Saint Lawrence County Revocation of Transfer on Death Deed Form

Saint Lawrence County Revocation of Transfer on Death Deed Form

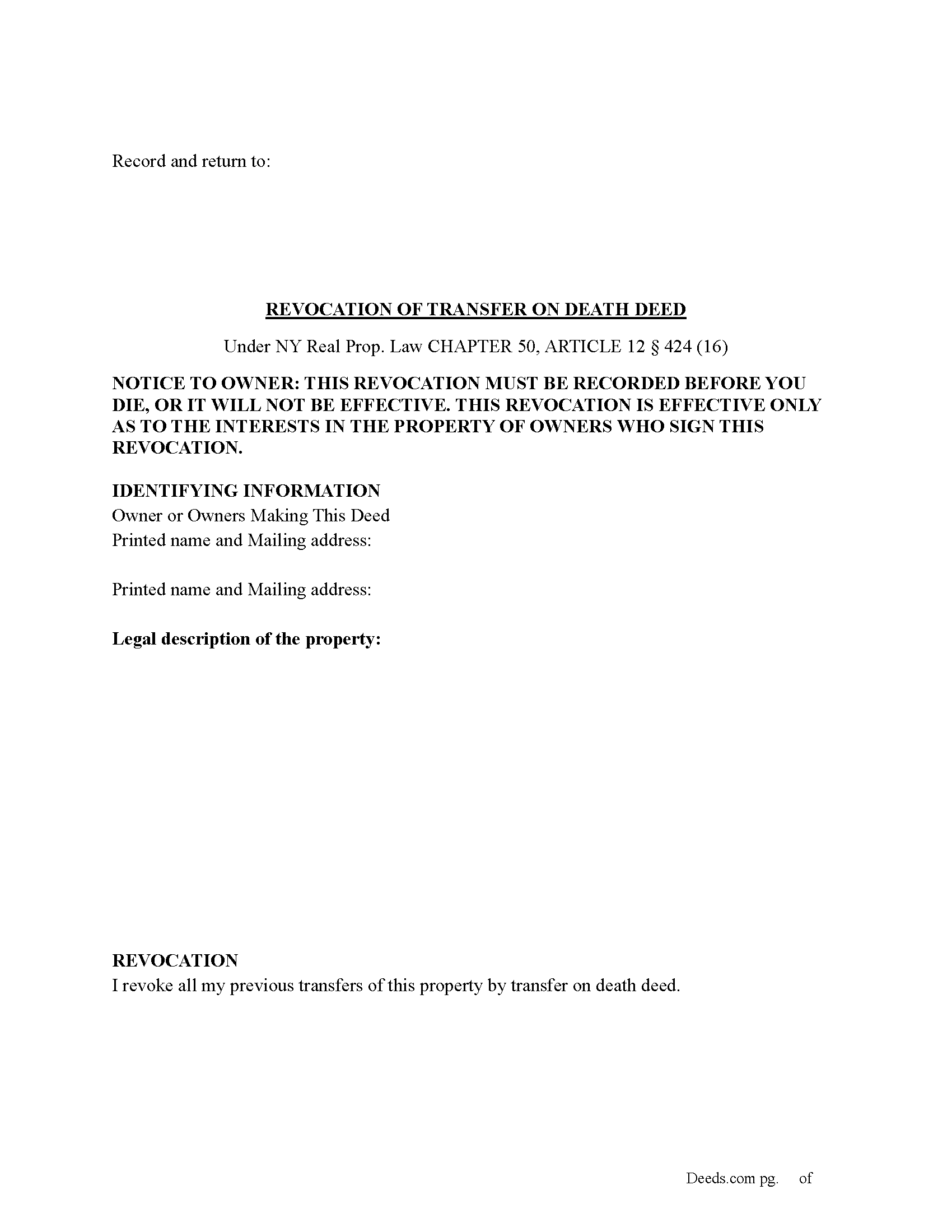

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

Saint Lawrence County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

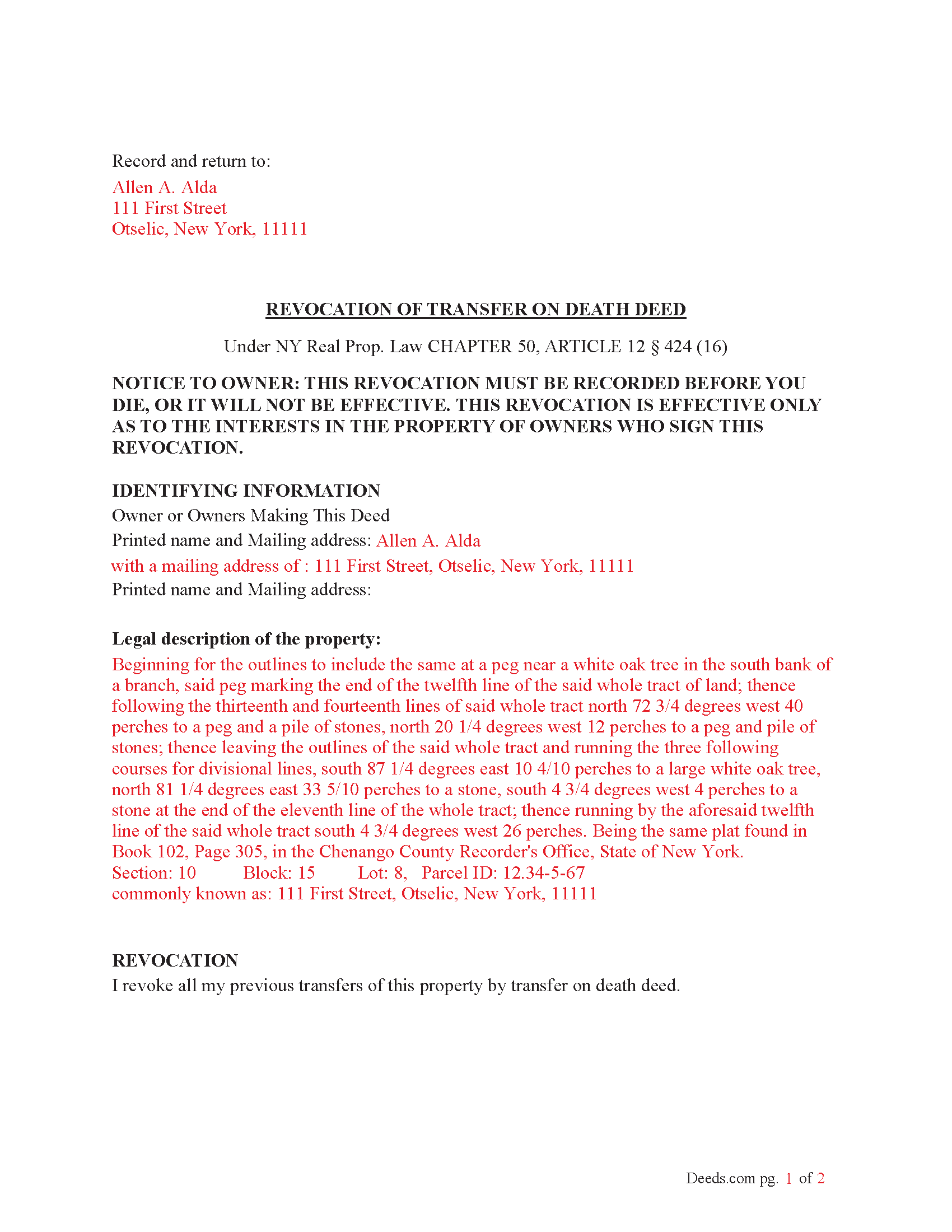

Saint Lawrence County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed New York Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Saint Lawrence County documents included at no extra charge:

Where to Record Your Documents

St. Lawrence County Clerk - County Courthouse

Canton, New York 13617

Hours: 9:00 to 5:00 M-F

Phone: (315) 379-2237

Recording Tips for Saint Lawrence County:

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Saint Lawrence County

Properties in any of these areas use Saint Lawrence County forms:

- Brasher Falls

- Brier Hill

- Canton

- Chase Mills

- Childwold

- Chippewa Bay

- Colton

- Cranberry Lake

- De Kalb Junction

- De Peyster

- Edwards

- Fine

- Gouverneur

- Hailesboro

- Hammond

- Hannawa Falls

- Helena

- Hermon

- Heuvelton

- Lawrenceville

- Lisbon

- Madrid

- Massena

- Morristown

- Newton Falls

- Nicholville

- Norfolk

- North Lawrence

- Norwood

- Ogdensburg

- Oswegatchie

- Parishville

- Piercefield

- Potsdam

- Pyrites

- Raymondville

- Rensselaer Falls

- Richville

- Rooseveltown

- Russell

- South Colton

- Star Lake

- Waddington

- Wanakena

- West Stockholm

- Winthrop

Hours, fees, requirements, and more for Saint Lawrence County

How do I get my forms?

