Wake County Appointment of Substitute Trustee Form (North Carolina)

All Wake County specific forms and documents listed below are included in your immediate download package:

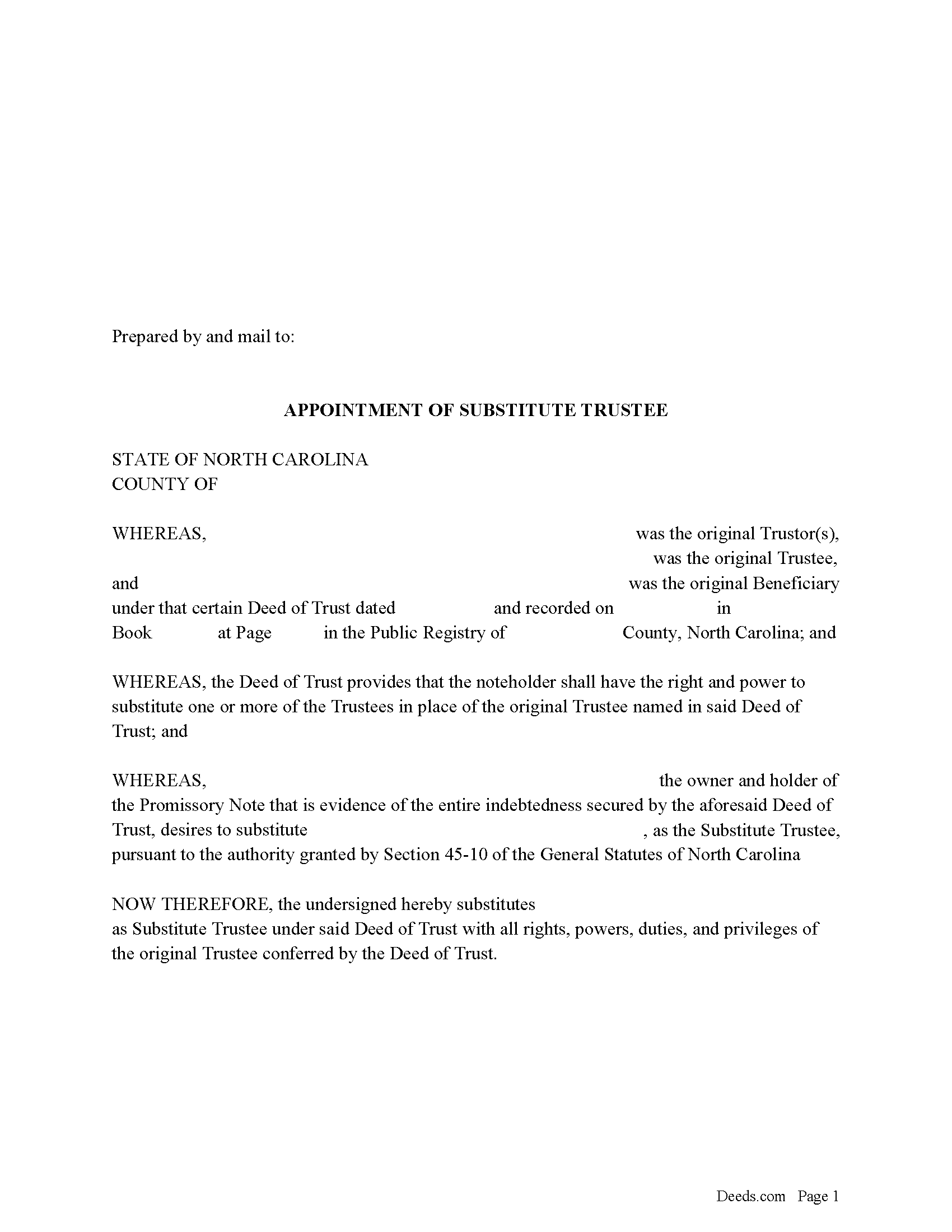

Appointment of Substitute Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Wake County compliant document last validated/updated 4/29/2025

