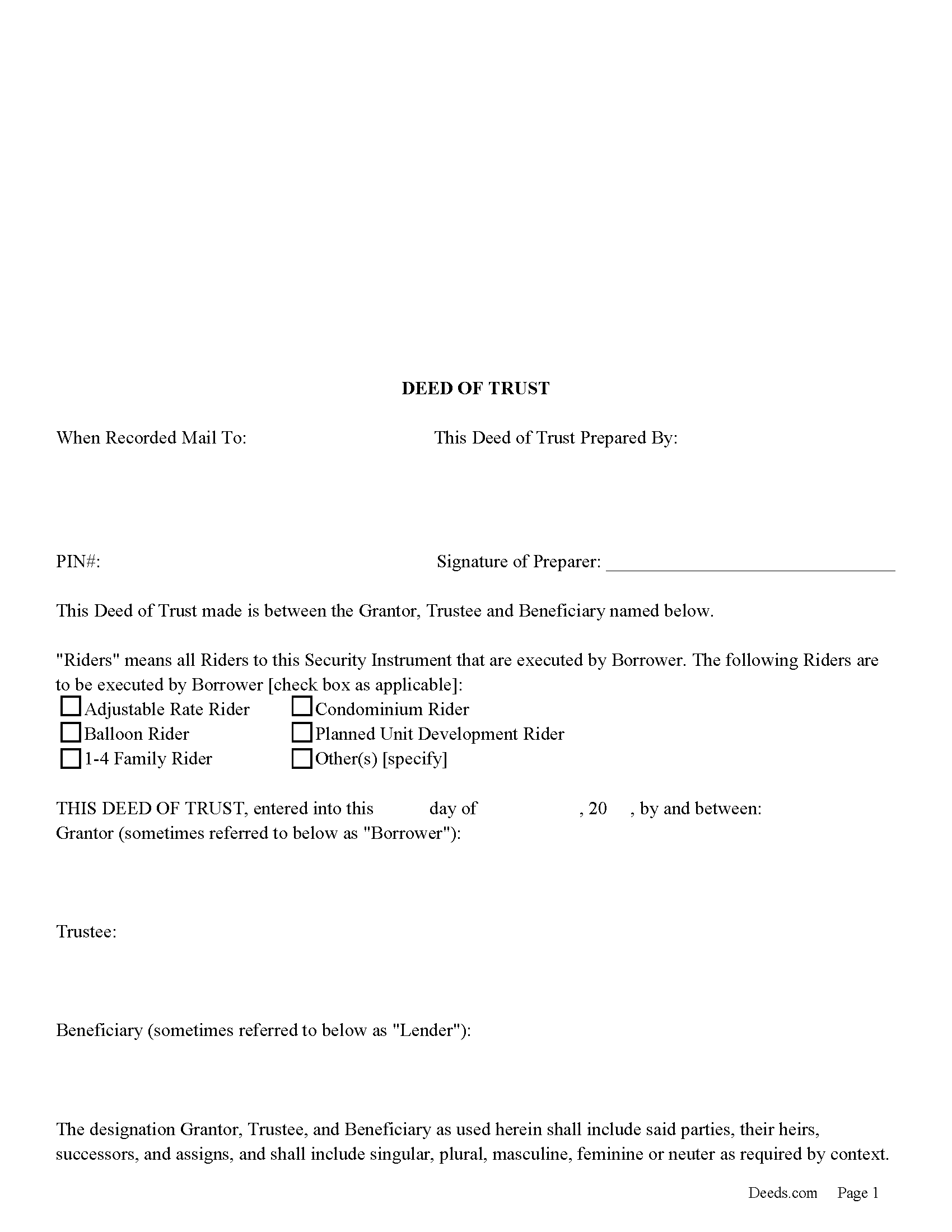

Warren County Deed of Trust Form

Warren County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

