Eddy County Transfer on Death Revocation Form

Last validated December 26, 2025 by our Forms Development Team

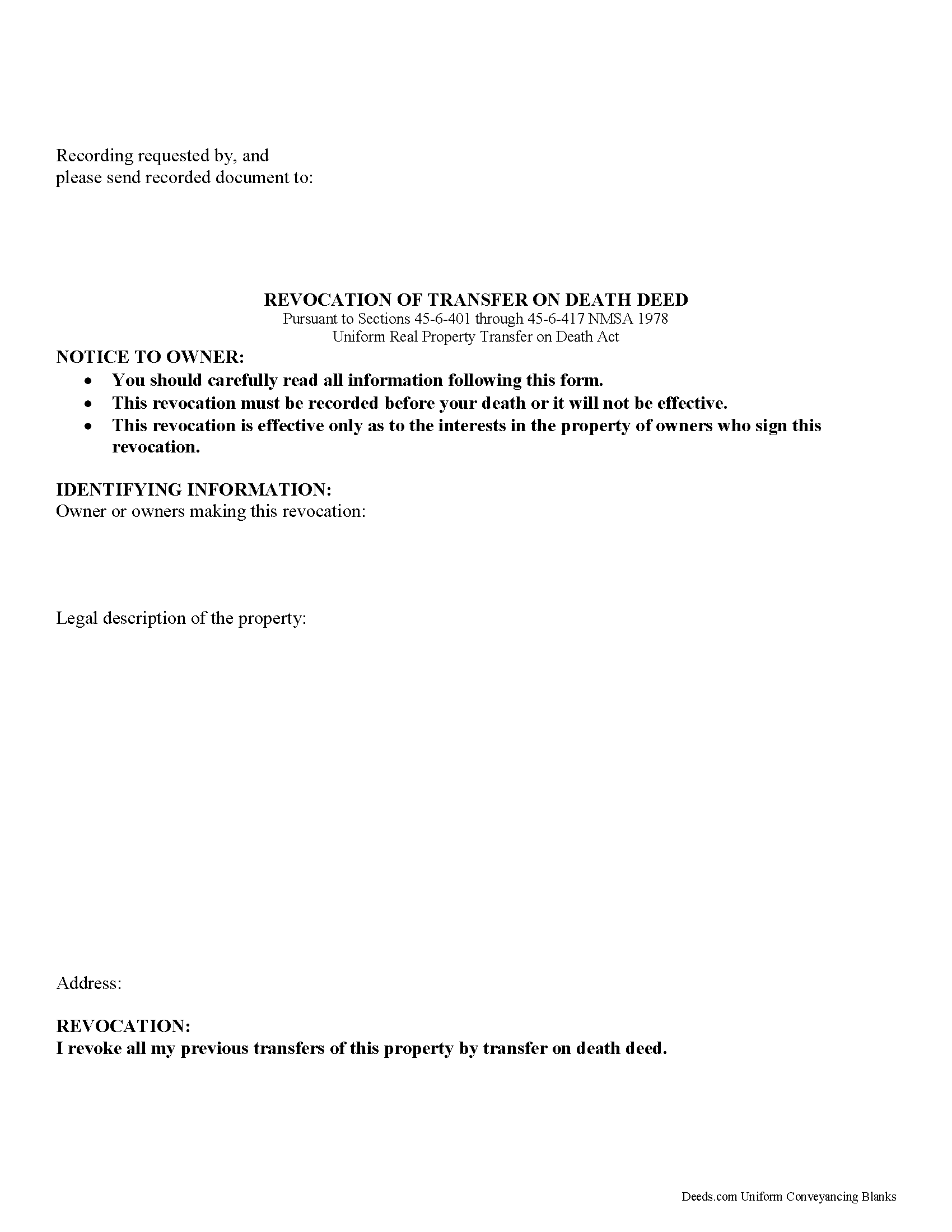

Eddy County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

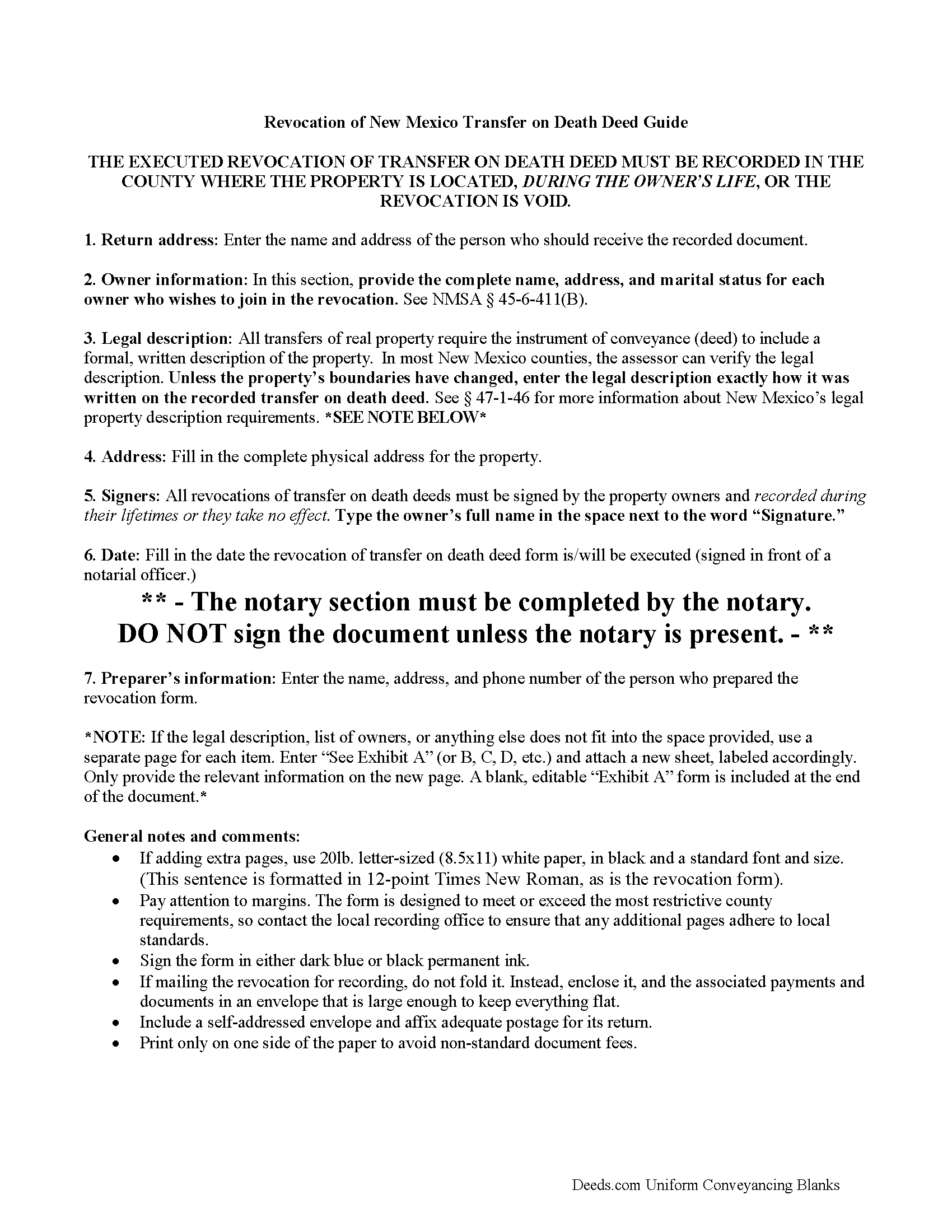

Eddy County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

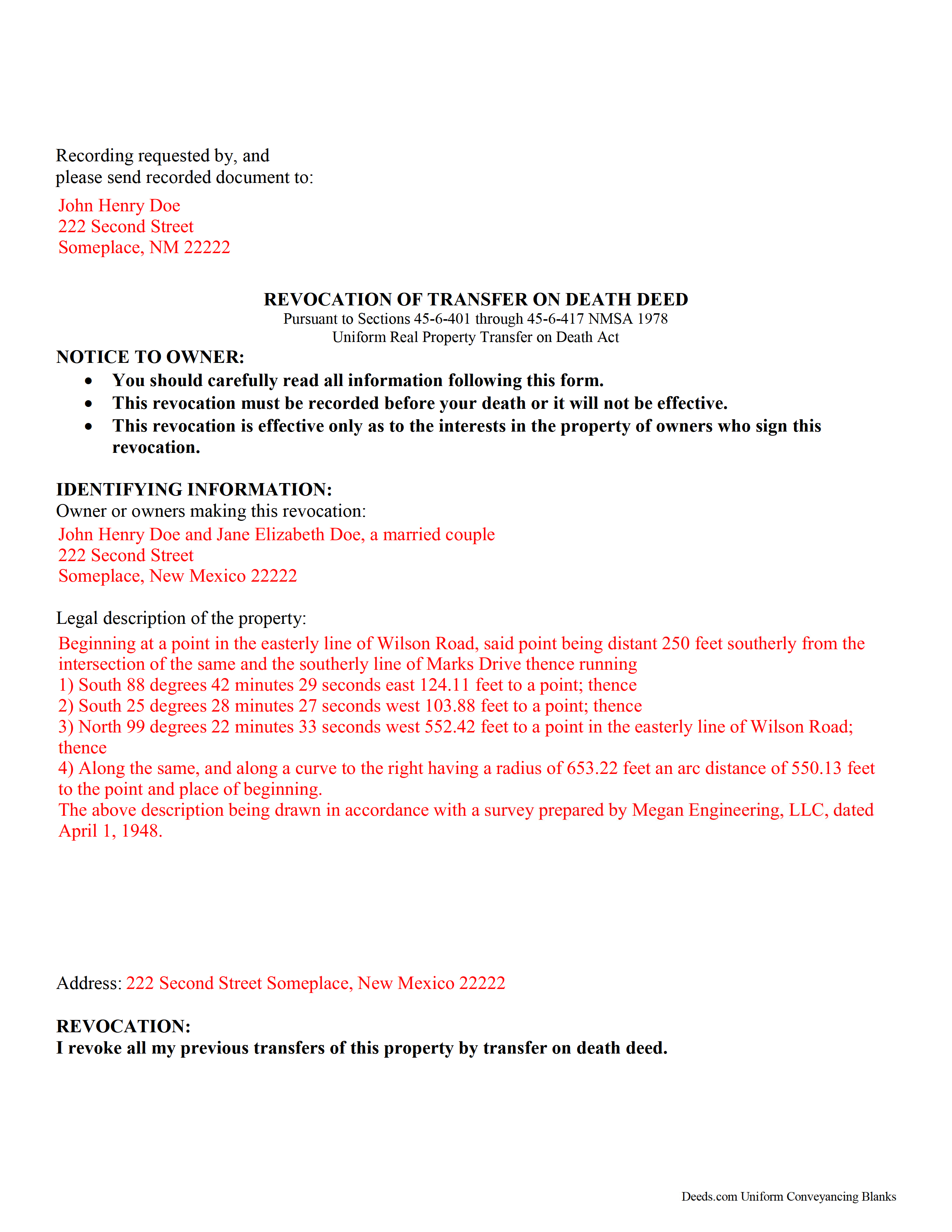

Eddy County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Eddy County documents included at no extra charge:

Where to Record Your Documents

Eddy County Clerk

Carlsbad, New Mexico 88220

Hours: 8:00 to 5:00 Mon-Fri

Phone: 575-885-3383

Artesia Sub Office

Artesia, New Mexico 88210

Hours: Mon, Tue, Thu, Fri 8:00 to 12:00; Wed 1:00 to 5:00

Phone: 575-746-2541

Recording Tips for Eddy County:

- Double-check legal descriptions match your existing deed

- Recording fees may differ from what's posted online - verify current rates

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Eddy County

Properties in any of these areas use Eddy County forms:

- Artesia

- Carlsbad

- Hope

- Lakewood

- Loco Hills

- Loving

- Malaga

- Whites City

Hours, fees, requirements, and more for Eddy County

How do I get my forms?

Forms are available for immediate download after payment. The Eddy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Eddy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Eddy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Eddy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Eddy County?

Recording fees in Eddy County vary. Contact the recorder's office at 575-885-3383 for current fees.

Questions answered? Let's get started!

On January 1, 2014, New Mexico joined with eleven other states to enact the Uniform Real Property Transfer on Death Act (URPTODA), found at Sections 45-6-401 through 45-6-417 NMSA 1978 (2014). This updated law enhances and adds clarity to the previous transfer on death statute already in force in the state.

