Fulton County Executor Deed Form

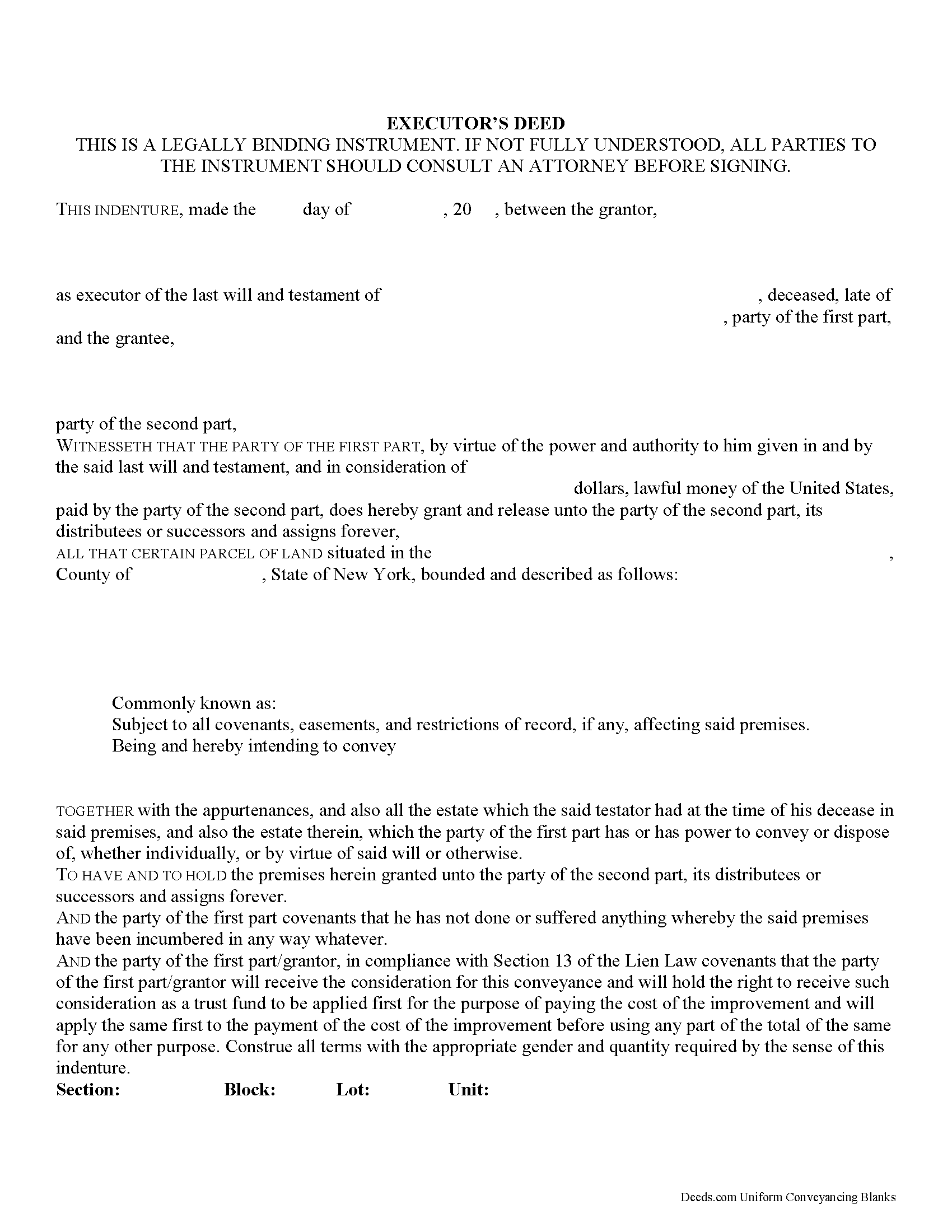

Fulton County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

