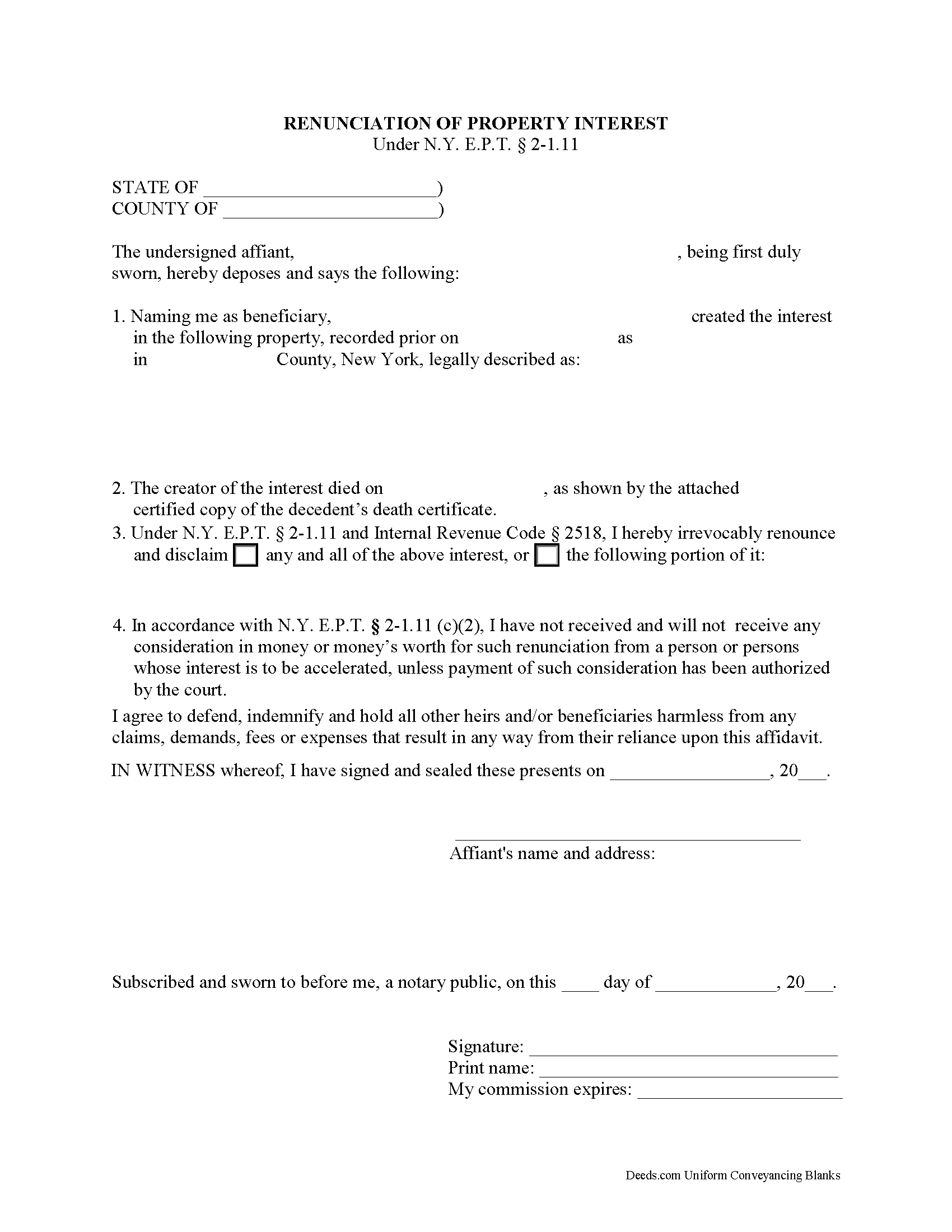

Jefferson County Disclaimer of Interest Form

Jefferson County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

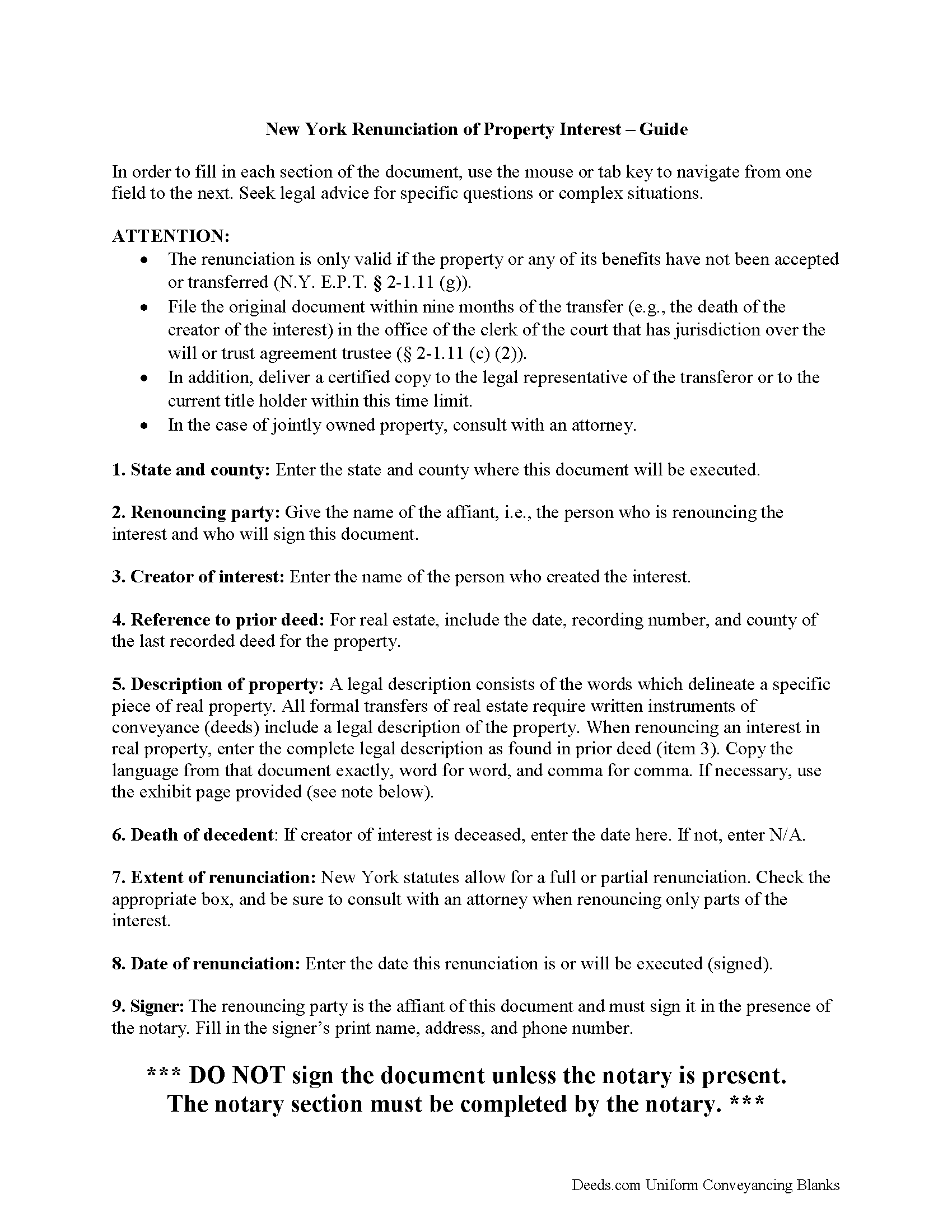

Jefferson County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

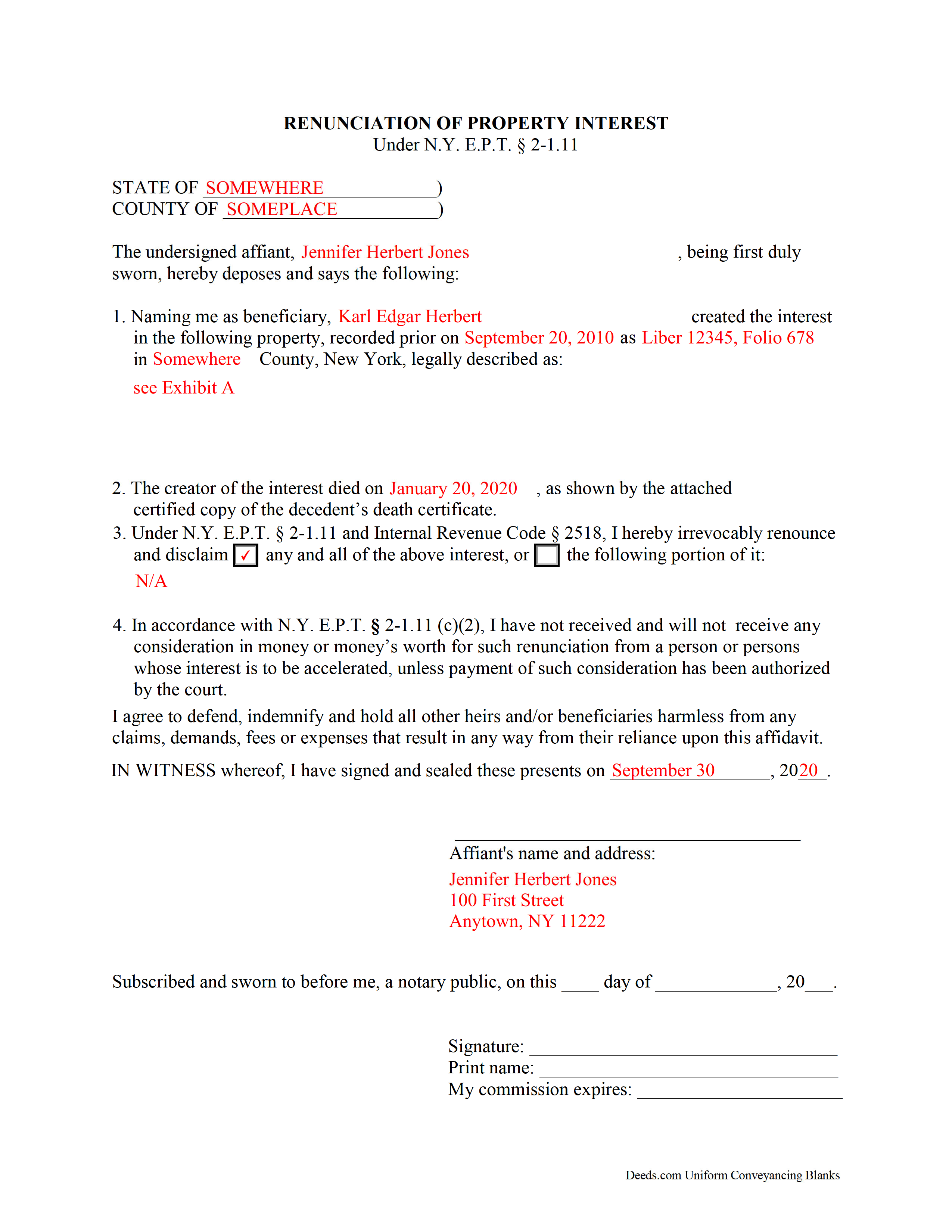

Jefferson County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Jefferson County documents included at no extra charge:

Where to Record Your Documents

Jefferson County Clerk

Watertown, New York 13601

Hours: 9:00am to 5:00pm / July - Aug: 8:30am to 4:00pm

Phone: (315) 785-3200

Recording Tips for Jefferson County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Have the property address and parcel number ready

Cities and Jurisdictions in Jefferson County

Properties in any of these areas use Jefferson County forms:

- Adams

- Adams Center

- Alexandria Bay

- Antwerp

- Belleville

- Black River

- Brownville

- Calcium

- Cape Vincent

- Carthage

- Chaumont

- Clayton

- Deferiet

- Depauville

- Dexter

- Ellisburg

- Evans Mills

- Felts Mills

- Fishers Landing

- Fort Drum

- Great Bend

- Henderson

- Henderson Harbor

- La Fargeville

- Limerick

- Lorraine

- Mannsville

- Natural Bridge

- Oxbow

- Philadelphia

- Pierrepont Manor

- Plessis

- Redwood

- Rodman

- Sackets Harbor

- Theresa

- Thousand Island Park

- Three Mile Bay

- Watertown

- Wellesley Island

Hours, fees, requirements, and more for Jefferson County

How do I get my forms?

Forms are available for immediate download after payment. The Jefferson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jefferson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jefferson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jefferson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jefferson County?

Recording fees in Jefferson County vary. Contact the recorder's office at (315) 785-3200 for current fees.

Questions answered? Let's get started!