Real estate owners who record a transfer on death deed (TODD) under the URPTODA retain the ability to revoke the recorded conveyance. These deeds offer a potential future interest but no guarantee of anything; the beneficiary only gains title to the property rights present when the owner dies.

Why does revocability matter? Life is unpredictable. For example, the original beneficiary may become unable or unwilling to accept the property. Marriage or divorce could alter the nature of the relationship between the owner and the intended recipient. The owner/transferor might decide to use the land another way. Regardless of the reason, the ability to cancel or modify a recorded TODD without involving the courts or restructuring their entire estate plan lets owners resolve unexpected issues in a relatively simple way.

There are three primary methods for revoking a transfer on death deed, as defined in the New Mexico Statutes at 45-6-411.

The named transferor may execute and record:

1. a statutory revocation form;

2. a new transfer on death deed that revokes all or part of a previously recorded TODD; or

3. an inter vivos deed (such as a warranty or quitclaim deed) that expressly revokes all or part of a previously recorded TODD.

Timely recording is essential for all documents dealing with ownership of real property, but it is even more important for documents associated with transfers at death. Just as with a TODD, the revocation must be recorded during the owner's life in the office of the clerk for the county in which the deed is recorded or it has no effect.

In addition to the reasons discussed above, consider filing a revocation form prior to selling real estate previously identified in a recorded transfer on death deed. Documenting the change helps to maintain a clear chain of title (ownership history) by closing out what might otherwise look like a potential claim against the property. A clear chain of title makes future transactions involving the property less complicated.

The right to revoke or modify a recorded transfer on death deed adds flexibility to a comprehensive estate plan. Executing and recording a statutory revocation form allows owners of New Mexico real estate to control the distribution of their property at death without the need for a will or probate. Each circumstance is unique, so contact an attorney with specific questions or for complex situations.

(New Mexico Revocation of TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Eddy County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Eddy County.

Our Promise

The documents you receive here will meet, or exceed, the Eddy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Eddy County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4622 Reviews )

Stacey S.

January 27th, 2022

The system was easy to use and download my documents but the way the packages are set up it was confusing and I wish there was a way to delete an item from a package if you make a mistake.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan P.

June 25th, 2020

Great service and well done forms thank you

Thank you!

David R A.

April 18th, 2023

Way overpriced But serves the Purpose.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald S.

July 7th, 2020

Good

Thank you!

Jan David F.

January 5th, 2019

Your data doesn't go deep enough in time to be useful to me. I needed deeds from 1911 to 1966.

Thank you for your feedback Jan. It does look like staff canceled your order after discussing your needs with you.

Jena S.

April 7th, 2020

I love how quick the turnaround is, my only request would be for an email notification be sent once an invoice is ready and then once a document is recorded and ready to download (only because I have a large caseload and it's very easy to forget things sometimes).

Thank you!

SUZANNE W.

December 29th, 2020

Very quick and efficient. Received recorded document within hours after beginning the process. Very reasonable fees. Highly recommended!

Thank you!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Jana C H.

July 29th, 2019

Form was the one I needed and the instructions along with a sample form was all I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rip V.

October 5th, 2022

Found the forms I needed but had to type these out my self in Word since these forms do not allow any information to be saved. I understand you want this to be proprietary information but you failed to deliver a usable product. I printed this template and built my own in microsoft word. Good examples and instructions with poor execution. I lost hours of typing and nearly lost real estate deals due to these documents not being in a format ready to use. Will be using another service next time or buying these as guides alone.

Thank you for taking the time to leave your feedback. Sorry to hear of the struggle you had using our forms. We will look into the issues you reported to see what we can do to provide a better product. For your trouble we have provided a full refund of your order.

Gerald S.

November 7th, 2020

Very pleased with the services provided by deeds.com. Quick response time after information was provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lawrence C.

October 18th, 2024

Excellent and expeditious service. Will definitely use in the future when the need arises.

Thank you for your positive words! We’re thrilled to hear about your experience.

Gary R.

December 17th, 2022

Very prompt response to my questions.

Thank you!

MIMI T.

October 7th, 2020

Awesome great service!

Fantastic! Thanks for the feedback Mimi.

Angela W.

March 12th, 2022

Very helpful and very quick to respond. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!