Harding County Deed of Trust and Promissory Note Form

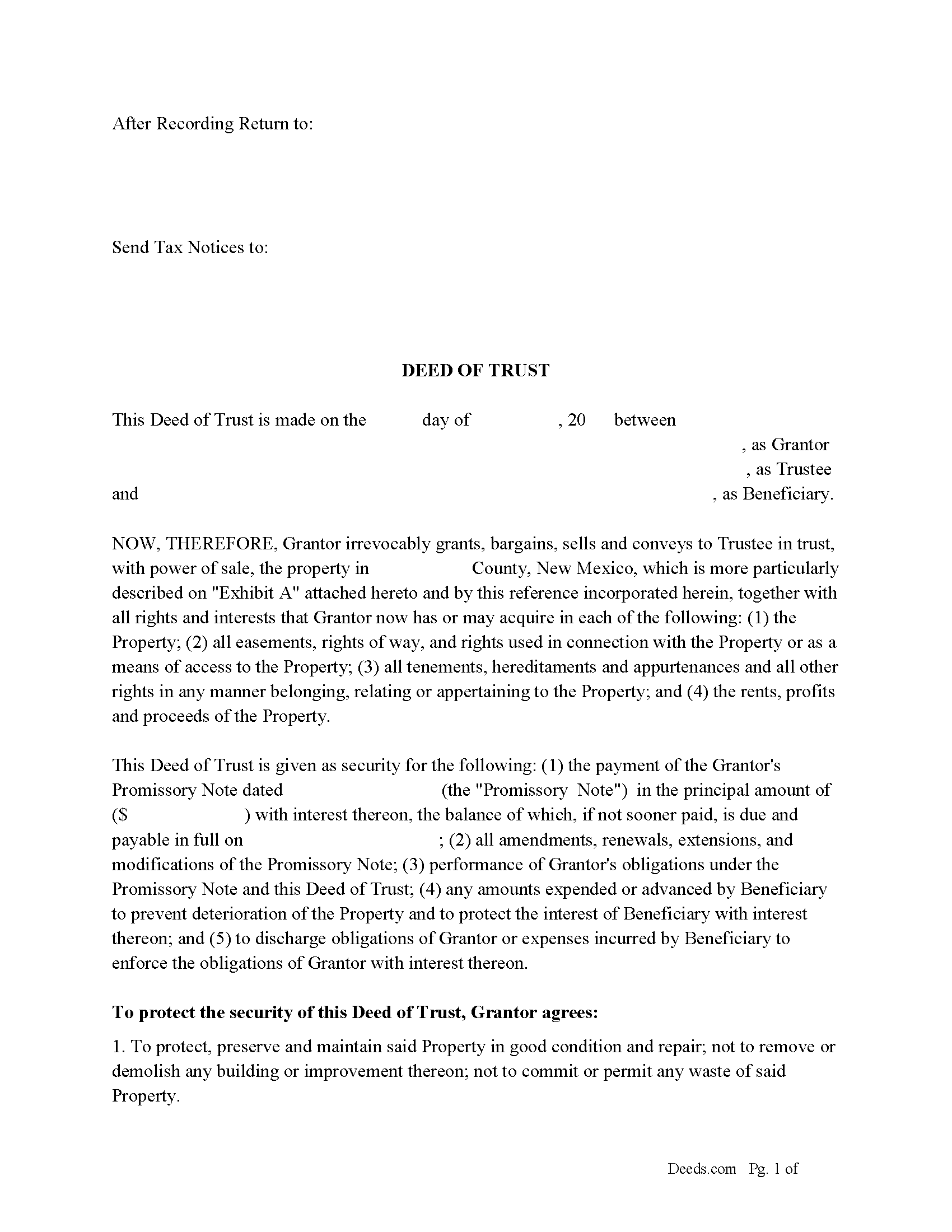

Harding County