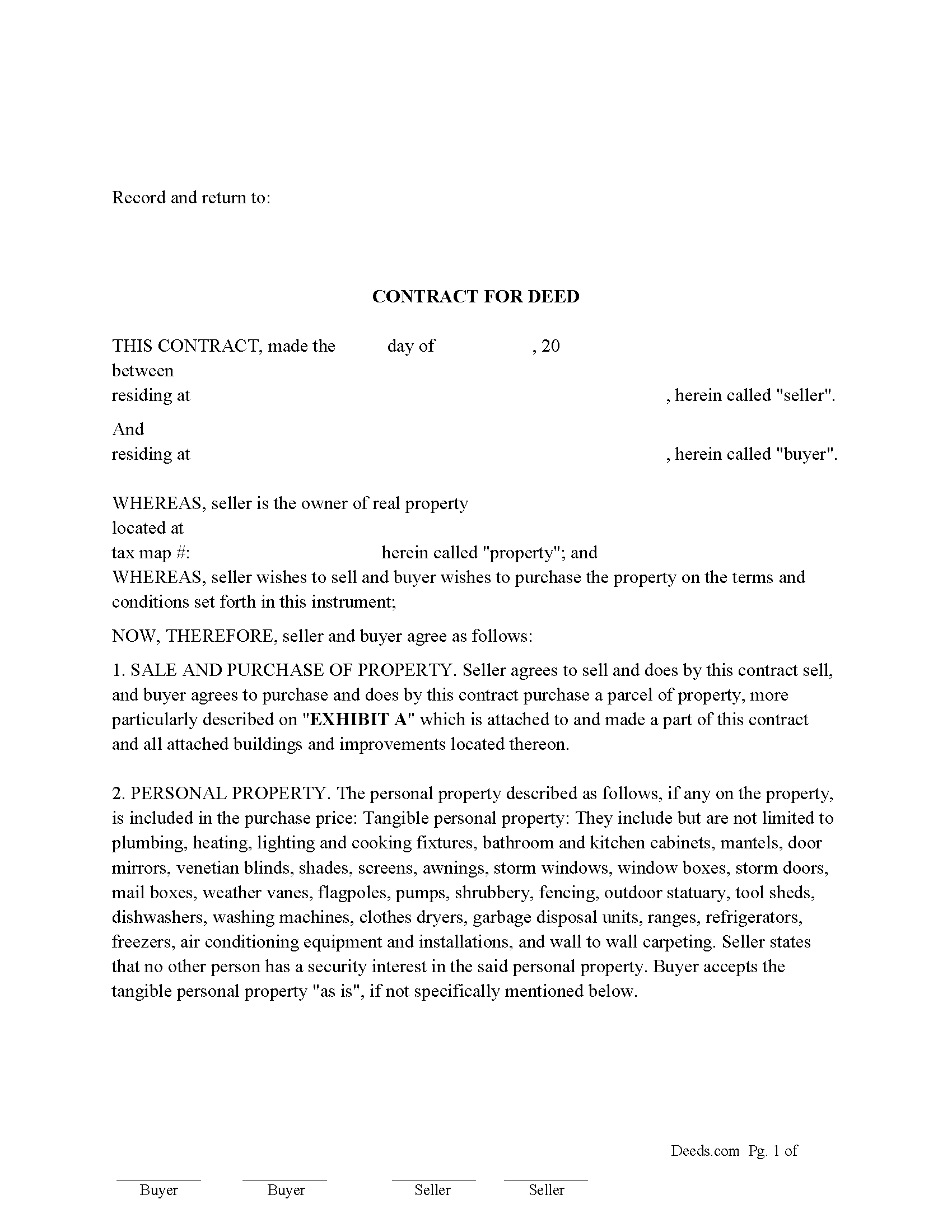

Delaware County Contract for Deed Form

Delaware County Contract for Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

