Eddy County Deed of Trust and Promissory Note Form

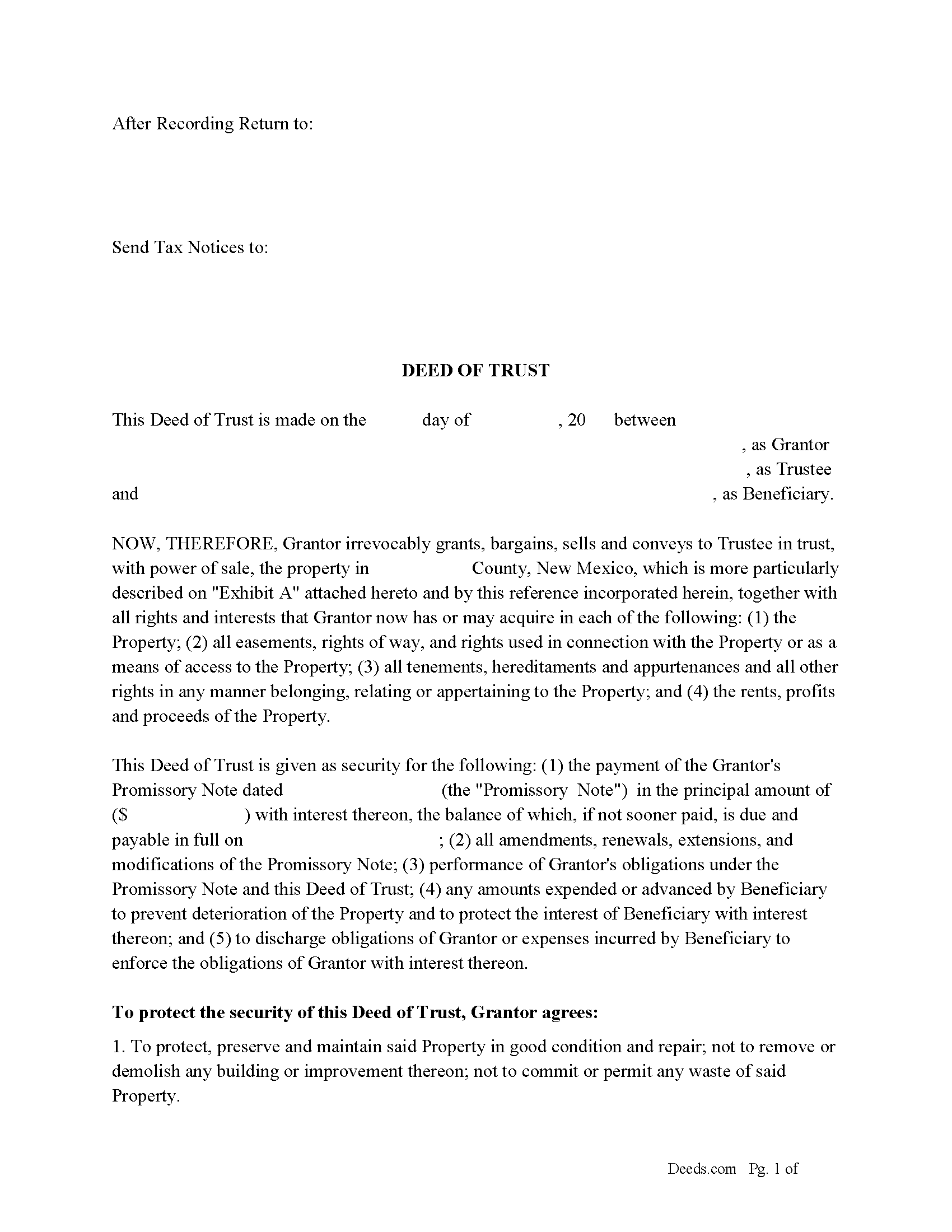

Eddy County