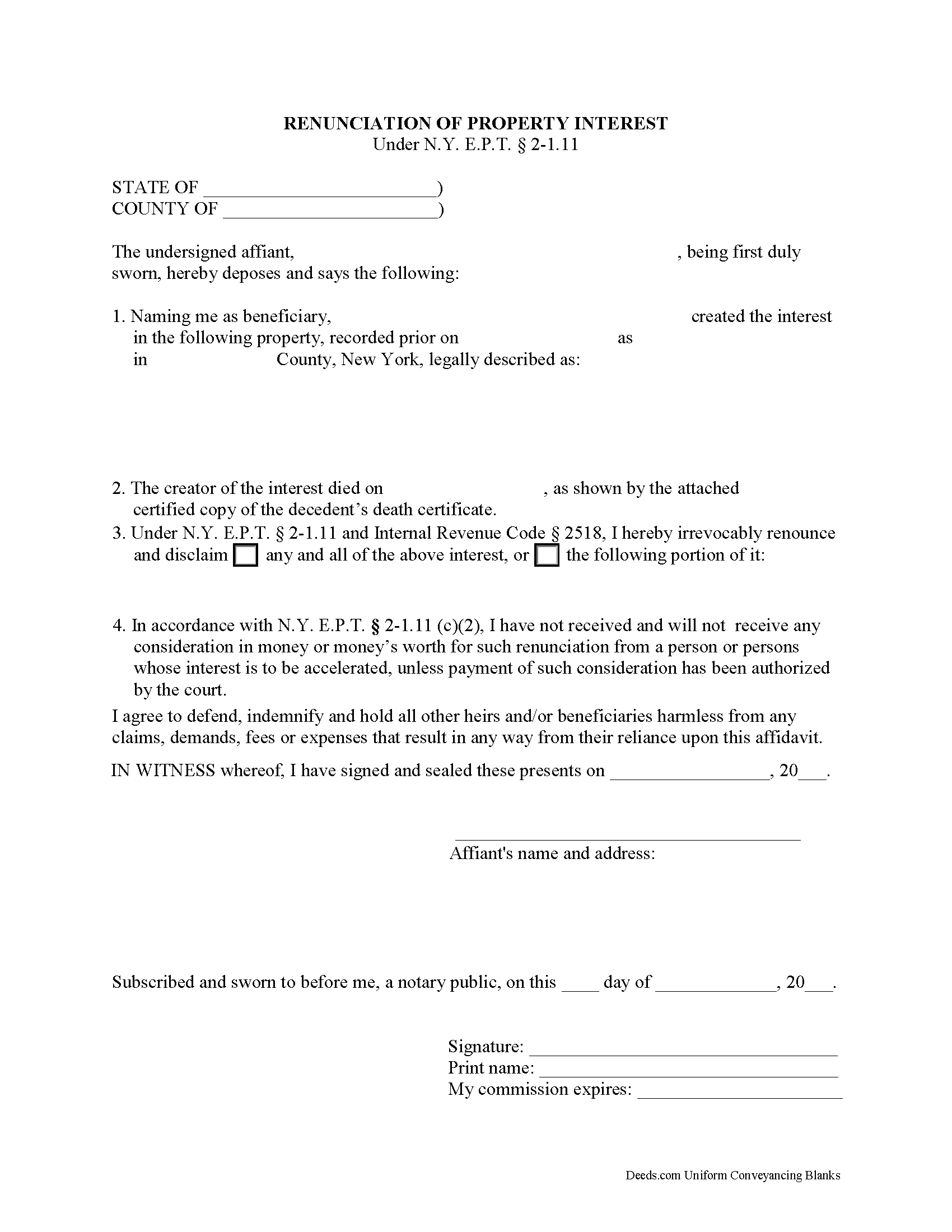

Sullivan County Disclaimer of Interest Form

Sullivan County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

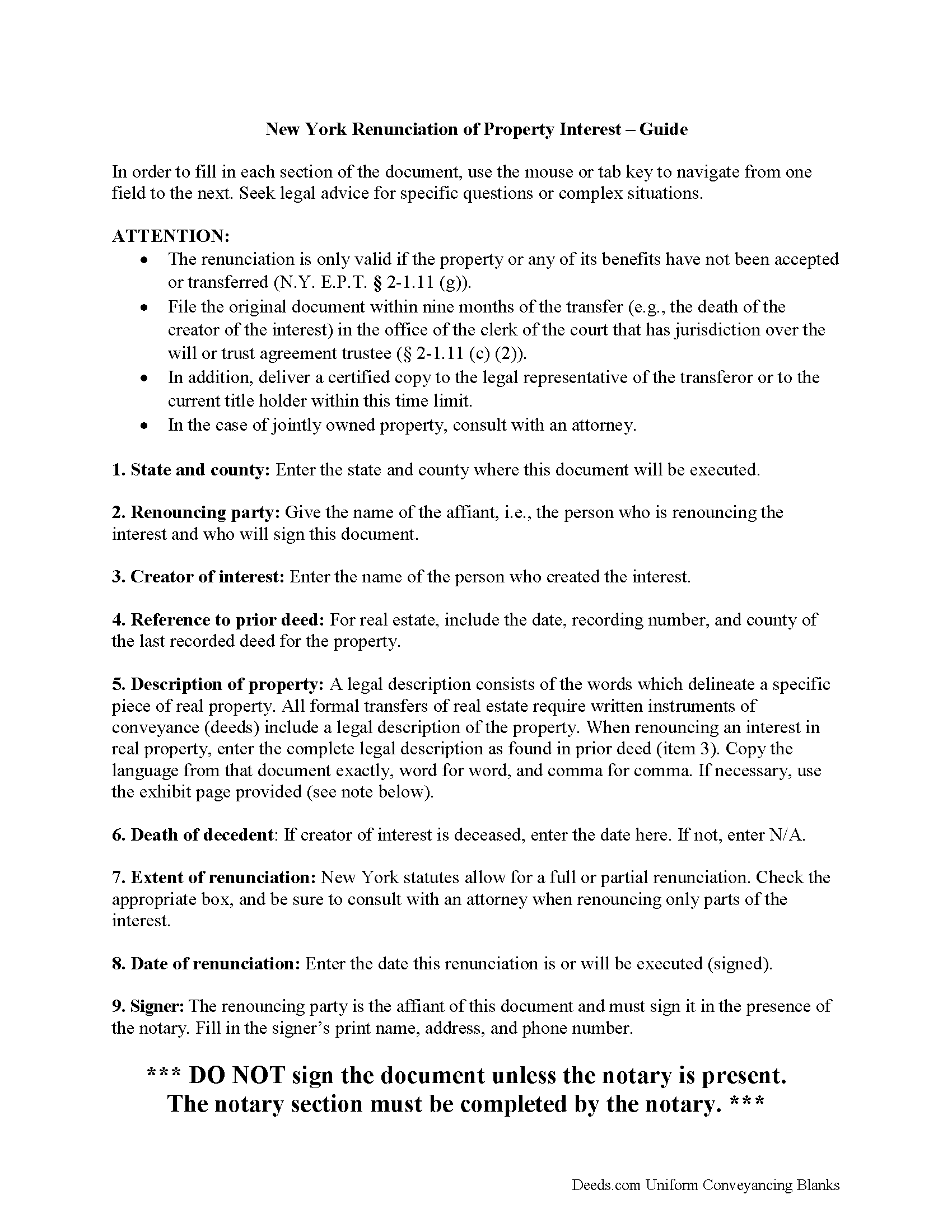

Sullivan County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

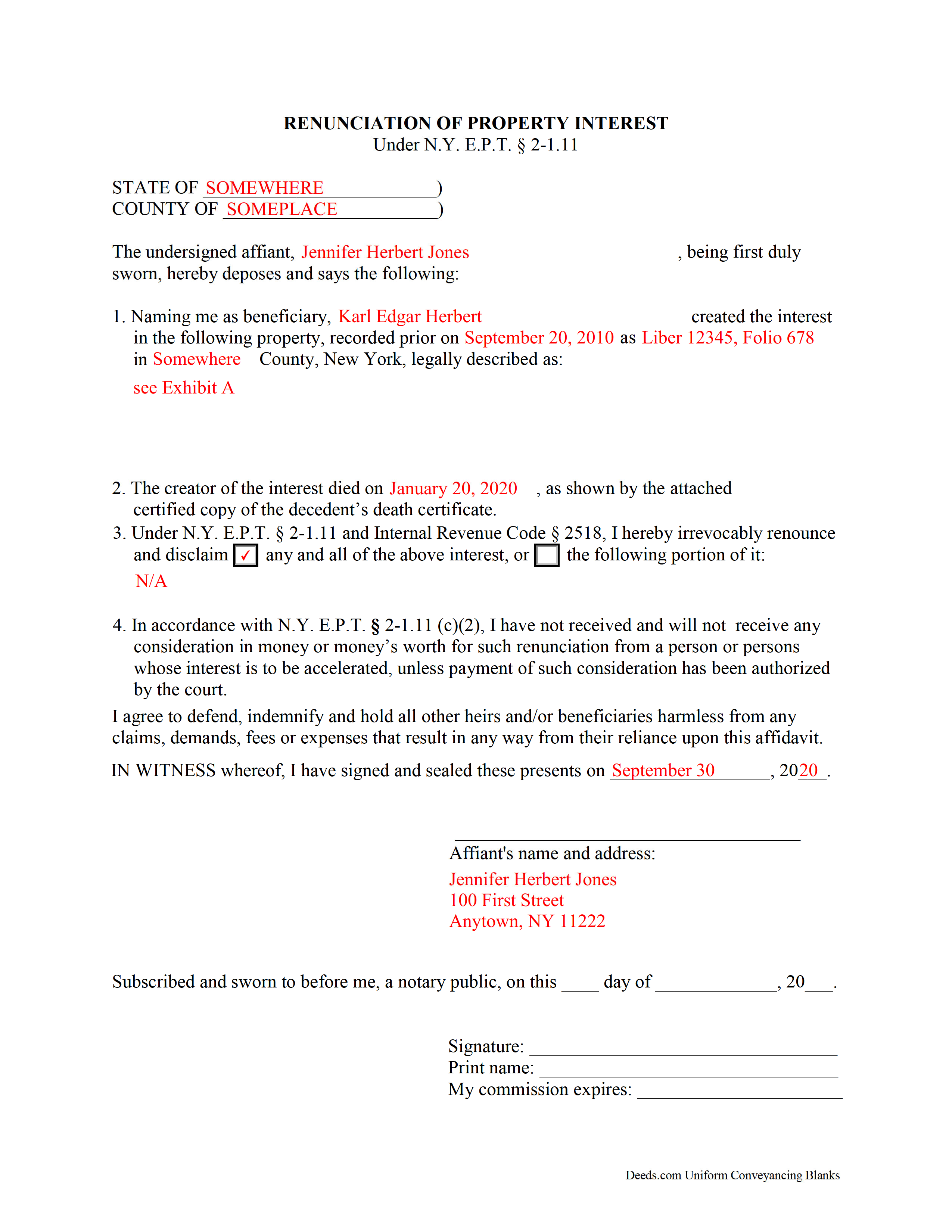

Sullivan County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Sullivan County documents included at no extra charge:

Where to Record Your Documents

Sullivan County Clerk

Monticello, New York 12701-5012

Hours: 9:00am to 5:00pm Monday through Friday

