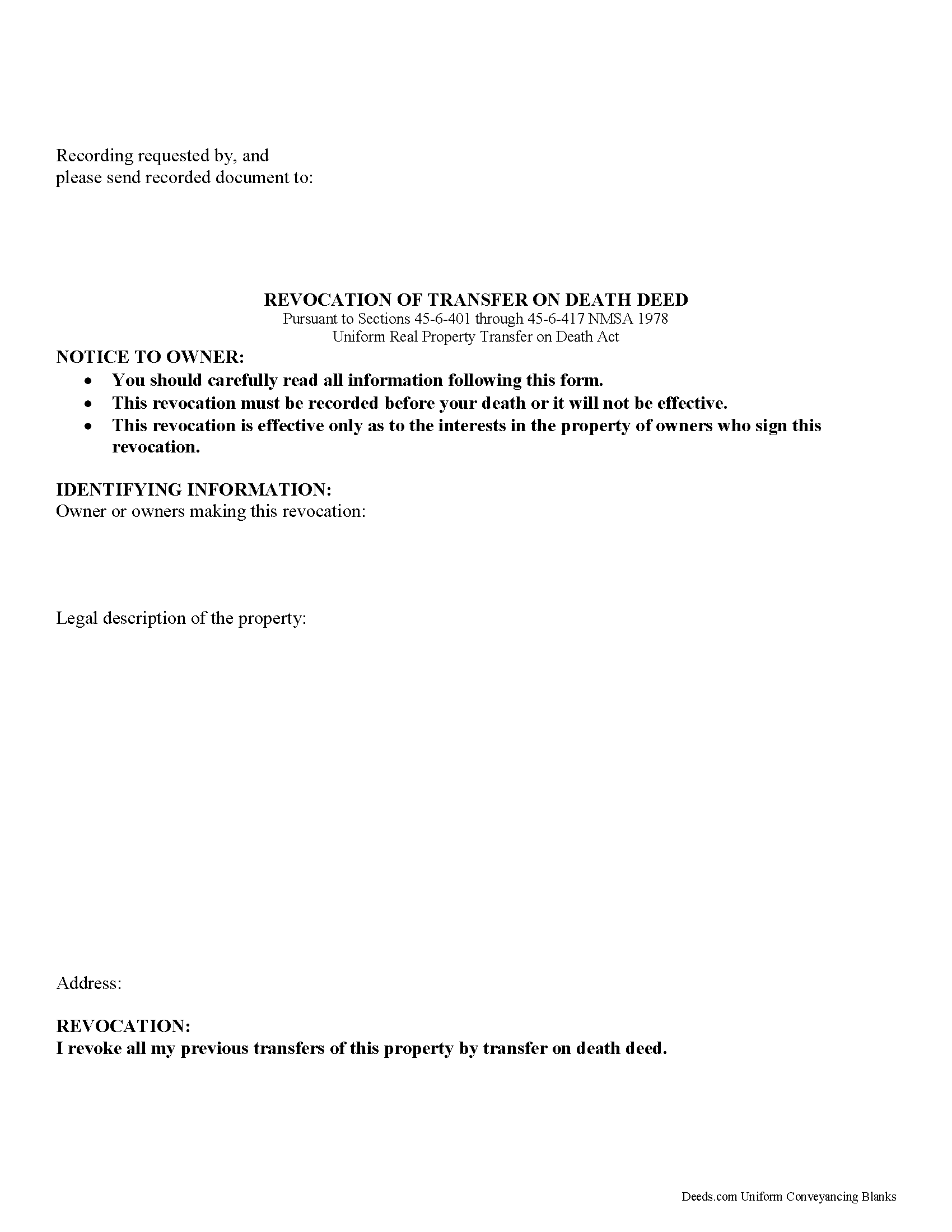

Santa Fe County Transfer on Death Revocation Form

Santa Fe County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