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

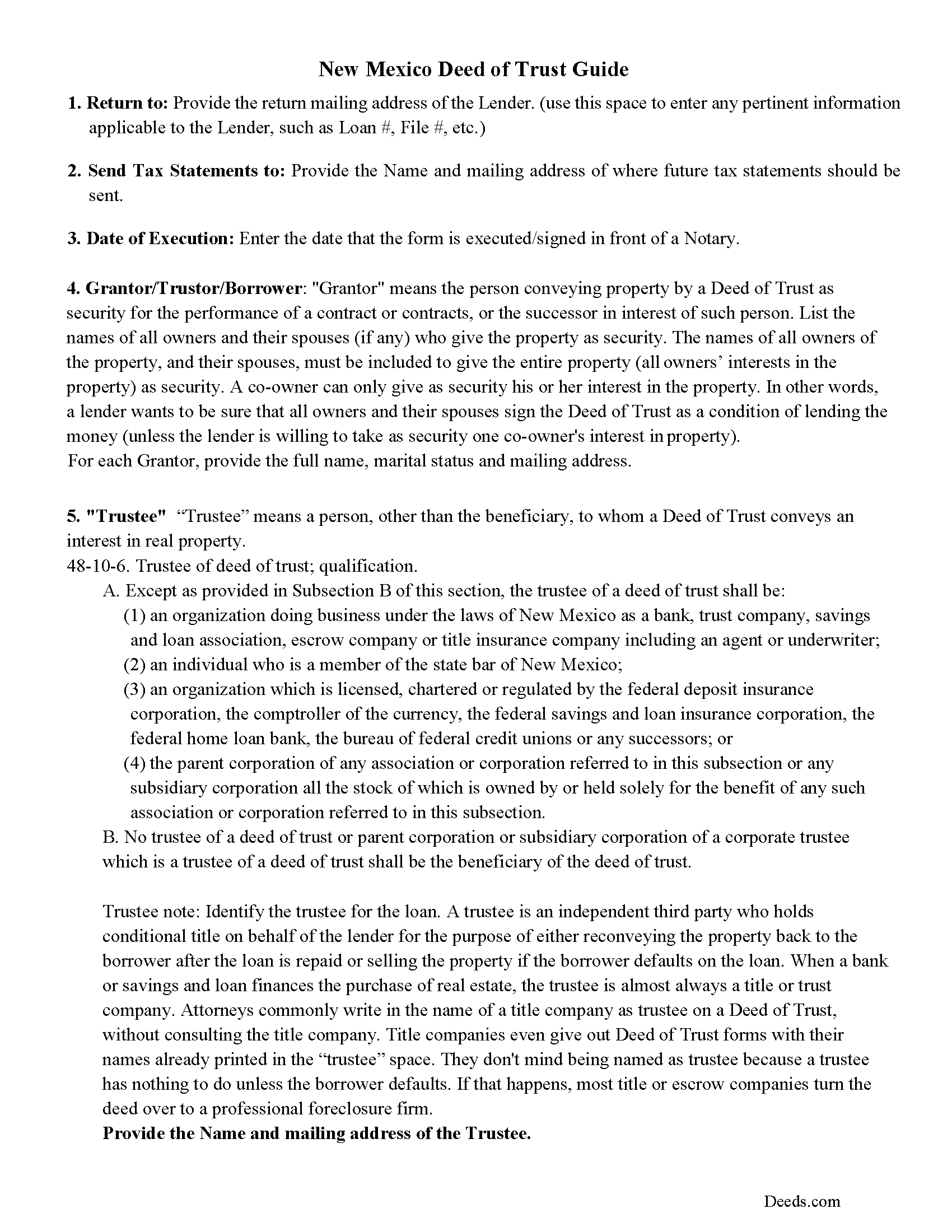

Eddy County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

