Rensselaer County Transfer on Death Deed Form

Rensselaer County Transfer on Death Deed Form

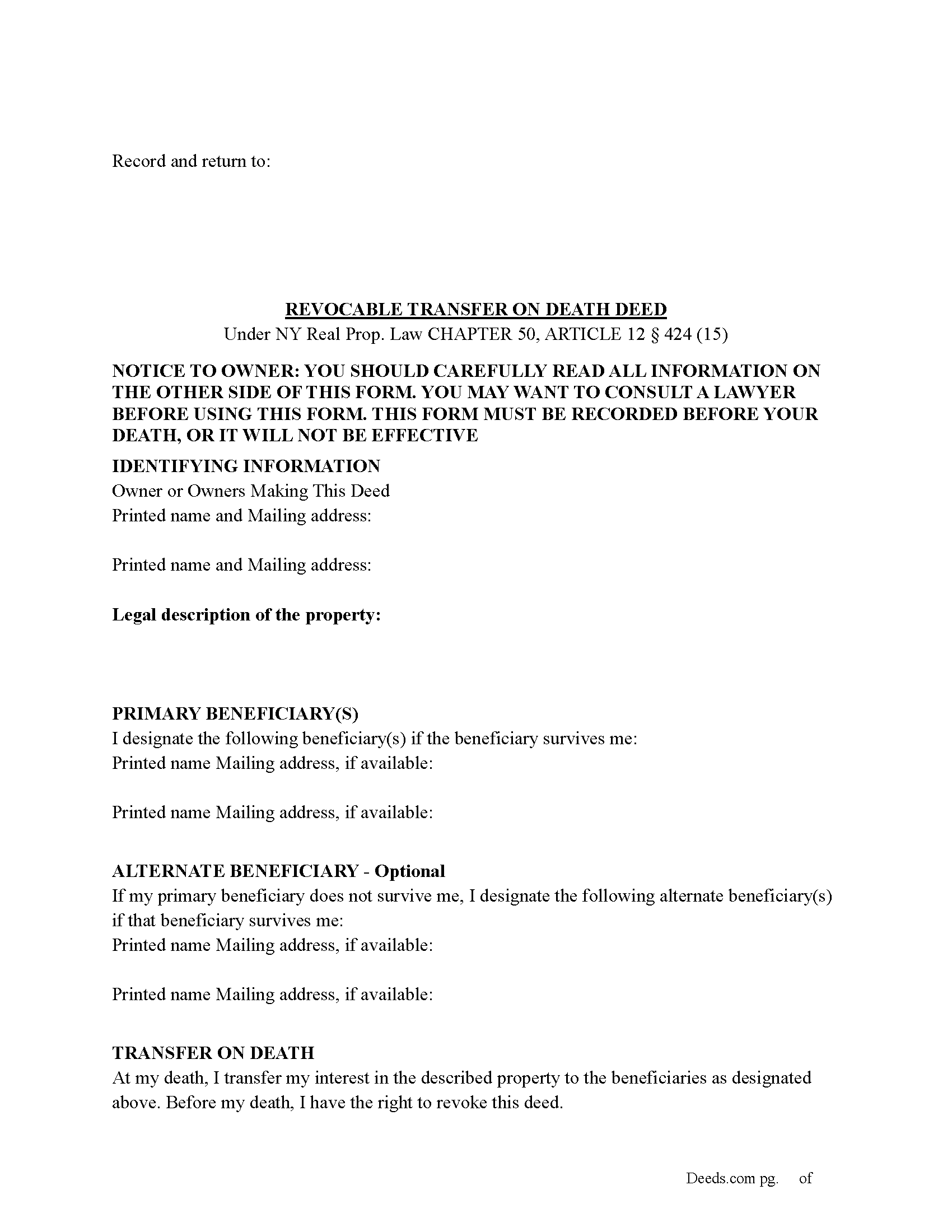

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

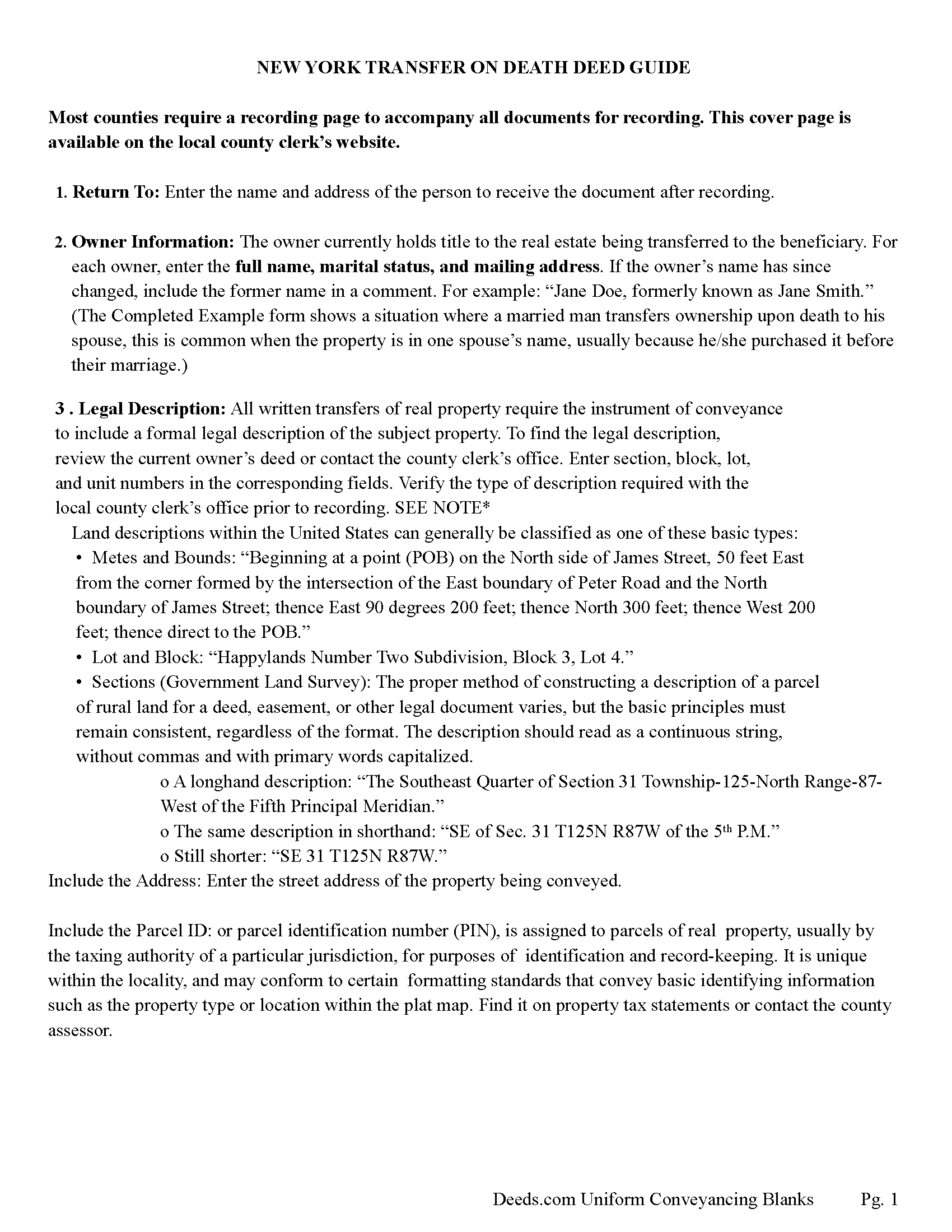

Rensselaer County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

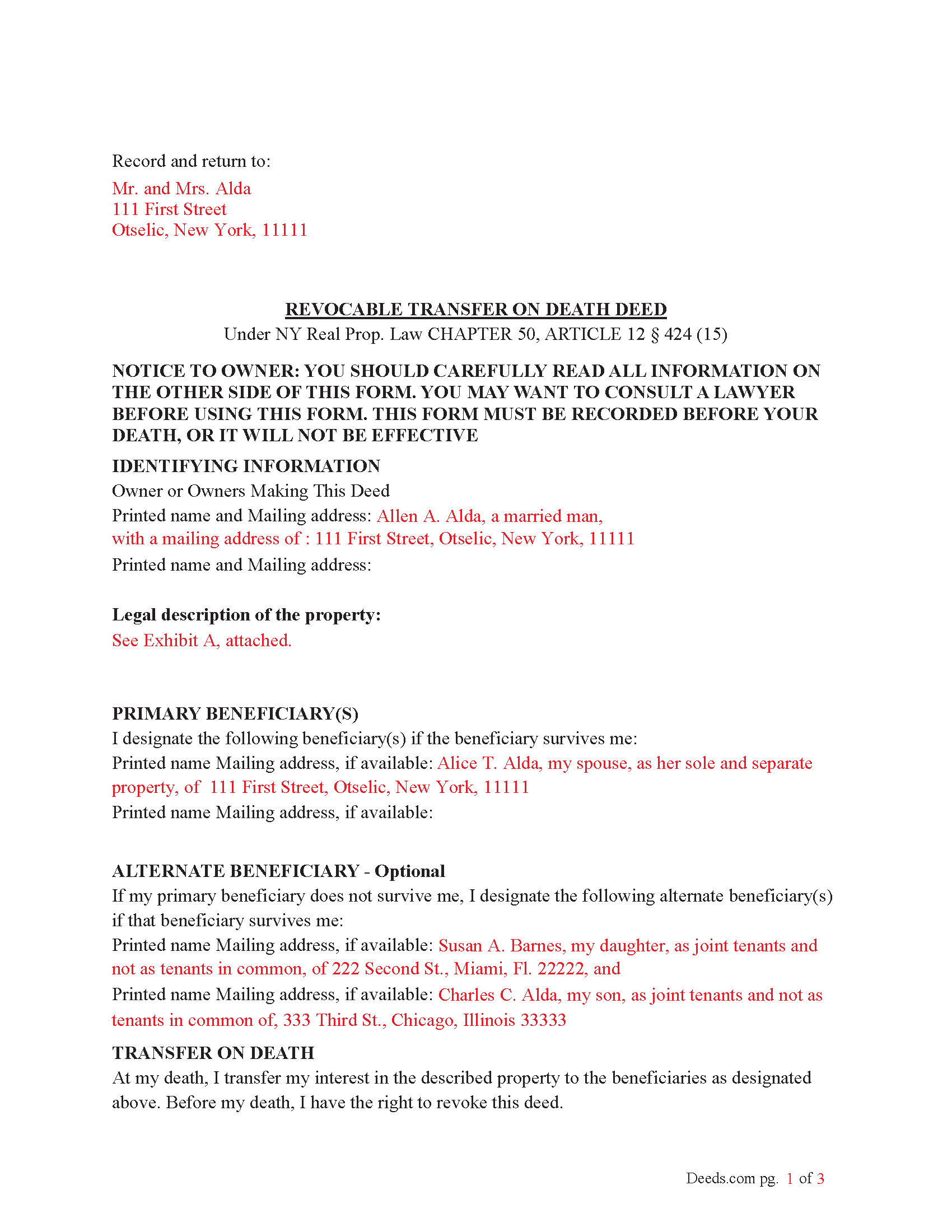

Rensselaer County Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Rensselaer County documents included at no extra charge:

Where to Record Your Documents

Rensselaer County Clerk

Troy, New York 12180

Hours: 9:00am to 5:00pm M-F

Phone: (518) 270-4080

Recording Tips for Rensselaer County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Rensselaer County

Properties in any of these areas use Rensselaer County forms:

- Averill Park

- Berlin

- Brainard

- Buskirk

- Castleton On Hudson

- Cherry Plain

- Cropseyville

- Eagle Bridge

- East Greenbush

- East Nassau

- East Schodack

- Grafton

- Hoosick

- Hoosick Falls

- Johnsonville

- Melrose

- Nassau

- North Hoosick

- Petersburg

- Poestenkill

- Rensselaer

- Sand Lake

- Schaghticoke

- Schodack Landing

- Stephentown

- Troy

- Valley Falls

- West Sand Lake

- Wynantskill

Hours, fees, requirements, and more for Rensselaer County

How do I get my forms?

Forms are available for immediate download after payment. The Rensselaer County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rensselaer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rensselaer County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rensselaer County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rensselaer County?

Recording fees in Rensselaer County vary. Contact the recorder's office at (518) 270-4080 for current fees.

Questions answered? Let's get started!