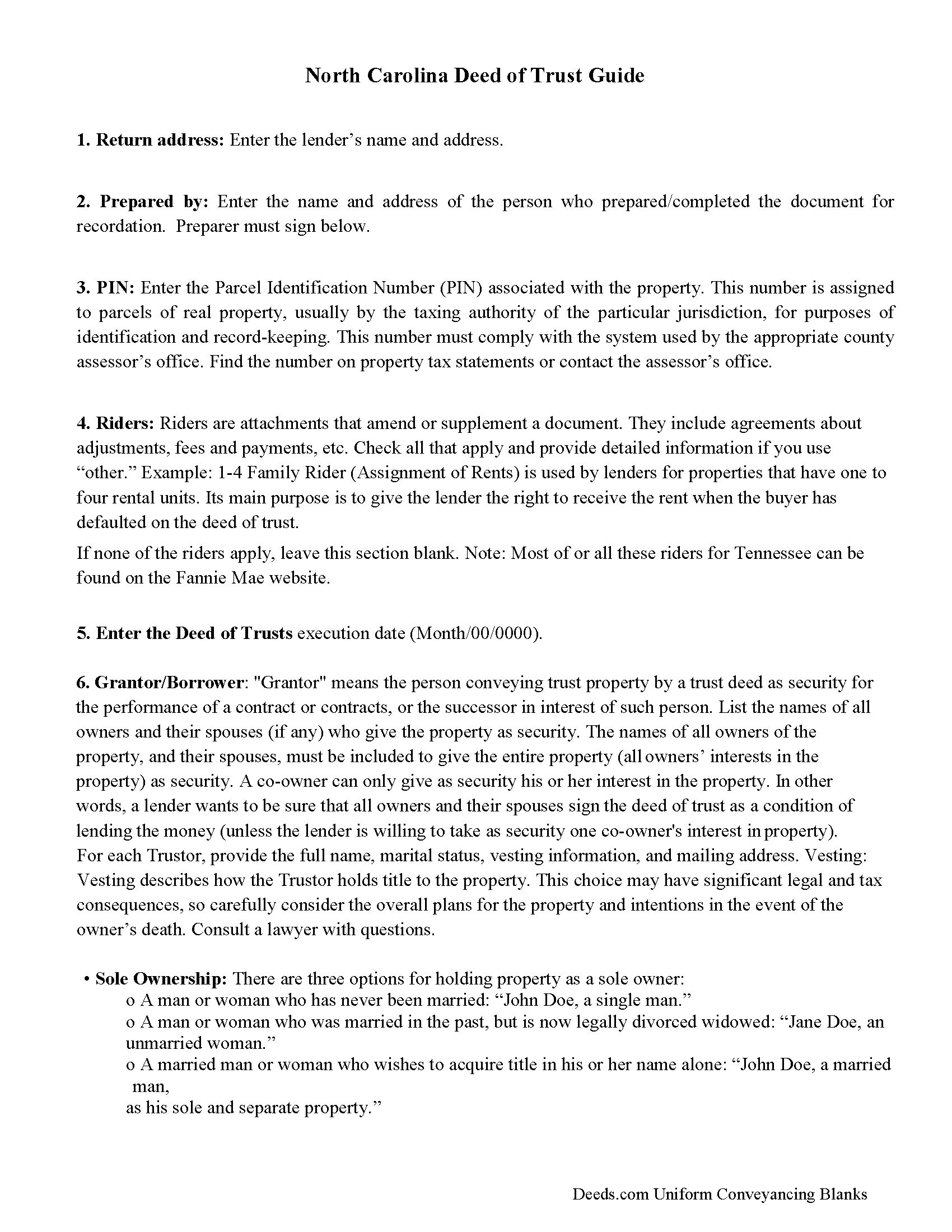

Warren County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

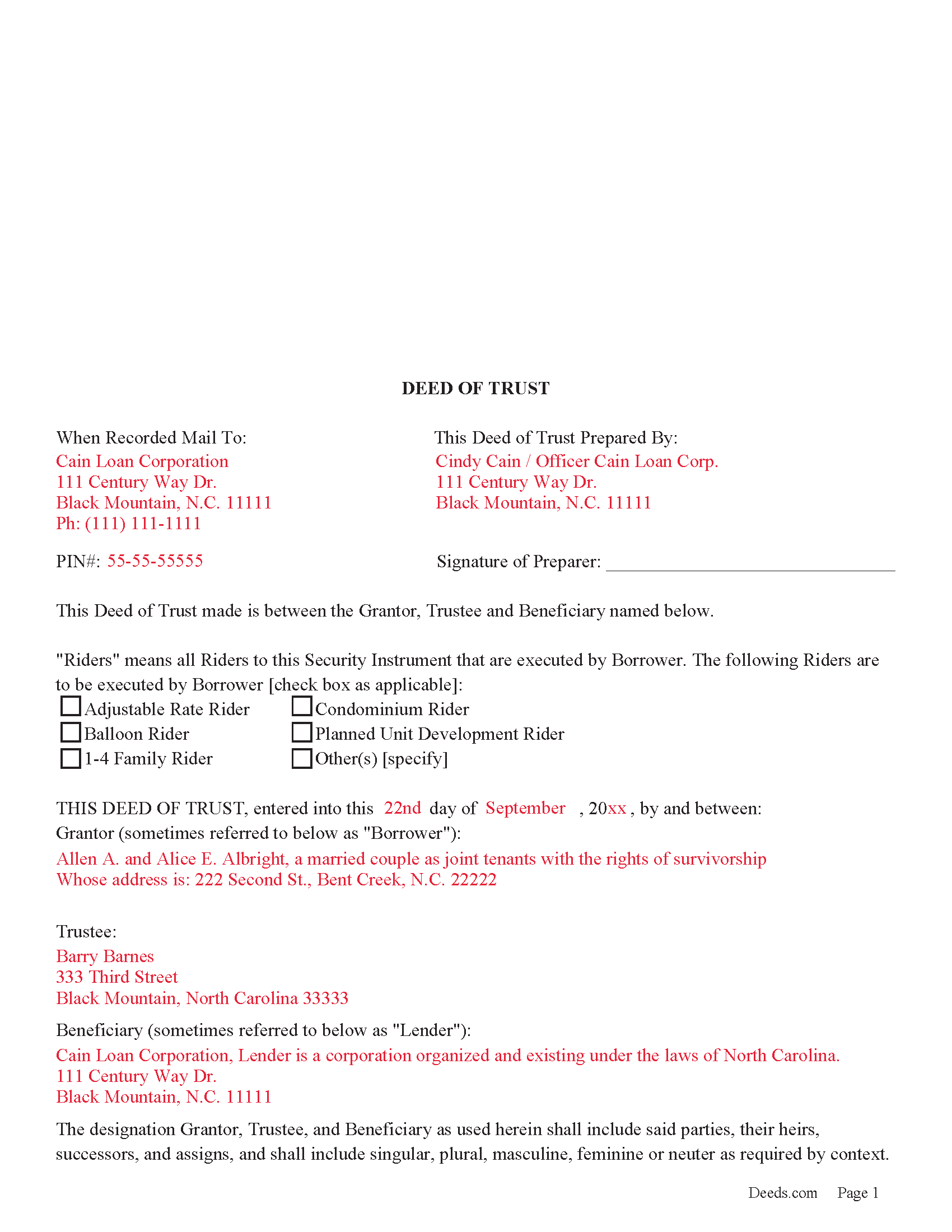