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

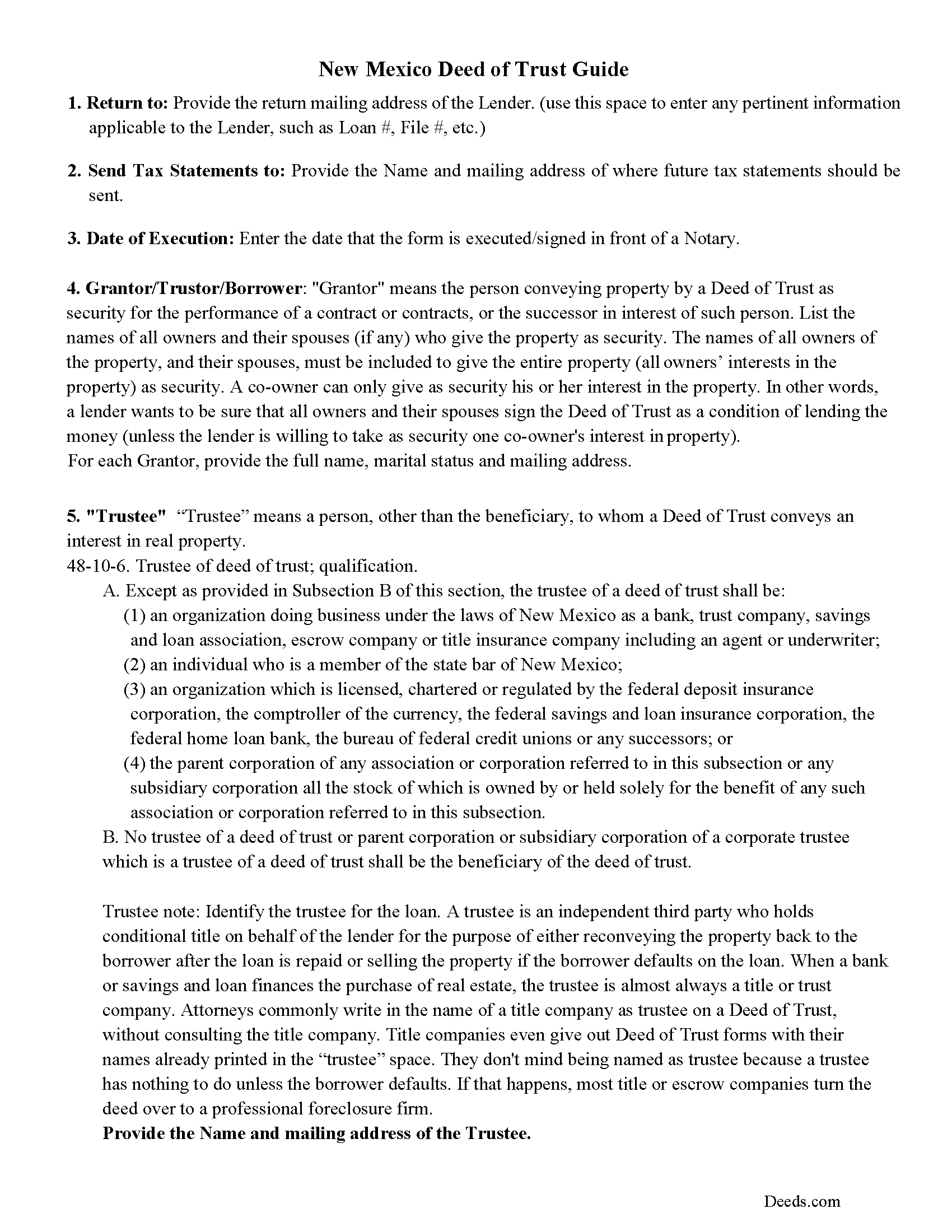

Harding County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