Renouncing Inherited Property in New York

A beneficiary of an interest in property in New York can disclaim a bequeathed asset or power (New York State Code, Estates, Powers, and Trusts, Article 2, 1.11). Such a renunciation, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to disclaim his or her interest in the property, either in full or partially (1.11 (c) (1), 1.11 (f)).

The renunciation is only valid if the beneficiary has not indicated acceptance of the property, for example, through transfer or encumbrance, acceptance of any payment, or other actions (1.11 (g)). It must be acknowledged by a notary and accompanied by an affidavit stating that the beneficiary is not receiving monetary consideration in exchange for the renunciation (1.11 (c) (2)).

The statutes provide a nine-month window, to be extended at the discretion of the court, during which the beneficiary must file the renunciation document with the surrogate court in the county where the will or estate is being administered. The document must also be delivered to the fiduciary or administrator of the estate, or to the person holding legal title to the property (1.11 (c) (2)).

A renunciation is irrevocable (1.11 (h)) and has the same effect as though the beneficiary "had predeceased the creator or the decedent" (1.11 (e)). So, consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited property.

(New York DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Jefferson County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Jefferson County.

Our Promise

The documents you receive here will meet, or exceed, the Jefferson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jefferson County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Angeline P.

April 29th, 2020

Great service! I downloaded the Quit Claim Deed package and I'm so grateful I did. It contained detailed directions on how to fill out all the forms, an example of a finalized copy, and excellent customer service. Also, if you choose to use their digital service, they will digitally submit the documents into the County Recorder's Office for you. Going through DEEDS.COM for the service I chose saved me over $300. Recording my new deed was a breeze. Thank you again DEEDS.com!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

December 15th, 2021

Thanks for such great service!

Thank you for your feedback. We really appreciate it. Have a great day!

Scott W.

March 31st, 2020

Wow! That was easy! I was expecting a more difficult process. Upload your docs and wait for a response. Which was minutes later. I would give it 6 stars.

Thank you for your kind words Scott, glad we could help.

Leadon N.

July 9th, 2022

Forms were easy to find, print, and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita C.

November 3rd, 2021

I found this site when looking for help filing a quitclaim deed to change my property deed to my married name. I received the correct forms, an example filled out, and a guide specific to my state. I have already submitted it for review to my county assessor's office (they were extremely helpful also) and it looks as if it should sail through. Thank you Deeds.com!

Thank you for your feedback. We really appreciate it. Have a great day!

Byron M.

June 17th, 2021

Very easy to sign up. Very quick to respond for payment once uploaded. Great communication. More expensive than other recording services.

Thank you for your feedback. We really appreciate it. Have a great day!

Rosie R.

November 22nd, 2021

LOVE THIS!! I am a REALTORand from time to time I have had to take documents for filing. I'm so glad I invested some time online researching eFiling services. The first few search results that populated required an expensive annual or monthly subscription. Luckily I continued to scroll and found Deeds.com. No annual or monthly subscription required. Just pay per use. I uploaded a ROL late one night and Deed.com had it eFiled the very next morning!!! They keep you updated throughout the process via email notifications which you click on the link provided in the email that directs you to your online portal to view the status and once your documents have been filed you can immediately download the filed of record documents including the receipt from the county in which the documents were filed. SO SIMPLE, CONVENIENT, & QUICK-THANK YOU DEEDS.com!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas T.

August 8th, 2022

Amazing site, been using it since 2018 for forms and never an issue.

Thank you for your feedback. We really appreciate it. Have a great day!

Sidney H.

August 3rd, 2022

Fabulous resource! They provide everything you need at an extremely reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

LuAnn F.

September 8th, 2022

Simple and quick access to the form I needed

Thank you!

Janet M.

December 17th, 2020

This site is amazing! What a time saver from driving somewhere and standing around waiting.

Thank you!

Elliot M V.

July 28th, 2021

Easy to use

Thank you!

carol g.

May 3rd, 2019

very good. got my info in minuetes. thank you

Thank you for your feedback Carol, have a great day!

Janet B.

July 28th, 2020

Review: Very user friendly and that is very important to me. Quick, easy and clear instructions. I would highly recommend deeds.com for your online filing services.

Thank you for your feedback. We really appreciate it. Have a great day!

Barry B.

November 19th, 2020

I was very impressed on how simple the process was to record the documents I needed recorded. Thank you for all of your help.

Thank you!