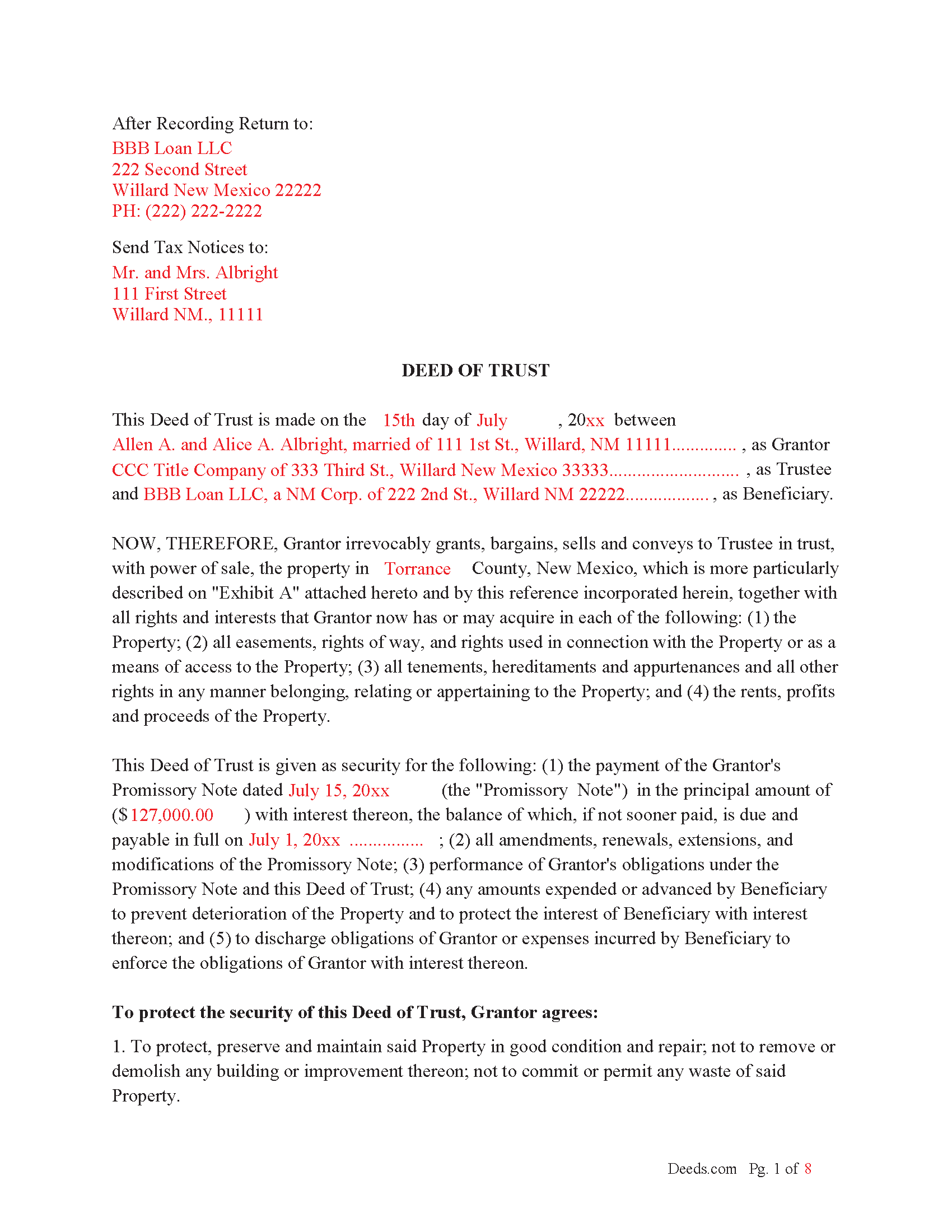

Eddy County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