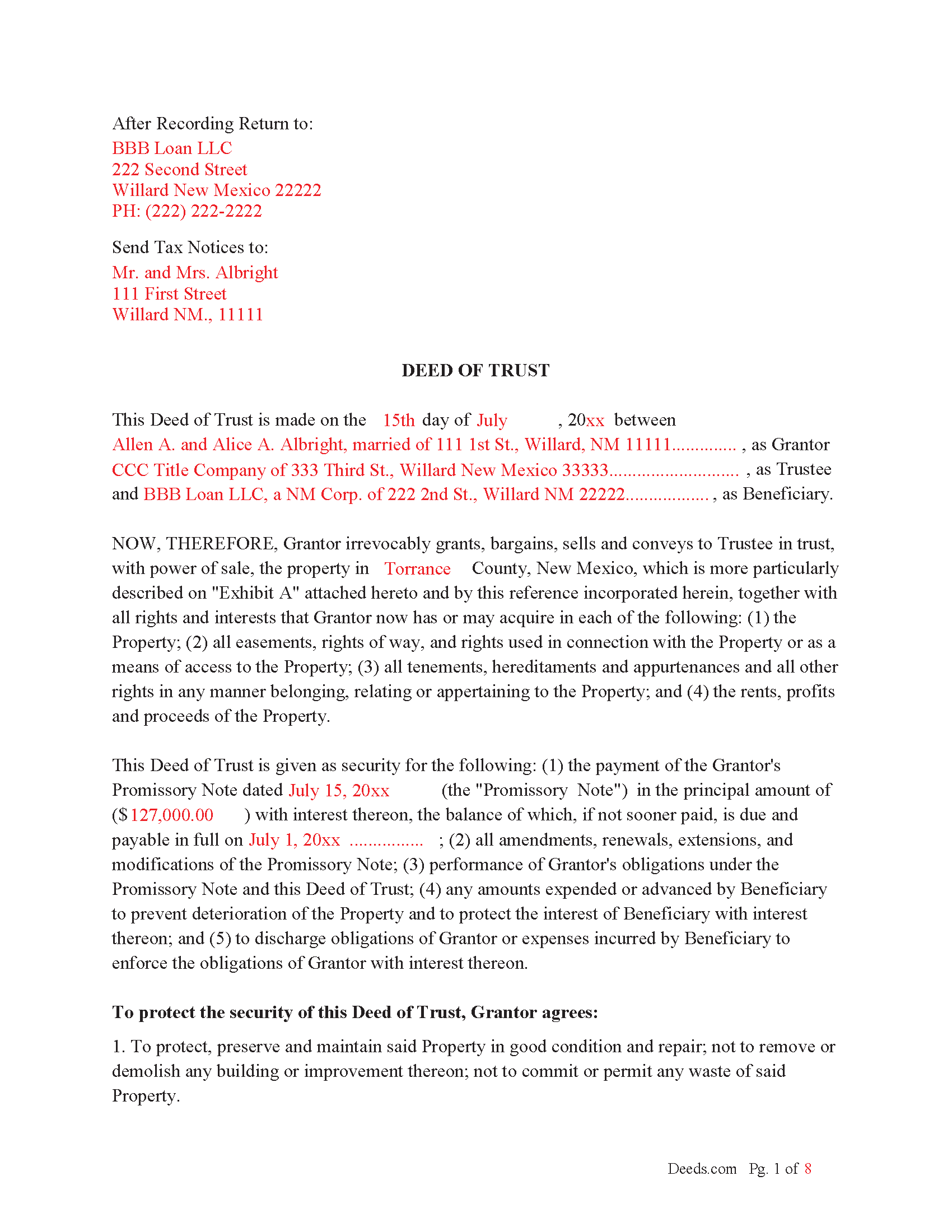

Harding County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