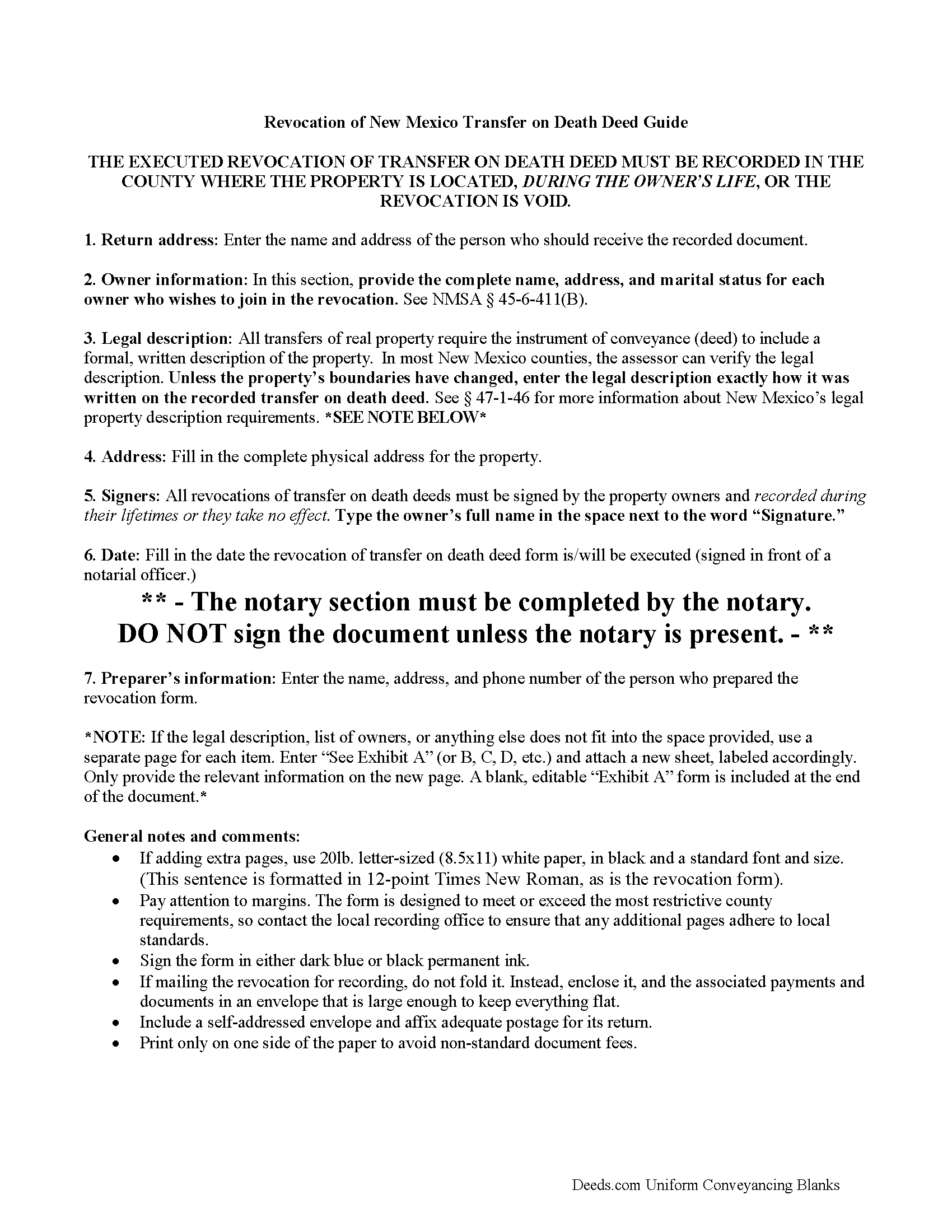

Santa Fe County Transfer on Death Revocation Guide

Line by line guide explaining every blank on the form.