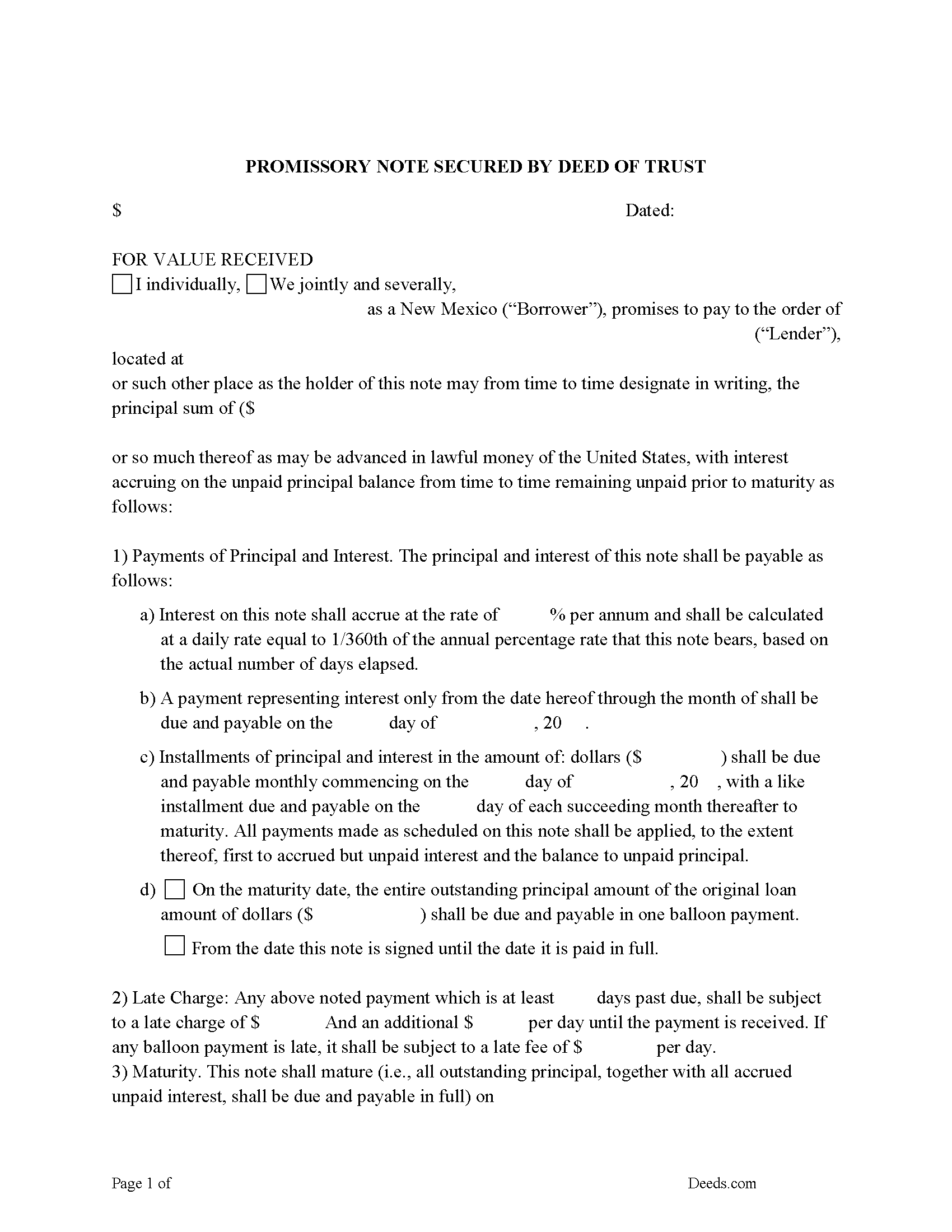

Eddy County Promissory Note Form

Note that is secured by the Deed of Trust.