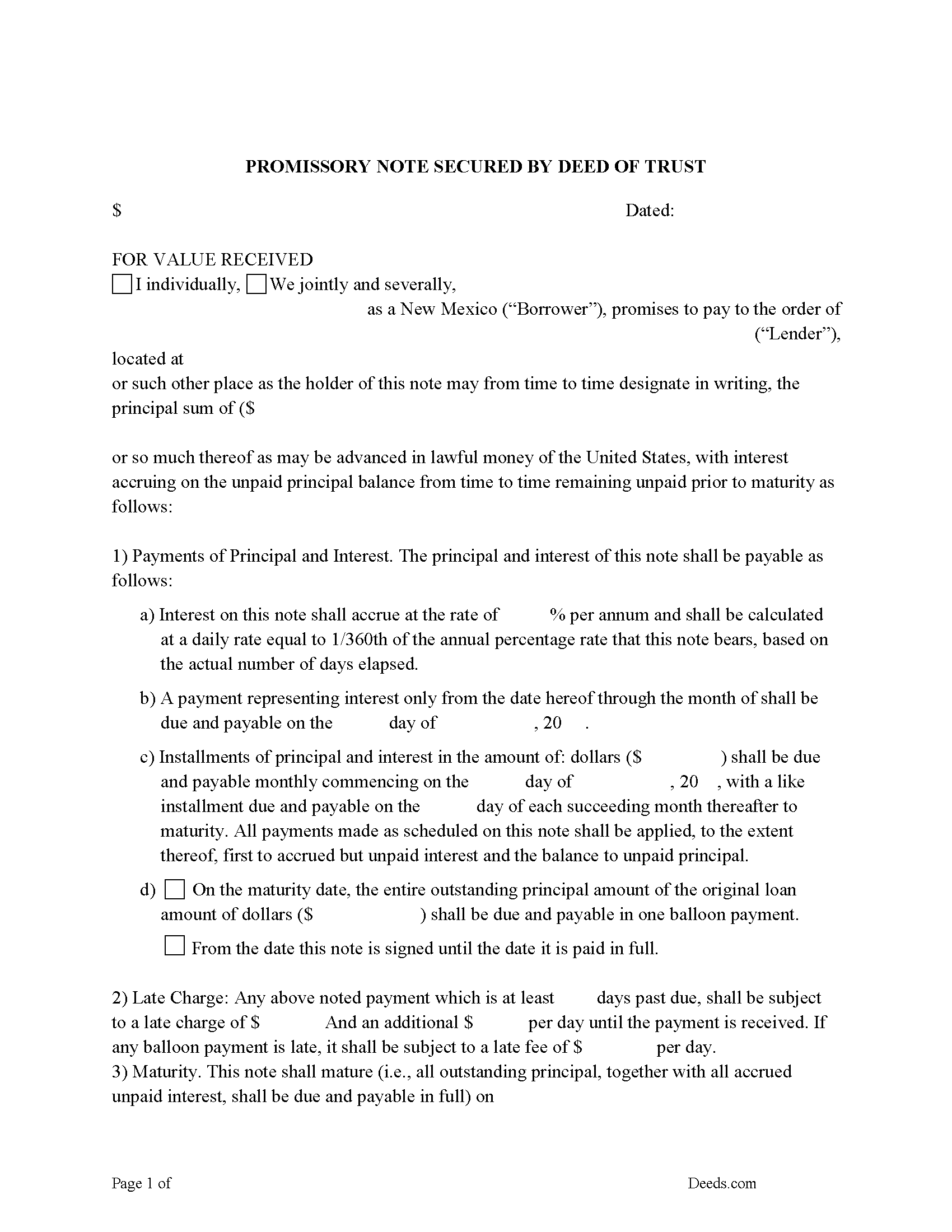

Harding County Promissory Note Form

Note that is secured by the Deed of Trust.