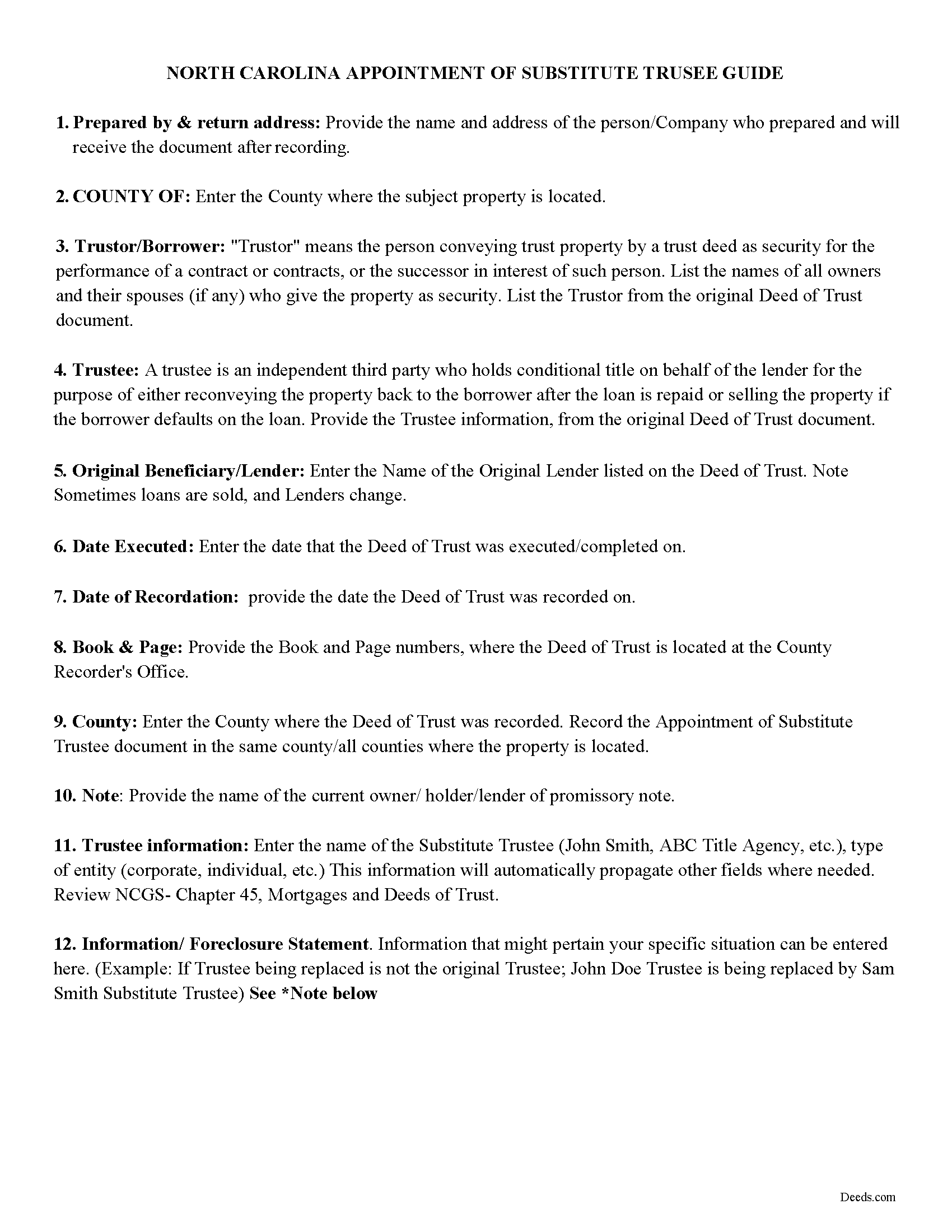

Appointment of Substitute Trustee Guidelines

Line by line guide explaining every blank on the form.

