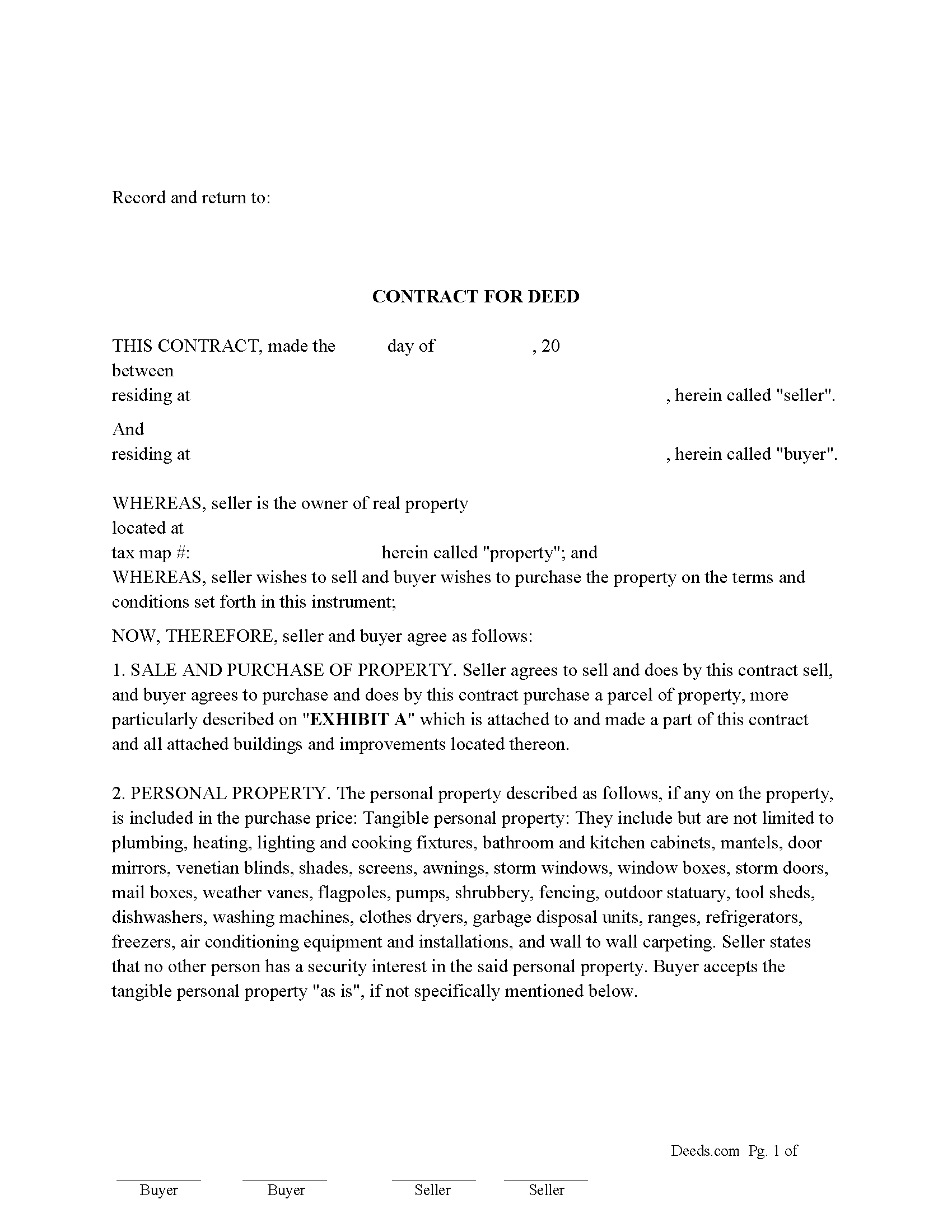

Niagara County Contract for Deed Form

Niagara County Contract for Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