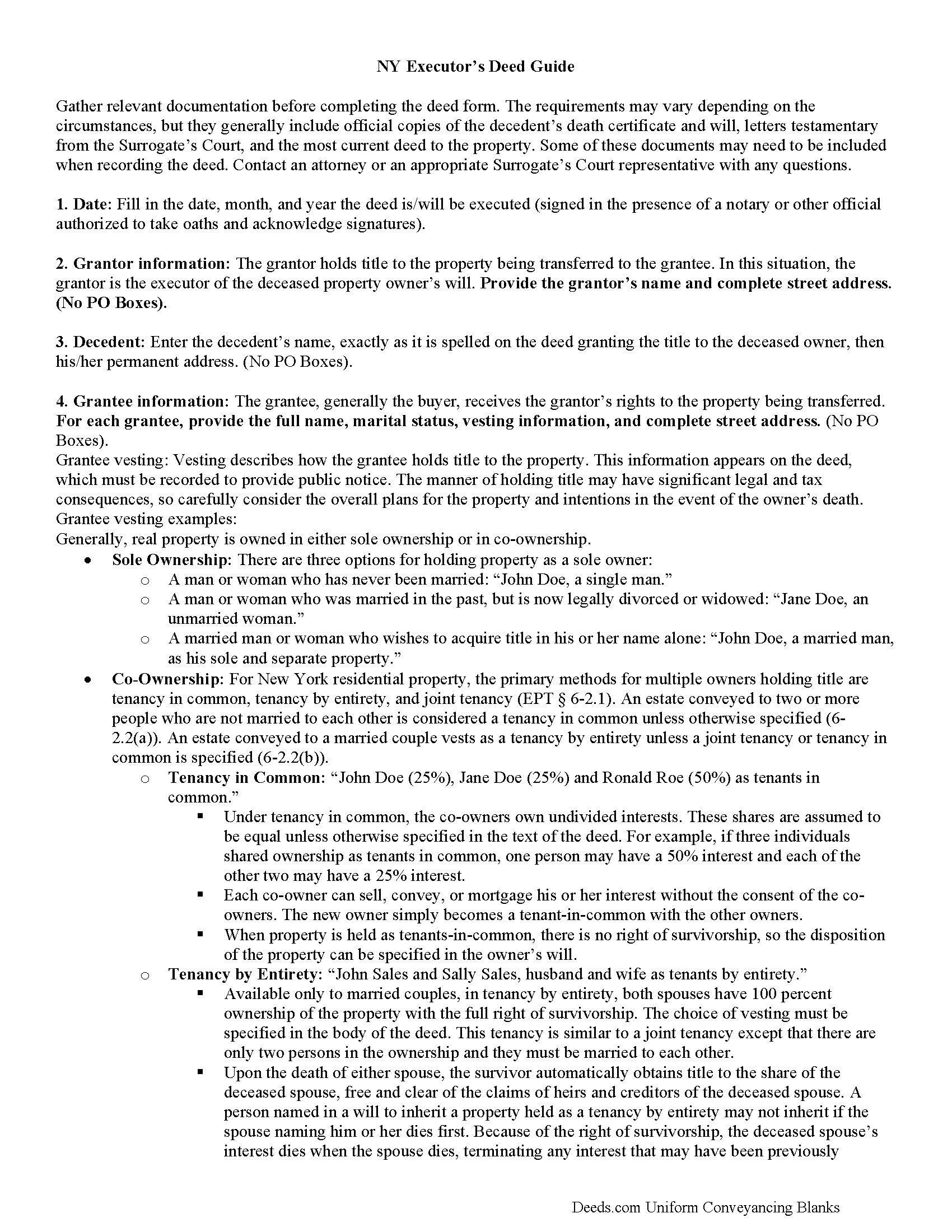

Fulton County Executor Deed Guide

Line by line guide explaining every blank on the form.