Included Wake County compliant document last validated/updated 6/2/2025

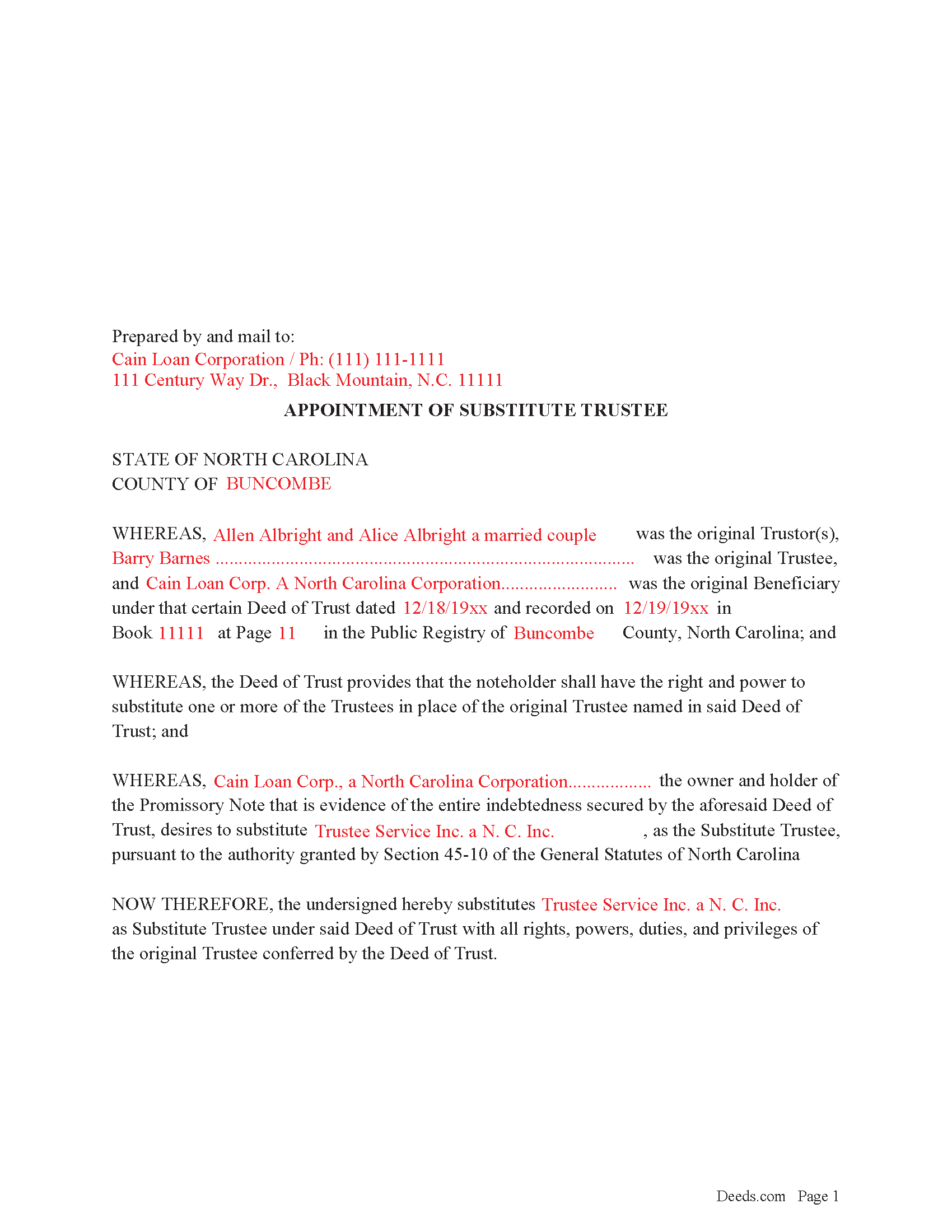

Completed Example of the Appointment of Substitute Trustee Form

Example of a properly completed form for reference.