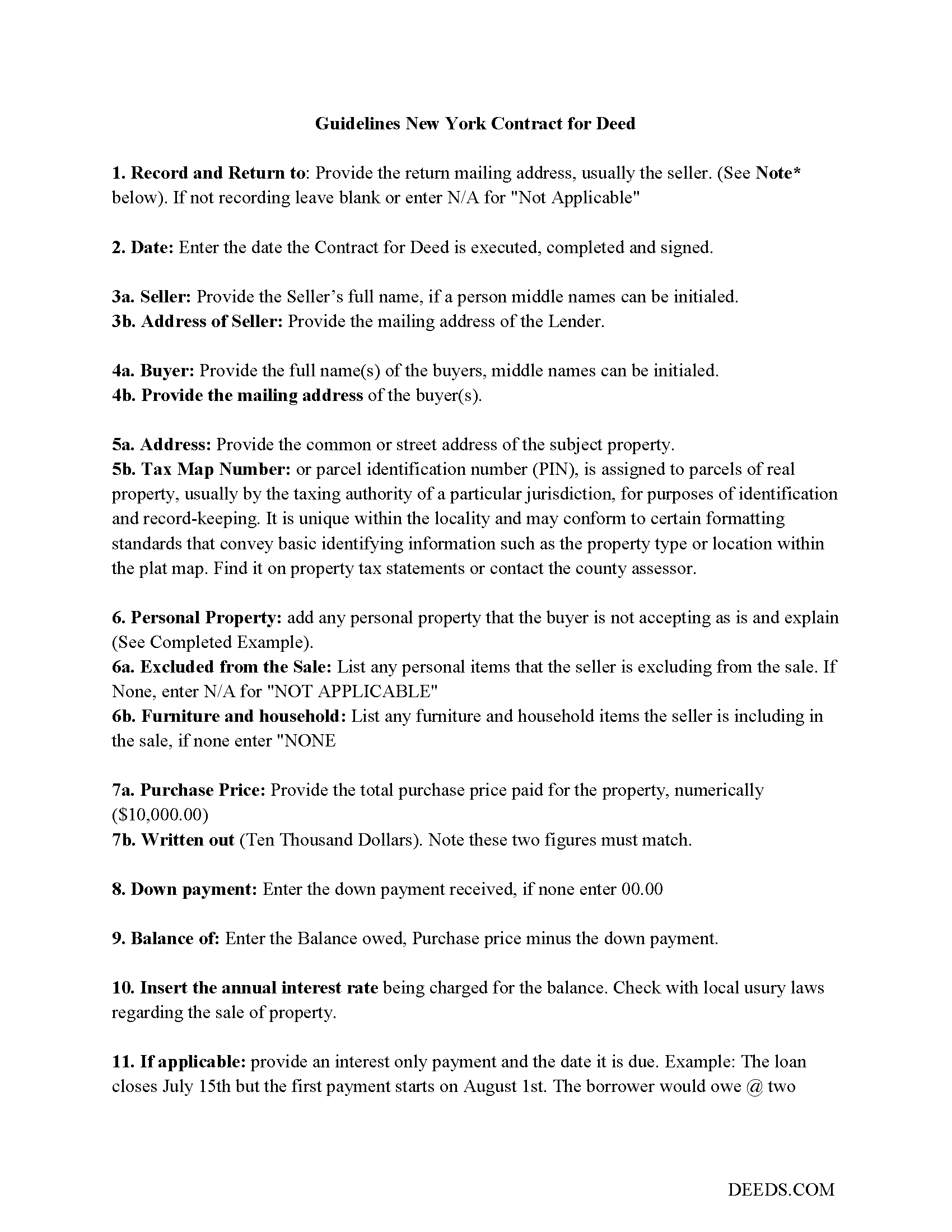

Niagara County Contract for Deed Guidelines

Line by line guide explaining every blank on the form.