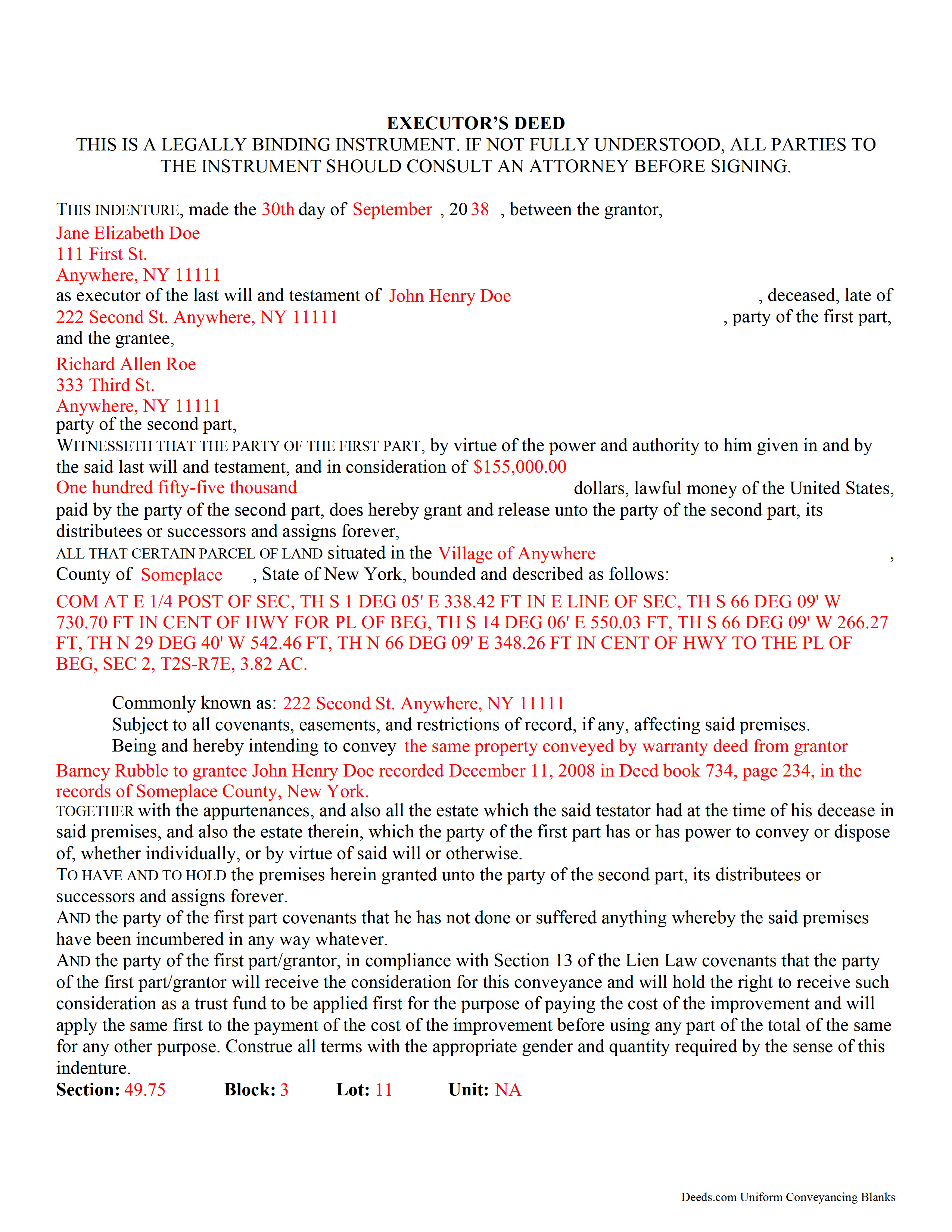

Fulton County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Fulton County documents included at no extra charge:

Where to Record Your Documents

Fulton County Clerk

Johnstown, New York 12095

Hours: 8:00am to 4:30pm Monday - Friday (except Holidays)

Phone: (518) 736-5555

Recording Tips for Fulton County:

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Fulton County

Properties in any of these areas use Fulton County forms:

- Broadalbin

- Caroga Lake

- Gloversville

- Johnstown

- Mayfield

- Northville

- Stratford

Hours, fees, requirements, and more for Fulton County

How do I get my forms?

Forms are available for immediate download after payment. The Fulton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Fulton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Fulton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Fulton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Fulton County?

