Lincoln County Transfer on Death Revocation Form

Lincoln County Transfer on Death Revocation Form

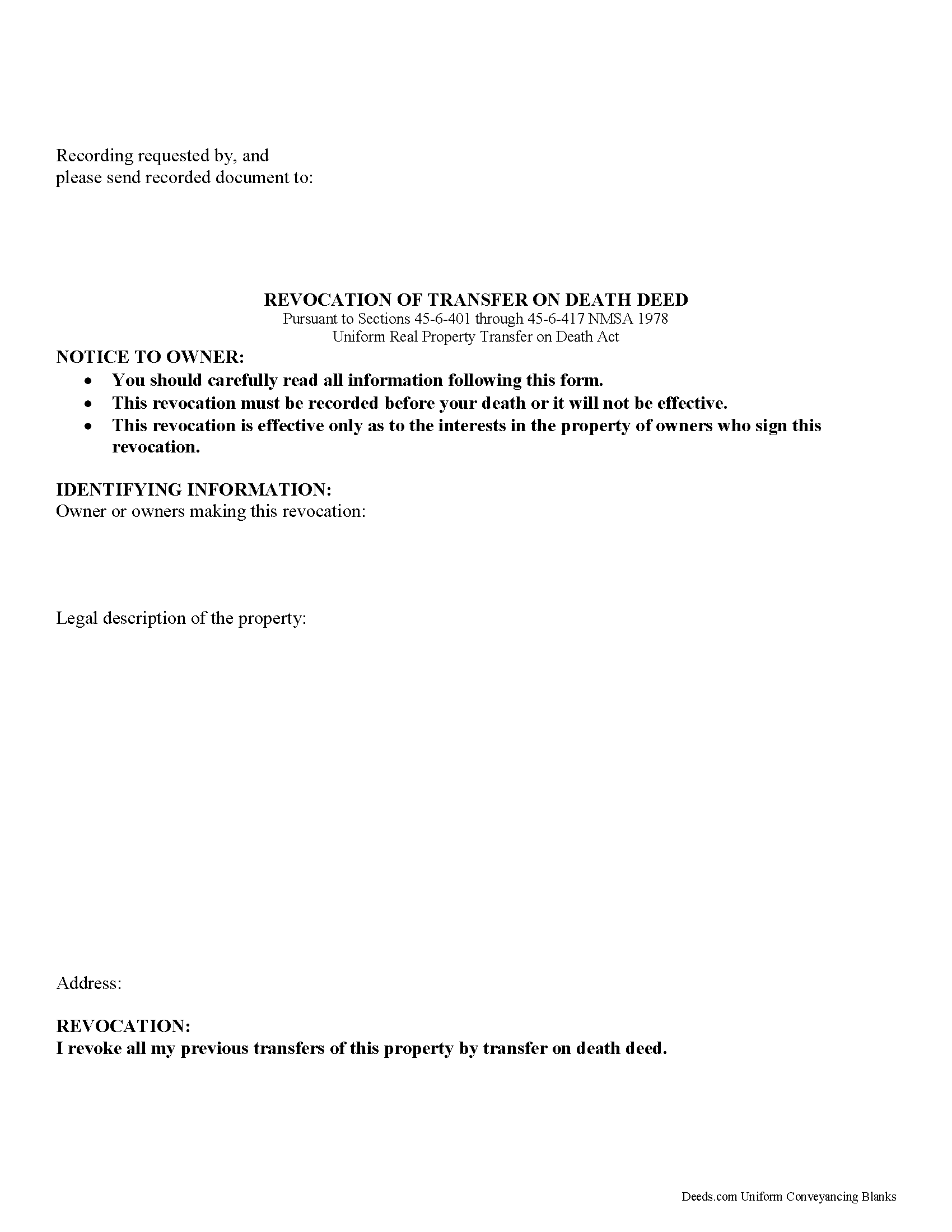

Fill in the blank form formatted to comply with all recording and content requirements.

