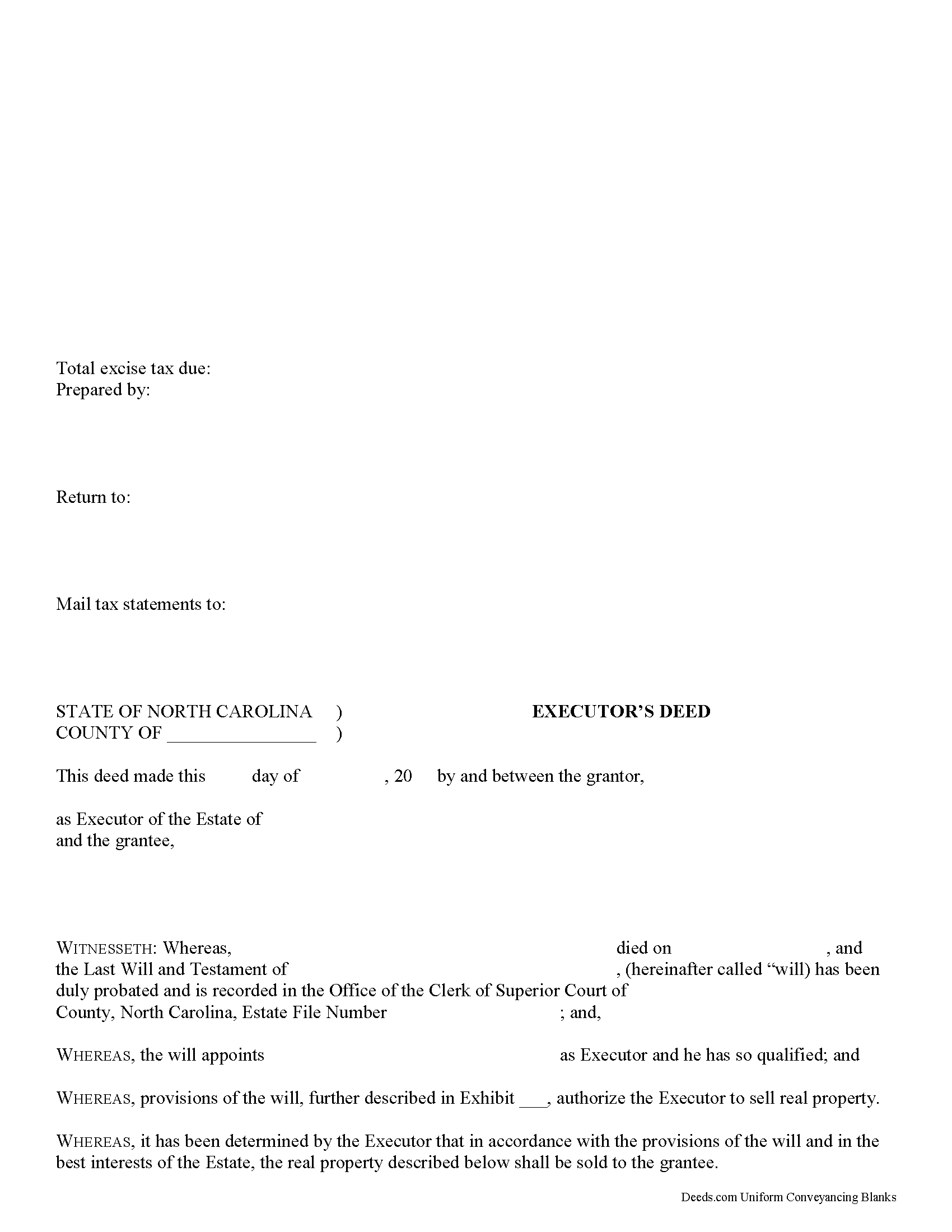

Bladen County Executor Deed Form

Bladen County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

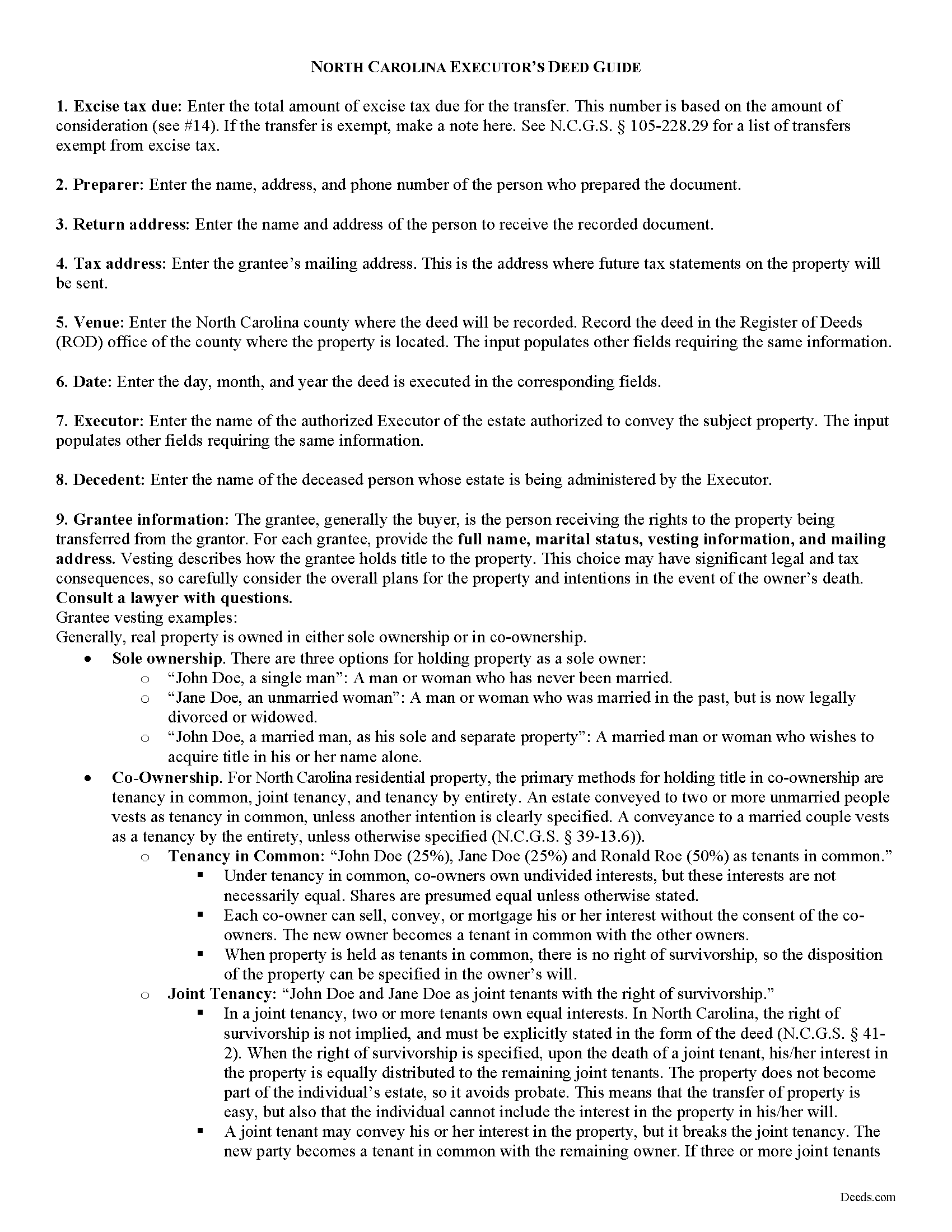

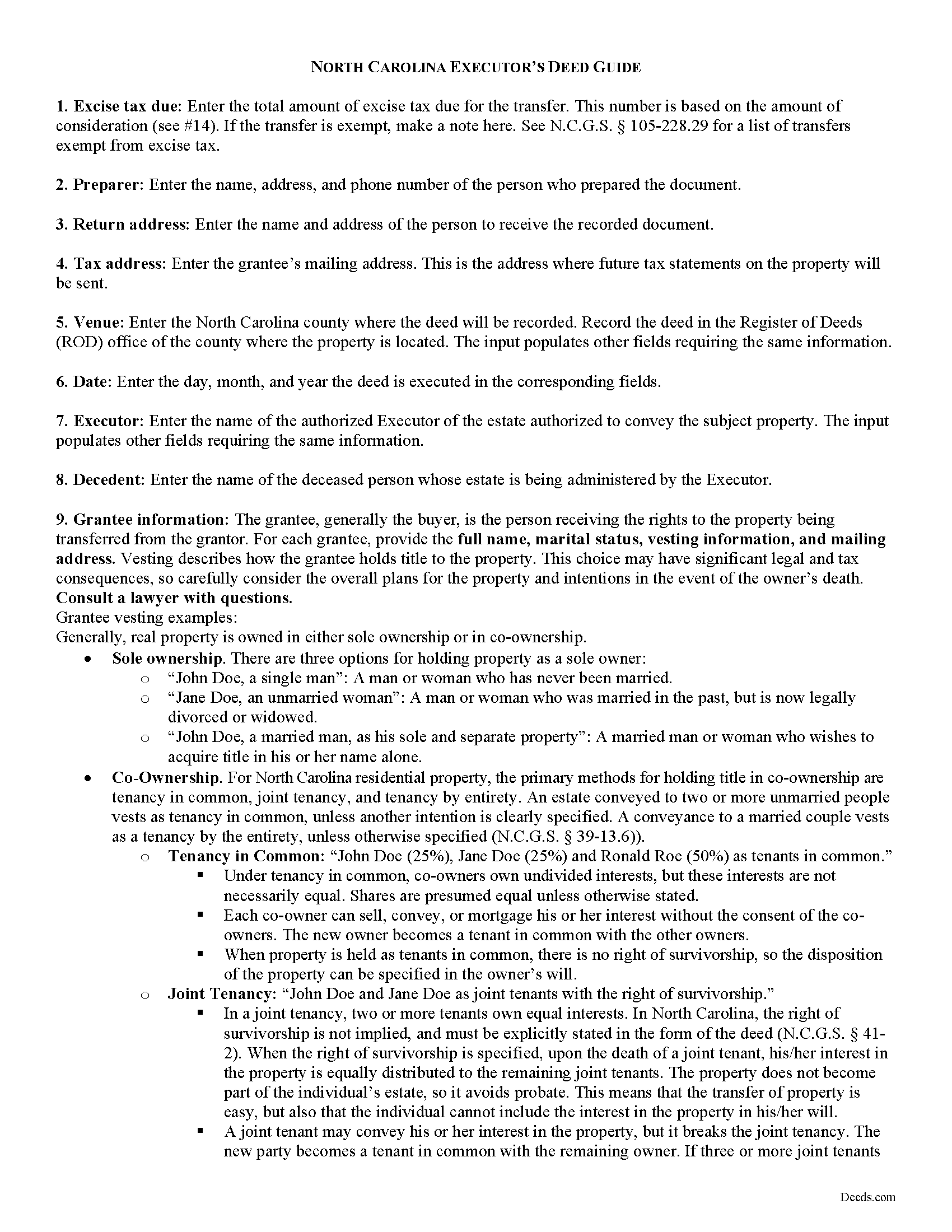

Bladen County Executor Deed Guide

Line by line guide explaining every blank on the form.

Bladen County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Bladen County documents included at no extra charge:

Where to Record Your Documents

Bladen County Register of Deeds

Elizabethtown, North Carolina 28337

Hours: 8:30am-5:00pm M-F

Phone: (910) 862-6710

Recording Tips for Bladen County:

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Bladen County

Properties in any of these areas use Bladen County forms:

- Bladenboro

- Clarkton

- Council

- Dublin

- Elizabethtown

- Kelly

- Tar Heel

- White Oak

Hours, fees, requirements, and more for Bladen County

How do I get my forms?

Forms are available for immediate download after payment. The Bladen County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bladen County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bladen County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bladen County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bladen County?

Recording fees in Bladen County vary. Contact the recorder's office at (910) 862-6710 for current fees.

Questions answered? Let's get started!

Probate is the legal process of proving a decedent's (deceased person's) will, if any, valid and settling his or her estate. An executor is the personal representative named in the decedent's will to administer his or her estate.

When the estate's assets are not sufficient to pay debts, the executor may need to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is typically required to bring the property into the estate.