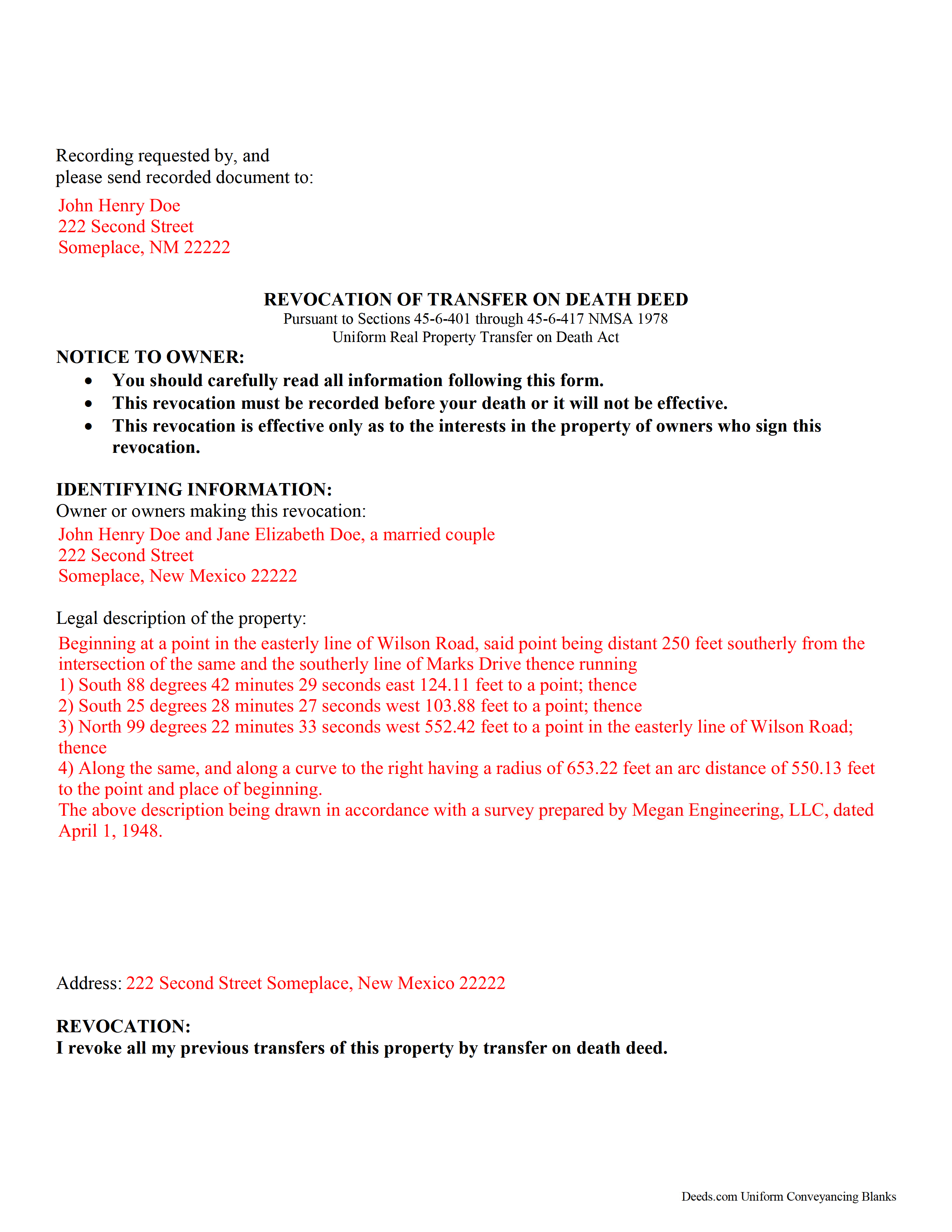

Santa Fe County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New Mexico and Santa Fe County documents included at no extra charge:

Where to Record Your Documents

Santa Fe County Clerk

Santa Fe, New Mexico 87504

Hours: 8:30 to 4:30 M-F

Phone: (505) 986-6280 & 6289

Recording Tips for Santa Fe County:

- Verify all names are spelled correctly before recording

- Ask if they accept credit cards - many offices are cash/check only

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Santa Fe County

Properties in any of these areas use Santa Fe County forms:

- Cerrillos

- Edgewood

- Glorieta

- Lamy

- Santa Cruz

- Santa Fe

- Stanley

- Tesuque

Hours, fees, requirements, and more for Santa Fe County

How do I get my forms?

Forms are available for immediate download after payment. The Santa Fe County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Santa Fe County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Santa Fe County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Santa Fe County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Santa Fe County?

Recording fees in Santa Fe County vary. Contact the recorder's office at (505) 986-6280 & 6289 for current fees.

Questions answered? Let's get started!