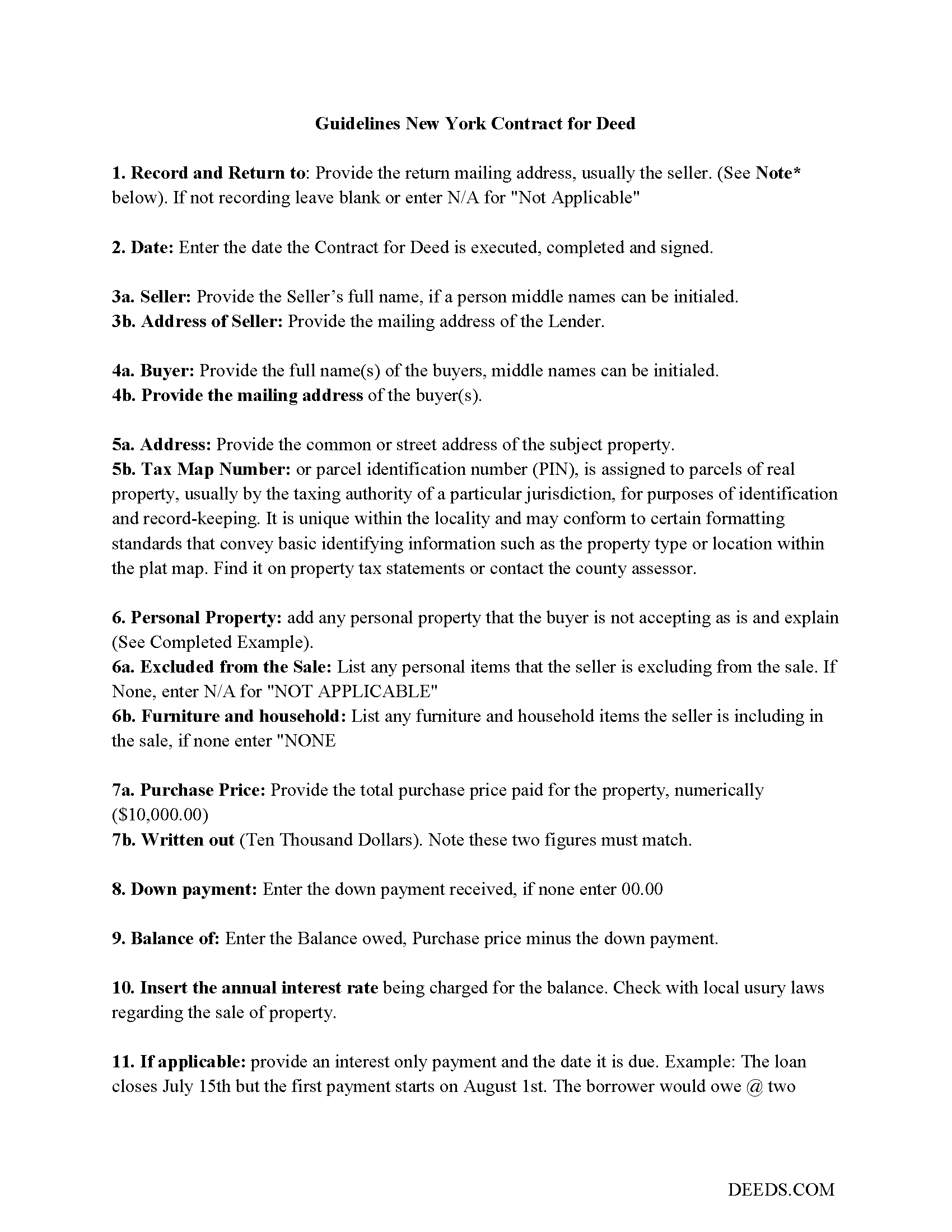

Delaware County Contract for Deed Guidelines

Line by line guide explaining every blank on the form.

