Orleans County Correction Deed Form

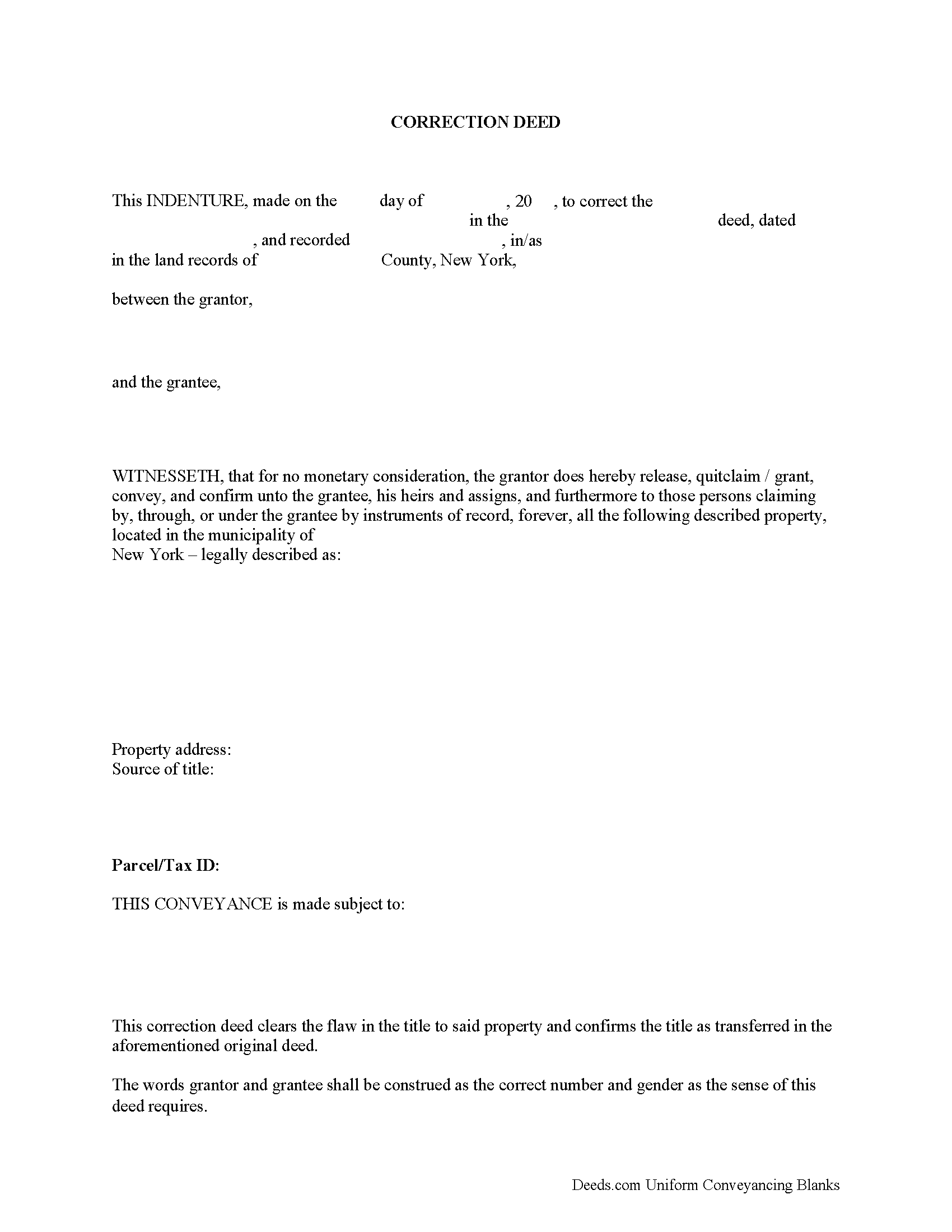

Orleans County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