Included Wake County compliant document last validated/updated 5/2/2025

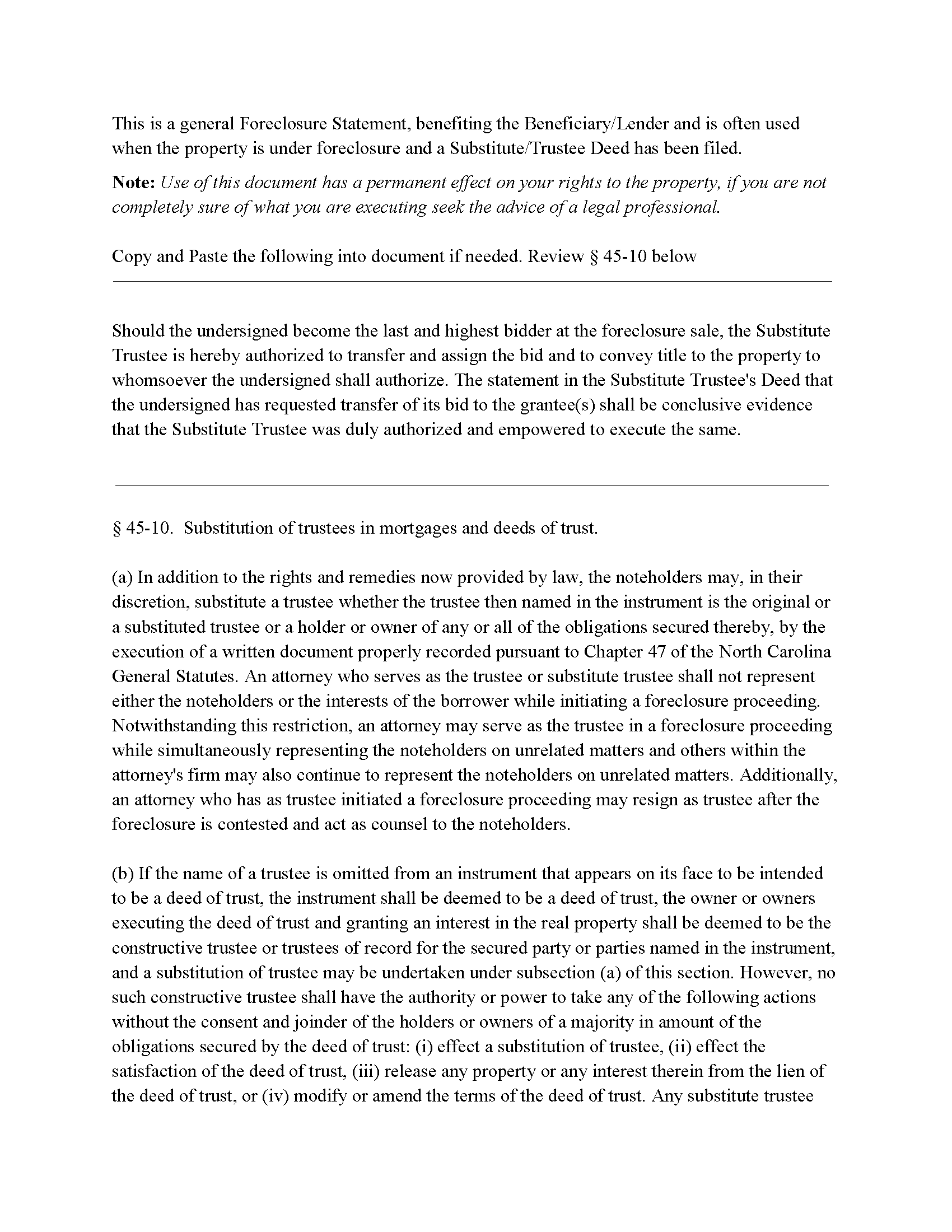

Foreclosure Clause

Clause that can be added to the form, if foreclosure is involved.

Included Wake County compliant document last validated/updated 4/29/2025

The following North Carolina and Wake County supplemental forms are included as a courtesy with your order:

When using these Appointment of Substitute Trustee forms, the subject real estate must be physically located in Wake County. The executed documents should then be recorded in one of the following offices:

Wake County Register of Deeds

300 S. Salisbury St., Suite 1700, Raleigh, North Carolina 27601

Hours: 8:30 to 4:45

Phone: (919) 856-5460

Mailing Address

P.O. Box 1897, Raleigh, North Carolina 27602

Hours: N/A

Phone: N/A

Local jurisdictions located in Wake County include:

- Apex

- Cary

- Fuquay Varina

- Garner

- Holly Springs

- Knightdale

- Morrisville

- New Hill

- Raleigh

- Rolesville

- Wake Forest

- Wendell

- Willow Spring

- Zebulon

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Wake County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Wake County using our eRecording service.