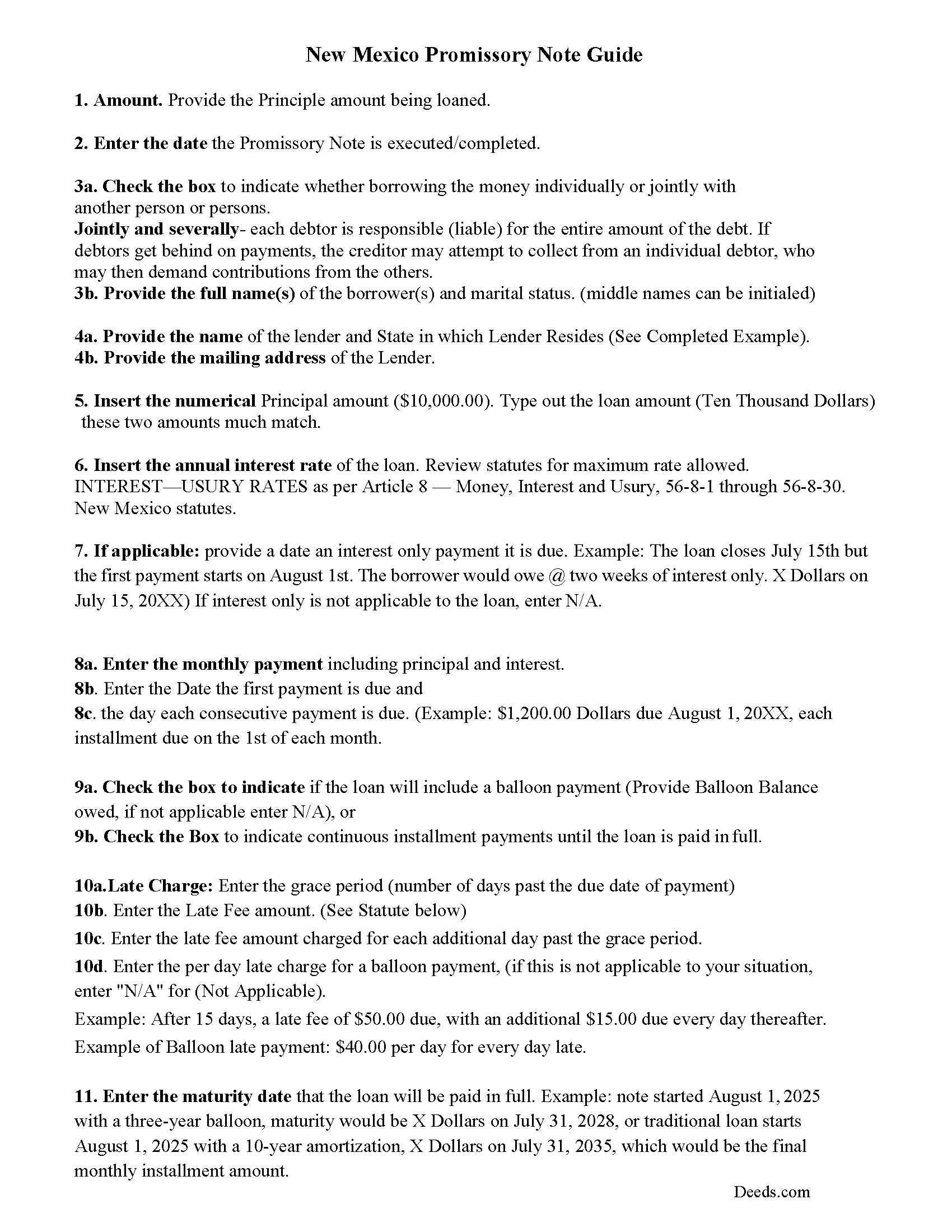

Harding County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

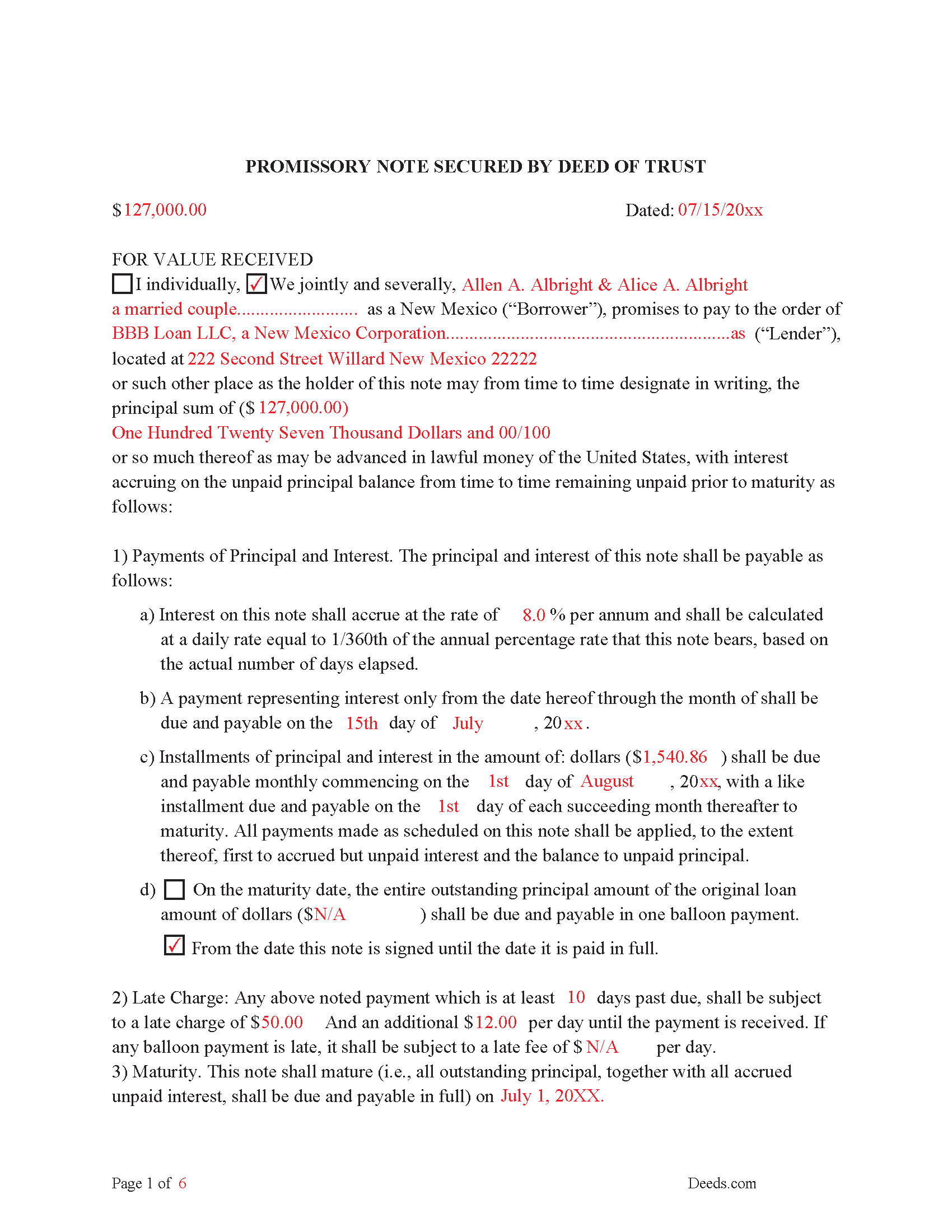

Harding County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

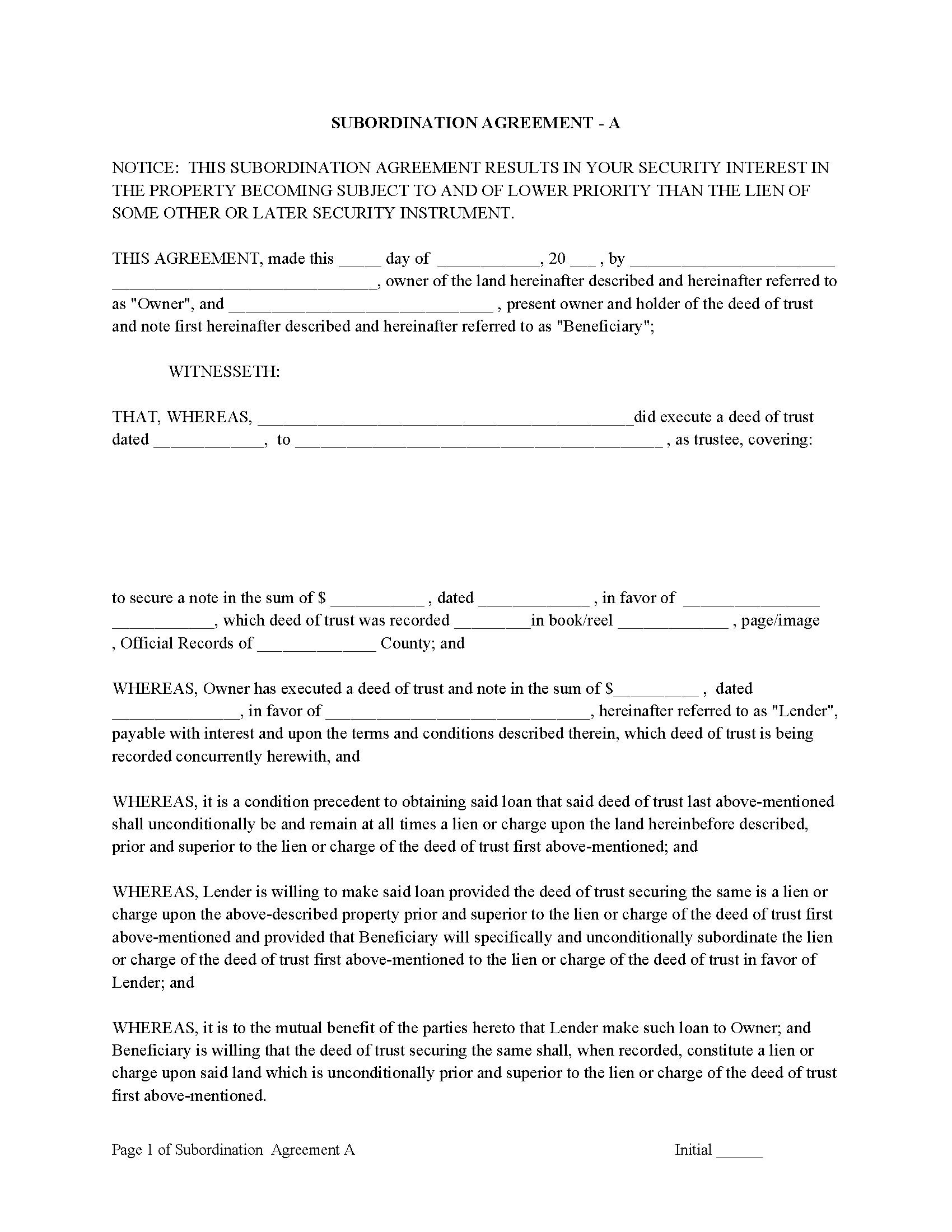

Harding County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

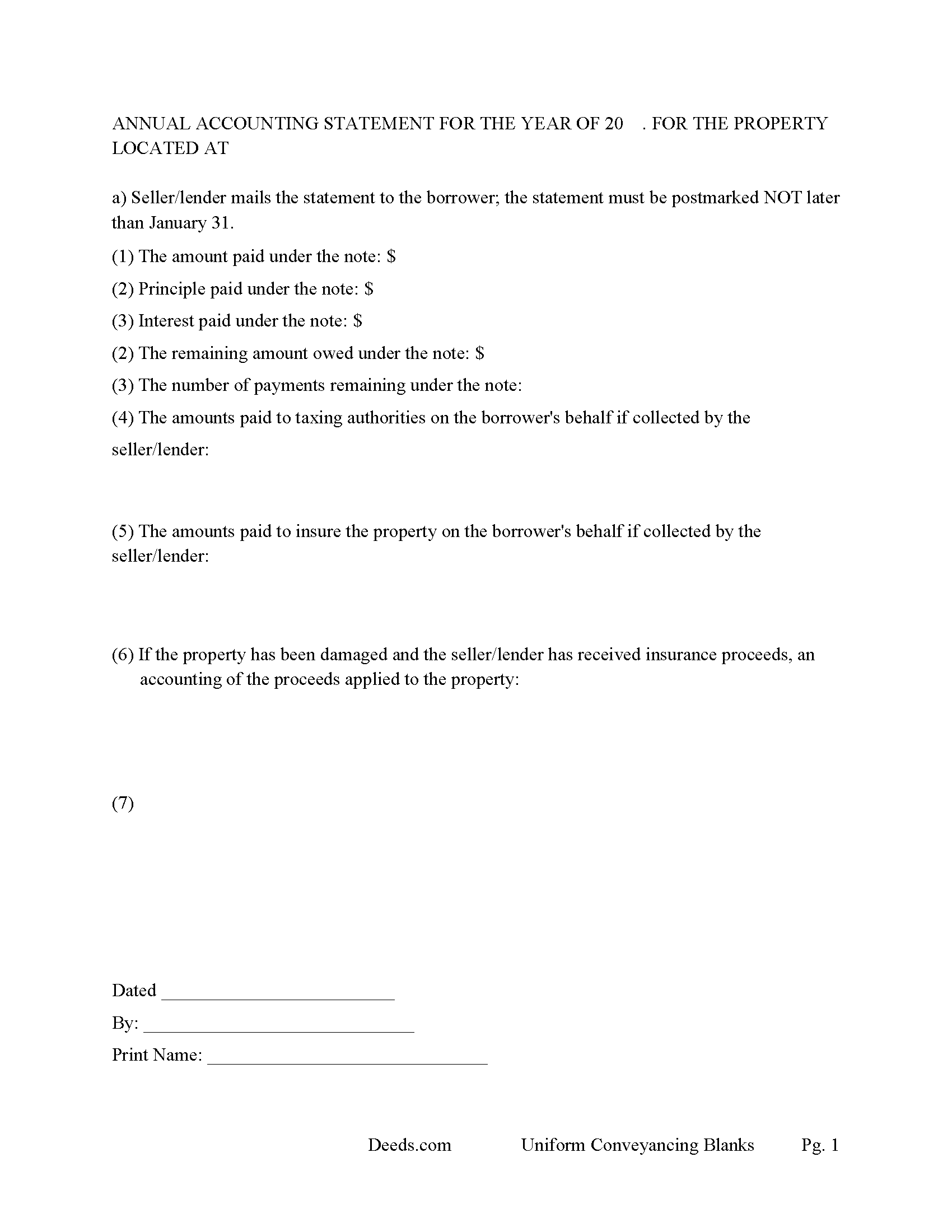

Harding County Annual Accounting Statement Form

Fill in the blank Deed of Trust and Promissory Note form formatted to comply with all New Mexico recording and content requirements.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Harding County documents included at no extra charge:

Where to Record Your Documents

Harding County Clerk

Mosquero, New Mexico 87733

Hours: 8:00 to 4:00 M-F

Phone: (575) 673-2301

Recording Tips for Harding County:

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Harding County

Properties in any of these areas use Harding County forms:

- Mills

- Mosquero

- Roy

- Solano

Hours, fees, requirements, and more for Harding County

How do I get my forms?

Forms are available for immediate download after payment. The Harding County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Harding County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Harding County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Harding County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Harding County?

