Wyoming County Transfer on Death Deed Form

Wyoming County Transfer on Death Deed Form

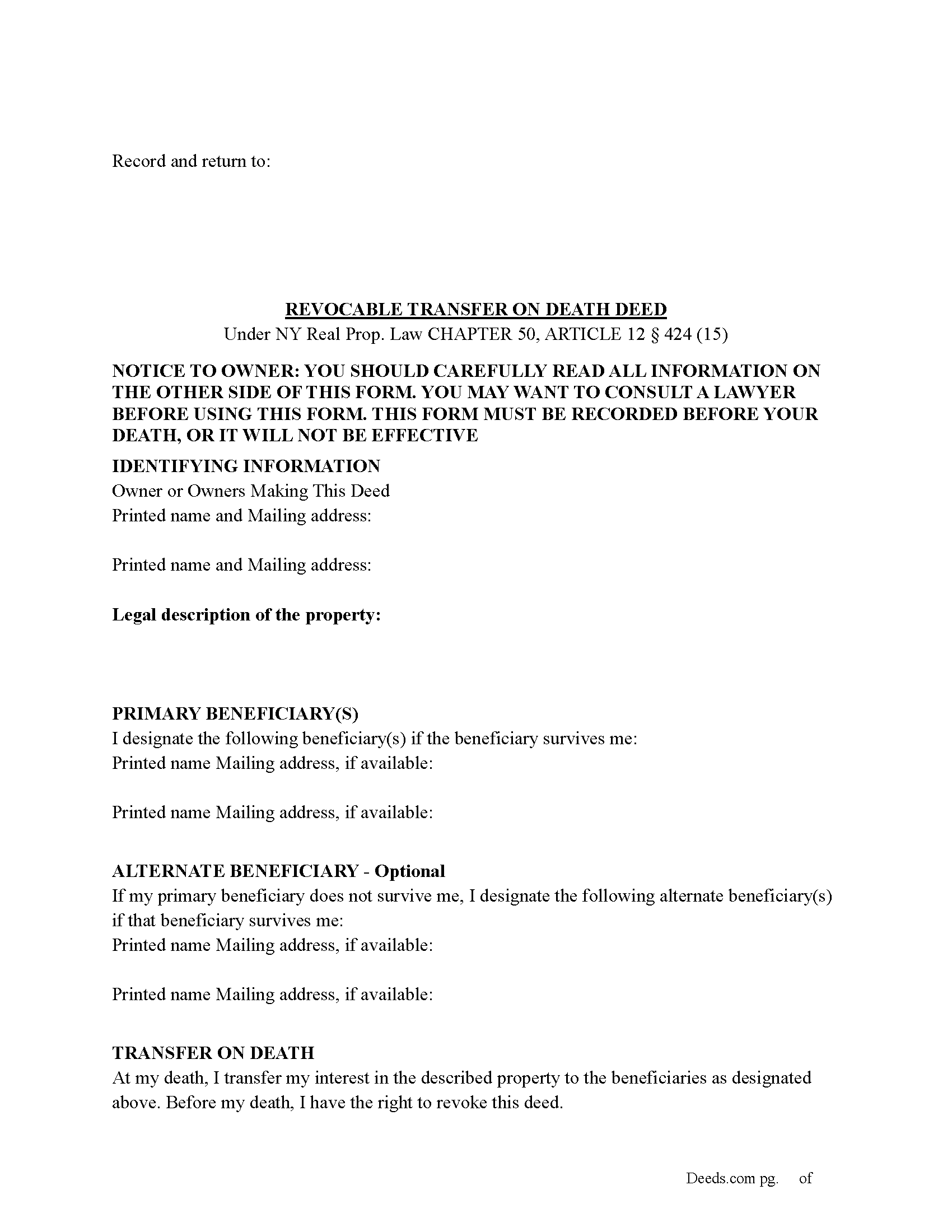

Fill in the blank Transfer on Death Deed form formatted to comply with all New York recording and content requirements.