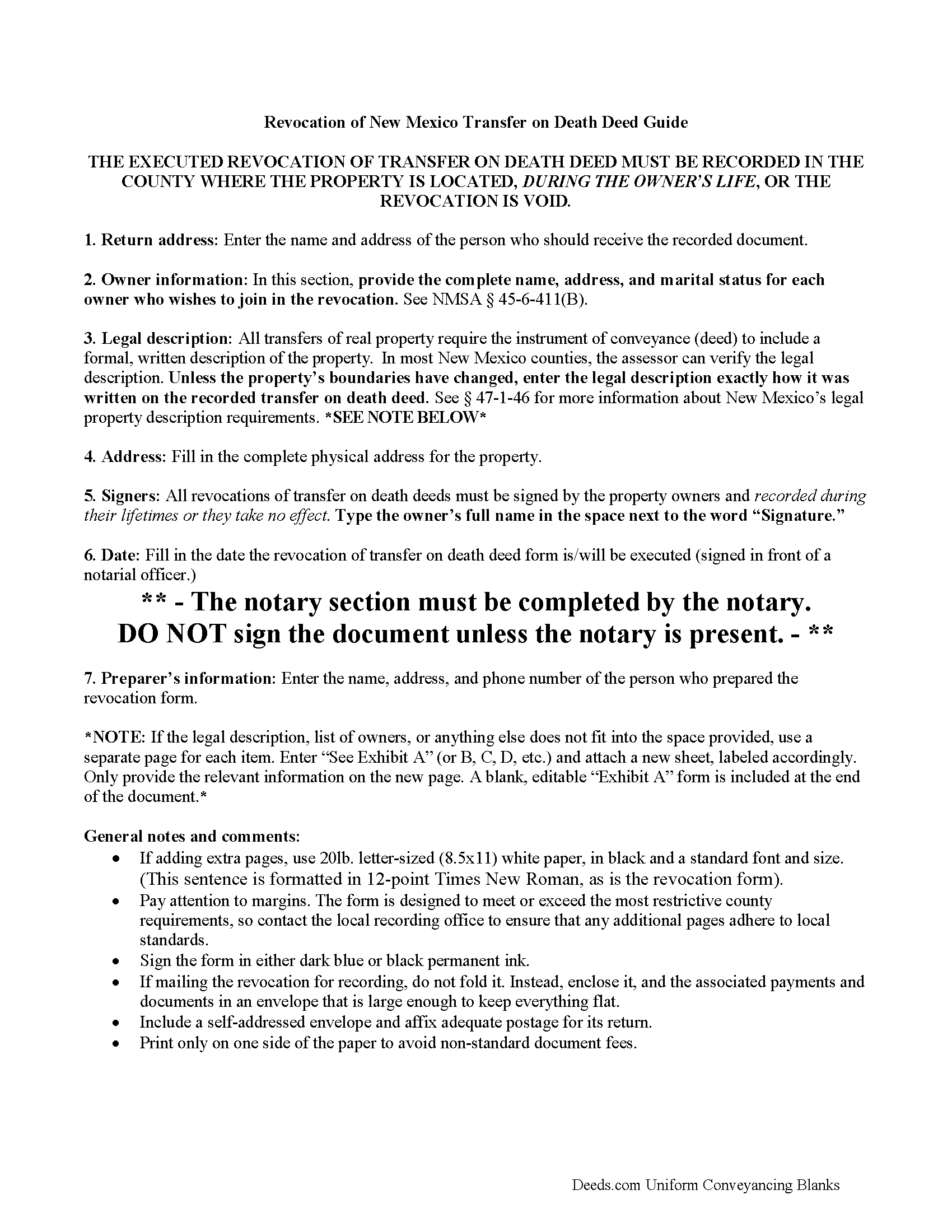

Lincoln County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

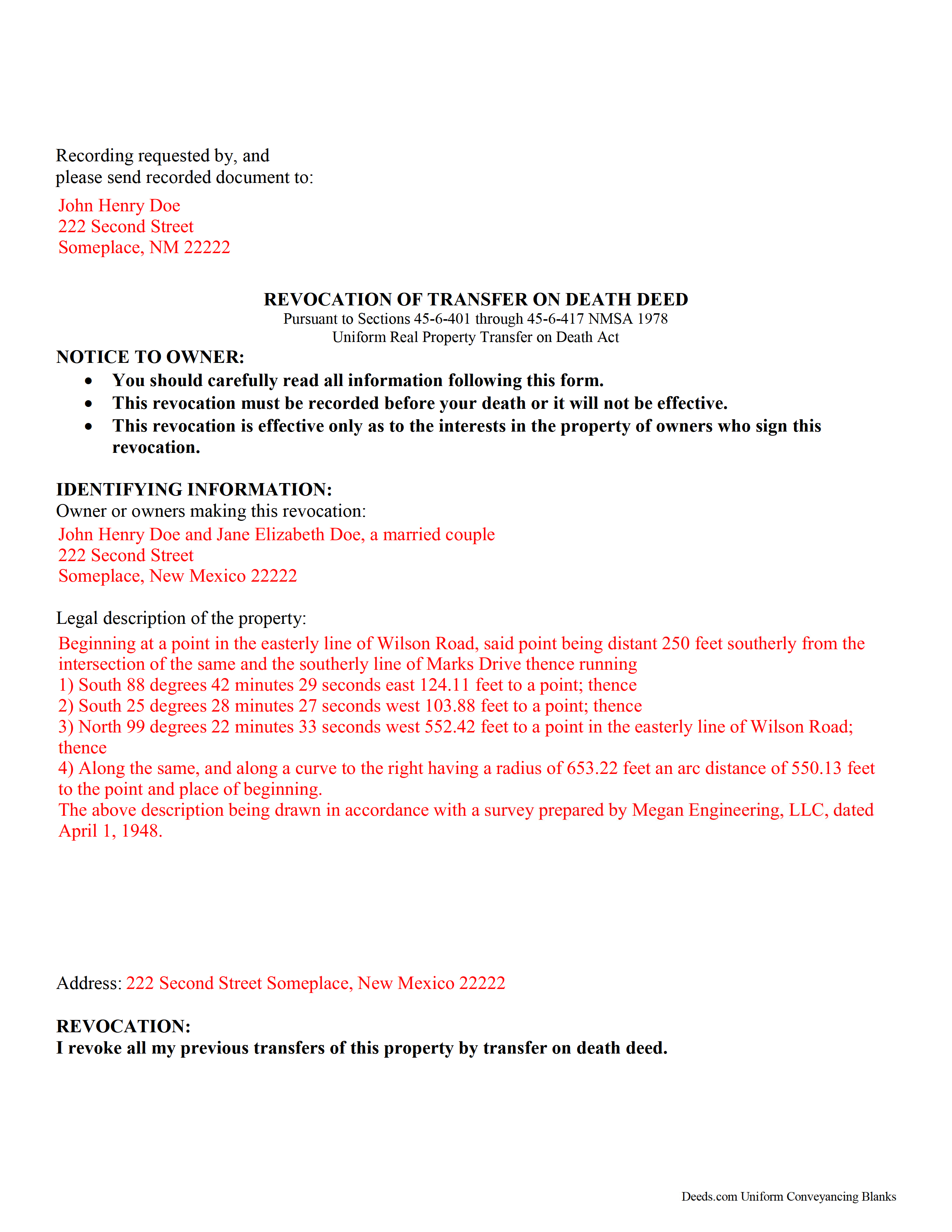

Lincoln County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Lincoln County documents included at no extra charge:

Where to Record Your Documents

Lincoln County Clerk / Recorder

Carrizozo, New Mexico 88301

Hours: 8:00am - 5:00pm M-F

Phone: (575) 648-2394 Ext. 6

Recording Tips for Lincoln County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Lincoln County

Properties in any of these areas use Lincoln County forms:

- Alto

- Capitan

- Carrizozo

- Corona

- Fort Stanton

- Glencoe

- Hondo

- Lincoln

- Nogal

- Picacho

- Ruidoso

- Ruidoso Downs

- San Patricio

- Tinnie

Hours, fees, requirements, and more for Lincoln County

How do I get my forms?

Forms are available for immediate download after payment. The Lincoln County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lincoln County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lincoln County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lincoln County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lincoln County?

Recording fees in Lincoln County vary. Contact the recorder's office at (575) 648-2394 Ext. 6 for current fees.

Questions answered? Let's get started!

On January 1, 2014, New Mexico joined with eleven other states to enact the Uniform Real Property Transfer on Death Act (URPTODA), found at Sections 45-6-401 through 45-6-417 NMSA 1978 (2014). This updated law enhances and adds clarity to the previous transfer on death statute already in force in the state.