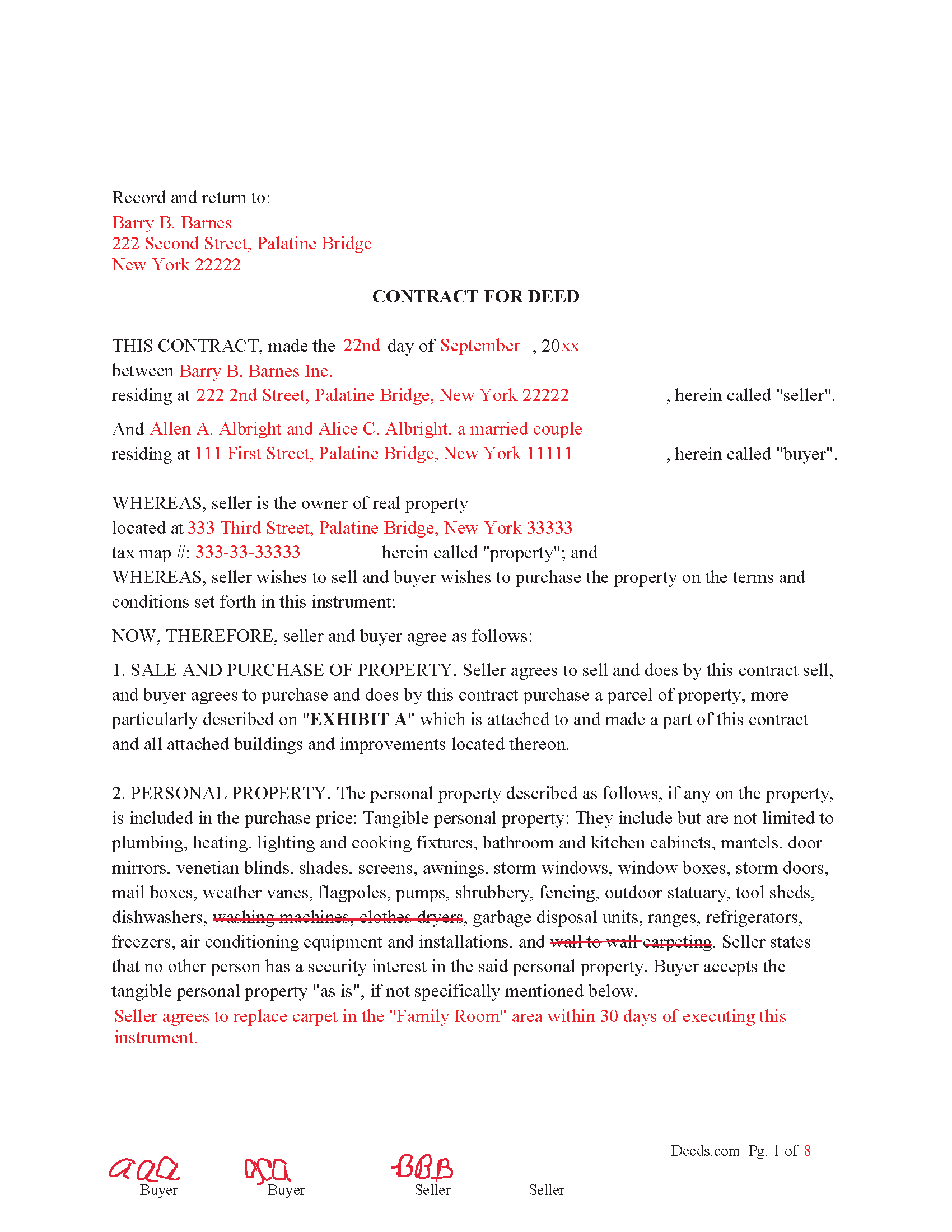

Niagara County Completed Example of the Contract for Deed

Example of a properly completed form for reference.