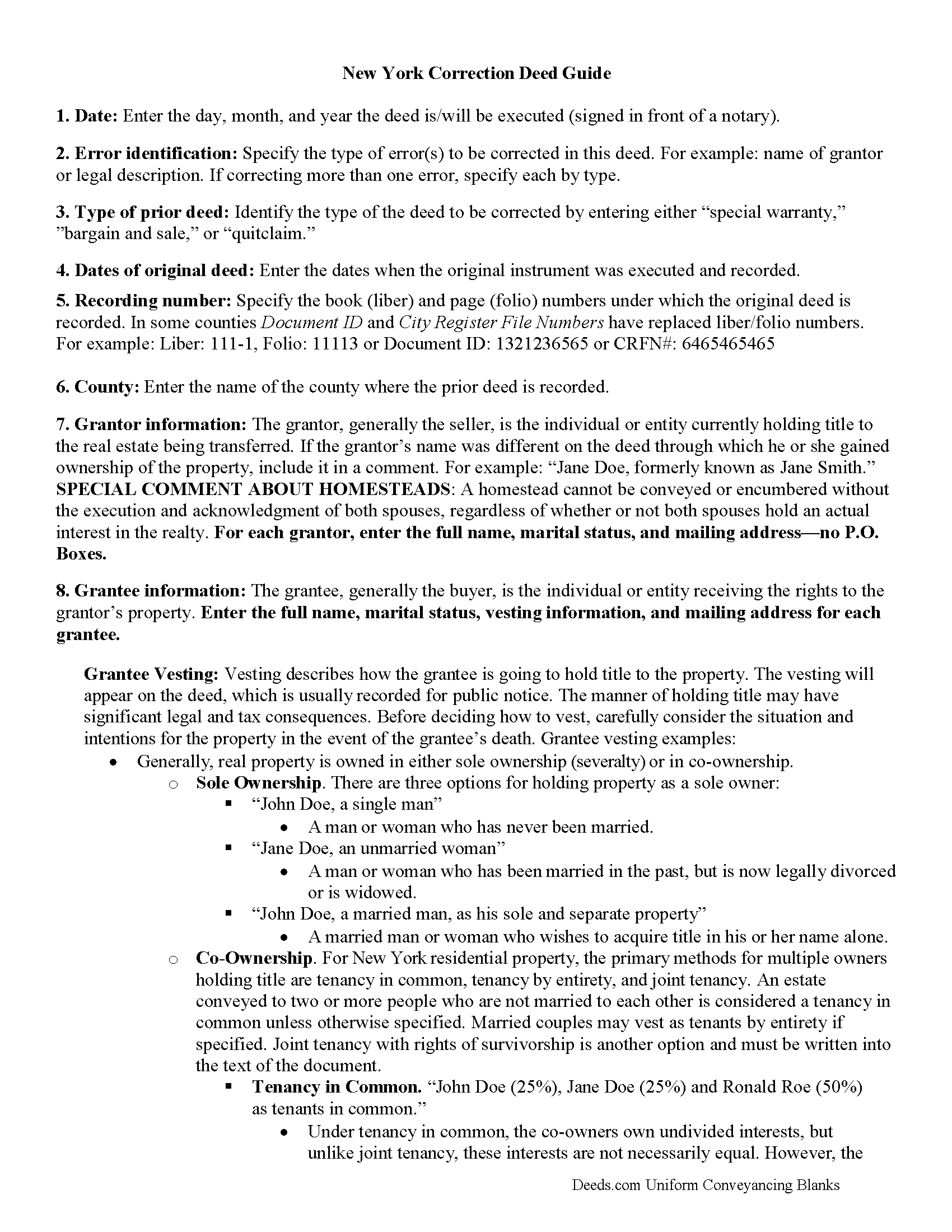

Orleans County Correction Deed Guide

Line by line guide explaining every blank on the form.