Recording fees in Fulton County vary. Contact the recorder's office at (518) 736-5555 for current fees.

Questions answered? Let's get started!

Transferring New York Real Property with an Executor's Deed

Executor's deeds are used to transfer title to real property whose owner died testate (with a last will and testament.)

The executor is someone named to carry out the provisions contained within in a deceased individual's will. After the will is admitted to probate in the Surrogate's Court, the surrogate (the judge managing the case) authorizes the executor to begin his/her duties. Frequently, these include using an executor's deed to sell the decedent's real estate.

Executor's deeds contain the same information as warranty or quitclaim deeds, but they also include details about the executor and the deceased owner. The executor's signature must be notarized, but some cases may require a witness to sign the deed in front of the notary, too. Note that at sections 309-a and 309-b, New York's Real Property Law (RPP) sets out specific notary statements based on whether the deed is signed inside or outside the state.

In addition to the standard state and local forms that accompany deeds submitted for recording, executors might also need to attach letters testamentary from the Surrogate's Court, certified copies of the decedent's death certificate and will, and other supporting documentation as appropriate.

Probate procedures can be complicated, and each situation is unique. Seek assistance from an attorney or from the surrogate responsible for the case with any questions about this process.

(New York Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Fulton County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Fulton County.

Our Promise

The documents you receive here will meet, or exceed, the Fulton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Fulton County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Ruth L.

August 18th, 2021

Easy to use form. I filled it out and took it to the county office. Entire process took less than 20 min.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John v.

November 13th, 2019

I don't have any experience with real estate legal forms and these were fairly easy to understand. The guide helped a bunch and the information provided on the site filled in any gaps. Overall I would definitely use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sandra B.

May 17th, 2019

Easy and fast. Was able to find the documents needed and saved so much money!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer S.

September 4th, 2021

We liked the ease of filling out our document in a professional layout.

Thank you for your feedback. We really appreciate it. Have a great day!

Joan E S.

June 10th, 2022

appreciate the ease of finding a group of forms without the need for a lawyer--the time and expense--for a basic transfer of joint tenancy following a death.

Thank you!

Ronald P.

July 24th, 2025

Forms easy to download but experienced problems trying to type in my information into the forms. Then when I went to print a form, Adobe wanted to charge me for printing. I ended up printing the blank forms and then filling them out manually.

Thank you, Ronald. We're glad you found the forms easy to download, though we're sorry to hear about the printing and fill-in experience. Our forms are designed to be fillable and printable using free software like Adobe Reader. If you ever run into issues, our support team is happy to help!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Marites T.

April 6th, 2023

Extremely helpful team of professionals who are patient when you need to get things filed correctly. Very small price for the comfort of knowing your DOCUMENTS are FILED with you local Recorder's Office. Some of the filings, if they are correctly formatted are already uploaded and official within a few hours. Here's the ALTERNATIVE you may encounter. For Example: King County Recorder's Office moved which means most filings are backed up 7-10 days if you DROP your filing in a BOX with your CHECK or MAIL IT. Neither is a great option, since they have no WALK IN HOURS.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

Christina H.

December 29th, 2022

I appreciate having forms available and not having to go to a business supply or attorney. This is great. However, there are two individual quit claim deed forms and I don't know which one is appropriate.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara H.

October 4th, 2019

So far so good. Thanks for making this easy and affordable.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa m.

April 25th, 2020

Very fast and easy! Thanks!!

Glad we could help. Thank you!

Rebecca C.

January 26th, 2021

Great service ! Hawaii is not a "forms state" so unfortunately the public has no way to get templates on our local gov site but deeds.com to the rescue. The template was affordable and easy to use and successfully recorded. Great to use when you don't need to involve title or attorneys for simple deed changes, thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Marjorie D.

November 1st, 2021

The process was easy and efficient. I will definitely be using this service!

Thank you for your feedback. We really appreciate it. Have a great day!

Jan M.

June 5th, 2019

Fantastic company. They are the absolute best and helped me get the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!