Phone: (845) 807-0411

Recording Tips for Sullivan County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Sullivan County

Properties in any of these areas use Sullivan County forms:

- Barryville

- Bethel

- Bloomingburg

- Burlingham

- Callicoon

- Callicoon Center

- Claryville

- Cochecton

- Cochecton Center

- Eldred

- Fallsburg

- Ferndale

- Forestburgh

- Fremont Center

- Glen Spey

- Glen Wild

- Grahamsville

- Hankins

- Harris

- Highland Lake

- Hortonville

- Hurleyville

- Jeffersonville

- Kauneonga Lake

- Kenoza Lake

- Kiamesha Lake

- Lake Huntington

- Liberty

- Livingston Manor

- Loch Sheldrake

- Long Eddy

- Mongaup Valley

- Monticello

- Mountain Dale

- Narrowsburg

- Neversink

- North Branch

- Obernburg

- Parksville

- Phillipsport

- Pond Eddy

- Rock Hill

- Roscoe

- Smallwood

- South Fallsburg

- Summitville

- Swan Lake

- Thompsonville

- Westbrookville

- White Lake

- White Sulphur Springs

- Woodbourne

- Woodridge

- Wurtsboro

- Youngsville

- Yulan

Hours, fees, requirements, and more for Sullivan County

How do I get my forms?