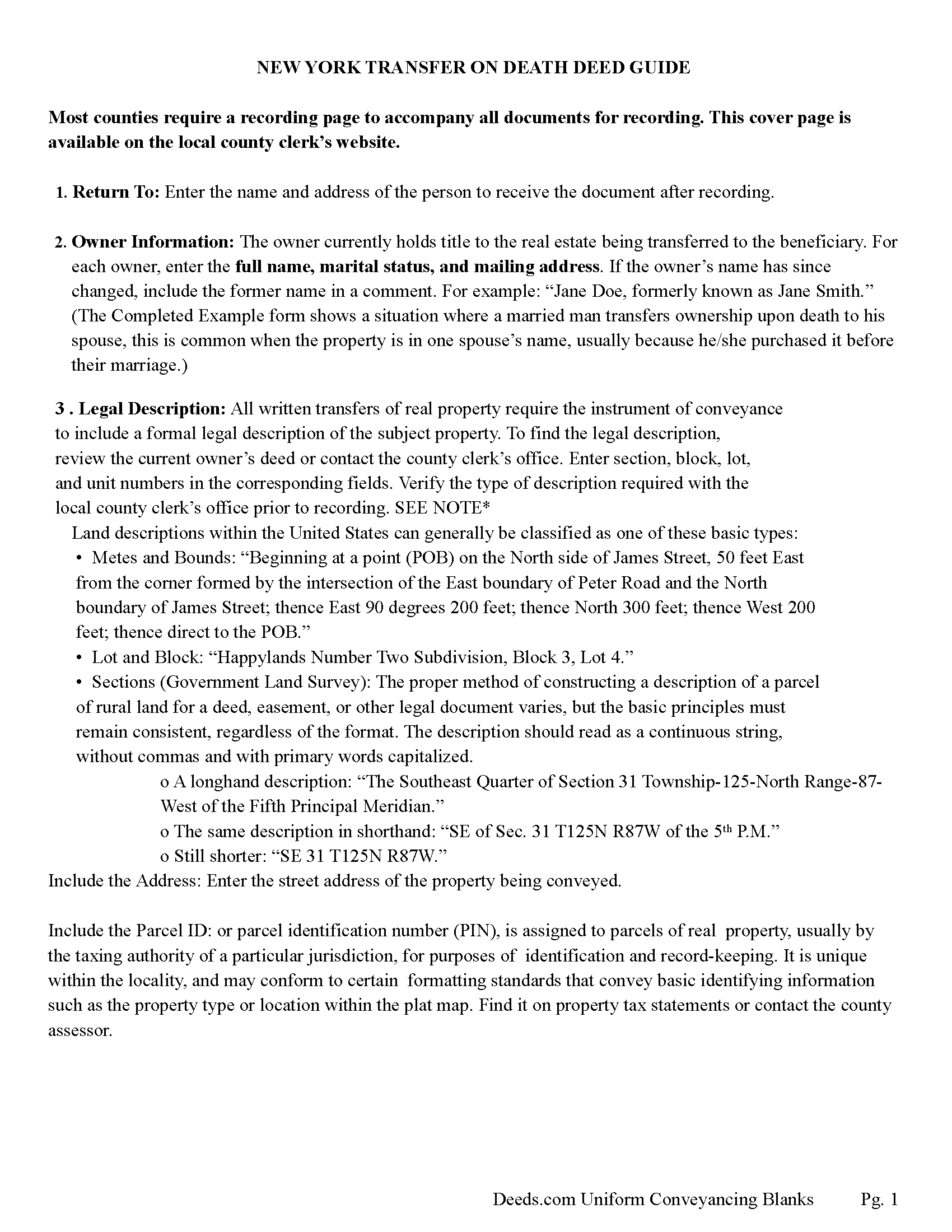

Wyoming County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

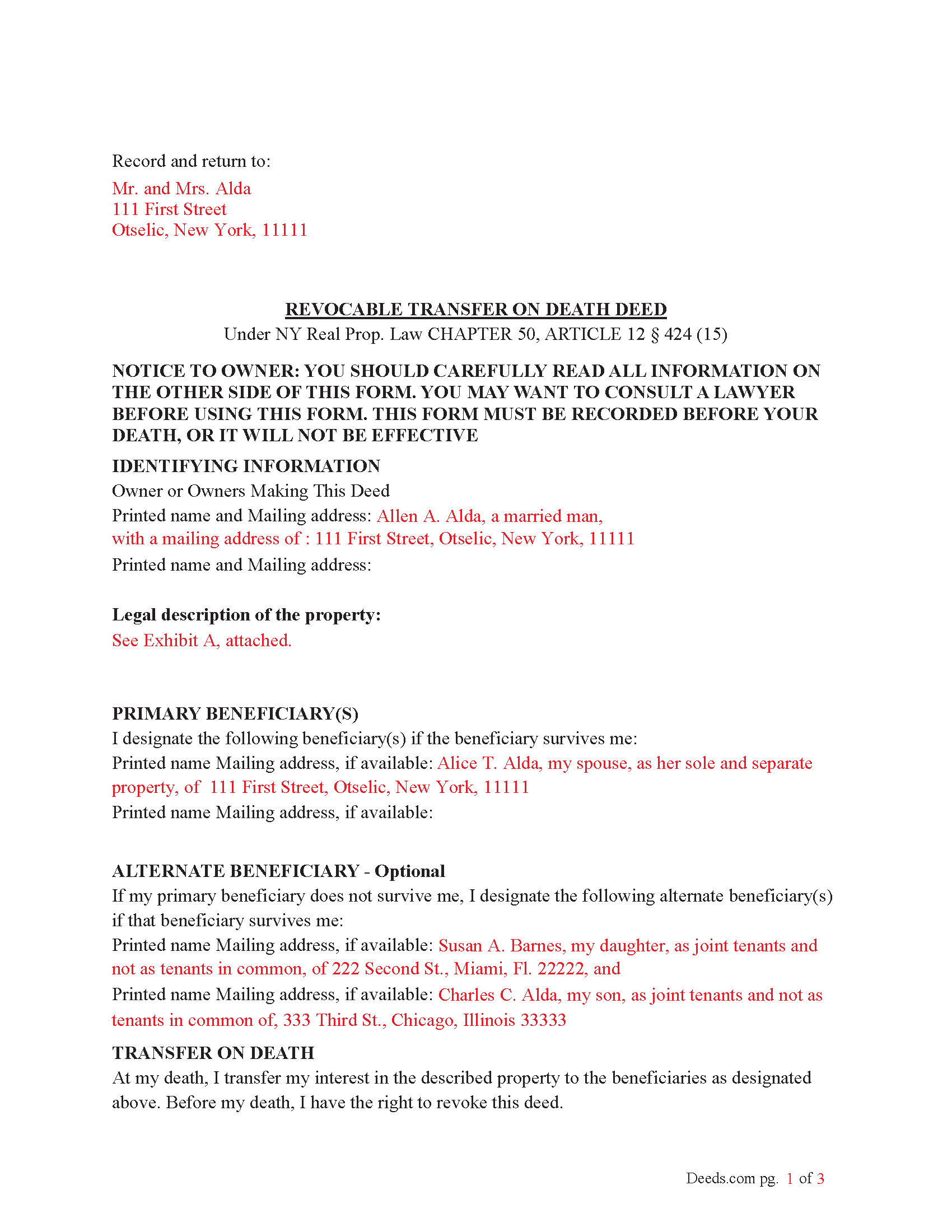

Wyoming County Completed Example of the Transfer on Death Deed Document

Example of a properly completed New York Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional New York and Wyoming County documents included at no extra charge:

Where to Record Your Documents

Wyoming County Clerk

Warsaw, New York 14569

Hours: 9:00 am to 5:00 pm Monday - Friday / Recording until 4:30 pm

Phone: (585) 786-8810

Recording Tips for Wyoming County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Wyoming County

Properties in any of these areas use Wyoming County forms:

- Arcade

- Attica

- Bliss

- Castile

- Cowlesville

- Dale

- Gainesville

- Java Center

- Java Village

- North Java

- Perry

- Pike

- Portageville

- Silver Lake

- Silver Springs

- Strykersville

- Varysburg

- Warsaw

- Wyoming

Hours, fees, requirements, and more for Wyoming County

How do I get my forms?

Forms are available for immediate download after payment. The Wyoming County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wyoming County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wyoming County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wyoming County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wyoming County?