Recording fees in Harding County vary. Contact the recorder's office at (575) 673-2301 for current fees.

Questions answered? Let's get started!

New Mexico has the Deed of Trust Act.

Foreclosure can be done non-judicially, saving time and expense. This process is called a Trustee Sale. After the Trustee sale the borrower has a right to redeem the property. This form allows one-month vs nine-months.

NM Statute 48-10-16(A)

Except as otherwise provided in Subsection E of this section, the redemption period after a trustee's sale shall be nine months, or the period provided in the deed of trust, whichever is the lesser period, and shall begin to run from the date of the trustee's sale. In the deed of trust, the parties may shorten the redemption period to not less than one month.

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Grantor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary can take an action against any person for damages.

Use this form for financing residential property, small commercial, rental property (up to 4 units), condominiums and planned unit developments. A Deed of Trust and Promissory Note with stringent default terms/conditions can be beneficial to the lender, mostly used by investors or parties selling and/or financing a real property.

(New Mexico DOT Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Harding County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Harding County.

Our Promise

The documents you receive here will meet, or exceed, the Harding County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Harding County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

John S.

May 20th, 2023

Easy to use website and reasonably priced forms. I recommend it.

Thank you for the kind words John.

Albert j.

June 3rd, 2020

Very easy site to use for a simple minded happy howmowner. Very reasonable fee Quick turn around Good communication

Thank you!

Ruth L.

June 4th, 2020

Extremely convenient for a moderate fee. Will definitely use Deeds.com for my recording needs going forward. Will also share with my team on their projects. Thanks a bunch!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Marcus F.

April 15th, 2025

Great resource! I was in a bind being out of state and deeds.com came through in a pinch for a very good price! If I need esigning again this is where I'll be coming.

Your words of encouragement and feedback are greatly appreciated. They motivate us to maintain high standards in our service.

Andrea R.

July 10th, 2020

Easy and fast. Thank you so much!!

Thank you!

Larry B.

May 18th, 2021

Poor quality document. Deed did not contain space for mandatory rax info required.

Thank you for your feedback Larry. We do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Jessica H.

March 3rd, 2021

As a first time user I was a little skeptical of the service. But Deeds.com put all my worries aside. Their service is quick and easy. I will definitely be using it again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Wilburn R.

July 23rd, 2023

absolutely great

Thank you!

BAHMAN B.

April 20th, 2020

Very good experience.

Thank you!

Alana G.

March 26th, 2021

I was very pleased. It was the form I needed. I was getting discouraged by companies that wanted me to sign up for monthly payments just to get the one form I needed. I prefer your system of paying for what I get. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Rob F.

April 16th, 2025

They are fantastic. I am a little technically challenged, but very helpful and respectful. Highly recommended. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert R.

August 26th, 2025

Big savings and easy to use. Thanks so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janice H.

June 21st, 2023

Thank you, easy to fill out forms. Now I can relax, knowing that this is done.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John H.

August 1st, 2019

Great service

Thank you!