Taos County Affidavit of Deceased Joint Tenant Form

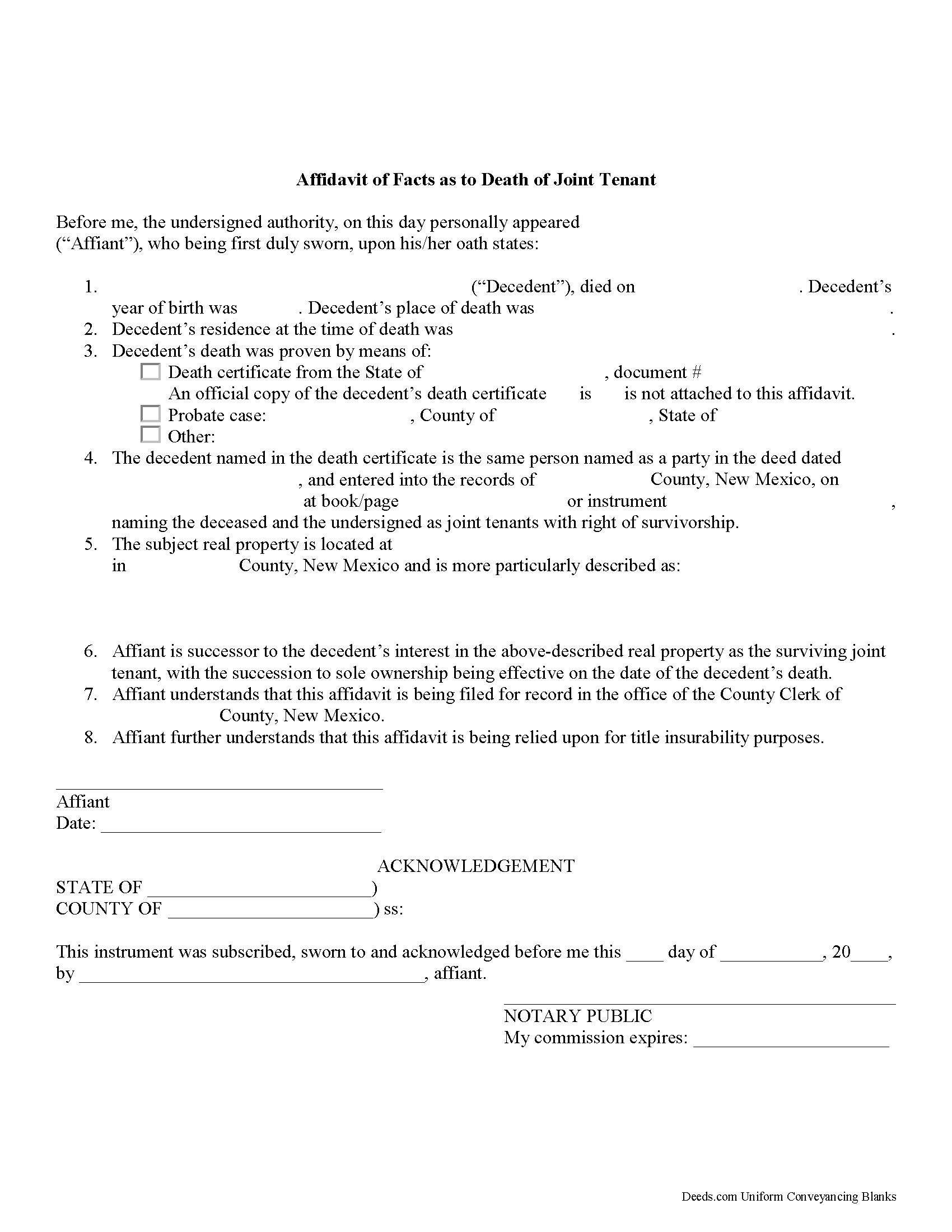

Taos County Affidavit of Deceased Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