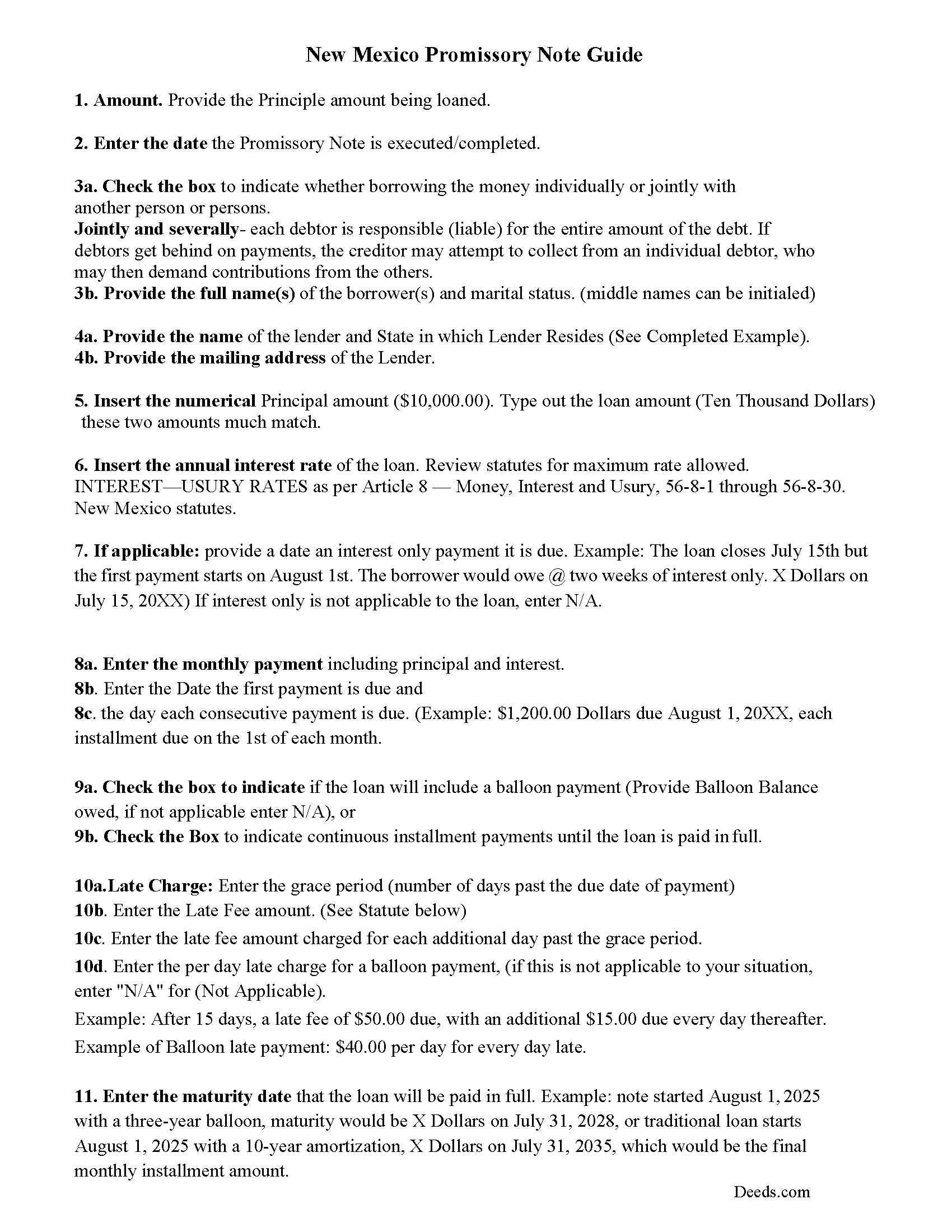

Eddy County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

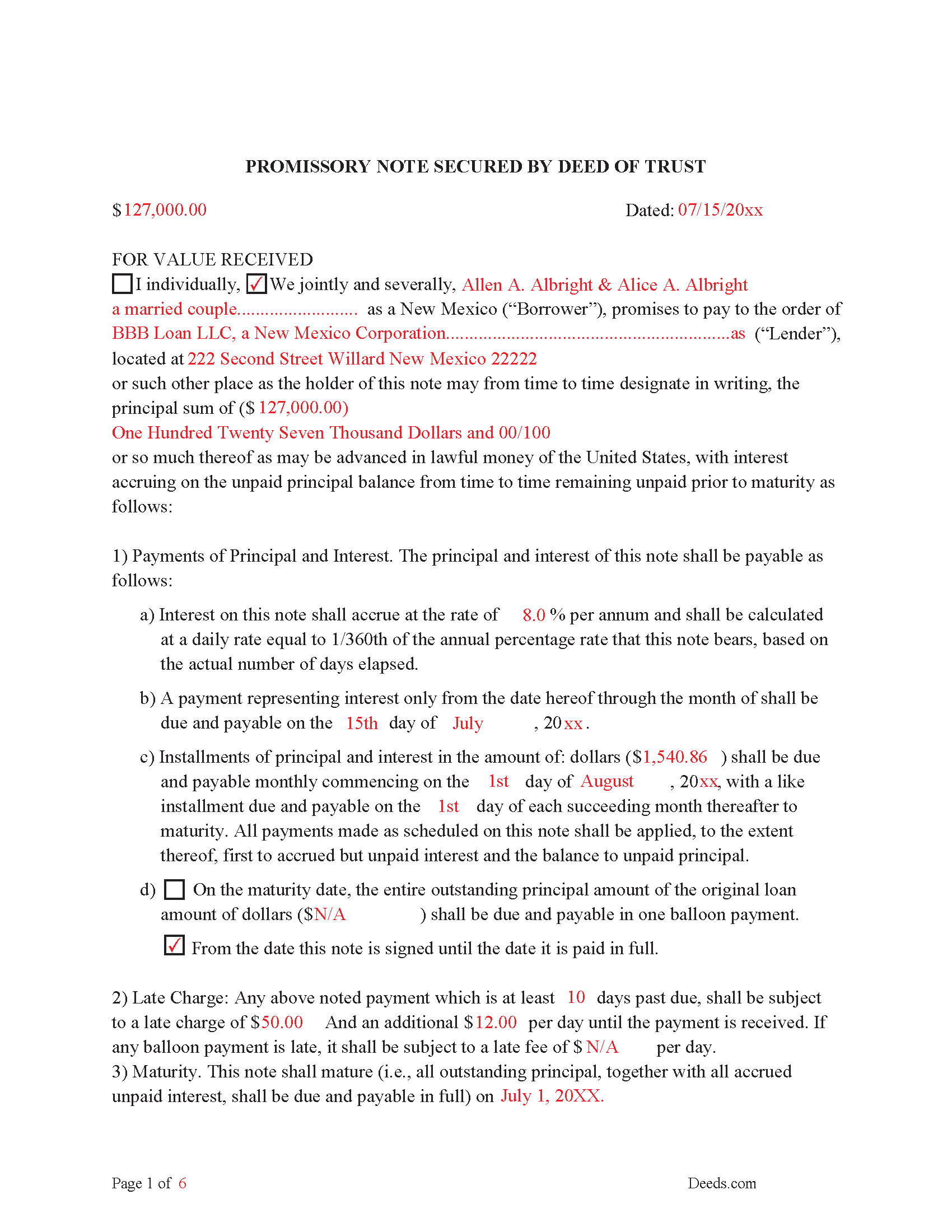

Eddy County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