Warren County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

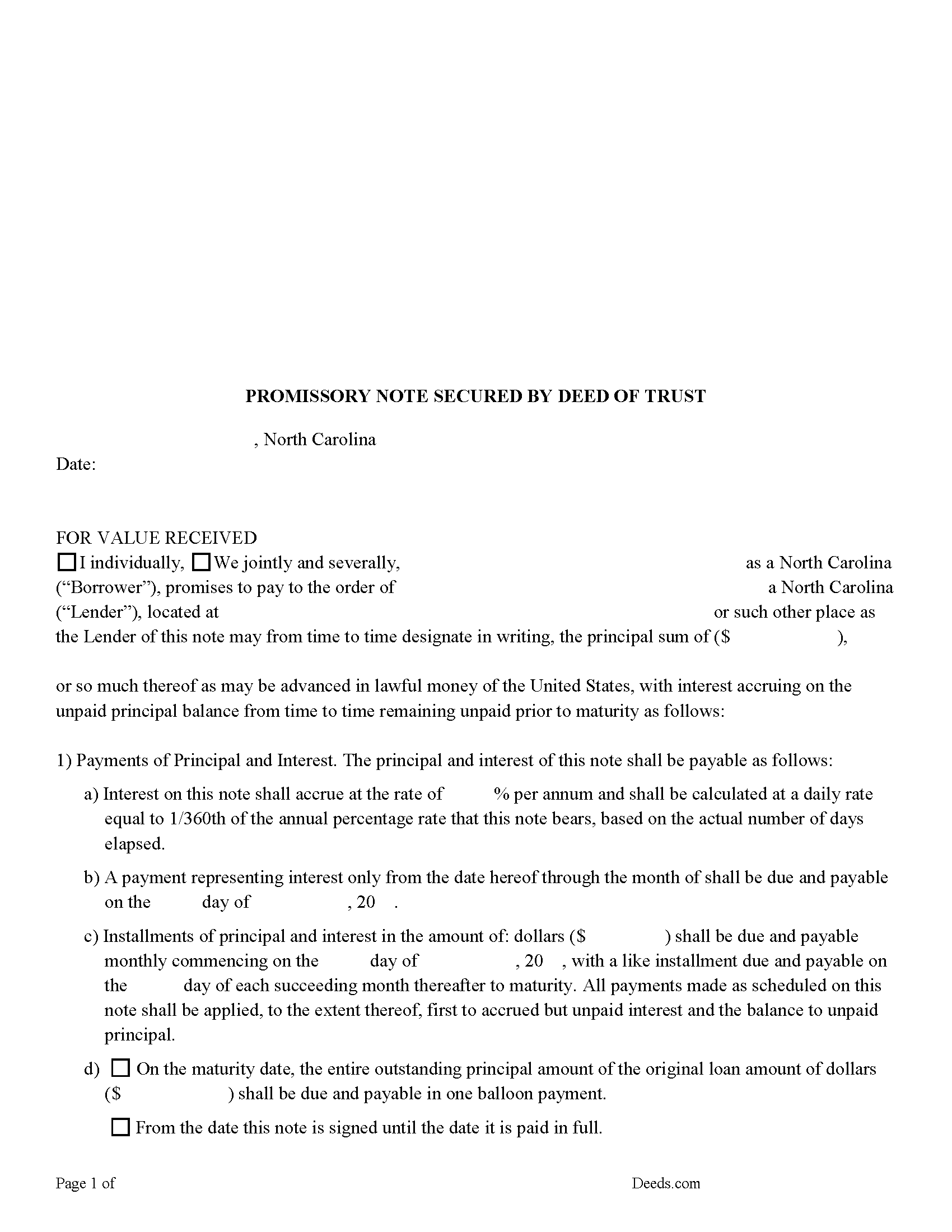

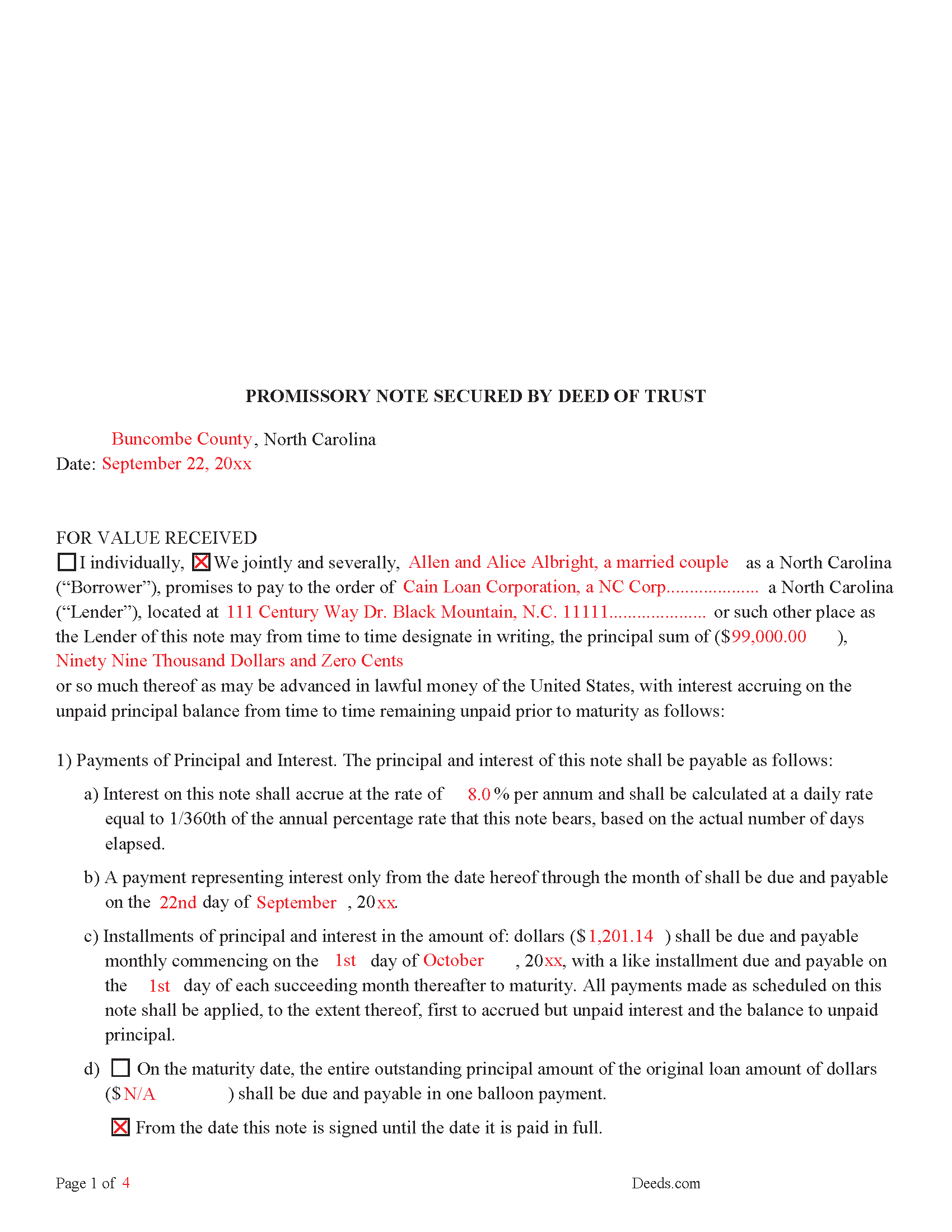

Warren County Promissory Note Form

Note that is secured by the Deed of Trust. Can be used for traditional installments or balloon payment.