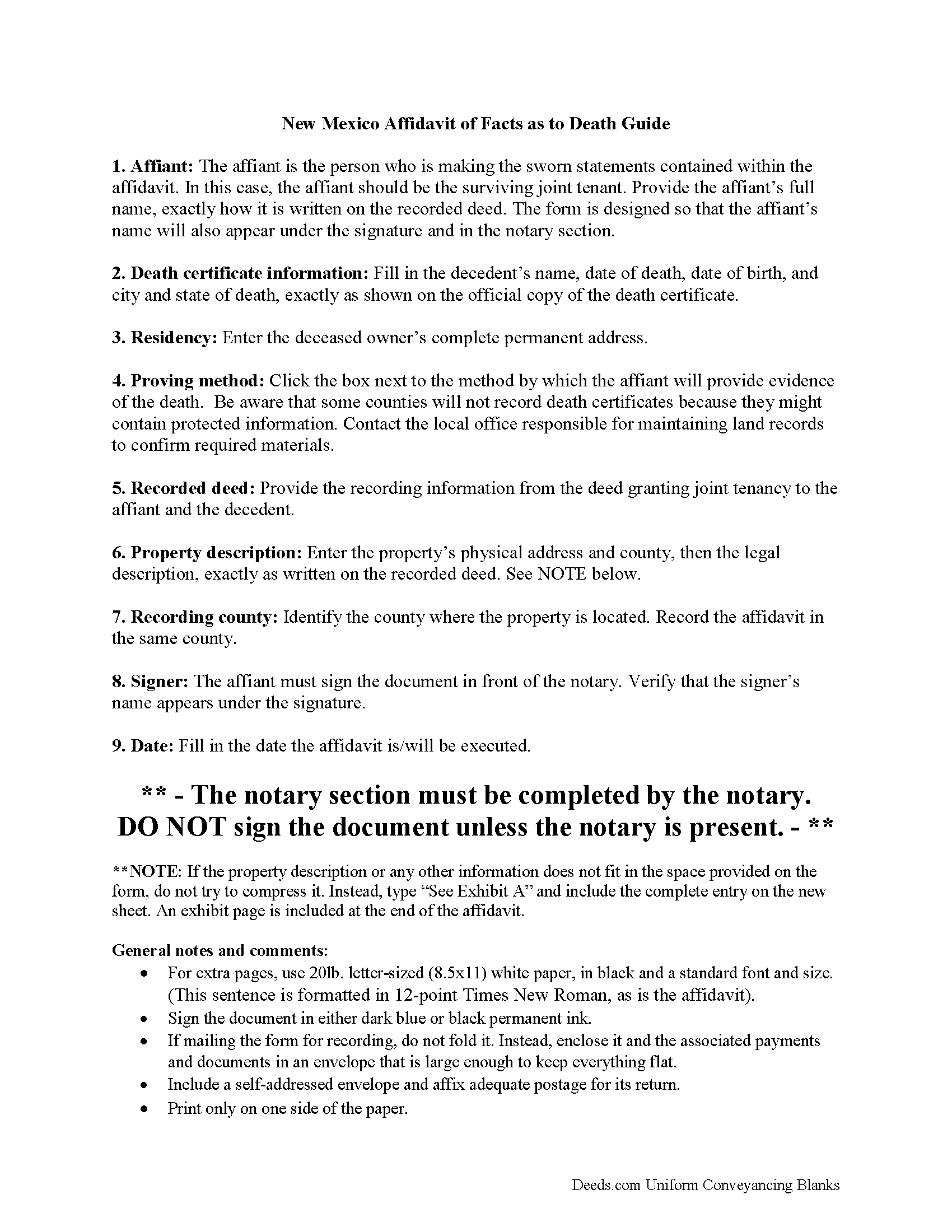

Taos County Affidavit of Deceased Joint Tenant Guide

Line by line guide explaining every blank on the form.