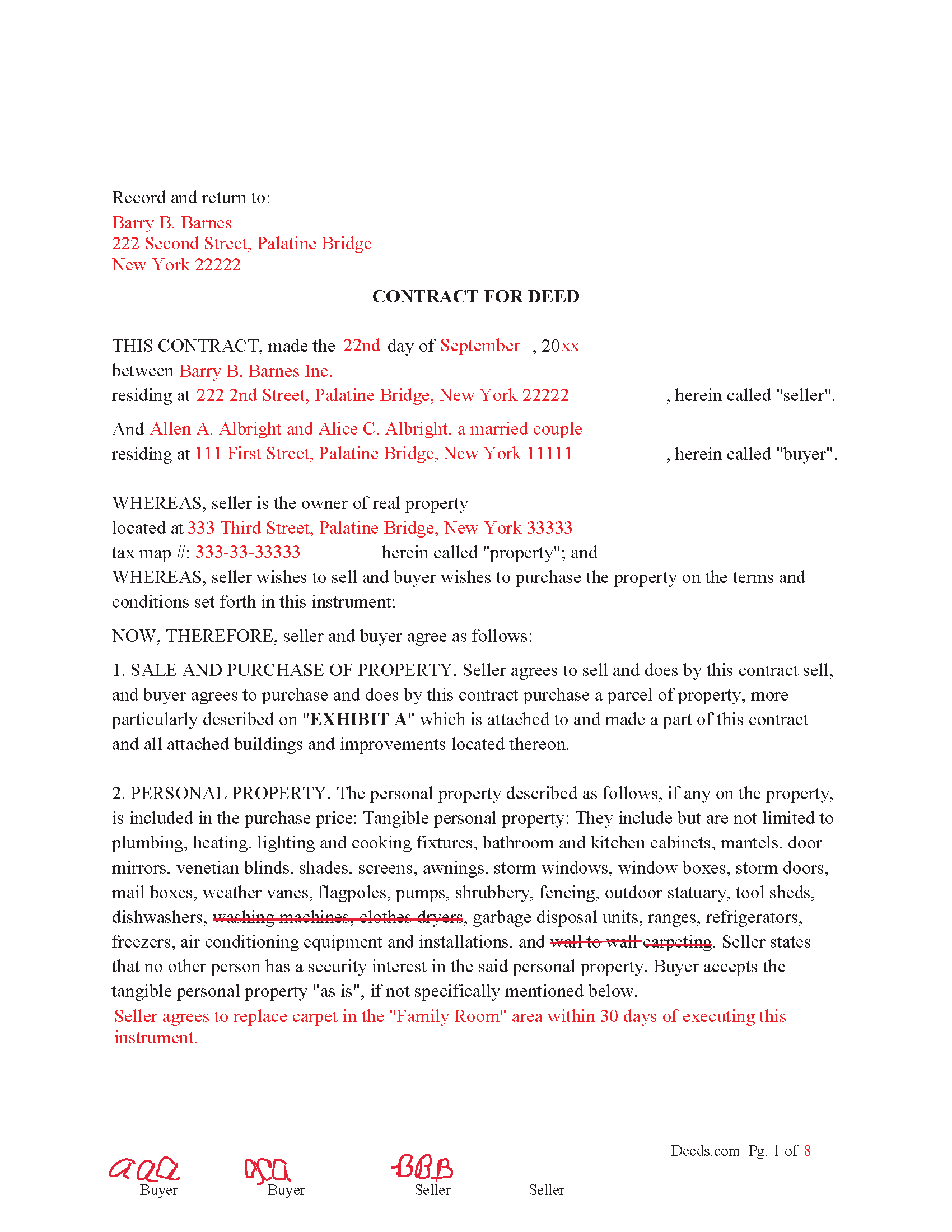

Delaware County Completed Example of the Contract for Deed

Example of a properly completed form for reference.