Recording fees in Wyoming County vary. Contact the recorder's office at (585) 786-8810 for current fees.

Questions answered? Let's get started!

To use the Transfer on Death (TOD) Deed under New York’s Real Property Law (RPP) CHAPTER 50, ARTICLE 12 § 424 (effective July 19, 2024), follow these steps:

1. Complete the TOD Deed

Designate a beneficiary: Clearly name the individual or entity (such as a charity or trust) who will inherit your property upon your death.

Include contingent beneficiaries if desired (NOT required). These are backup beneficiaries who would inherit the property if your primary beneficiary cannot (e.g., if they predecease you). Ensure the deed is filled out correctly, including the legal description of the property.

2. Execute the TOD Deed: The TOD deed must be signed by the property owner (the transferor) in the presence of two witnesses and a Notary Public. The witnesses should not be the beneficiaries themselves, as this could raise legal issues.

3. Record the TOD Deed: The completed deed must be recorded with the County Clerk's office where the property is located during your lifetime. Recording the deed is crucial because, without it, the transfer will not be valid upon your death.

4. Retain Ownership During Lifetime: After recording the TOD deed, you retain full control of the property during your lifetime. You can still sell, mortgage, or revoke the TOD deed at any time.

If you change your mind, you can revoke the TOD deed by filing a revocation form or executing a new TOD deed, which automatically invalidates the previous one.

5. Upon Your Death: Upon your death, the property automatically transfers to the designated beneficiary without going through probate.

Key points about when it takes effect:

Timing of Transfer: The deed only takes effect upon the death of the property owner. Until then, the owner retains full control over the property and can revoke or change the TOD deed at any time.

Recording Requirement: For the TOD deed to be valid, it must be recorded with the county clerk during the property owner's lifetime. If the deed is not recorded before death, it will not be effective.

Probate Avoidance: By using a TOD deed, the property passes directly to the named beneficiary without going through probate, simplifying the transfer process and reducing legal costs.

Important: Your property must be located in Wyoming County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Wyoming County.

Our Promise

The documents you receive here will meet, or exceed, the Wyoming County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wyoming County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Rachel S.

January 25th, 2021

It would be nice to get a reply in a small window that says "Your request package has been submitted." That way I can log out and wait for the email. I do love the efficient service.

Thank you!

Maria-Luisa: M.

February 24th, 2021

So far so good!

Thank you!

Karl H.

January 5th, 2021

Still in process, but it is well explained. I would recommend it to anyone in Texas.

Thank you for your feedback. We really appreciate it. Have a great day!

fran g.

April 25th, 2021

To hard for me. But with that being said it's a great option for most people.

Thank you!

Lisa M.

August 30th, 2023

Awesome and so easy to use!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna R.

February 10th, 2021

Great service. Just started using Deeds.com yesterday. So far, so good.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa C.

July 2nd, 2020

Great. Thank you. Received information quickly. Helped out a lot.

Thank you!

Carol N.

September 11th, 2019

Not helpful couldn't find anything

Thank you for your feedback Carol. Sorry to hear that you could not find what you were looking for. Have a wonderful day.

Samantha A.

April 19th, 2023

This company is a super time saver for our firm and our client! Their website was easy to use and their staff was fast and efficient. Their fees are very reasonable. I would most certainly use their services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ismael T.

January 19th, 2021

I was surprised and how quickly you guys process documents and helped on a mistake I had. Thank so much. I will definitely keep using Deeds.com

Thank you!

jim g.

June 4th, 2020

so far so good. was hoping to have the recorded document already. i need the recorded document by friday, june 5th for my city approval. anyway you can please get it to me tomorrow. thanks, jim

Thank you!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

DIANE S.

June 6th, 2020

I received my report pretty quick! Had info that I needed. Thank you!

Thank you!

Nathan M.

April 6th, 2020

It had the info, but when I would type into the document the items I needed in adobe all that would print out was the info I typed and none of the document information.

Thank you!

Lillian D.

May 24th, 2020

I found the deeds.com site easy to use and very up to date. I am a senior citizen and not very tek inclined but I was able to reach the goal that I was seeking. I would use it again if the need arrived.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!