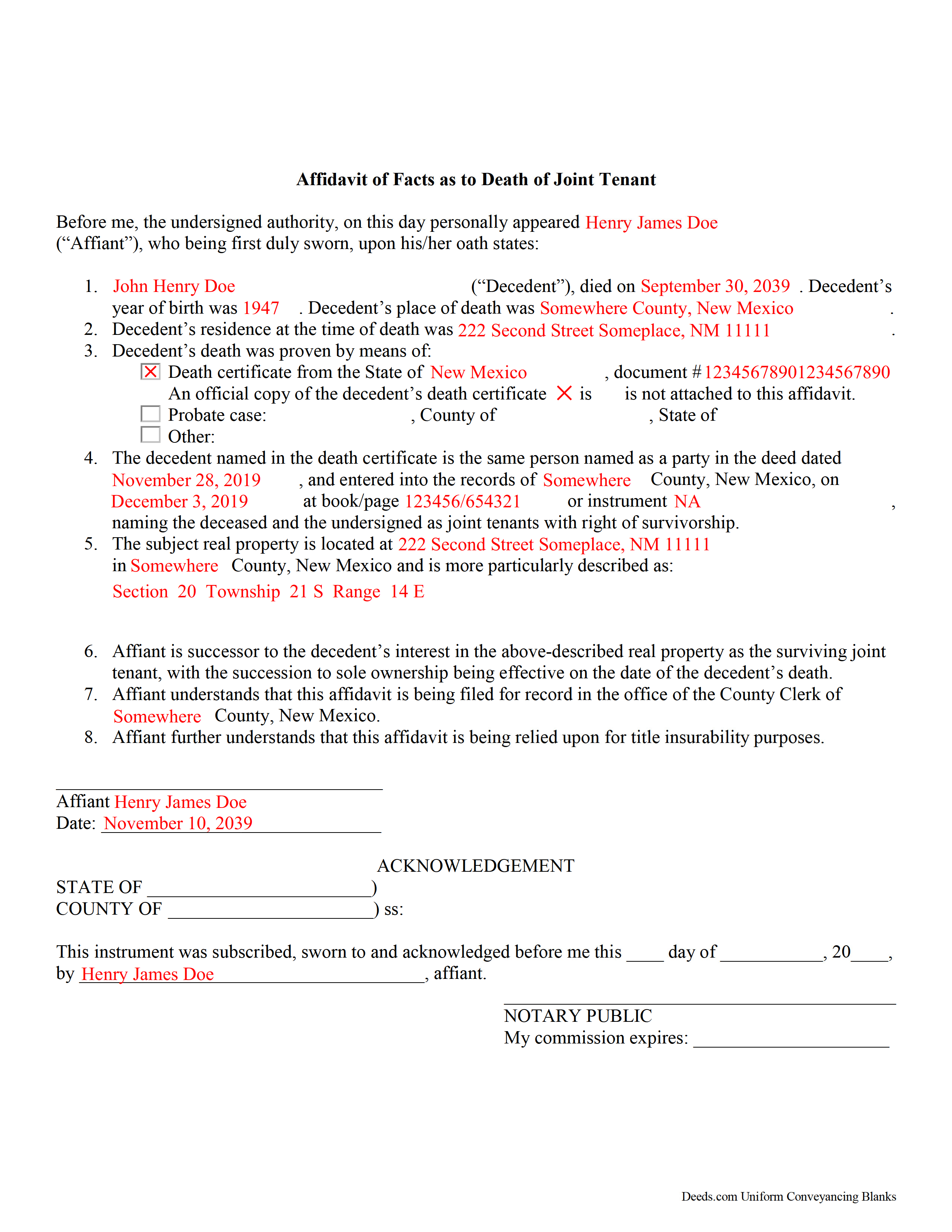

Taos County Completed Example of the Affidavit of Deceased Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Taos County documents included at no extra charge:

Where to Record Your Documents

Taos County Clerk

Taos, New Mexico 87571

Hours: 8:00am-5:00pm M-F

Phone: (575) 737-6380

Recording Tips for Taos County:

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Taos County

Properties in any of these areas use Taos County forms:

- Amalia

- Arroyo Hondo

- Arroyo Seco

- Carson

- Cerro

- Chamisal

- Costilla

- El Prado

- Llano

- Ojo Caliente

- Penasco

- Questa

- Ranchos De Taos

- Red River

- San Cristobal

- Taos

- Taos Ski Valley

- Trampas

- Tres Piedras

- Vadito

- Valdez

Hours, fees, requirements, and more for Taos County

How do I get my forms?

Forms are available for immediate download after payment. The Taos County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Taos County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Taos County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Taos County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Taos County?

Recording fees in Taos County vary. Contact the recorder's office at (575) 737-6380 for current fees.

