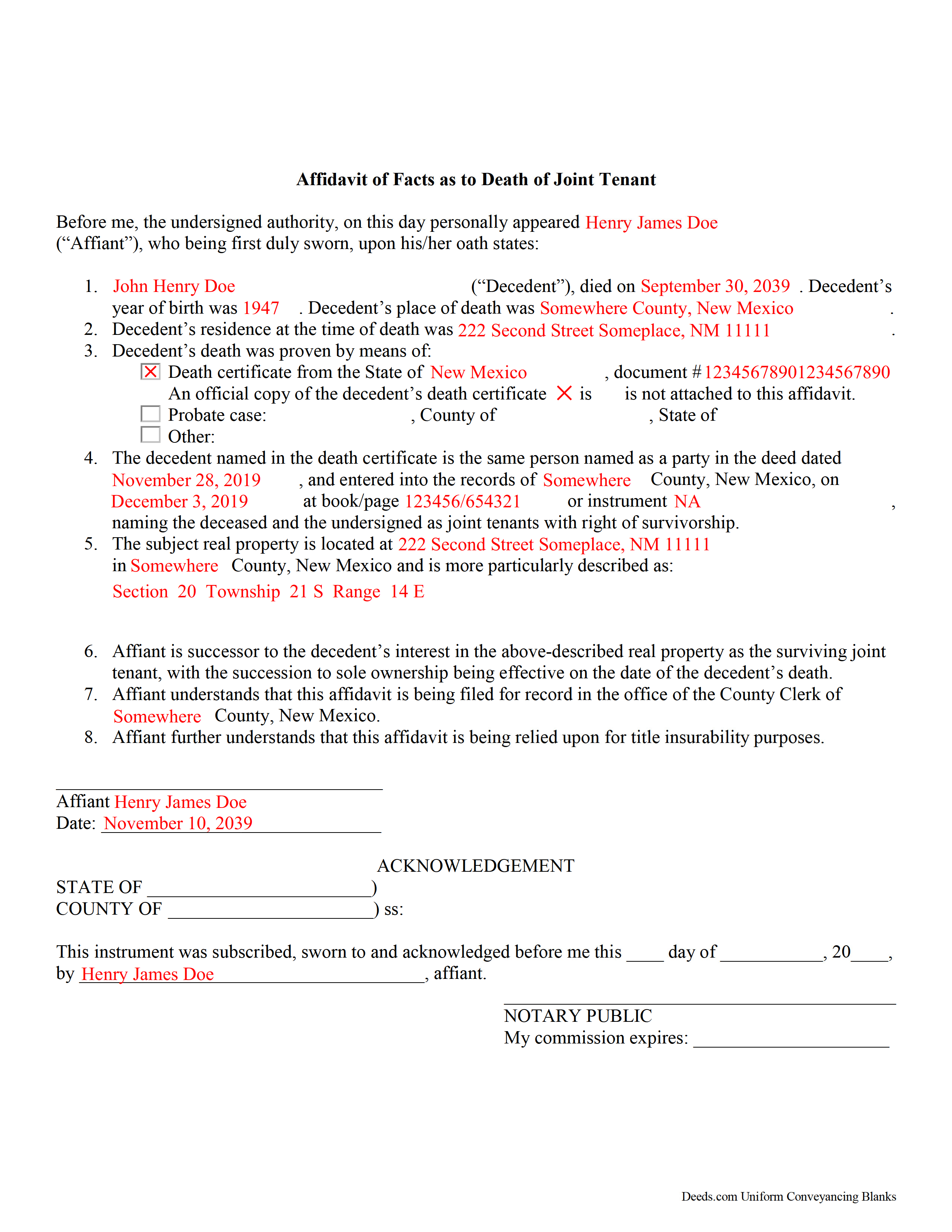

Harding County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Harding County documents included at no extra charge:

Where to Record Your Documents

Harding County Clerk

Mosquero, New Mexico 87733

Hours: 8:00 to 4:00 M-F

Phone: (575) 673-2301

Recording Tips for Harding County:

- Ask if they accept credit cards - many offices are cash/check only

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Harding County

Properties in any of these areas use Harding County forms:

- Mills

- Mosquero

- Roy

- Solano

Hours, fees, requirements, and more for Harding County

How do I get my forms?