Forms are available for immediate download after payment. The Sullivan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sullivan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sullivan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sullivan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sullivan County?

Recording fees in Sullivan County vary. Contact the recorder's office at (845) 807-0411 for current fees.

Questions answered? Let's get started!

Renouncing Inherited Property in New York

A beneficiary of an interest in property in New York can disclaim a bequeathed asset or power (New York State Code, Estates, Powers, and Trusts, Article 2, 1.11). Such a renunciation, which must be in writing and signed by the beneficiary or a legally authorized representative, allows that beneficiary to disclaim his or her interest in the property, either in full or partially (1.11 (c) (1), 1.11 (f)).

The renunciation is only valid if the beneficiary has not indicated acceptance of the property, for example, through transfer or encumbrance, acceptance of any payment, or other actions (1.11 (g)). It must be acknowledged by a notary and accompanied by an affidavit stating that the beneficiary is not receiving monetary consideration in exchange for the renunciation (1.11 (c) (2)).

The statutes provide a nine-month window, to be extended at the discretion of the court, during which the beneficiary must file the renunciation document with the surrogate court in the county where the will or estate is being administered. The document must also be delivered to the fiduciary or administrator of the estate, or to the person holding legal title to the property (1.11 (c) (2)).

A renunciation is irrevocable (1.11 (h)) and has the same effect as though the beneficiary "had predeceased the creator or the decedent" (1.11 (e)). So, consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited property.

(New York DOI Package includes form, guidelines, and completed example)

Important: Your property must be located in Sullivan County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Sullivan County.

Our Promise

The documents you receive here will meet, or exceed, the Sullivan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sullivan County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

matthew h.

June 6th, 2022

Totally awesome. Useless waste of time looking anywhere else for real estate deed forms. All the stars!!

Thank you!

Marc Z.

March 24th, 2019

Thank you for having an easy to navigate website with updated documents! Had everything I needed, took care of business and on to the next transaction.- Aloha

Thank you Marc. Have a fantastic day!

Jason B.

May 9th, 2019

Providing .doc versions would be much easier than trying to jam information into a non-editable PDF.

Thank you for your feedback. We really appreciate it. Have a great day!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Chastity S.

March 14th, 2019

Very confusing and a waste of money, Now I will have to pay for another service from another site. Very disappointed.

Thank you for your feedback. Sorry to hear about your disappointment. It is certainly a good idea to seek a more full service route if you are not completely sure of what you are doing. We have canceled your order and payment.

Karen S.

October 19th, 2021

Deeds.com made everything easy, with instructions and samples it was simple to fill out the forms. I loved that it was county specific.

Thank you for your feedback. We really appreciate it. Have a great day!

Pietrina P.

December 18th, 2020

Recording with Deeds.com was a seamless experience. Communications were timely, clear and professional. When I had a question, I received a prompt email reply. Overall an excellent experience

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JoAnn T.

October 7th, 2022

Very happy! This was a very easy to use web site, the form came with directions and an example, both were very helpful. I will absolutely use Deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

AARON D.

July 26th, 2024

Forms were great ! Cancelled my lawyer's appointment & utilized your forms.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Melody P.

July 21st, 2021

Thanks once again for such great service!

Thank you!

Roger A.

November 2nd, 2023

Easy peasy to use! It's great to have the guide for completing the form and an example of a completed form.

It was a pleasure serving you. Thank you for the positive feedback!

Jennifer C.

January 8th, 2021

Fast turnaround. Very much appreciated!

Thank you!

Katherine D.

August 22nd, 2022

Once I found your site it was very easy to understand, order and copy the forms. It is very helpful that you included an example of a completed form. Thank you. This form helps hundreds of seniors avoid lawyers, probate and the fear of losing their homes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

Patricia R.

October 26th, 2022

Very quick to respond with the obvious answers. I asked what form to use when adding my daughter to deed. Answer: talk to an attorney duh.

Thank you!