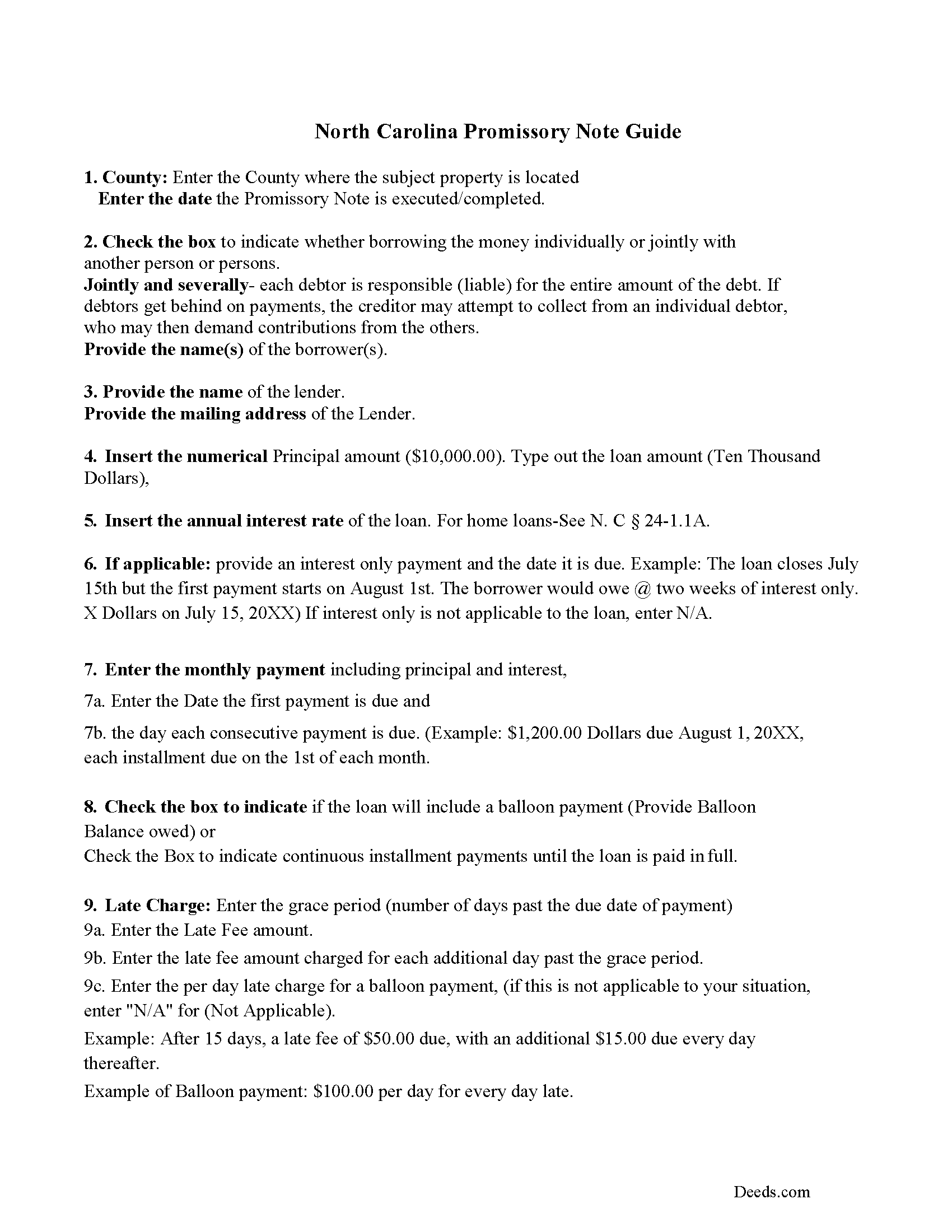

Warren County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Warren County Completed Example of the Promissory Note Document