Are these forms guaranteed to be recordable in Wake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wake County including margin requirements, content requirements, font and font size requirements.

Can the Appointment of Substitute Trustee forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wake County that you need to transfer you would only need to order our forms once for all of your properties in Wake County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by North Carolina or Wake County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Wake County Appointment of Substitute Trustee forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

In a Deed of Trust, the trustee is an independent third party who holds conditional title on behalf of the lender for the purpose of either reconveying the property back to the borrower after the loan is repaid or selling the property if the borrower defaults on the loan. Trustee's can be replaced for many reasons, incapacity, incompetency, death, etc. Often a lender will substitute a trustee with a firm or corporation that will be conducting a foreclosure.

NCG 45-10. States:

In addition to the rights and remedies now provided by law, the noteholders may, in their discretion, substitute a trustee whether the trustee then named in the instrument is the original or a substituted trustee or a holder or owner of any or all of the obligations secured thereby, by the execution of a written document properly recorded pursuant to Chapter 47

This form is executed by the beneficiary/lender for the substitution of a trustee, it includes an optional foreclosure clause if needed for that purpose.

(North Carolina AOST Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Wake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wake County Appointment of Substitute Trustee form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4560 Reviews )

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Loretta W.

June 26th, 2025

Thank you for your excellent service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberaley J.

May 24th, 2021

I had no problem printing out the forms, very easy. Also when I called, customer service was very helpful and very polite.

Thank you for that, have a great day.

Thank you!

Diana H.

February 10th, 2019

little expensive same document in other county is free. however quite fast in responding. and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kyle E.

November 8th, 2023

Works great thank you for saving us driving time!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara G.

May 12th, 2021

High rating, great site and forms were exactly what I needed. Thanks for being there for me.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda L.

July 7th, 2021

The service was excellent. The fee to use Deeds was more than I expected however, but the service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ROBERT B.

November 6th, 2020

The staff of DEEDS.COM is in a class of excellence all by themselves! From my own personal experience, I had multiple problems with some documents I was submitting. DEEDS.COM stayed with me and held my hand through the project until it was completed! I have never met the staff at DEEDS, but their personal service & professionalism make me feel like part of the DEEDS Family! If I ever need legal documents submitted to government agencies nationwide ever again, THE ONLY STOP ONLINE I WILL MAKE WILL BE DEEDS.COM!

Thank you for your feedback. We really appreciate it. Have a great day!

LEROY S.

March 8th, 2022

Thank you for your kind help. Great help.

VR

Roy F. Sutton

Thank you for your feedback. We really appreciate it. Have a great day!

Frank H.

September 22nd, 2022

Form and instructions were useful. But I suggest creating a form for transferring a deed pursuant to a trust. The existing form is based on a will going through probate so it doesn't fit the trust situation in some respects.

Thank you for your feedback. We really appreciate it. Have a great day!

FRANCIS P.

July 17th, 2022

Finding what I needed was easy. The payment process was easy. Using what I found was easy. Easy-peasy and GREAT results. Professional and succinct all for the price of a steak dinner. I'll be back to DEEDS.COM when I need any paperwork/forms related to deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Erika K.

July 3rd, 2020

Very Easy to use, especially since the county recorder's office is closed due to COVID-19

Thank you!

Kathy B.

April 19th, 2019

Used this service in 2016 and had NO problems with getting all the correct paperwork submitted and I would definitely recommend this company

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

April 15th, 2020

I am generally pleased with your products. However, I found it difficult to return to the package after accessing one selected document. One other comment: Your Trustee's Deed package should include a Certificate of Trust form.

Thank you for your feedback. We really appreciate it. Have a great day!