On January 1, 2014, New Mexico joined with eleven other states to enact the Uniform Real Property Transfer on Death Act (URPTODA), found at Sections 45-6-401 through 45-6-417 NMSA 1978 (2014). This updated law enhances and adds clarity to the previous transfer on death statute already in force in the state.

Real estate owners who record a transfer on death deed (TODD) under the URPTODA retain the ability to revoke the recorded conveyance. These deeds offer a potential future interest but no guarantee of anything; the beneficiary only gains title to the property rights present when the owner dies.

Why does revocability matter? Life is unpredictable. For example, the original beneficiary may become unable or unwilling to accept the property. Marriage or divorce could alter the nature of the relationship between the owner and the intended recipient. The owner/transferor might decide to use the land another way. Regardless of the reason, the ability to cancel or modify a recorded TODD without involving the courts or restructuring their entire estate plan lets owners resolve unexpected issues in a relatively simple way.

There are three primary methods for revoking a transfer on death deed, as defined in the New Mexico Statutes at 45-6-411.

The named transferor may execute and record:

1. a statutory revocation form;

2. a new transfer on death deed that revokes all or part of a previously recorded TODD; or

3. an inter vivos deed (such as a warranty or quitclaim deed) that expressly revokes all or part of a previously recorded TODD.

Timely recording is essential for all documents dealing with ownership of real property, but it is even more important for documents associated with transfers at death. Just as with a TODD, the revocation must be recorded during the owner's life in the office of the clerk for the county in which the deed is recorded or it has no effect.

In addition to the reasons discussed above, consider filing a revocation form prior to selling real estate previously identified in a recorded transfer on death deed. Documenting the change helps to maintain a clear chain of title (ownership history) by closing out what might otherwise look like a potential claim against the property. A clear chain of title makes future transactions involving the property less complicated.

The right to revoke or modify a recorded transfer on death deed adds flexibility to a comprehensive estate plan. Executing and recording a statutory revocation form allows owners of New Mexico real estate to control the distribution of their property at death without the need for a will or probate. Each circumstance is unique, so contact an attorney with specific questions or for complex situations.

(New Mexico Revocation of TOD Package includes form, guidelines, and completed example)

Important: Your property must be located in Santa Fe County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Santa Fe County.

Our Promise

The documents you receive here will meet, or exceed, the Santa Fe County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Santa Fe County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Scott P.

October 24th, 2020

So far so good

Thank you!

Mark W.

May 9th, 2019

Easy, simple and fast. I am familiar with deeds in my state and these looked correct. The common missed document of TRANSFER OF REAL ESTATE VALUE document was also included. Kudos on being complete.

Thanks Mark, we really appreciate your feedback.

Dale A C.

January 31st, 2019

Deeds.com was a very efficient and simple website to use in preparing my documents needed to complete a real estate closing. I highly recommend this website, as it is easy to use, inexpensive, and effective.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

candy h.

June 18th, 2020

service was great!

Thank you!

Brian T.

June 16th, 2022

Great to find this makes for easy work when you need to secure your ownership of a property!!Thanks guys Brian the Mann

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kyle K.

May 3rd, 2022

Deeds is extremely helpful and cost effective for small and large businesses. Saves me time to do more valuable tasks.

Thank you for your feedback. We really appreciate it. Have a great day!

Martha R.

March 16th, 2023

Provided all the info that I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RAMONA F.

July 29th, 2020

Good communication but they were unable to help me

Thank you for your feedback. We really appreciate it. Have a great day!

Evelynne H.

December 3rd, 2020

The service was quick and easy to use. Which is something I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Pat A.

July 18th, 2019

I was impressed that the forms were easy to read and the directions were helpful. Thank you for providing this.

Thank you!

Kendall B.

September 24th, 2019

Good

Thank you!

Terrill B.

May 10th, 2019

I found it very difficult to find this website, had my accountant search for me. Instructions are invaluable through guide and example. Thank you for them.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas W.

September 15th, 2019

A great way to access form knowledge

Thank you!

Lisa G.

January 4th, 2019

Rec'd downloads for quitclaim deed process in Florida. Recorded with the clerk of courts today and the form was done perfectly--she had no changes to make. Well worth the money--thanks

Glad to hear Lisa, we appreciate you taking the time to leave your feedback.