This NC Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

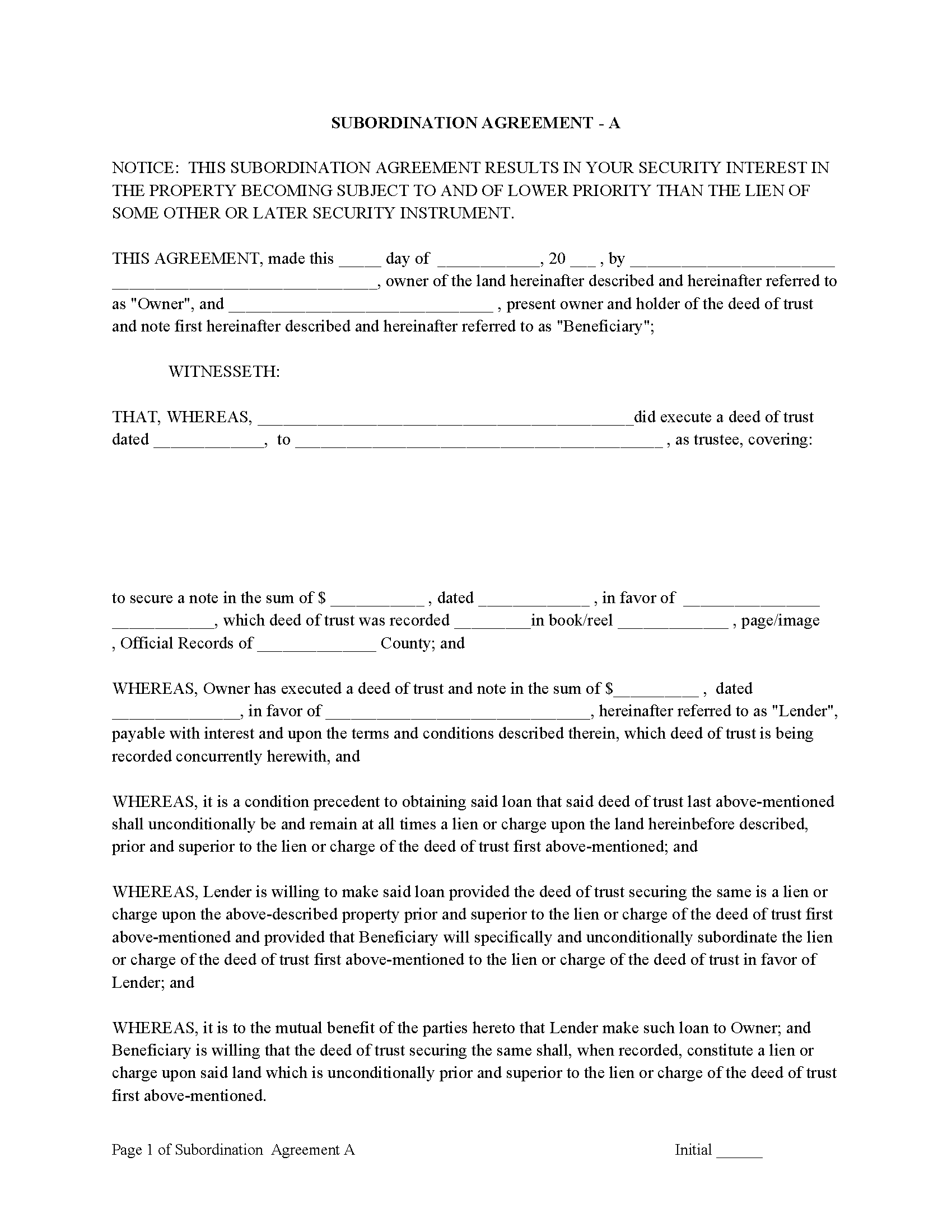

Warren County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

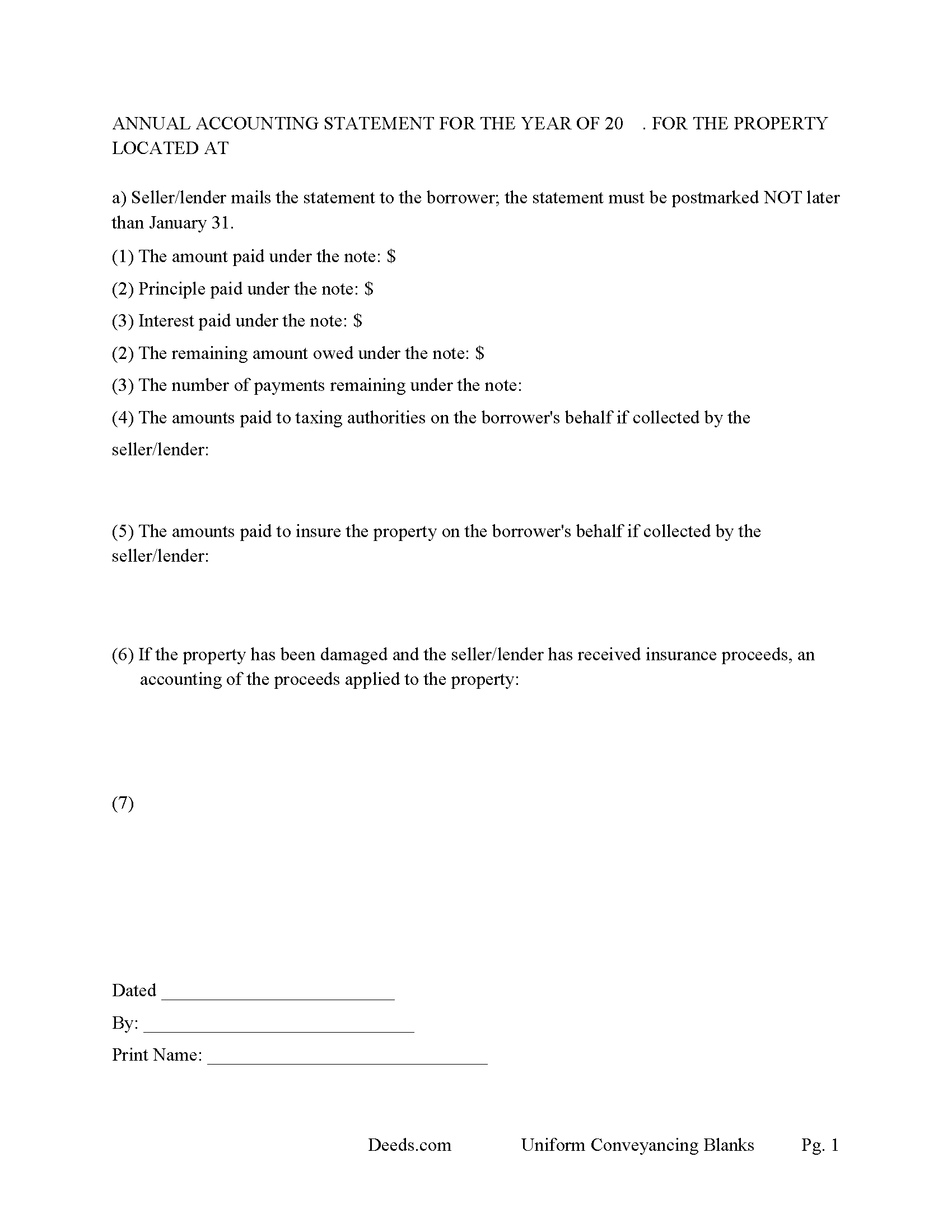

Warren County Annual Accounting Statement

Mail to borrower for fiscal year reporting.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Warren County documents included at no extra charge:

Where to Record Your Documents

Warren County Register of Deeds

Warrenton, North Carolina 27589

Hours: 8:30 to 5:00 M-F

Phone: (252) 257-3265

Recording Tips for Warren County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Warren County

Properties in any of these areas use Warren County forms:

- Macon

- Norlina

- Ridgeway

- Vaughan

- Warrenton

- Wise

Hours, fees, requirements, and more for Warren County

How do I get my forms?