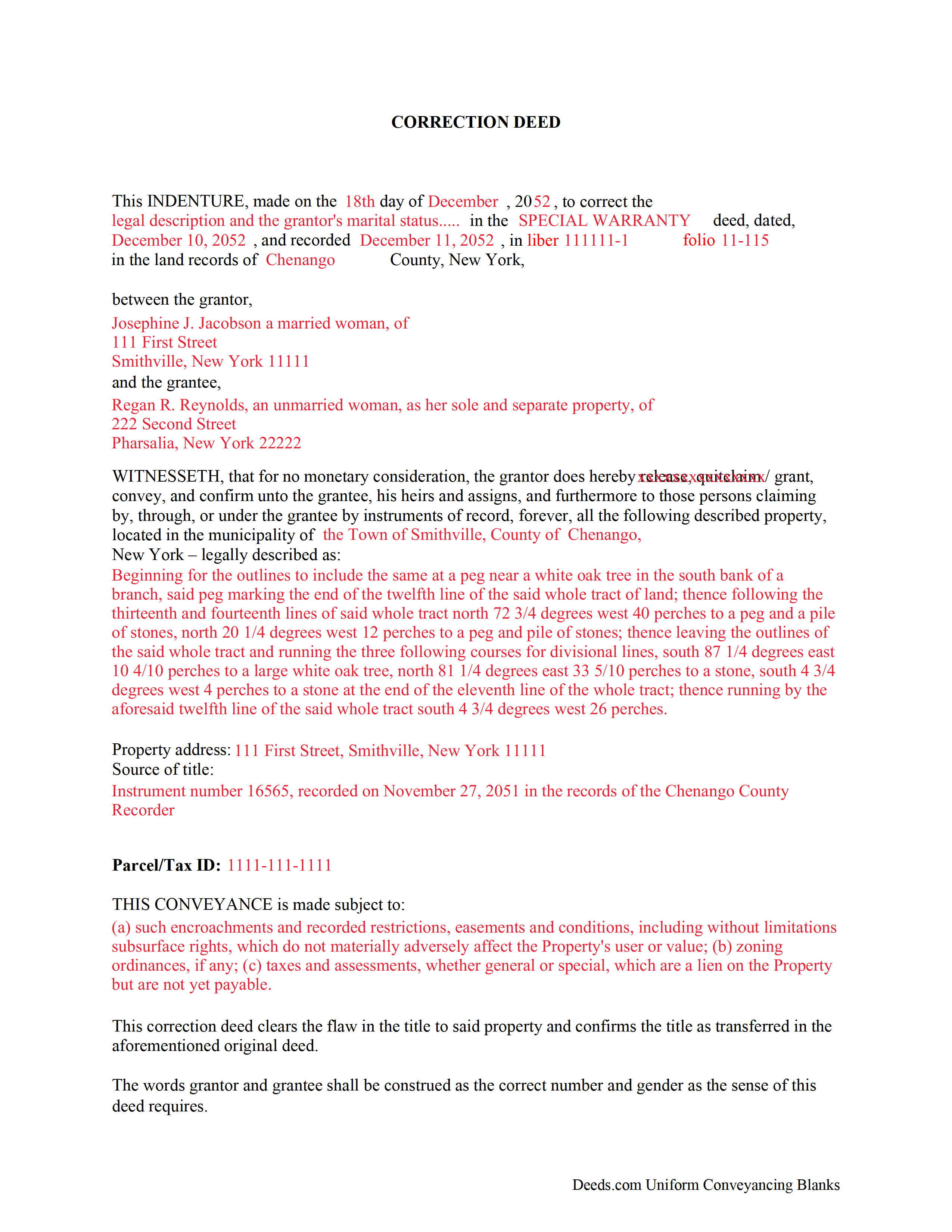

Orleans County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Orleans County documents included at no extra charge:

Where to Record Your Documents

Orleans County Clerk - Courthouse Square

Albion, New York 14411

Hours: Monday through Friday 9:00am to 5:00pm / Summer: 8:30am to 4:00pm

Phone: (585) 589-5334

Recording Tips for Orleans County:

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Orleans County

Properties in any of these areas use Orleans County forms:

- Albion

- Clarendon

- Fancher

- Holley

- Kendall

- Kent

- Knowlesville

- Lyndonville

- Medina

- Waterport

Hours, fees, requirements, and more for Orleans County

How do I get my forms?

Forms are available for immediate download after payment. The Orleans County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Orleans County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Orleans County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Orleans County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Orleans County?

Recording fees in Orleans County vary. Contact the recorder's office at (585) 589-5334 for current fees.

Questions answered? Let's get started!

Correction deeds are sometimes called confirmatory instruments. As such, they confirm and perfect an existing title created earlier and remove any defects from it, but they do not pass title on their own. They make explicit reference to the instrument that is being corrected by indicating its execution and recording date, the place of recording and the number under which the document is filed. They also need to identify the error or errors by type before supplying the correction in the subsequent body of the deed.

A new real property transfer report, RP-5217-pdf (or RP-5217NYC), with original signatures must accompany all deeds in New York, including correction deeds; the same goes for the tax affidavit TP-584, which both seller and buyer must sign. Forms are available at the county recording office or can be ordered online (but not downloaded). As a correction, the transaction may be exempt from transfer tax. Be sure to include proof that the transfer tax was paid, either by including the original cover page of the prior deed, or by providing an affidavit stating that transfer tax was paid with the prior document.

Furthermore, counties often require a cover page, which may be specific to the county or city and provided on their websites. It serves to identify the document more easily and may be called "recording and endorsement (cover) page." New recording fees per page must be paid for a correction instrument.

(New York CD Package includes form, guidelines, and completed example)

Important: Your property must be located in Orleans County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Orleans County.

Our Promise

The documents you receive here will meet, or exceed, the Orleans County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Orleans County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Mary D.

January 21st, 2022

Gift Deed is exactly what was required. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Stanley P.

February 14th, 2019

Fast accurate service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jay B.

March 17th, 2021

I've never had a problem locating the records I need. I can't imagine what can be done to improve the service.

Thank you!

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Grace V.

February 29th, 2020

Easy to use

Thank you!

timothy h.

November 12th, 2020

Too complicated and too expensive

Sorry to hear that Timothy, we do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

luisana w.

September 9th, 2022

Super easy, excellente

Thank you!

Roger V.

April 26th, 2019

Very easy to use.

Thank you Roger, we appreciate your feedback.

william l H.

June 26th, 2021

Just downloaded package , fast and quick and all the info i will need to complete my deed. Thanks again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia N.

May 7th, 2025

Wonderful fast service, quick thoughtful responses on chat! Files download easily too, great pruces

We are delighted to have been of service. Thank you for the positive review!

Robert R.

September 7th, 2025

I found the form I needed. I ordered the wrong ones the first time. I didn't know if I could get refund or not. The information with the forms is very helpful Thank you

Thank you for your feedback. We’re pleased to hear you found the forms and supporting information helpful. Your initial order has been canceled and refunded, and we’re glad you now have the correct forms in hand. We appreciate your business and are here if you need further assistance.

kabir r.

May 11th, 2022

Wonderful quitclaim forms, very happy

Thank you!

Sue C.

December 1st, 2023

Very helpful. Easy to use. Able to avoid the cost of having an attorney prepare the document I needed.

Your appreciative words mean the world to us. Thank you and we look forward to serving you again!

Luis C.

May 10th, 2019

Excellent forms but the instructions are not to clear.

Thank you for your feedback. We really appreciate it. Have a great day!