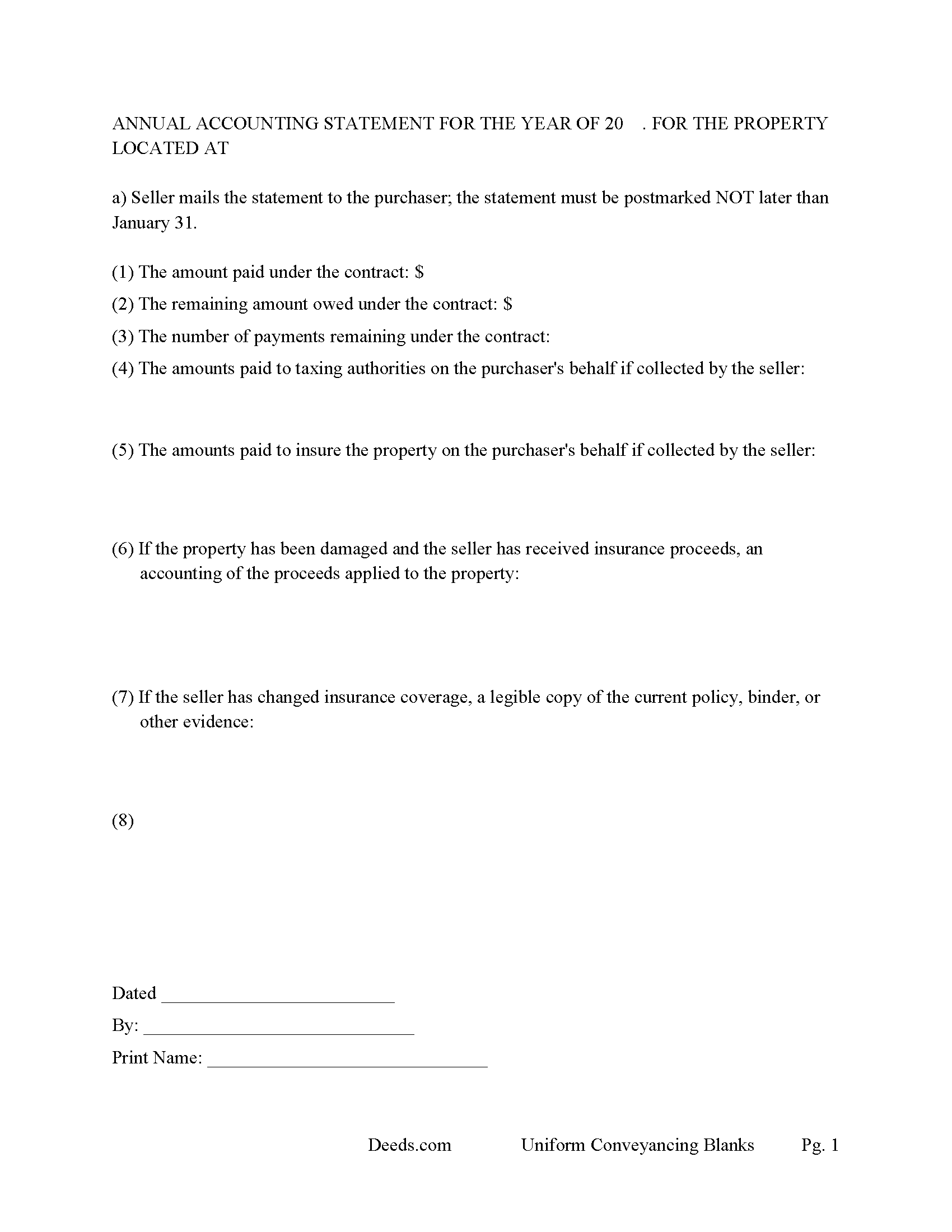

Delaware County Annual Accounting Statement Form

Required annually to notify buyer of remaining balances.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Delaware County documents included at no extra charge:

Where to Record Your Documents

Delaware County Clerk

Delhi, New York 13753

Hours: 9:00am to 5:00pm Monday through Friday

Phone: (607) 832-5700

Recording Tips for Delaware County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Delaware County

Properties in any of these areas use Delaware County forms:

- Andes

- Arkville

- Bloomville

- Bovina Center

- Davenport

- Davenport Center

- Delancey

- Delhi

- Denver

- Downsville

- East Branch

- East Meredith

- Fishs Eddy

- Fleischmanns

- Franklin

- Grand Gorge

- Halcottsville

- Hamden

- Hancock

- Harpersfield

- Hobart

- Margaretville

- Masonville

- Meridale

- New Kingston

- Roxbury

- Shinhopple

- Sidney

- Sidney Center

- South Kortright

- Stamford

- Treadwell

- Trout Creek

- Walton

- West Davenport

Hours, fees, requirements, and more for Delaware County

How do I get my forms?