Forms are available for immediate download after payment. The Harding County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harding County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harding County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harding County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harding County?

Recording fees in Harding County vary. Contact the recorder's office at (575) 673-2301 for current fees.

Questions answered? Let's get started!

Removing a Deceased Joint Tenant from a New Mexico Real Estate Title

New Mexico's statutes define joint tenancy at 47-1-36. This law states that a "joint tenancy in real property is one owned by two or more persons, each owning the whole and an equal undivided share, by a title created by a single devise or conveyance, when expressly declared . . . to be a joint tenancy." Property titled in this manner cannot be passed in a will; instead, a deceased joint tenant's share is distributed equally amongst the survivors as a function of law until only one person holds the property in sole ownership.

While technically accurate, this description oversimplifies the situation. What happens when it's time to sell the property? Unless the local recording office cross-references death notices with real estate records, the deceased owner's name still appears on the title. This inaccuracy can create confusion during a title search and slow down the transfer process. In addition, outdated ownership information might interfere with property tax billing, which could lead to unnecessary fees and/or penalties.

The surviving owner(s) may prevent these potential issues with a simple step: when one joint tenant dies, the other(s) can execute and record an affidavit of facts as to death with the local recording office. It is possible to address this at the time of sale, but it makes sense to handle it within a short time after the owner's death because the necessary documentation is more likely to be easily accessible. This action keeps property records up-to-date, verifies the owner's interest and rights to the title, and ensures smoother transfers in the future.

Each circumstance is unique, so please contact an attorney with questions or for complex situations.

(New Mexico Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Harding County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Harding County.

Our Promise

The documents you receive here will meet, or exceed, the Harding County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harding County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

William B.

May 29th, 2021

The website works just as described. I couldn't ask for anything more helpful in drafting an easement and all at a very reasonable price. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Eric B.

April 2nd, 2023

Document was well formatted with the extra help of an example and useful instructions. I ended up with a better warranty deed than I was getting on another website. Worth the small price.

Thank you for your feedback. We really appreciate it. Have a great day!

Rachel C.

January 18th, 2021

This service is a game-changer. I work all over and being able to e-record so easily has been so effective for my business.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda A.

April 21st, 2022

This was perfect for providing the necessary forms. Easy to enter needed information. I would recommend this for legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Paula M.

October 15th, 2021

So far it seems good. I am still trying to send information to this company so they can help me with the deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Z. L.

October 20th, 2021

I appreciate a service that can reach any county in Texas to file deed distribution deeds. It is convenient, time and money saving for our clients and takes the headache out of estate administration. Thanks.

Thank you!

Nancy H.

May 31st, 2019

Easy to use site. Would continue to go to for future needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine N.

May 22nd, 2019

Very easy to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kristen H.

August 29th, 2019

This was such a money saver. I was told by someone at the courthouse that I had to have a lawyer prepare the paper work for my mom. They stated that family members couldn't prepare the papers. I was hopeful when I found that I could prepare the survivorship affidavit on Deeds. I was able to prepare everything myself and had no issues today when at the courthouse for all the changes. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William P.

October 31st, 2019

I was very pleased with the end results regarding Quitclaim deeds.

Thank you!

Stephenie A.

January 11th, 2019

No review provided.

Thank you!

COURTNEY K.

August 7th, 2020

I could not be happier with this service! It was so easy and fast!

Thank you!

Elizabeth R.

April 20th, 2023

It was easy to download and save the Revocation of Beneficiary of Deed form. The example and instructions helped a lot. When I went to file with the county clerk's office, she read through it carefully and said "perfect" when she was through. Thank you for making it so easy!

Thank you!

Karen P.

March 19th, 2021

Very easy to use.

Thank you!

Robert D.

March 7th, 2019

These forms made it so easy to update the property deed and the instructions and sample filled out form were most helpful. You might want to add some brief information on when or why to use the Acknowledgment in Individual Capacity notary form. In my case the notary was required to use it but also filled in the brief notarize section on the Affidavit as well. She said the one on the Affidavit had some value because it showed she had witnessed the my signature. But this was only after I suggested both be filled in as she initially thought to just strike through it and just use the Acknowledgment in Individual Capacity form.

Thank you for your feedback. We really appreciate it. Have a great day!