Questions answered? Let's get started!

Removing a Deceased Joint Tenant from a New Mexico Real Estate Title

New Mexico's statutes define joint tenancy at 47-1-36. This law states that a "joint tenancy in real property is one owned by two or more persons, each owning the whole and an equal undivided share, by a title created by a single devise or conveyance, when expressly declared . . . to be a joint tenancy." Property titled in this manner cannot be passed in a will; instead, a deceased joint tenant's share is distributed equally amongst the survivors as a function of law until only one person holds the property in sole ownership.

While technically accurate, this description oversimplifies the situation. What happens when it's time to sell the property? Unless the local recording office cross-references death notices with real estate records, the deceased owner's name still appears on the title. This inaccuracy can create confusion during a title search and slow down the transfer process. In addition, outdated ownership information might interfere with property tax billing, which could lead to unnecessary fees and/or penalties.

The surviving owner(s) may prevent these potential issues with a simple step: when one joint tenant dies, the other(s) can execute and record an affidavit of facts as to death with the local recording office. It is possible to address this at the time of sale, but it makes sense to handle it within a short time after the owner's death because the necessary documentation is more likely to be easily accessible. This action keeps property records up-to-date, verifies the owner's interest and rights to the title, and ensures smoother transfers in the future.

Each circumstance is unique, so please contact an attorney with questions or for complex situations.

(New Mexico Affidavit of DJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Taos County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Joint Tenant meets all recording requirements specific to Taos County.

Our Promise

The documents you receive here will meet, or exceed, the Taos County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Taos County Affidavit of Deceased Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Lisa C.

July 2nd, 2020

Great. Thank you. Received information quickly. Helped out a lot.

Thank you!

Gerry H.

July 29th, 2020

Very good instruction for filling out the forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela J.

October 10th, 2021

Thank you the service was prompt and efficient.

Thank you!

samantha b.

February 18th, 2019

excellent instructions and the examples made completing the forms so very simple. thanks so much.

Thank you Samantha.

Thomas W.

February 4th, 2020

The serevice was fast and accurate. I would highly recommend Deeds.com to my friends and associates.

Thank you!

richard z.

April 27th, 2022

Great service they had what i need easy to use on printing as soon as you pay you can print also as many copys as you need. i would use this service again

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna W.

November 7th, 2023

This is an amazing place to come for all your deed help. I had looked on several other sites without luck, but deeds.com got everything I needed quickly and they are very inexpensive! Love this site and will be recommending it to anyone needing this type of help.

Thank you for your positive words! We’re thrilled to hear about your experience.

Marion R.

January 30th, 2019

YOU WERE NOT ABLE TO PROVIDE SERVICE IN THE COUNTY WE NEEDED IN NEW MEXICO. YOUR RESPONSE WAS QUICK SO I APPRECIATE THAT. THANK YOU

Thank you for your feedback Marion.

Eva L.

June 19th, 2020

So far so good! I haven't had an opportunity to populate the forms but they seem to be very easy to do. The sample deed serves very well. Ordering the forms were very easy, I was impressed with the ease of doing so.

Thank you!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara E.

March 19th, 2024

Love the accessibility to all counties. Save money and time using Deeds for all our recording needs!

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Zachary F.

February 1st, 2022

I am a lawyer and purchased a specialized type of deed for a special scenario. The product received was functional, but not great. Wording is slightly clunky and the form layout was not convenient for making a professional final product. The wording also didn't contemplate a remote-state probate, which is a common scenario. Something about the PDF prevented me from doing cut and paste, so I had to do OCR to get the relevant text for inserting in my existing draft deed. Finally, while the site claims it is customized for the exact state and county, it does not appear to be well-customized for that purpose and I had to use other language (not sourced from the deeds.com document) to meet local norms.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia G.

January 19th, 2021

Oh my goodness! Y'all are an answer to prayers! You provided all the forms necessary in one convenient packet, and at a VERY reasonable price! I can't thank y'all enough for helping my family & myself with what could've been a difficult and expensive situation! God bless you for your time and talent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Cheryl C.

November 19th, 2020

So far this looks like exactly what I need and at a reasonable price. Glad it was so easy to find online. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!