Forms are available for immediate download after payment. The Warren County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Warren County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Warren County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Warren County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Warren County?

Recording fees in Warren County vary. Contact the recorder's office at (252) 257-3265 for current fees.

Questions answered? Let's get started!

A Deed of Trust is commonly used in North Carolina to secure a loan. Foreclosure can be done non-judicially, saving time and expense. This process is called a Foreclosure by action. The procedure for power of sale foreclosure is contained in Article 2A in Chapter 45 of the North Carolina General Statutes.

There are three parties in this Deed of Trust:

1- The Grantor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take an action against any person for damages.

This form can be used by a party selling/financing their own house, rental, condominium or small office building. A Promissory Note and Deed of Trust combined with stringent default terms, can be beneficial to the Lender. The Lender can choose whether the borrower must use the property as their primary residence for the term of the Loan. This can be advantageous for a someone selling a house. Take for example; the borrower moves out and rents the home to someone who diminishes its value or in the case of a small commercial space the Lender wouldn't want the borrower living there because of a financial stress.

The Trustee allows the Grantor/Borrower to collect rents until there is a default. Upon the occurrence of any such event of default, the permission given to Grantor/Borrower to collect such rents, income, maintenance fees and other benefits from the property shall automatically terminate. This can be powerful tool for the Beneficiary/Lender.

The Beneficiary/Lender or Trustee shall have the right and license to go on and into the Subject Real Property to inspect it in order to determine whether the provisions of the Deed of Trust are being kept and performed. This is important because Grantor/Borrower shall take reasonable care of the Subject Real Property and shall maintain them in good repair and condition.

(North Carolina DOT Package includes form, guidelines, and completed example)

Important: Your property must be located in Warren County to use these forms. Documents should be recorded at the office below.

This Deed of Trust meets all recording requirements specific to Warren County.

Our Promise

The documents you receive here will meet, or exceed, the Warren County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Warren County Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Charlotte V.

June 13th, 2024

t was a bit confusing at first. I am really old though. It was fairly easy to use. I will continue to use Deeds. com for all my future needs. Thank you Deeds.com for making life so much easier.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Ismael T.

January 19th, 2021

I was surprised and how quickly you guys process documents and helped on a mistake I had. Thank so much. I will definitely keep using Deeds.com

Thank you!

Arturo P.

August 16th, 2021

Super easy to use! Totally satisfied. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Earl L.

February 13th, 2019

Fair!

Thank you!

Georgana T.

May 28th, 2019

Not clear information on ownership, which is what I wanted.

Sorry to hear that we were unable to find the information you need Georgana. Your account has been credited. Have a wonderful day.

Toni C.

June 10th, 2021

The system was simple to use. The rep that answered my questions could have been a little more forthcoming, but that being said I would use the service again.

Thank you!

Laurie S.

May 24th, 2023

This was amazingly easy to access.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim K.

December 16th, 2021

Looks like it will be helpful in preparing deeds for distant counties

Thank you!

Amy R.

November 18th, 2021

Great personal support via messaging. Website confusing and broken links in emails.

Thank you!

Gretchen R.

November 13th, 2019

I can't think of any suggestions for improvement. The documents I needed were readily available. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Steven S.

June 22nd, 2020

Very convenient and great tool for my real estate business. I'm a fan and will be a repeat customer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara E.

March 7th, 2023

The online forms were very helpful and self-explanatory. My husband and I used several as we completed our estate planning documents. Thank you for these forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Fred B.

May 19th, 2020

Great site and very easy to use. I will be using this for all of my search and form requirements.

Thank you for your feedback. We really appreciate it. Have a great day!

Devra R.

May 30th, 2022

A refreshingly easy service to use. They offer auxiliary forms as a courtesy. Theres no "gotcha" capitalism. You pay the reasonable fee and the needed forms are accessible instantly to download. I've used it twice so far and it worked perfectly!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael L. G.

October 1st, 2022

Thank you, Deed.com provided the needed forms to change county and state information after the passing of my father, saved me a trip to law office, especially after the lawyers would not return my calls, so I would recommend you check Deed.com for information, saved my family money for lawyer fees, would use Deed.com again. Mike

Thank you for your feedback. We really appreciate it. Have a great day!