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Important: Your property must be located in Rensselaer County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Rensselaer County.

Our Promise

The documents you receive here will meet, or exceed, the Rensselaer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rensselaer County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Brennan H.

October 4th, 2023

I had worked for a couple of months sending things back and forth to the county and still had no success. I decided to use deeds.com and it was all done in a few hours. Such a relief! While I find this to be wrong and the county should work with property owners as well as they work with third parties, I was still grateful for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Rosie M.

March 13th, 2025

I found exactly what I was looking for, and the documents are a complete package. Great service!

Thank you, Rosie! We're so glad you found exactly what you needed and that the documents met your expectations. We appreciate your kind words and your support! If you ever need anything else, we're here to help.

James C.

December 28th, 2021

Worked well.

Thank you!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joyce D.

January 27th, 2019

Good after I figured out the form process. Hopefully I won't be charged for two as I redid the request thinking I might have made a mistake in the first request.

Thank you for your feedback Joyce. We have reviewed your account and there have been no duplicate orders submitted. Have a great day!

Matthew L.

September 15th, 2022

I would make just two suggestions. (1) Create and example showing multiple grantor(s) and (2) In the same example, show where and estate is conveyed to two or more people. It would help in knowing the correct format.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenia B.

August 31st, 2020

Very convenient and efficient. I will recommend it, definitely.

Thank you!

Janet R.

October 21st, 2019

The site was easy to navigate...all the information needed to fill in the forms was included, which was very helpful and a pleasant surprise...form completed in short order...made taking care of business quick and easy...Thanks for the thoughtful and excellent help, I will share the link with others and I will use the site again...Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

January 11th, 2023

It was a seamless process, inexpensive, and probably saved me thousands by having an attorney draw this same form us. Highly recommend!

Thank you!

Helen M.

April 13th, 2023

All forms were exactly what I needed. Thank you Immediate, smoothly downloaded and printed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Suzanne D.

January 7th, 2019

Information found, thank you. I own Ground Rent on property and needed to know name of property owner and address for mailing bill.

Thank you!

Michael F.

March 12th, 2020

Very useful and right at your fingers when you need a form. Recommend these forms highly. Thank you!!!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diana H.

February 10th, 2019

little expensive same document in other county is free. however quite fast in responding. and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SHALINI W.

August 24th, 2020

Exceptionally easy to use. Very user friendly. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kwaku A.

May 27th, 2021

Excellent service ! Came through in the clutch! Easy to use and understand ! Exceptional service ! 10/10

Thank you!