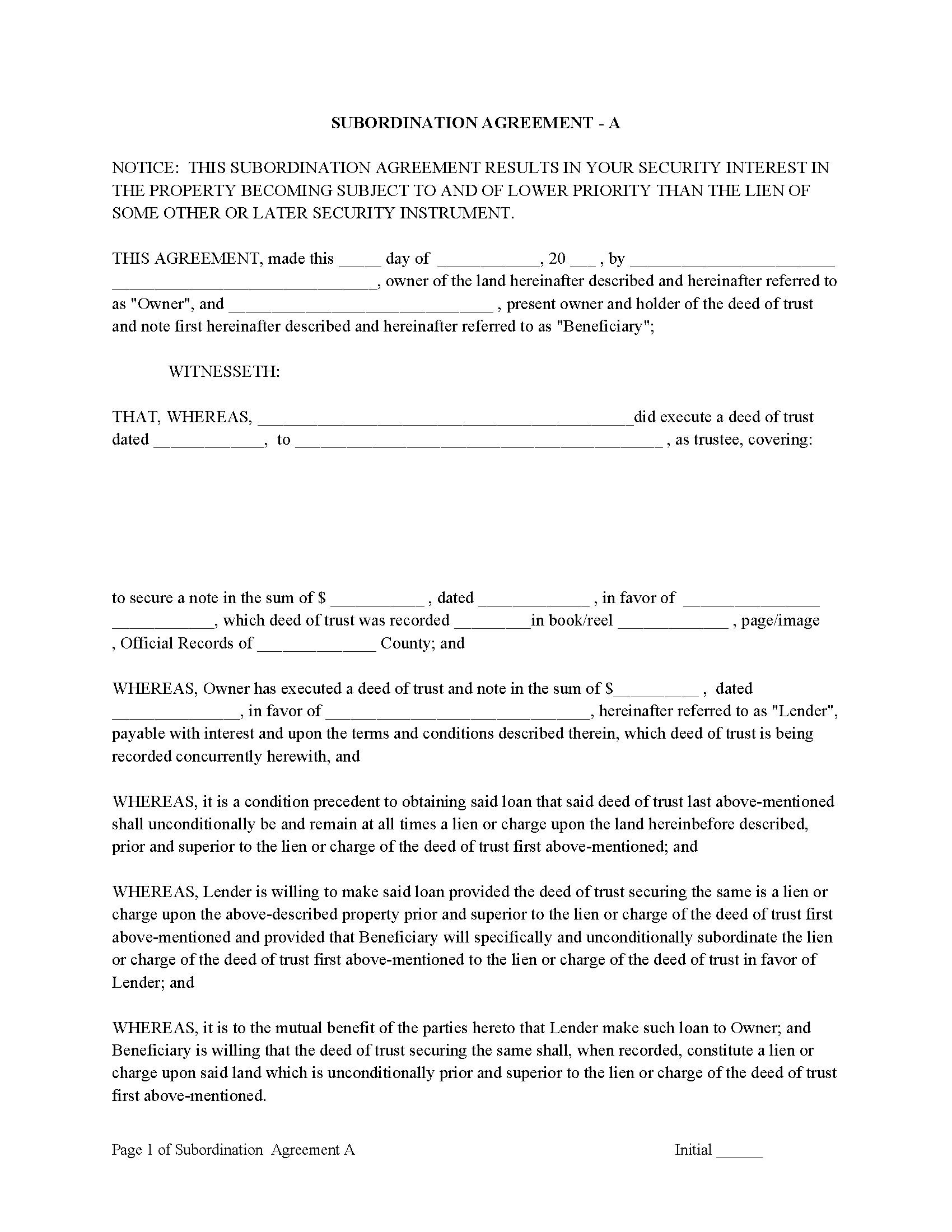

Eddy County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

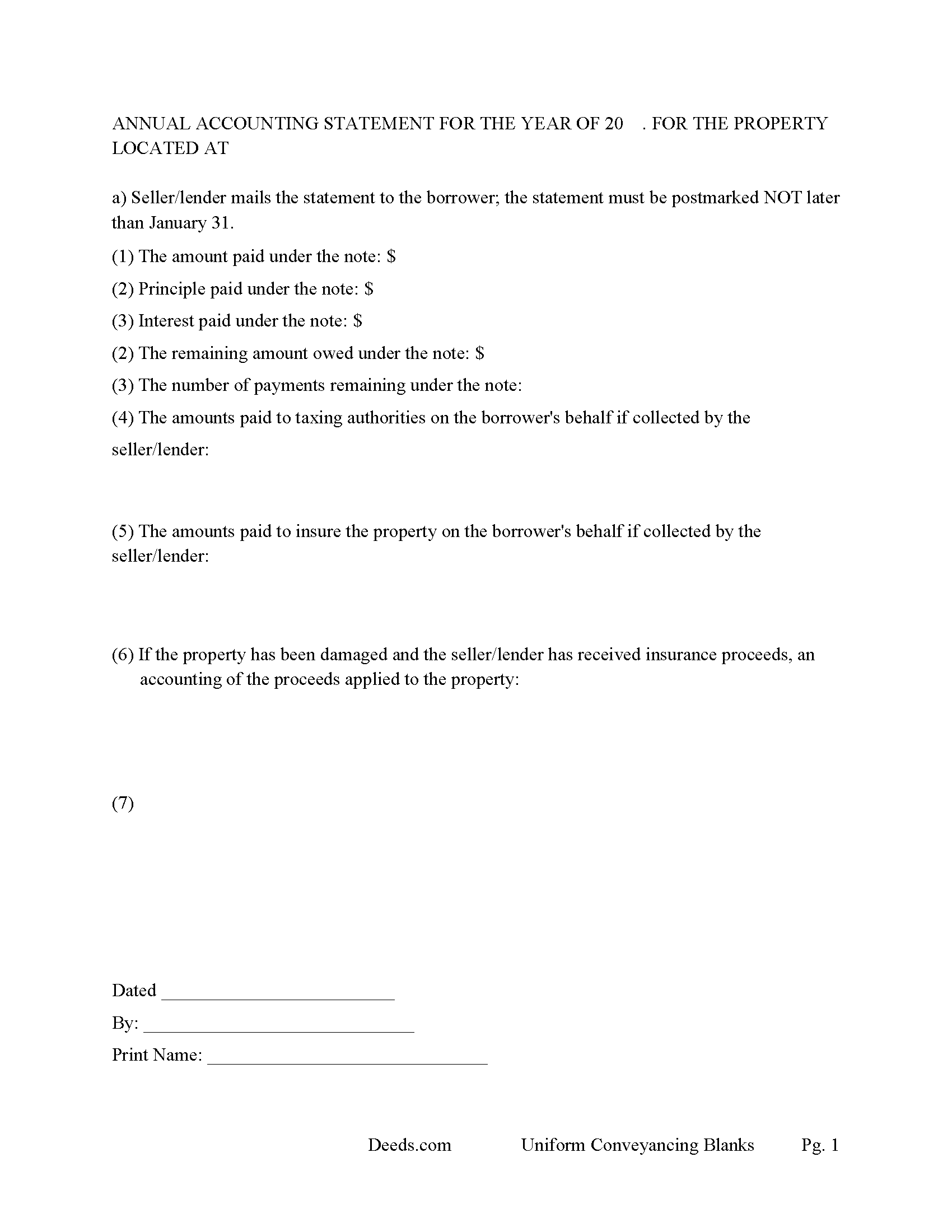

Eddy County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all New Mexico recording and content requirements.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Eddy County documents included at no extra charge:

Where to Record Your Documents

Eddy County Clerk

Carlsbad, New Mexico 88220

Hours: 8:00 to 5:00 Mon-Fri

Phone: 575-885-3383

Artesia Sub Office

Artesia, New Mexico 88210

Hours: Mon, Tue, Thu, Fri 8:00 to 12:00; Wed 1:00 to 5:00

Phone: 575-746-2541

Recording Tips for Eddy County:

- Make copies of your documents before recording - keep originals safe

- Request a receipt showing your recording numbers

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Eddy County

Properties in any of these areas use Eddy County forms:

- Artesia

- Carlsbad

- Hope

- Lakewood

- Loco Hills

- Loving

- Malaga

- Whites City

Hours, fees, requirements, and more for Eddy County

How do I get my forms?

Forms are available for immediate download after payment. The Eddy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Eddy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Eddy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Eddy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Eddy County?

Recording fees in Eddy County vary. Contact the recorder's office at 575-885-3383 for current fees.

Questions answered? Let's get started!

New Mexico has the Deed of Trust Act.

Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale. After the Trustee sale the borrower has a right to redeem the property. This form allows one-month vs nine-months.

NM Statute 48-10-16(A)

Except as otherwise provided in Subsection E of this section, the redemption period after a trustee's sale shall be nine months, or the period provided in the deed of trust, whichever is the lesser period, and shall begin to run from the date of the trustee's sale. In the deed of trust, the parties may shorten the redemption period to not less than one month.

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Grantor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary can take an action against any person for damages.

Use this form for financing residential property, small commercial, rental property (up to 4 units), condominiums and planned unit developments. A Deed of Trust and Promissory Note with stringent default terms/conditions can be beneficial to the lender, mostly used by investors or parties selling and/or financing a real property.

(New Mexico DOT Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Eddy County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Eddy County.

Our Promise

The documents you receive here will meet, or exceed, the Eddy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Eddy County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Angela B.

July 22nd, 2020

The site made everything very easy to understand and access. I was able to get everything I needed and the cost was reasonable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Equity S.

June 2nd, 2021

I love the service you provide. Very helpful and saves a ton of time.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

yaakov f.

June 5th, 2023

you are awesome never had such a great expriance will be back with other transfers you the best

Great to hear Yaakov! Hope you have a great day!

Don M.

September 9th, 2021

I find the site very difficult to nagitagte.

Sorry to hear that Don, we’ll try harder.

David B.

January 27th, 2020

I'm not sure how a forms web-site could be so, but I find deeds.com to be sweet.

Thank you for your feedback. We really appreciate it. Have a great day!

John C.

May 30th, 2023

So far it's OK but have not filed it with the the county so can't say if it will be what they want

Thank you for your feedback. We really appreciate it. Have a great day!

Judith F.

May 6th, 2022

The form I needed was perfect!

Thank you!

John G.

August 6th, 2019

Great on line help with the recording process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Monique C.

August 21st, 2020

Very quick and efficient service! I will continue to use them for future reference.

Thank you!

Keith H.

May 18th, 2021

These forms were helpful and comprehensive. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

April 15th, 2020

I am generally pleased with your products. However, I found it difficult to return to the package after accessing one selected document. One other comment: Your Trustee's Deed package should include a Certificate of Trust form.

Thank you for your feedback. We really appreciate it. Have a great day!

Anna L W.

December 19th, 2021

Was insecure about being able to access the information but pleasantly found that the site was easy to use. Seems that I can use it repeatedly to go back and reprint the forms once I paid.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger J.

December 3rd, 2020

I found the service easy to use and very helpful.

Thank you!

Adelola O.

April 28th, 2020

I called the county clerk office yesterday that i wanted to get a deed e-filed and recorded. I was told they are not accepting documents in person because of the COVID 19 pandemic that I have to mail it. I found Deeds.com online and in less than 24hrs i have my document. Thank you!!!!! $15....Totally worth it.

Thanks Adelola, glad we could help.

Donald P.

March 9th, 2021

I wish the quick claim dead would have had letterhead that said, State South Carolina.

Thank you for your feedback. We really appreciate it. Have a great day!