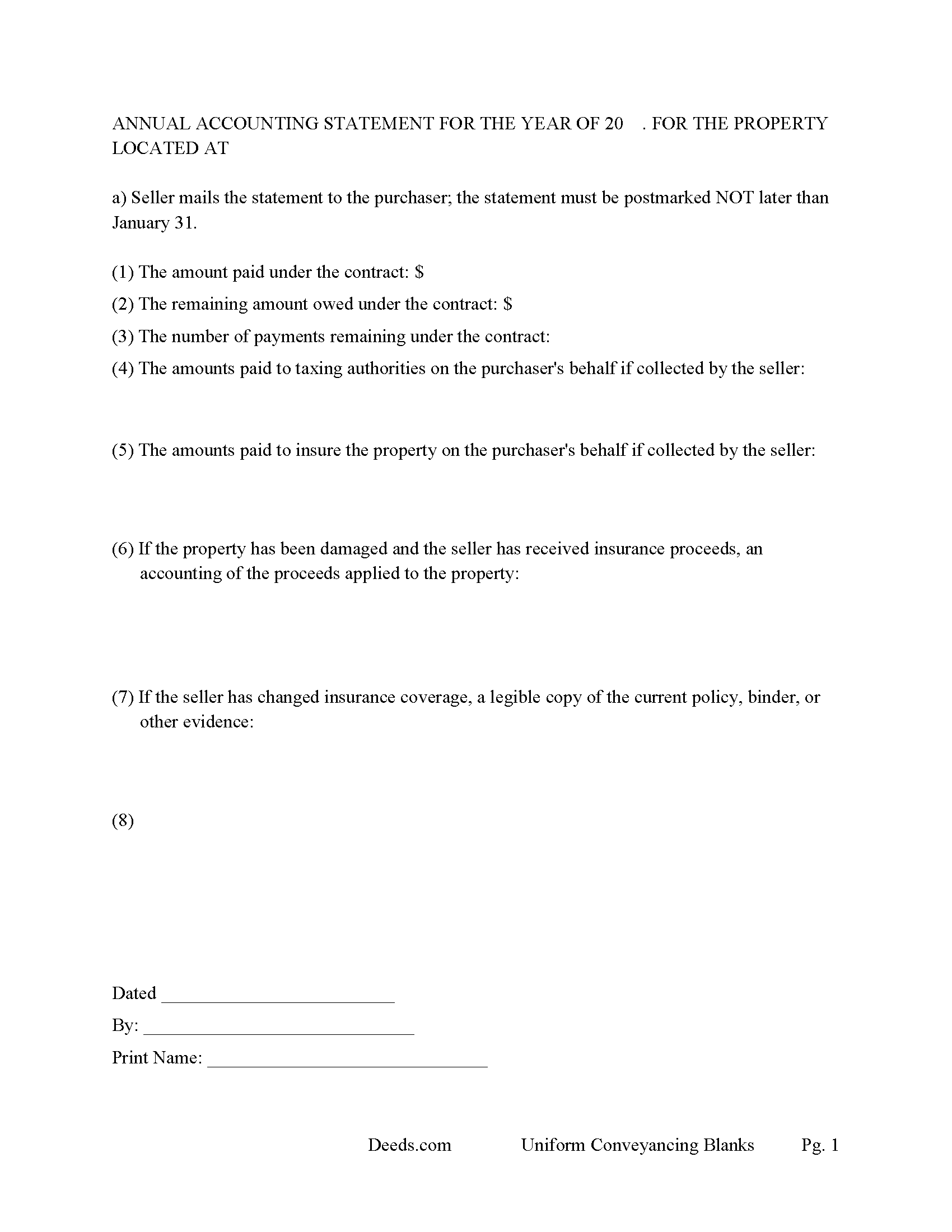

Niagara County Annual Accounting Statement Form

Required annually to notify buyer of remaining balances.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Niagara County documents included at no extra charge:

Where to Record Your Documents

Niagara County Clerk - County Court House

Lockport , New York 14095-0461

Hours: 9:00 am - 5:00 pm Monday - Friday / Recording: 9:30 am - 4:30 pm

Phone: (716) 439-7022

Recording Tips for Niagara County:

- Verify all names are spelled correctly before recording

- Check that your notary's commission hasn't expired

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Niagara County

Properties in any of these areas use Niagara County forms:

- Appleton

- Barker

- Burt

- Gasport

- Lewiston

- Lockport

- Middleport

- Model City

- Newfane

- Niagara Falls

- Niagara University

- North Tonawanda

- Olcott

- Ransomville

- Sanborn

- Stella Niagara

- Wilson

- Youngstown

Hours, fees, requirements, and more for Niagara County

How do I get my forms?

Forms are available for immediate download after payment. The Niagara County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Niagara County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Niagara County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Niagara County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Niagara County?

Recording fees in Niagara County vary. Contact the recorder's office at (716) 439-7022 for current fees.

Questions answered? Let's get started!