Forms are available for immediate download after payment. The Delaware County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Delaware County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Delaware County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Delaware County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Delaware County?

Recording fees in Delaware County vary. Contact the recorder's office at (607) 832-5700 for current fees.

Questions answered? Let's get started!

Contract for Deed often referred to as a Land Contract

Use this form for an Owner Financed Sale. This is an 8-page form adaptable to a multitude of situations, a general synopsis; Seller(s) and buyer(s) set their terms and conditions and once the property is paid in full, seller will provide clean title to said property. Financing with Installment payments (Example: $$$$ a month for 10 years), or balloon payment. (Example: Three years of payments with a balance of $$$) owed on this maturity date. Late fees are set by so much owed after so many days with an additional amount owed each and every day thereafter. If this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, (a) one percent (1.0%) of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

BUYER DEFAULT. Buyer is in default upon the occurrence of any of the following:

a. The monthly payment, and any applicable late charge, is not made within thirty (30) days after the monthly due date; or

b. Insurance or taxes are not paid, repairs and maintenance is not performed, or the property is in violation of any applicable laws or government regulations and corrective action is not completed by buyer within thirty (30) days after notice to buyer to pay the insurance or taxes, repair the property, or correct any violation or non-compliance with any applicable laws or regulations. If buyer fails to pay any taxes, insurance, maintain the property in good repair, or correct any violations within the time specified above, seller may do so and any expense incurred by seller shall be paid by buyer to seller within thirty (30) days from receipt by buyer of a written bill therefor paid therefor by seller.

TRANSFER OF DEED. Upon payment in full of the purchase price, seller agrees to complete, sign and deliver the following to buyer: (a) a warranty deed conveying a good and marketable title to the premises described in this contract, except for encumbrances that may be caused by the acts or omissions of Buyer after the parties sign this contract; (b) Combined Real Estate Transfer Tax Return and Credit Line Mortgage (TP-584); (c) Real Property Transfer Report (RP-5217);

INTERPRETATION OF CONTRACT. New York Law.

Most "Contract for Deeds" are recorded, this is formatted for such use if needed.

(New York CFD Package includes form, guidelines, and completed example)

Important: Your property must be located in Delaware County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Delaware County.

Our Promise

The documents you receive here will meet, or exceed, the Delaware County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Delaware County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Glenn W.

May 5th, 2021

I love this tool and it is easy to work with. The interface is straight forward and notifications are consistently accurate.

Thank you for your feedback. We really appreciate it. Have a great day!

Audra M.

December 28th, 2020

It was easy to e-record and will/would recommend it to everyone.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Susan S.

February 9th, 2021

I just started using Deeds.com but so far it has been a very easy and pleasant experience. I work in the area of family law and I was thrilled to find a service that offers the recoding of deeds via e-recording.

Glad we could be of service Susan, thank you for your kind words. Have an amazing day!

Jo Carol K.

October 17th, 2020

The information/forms/and ease of filling in the blanks provided me with the confidence to "do it myself". Excellent customer service. Thank you for being there.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William P.

April 13th, 2021

Warranty Deed was just what I needed.Easy to complete and accepted by the county.

Thank you!

Maria C.

June 3rd, 2022

Amazing service truly great to work with your team on a difficult filing!

Thank you!

Kay C.

December 22nd, 2021

Thank you for your patience and help with filing the documents needed. You were helpful, prompt, courteous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tiffany J.

December 26th, 2020

Easy steps to create an account, will recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

John T.

May 5th, 2022

Great site, I was able to navigate with ease. We appreciate all those who contributed in making this possible

Thank you!

M. TIMOTHY P.

February 17th, 2021

EXCELLENT service! Deed came back within minutes!

Thank you for your feedback. We really appreciate it. Have a great day!

Rodrigo M.

September 10th, 2022

Excellent service

Thank you!

Margaret M.

August 9th, 2022

Quick and easy, but the 2MB file limit ended up causing some big headaches. Had I known the limit could be easily increased, it would have saved me a lot of time and trouble.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Valerie I.

November 19th, 2020

Quick and easy! Had my document submitted to the county and back in one day. Good rates as well!

Thank you!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!