Real estate owners who record a transfer on death deed (TODD) under the URPTODA retain the ability to revoke the recorded conveyance. These deeds offer a potential future interest but no guarantee of anything; the beneficiary only gains title to the property rights present when the owner dies.

Why does revocability matter? Life is unpredictable. For example, the original beneficiary may become unable or unwilling to accept the property. Marriage or divorce could alter the nature of the relationship between the owner and the intended recipient. The owner/transferor might decide to use the land another way. Regardless of the reason, the ability to cancel or modify a recorded TODD without involving the courts or restructuring their entire estate plan lets owners resolve unexpected issues in a relatively simple way.

There are three primary methods for revoking a transfer on death deed, as defined in the New Mexico Statutes at 45-6-411.

The named transferor may execute and record:

1. a statutory revocation form;

2. a new transfer on death deed that revokes all or part of a previously recorded TODD; or

3. an inter vivos deed (such as a warranty or quitclaim deed) that expressly revokes all or part of a previously recorded TODD.

Timely recording is essential for all documents dealing with ownership of real property, but it is even more important for documents associated with transfers at death. Just as with a TODD, the revocation must be recorded during the owner's life in the office of the clerk for the county in which the deed is recorded or it has no effect.

In addition to the reasons discussed above, consider filing a revocation form prior to selling real estate previously identified in a recorded transfer on death deed. Documenting the change helps to maintain a clear chain of title (ownership history) by closing out what might otherwise look like a potential claim against the property. A clear chain of title makes future transactions involving the property less complicated.

The right to revoke or modify a recorded transfer on death deed adds flexibility to a comprehensive estate plan. Executing and recording a statutory revocation form allows owners of New Mexico real estate to control the distribution of their property at death without the need for a will or probate. Each circumstance is unique, so contact an attorney with specific questions or for complex situations.

(New Mexico Revocation of TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Lincoln County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Lincoln County.

Our Promise

The documents you receive here will meet, or exceed, the Lincoln County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lincoln County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Donna O.

March 6th, 2020

Quick and easy to use. I was able to download the Transfer on Death Deed form to my computer so that I can read through and fill them out at a later time. That made it convenient and "no pressure". The complimentary guide and completed example that came with the form was also very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alan G.

October 28th, 2021

Using www.deeds.com was super ez even for a non-technical person like me, it saved me lots of time and the instructions and communications were great,I was able to file my deed online in half a day with most of that time taken up by the jurisdiction I filed with processing my submittal. I will use it again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edward B.

September 22nd, 2023

I was looking for a certain form I needed. Deeds.com had the necessary form and I was able to purchase it with little effort on my part. This was a good customer experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jared D.

April 29th, 2020

Yes it was awsome experience,thank you

Thank you!

Robin B.

November 6th, 2020

Nice and easy

Thank you!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property. My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

Colleen N.

March 30th, 2021

The instruction were very clear and the sample was also very helpful.

Thank you!

Renu A.

September 30th, 2020

The service was very reliable and they even helped with filling out the paperwork properly. Very quick turn around and efficient!

Thank you!

Qingqiu H.

May 14th, 2022

I ordered the wrong forms at first because I'm an idiot and didn't do my research. When I told the customer service about my error they were understanding.

Thank you for your feedback. We really appreciate it. Have a great day!

Traci R.

November 21st, 2019

I was disappointed in the form received. The language was not clear and for the price, one would think we would receive a Word version rather than a PDF.

Sorry to hear of your struggle Traci. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Susan J.

June 29th, 2020

very fast service. immediate response and kept me informed along the way. the county was not cooperating and this was communicated to me and my fee was refunded, just like that. will definitely use this company again

Thank you!

Karen L.

October 3rd, 2022

Good service could give a little more detail on where to location some of the information needed. Overall fairly simply to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria H.

December 17th, 2020

Very content with the service received. The document was recorded in the city in no time. Will definitely use Deeds.com again in the near future.

Thank you!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Harley N.

August 25th, 2022

Well thought out and user friendly website. The forms were easily fillable as well.

Thank you for your feedback. We really appreciate it. Have a great day!