Contract for Deed often referred to as a Land Contract

Use this form for an Owner Financed Sale. This is an 8-page form adaptable to a multitude of situations, a general synopsis; Seller(s) and buyer(s) set their terms and conditions and once the property is paid in full, seller will provide clean title to said property. Financing with Installment payments (Example: $$$$ a month for 10 years), or balloon payment. (Example: Three years of payments with a balance of $$$) owed on this maturity date. Late fees are set by so much owed after so many days with an additional amount owed each and every day thereafter. If this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee, (a) one percent (1.0%) of such principal balance if the Note is paid in full on or after thirty (30) days after the Maturity Date but less than sixty (60) days after the Maturity Date, or

(b) two percent (2.0%) of such principal balance if the Note is paid in full on or after sixty (60) days after the Maturity Date.

BUYER DEFAULT. Buyer is in default upon the occurrence of any of the following:

a. The monthly payment, and any applicable late charge, is not made within thirty (30) days after the monthly due date; or

b. Insurance or taxes are not paid, repairs and maintenance is not performed, or the property is in violation of any applicable laws or government regulations and corrective action is not completed by buyer within thirty (30) days after notice to buyer to pay the insurance or taxes, repair the property, or correct any violation or non-compliance with any applicable laws or regulations. If buyer fails to pay any taxes, insurance, maintain the property in good repair, or correct any violations within the time specified above, seller may do so and any expense incurred by seller shall be paid by buyer to seller within thirty (30) days from receipt by buyer of a written bill therefor paid therefor by seller.

TRANSFER OF DEED. Upon payment in full of the purchase price, seller agrees to complete, sign and deliver the following to buyer: (a) a warranty deed conveying a good and marketable title to the premises described in this contract, except for encumbrances that may be caused by the acts or omissions of Buyer after the parties sign this contract; (b) Combined Real Estate Transfer Tax Return and Credit Line Mortgage (TP-584); (c) Real Property Transfer Report (RP-5217);

INTERPRETATION OF CONTRACT. New York Law.

Most "Contract for Deeds" are recorded, this is formatted for such use if needed.

(New York CFD Package includes form, guidelines, and completed example)

Important: Your property must be located in Niagara County to use these forms. Documents should be recorded at the office below.

This Contract for Deed meets all recording requirements specific to Niagara County.

Our Promise

The documents you receive here will meet, or exceed, the Niagara County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Niagara County Contract for Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Rosa D.

June 18th, 2019

Obtaining a quick claim deed from this website was easy and friendly I must say. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

JESSICA B.

June 25th, 2020

easy to move through the site and create an account.

Thank you!

Virginia K.

October 24th, 2021

Easy to use instructions and fast service delivery. I was kept up to date on the status of my filing.

Thank you!

Joy R.

August 10th, 2020

Easy and efficient way to get a deed copy.

Thank you!

Michelle J.

June 11th, 2022

I believe this is great! It protects the residents from theft of property. Proud of what Wayne County is doing.

Thank you!

Donna F.

March 4th, 2019

Straight forward easy to understand completing my document. The guide readily explained filing all portions of the document.

Thank you Donna, we appreciate your feedback.

Bruce C.

February 13th, 2024

Easy to navigate. The guide and sample helped a lot, including the availability of "Exhibit A". Knowing your documents are guaranteed to be in the required format and the ease of using your forms has been a great service, Thank you!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Marilyn S.

August 20th, 2022

I was pleased with the service and product.

Thank you!

Constance F.

August 27th, 2021

Quick and easy download with instructions and a sample document to ensure conformity to the different jurisdictions.

Thank you!

Linda B.

June 15th, 2020

Very simple, fast and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alfred J. H.

August 17th, 2019

Excellent resource for legal forms. Very satisfied. Instructions and caveats explained clearly. Thank You!

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori M.

March 6th, 2021

So easy to use. The directions are very clear.

Thank you!

Dee S.

October 24th, 2023

Great service and so quick at responding!

We are motivated by your feedback to continue delivering excellence. Thank you!

Jack S.

March 5th, 2019

This is a great service and fairly priced.

Thank you Jack. hope you're having a great day!