Forms are available for immediate download after payment. The Saint Lawrence County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Saint Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Saint Lawrence County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Saint Lawrence County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Saint Lawrence County?

Recording fees in Saint Lawrence County vary. Contact the recorder's office at (315) 379-2237 for current fees.

Questions answered? Let's get started!

(How do I revoke the TOD deed after it is recorded?

There are three ways to revoke a recorded TOD deed:

(1) Complete and acknowledge a revocation form and record it in each county where the property is located.

(2) Complete and acknowledge a new TOD deed that disposes of the same property and record it in each county where the property is located.

(3) Transfer the property to someone else during your lifetime by a recorded deed that expressly revokes the TOD deed. You may not revoke the TOD deed by will.) (Real Property (RPP) CHAPTER 50, ARTICLE 12 § 424(15))

Execution of Revocation: The revocation must be executed (signed) by the property owner in the presence of two witnesses and a Notary Public, similar to how the original TOD deed was executed.

Recording the Revocation: The revocation (whether via a new TOD deed or a revocation form) must be recorded in the County Clerk's office where the property is located, just like the original TOD deed. If the revocation is not recorded, it will not be valid.

Retain Control Until Revoked: The property owner retains full control over the property and can revoke the TOD deed at any time during their lifetime. However, after the owner's death, the TOD deed takes effect and cannot be revoked.

Important Considerations: Beneficiary Consent- The property owner does not need the consent of the beneficiary to revoke the TOD deed.

Automatic Revocation by Sale: If the property owner sells or transfers the property during their lifetime, this will also effectively revoke the TOD deed.

Important: Your property must be located in Saint Lawrence County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Saint Lawrence County.

Our Promise

The documents you receive here will meet, or exceed, the Saint Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Saint Lawrence County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Jeffery H.

October 18th, 2023

Very easy to use. Thanks for your quick response on my document submissions and follow up and guidance on specific questions.

Thank you for your positive words! We’re thrilled to hear about your experience.

Dale V.

April 21st, 2019

Great site good price everything easy to use and correct.. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy G L.

March 25th, 2022

Using your site was simple, and the forms downloaded as expected.

Thank you!

Amy L B.

March 12th, 2025

easy to download forms and help is there if you need it!

Thank you, Amy! We appreciate your kind words and are glad you found the forms easy to download. Our team is always here if you ever need assistance. Thanks for choosing us!

Iva R.

August 20th, 2020

Great service. Fast, got everything done (form, recording) done in a couple of hours, lightning speed in the real estate world. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Barry C.

March 8th, 2019

prompt, complete and efficient process --- kudos to you

Thank you so much Barry. Have a great day!

Ron B.

September 15th, 2019

Solved my requirement. Happy to have found the site

Thank you for your feedback. We really appreciate it. Have a great day!

James C.

January 15th, 2021

Satisfactory. I was confused and somwhat lost on what to do and what I was getting.

Thank you!

Debbie M.

July 3rd, 2020

The forms and instructions were easy to follow and get complete. It was very nice to be able to just find them, pay for them, and download them so that they were printed just within a matter of 30 minutes. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Keli A.

June 3rd, 2021

Excellent site, super fast responses to messages, and great patience with a newbie user. Couldn't be more pleased. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Tracy M.

July 9th, 2020

The form is easy to use. However, the quit claim deed form seems to be for parcel of land, because the word "real property" is not in the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles G.

August 14th, 2022

Easy to request. Fast response

Thank you!

Lutalo O.

December 26th, 2019

Great tool for finding the best real estate forms!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Norma G.

July 30th, 2020

Very fast response!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bonnie A.

March 3rd, 2020

I little struggle downloading the forms at first but support helped. After that it was a breeze, happy with everything.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!