Under N.C.G.S. 28A-15-1(c), a special proceeding before the clerk of superior court is not required for a sale by a personal representative made pursuant to authority given by a will, which permission may include a general provision granting authority to the personal representative to sell the testator's real property, or incorporation by reference of the provisions of N.C.G.S. 32-27(2).

An executor's deed is an instrument executed by the executor of the decedent's will to convey an interest in real property from a testate estate (so called when the decedent leaves a will) to a purchaser. Personal representatives' deeds typically carry limited warranties of title, commensurate with the office of a fiduciary. This means that the executor covenants that he has not placed or suffered to be placed any presently existing liens or encumbrances on the property conveyed, and warrants and defends the title against the lawful claims of all persons claiming by, through, under, or on account of decedent's estate, insofar as it is the executor's duty to do by virtue of his office, but no further.

Recitals of an executor's deed include information regarding the probated will, including the date of death, the county of probate, and the file number assigned to the decedent's estate by the clerk of superior court. In addition, the deed contains a statement that the executor named within was appointed by the decedent's will and is duly qualified to administer the estate; an explanation of the provisions of the will that authorize the executor to sell real property; and a statement that such sale is within the best interests of the estate.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel, and recites the grantor's source of title. When properly executed and recorded, the executor's deed vests title to the within-described property in the named grantee(s). Any restrictions to the transfer should be noted in the body of the deed.

The executor's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. An affidavit of consideration or value may be required.

Opinions differ in North Carolina on best practices when executing a fiduciary deed. Some buyers may be hesitant to accept a deed executed by the PR without court authority or without execution by the decedent's heirs. Consult a lawyer for guidance when conveying a decedent's real property. Consult an attorney licensed in the State of North Carolina with questions regarding executor's deeds, as each situation is unique.

(North Carolina ED Package includes form, guidelines, and completed example)

Important: Your property must be located in Bladen County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Bladen County.

Our Promise

The documents you receive here will meet, or exceed, the Bladen County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bladen County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jimmy P.

November 7th, 2021

Works well. Very satisfied.

Thank you!

Jan H.

October 15th, 2020

This is a great service. It was easy to find and the instructions were complete and easy to follow.

Thank you!

Joe W.

January 22nd, 2020

Effortless transaction and very thorough paperwork and explanations.

Thank you!

Angela L.

November 2nd, 2020

AWESOME!

Thank you!

Peter W.

February 28th, 2019

Thanks worked out great

Thank you for the follow up Peter. Have a great day!

Connie J L.

August 26th, 2020

Fast and easy to use. Easy to print.

Thank you!

Kenneh C.

December 23rd, 2022

I was looking for something this website does not offer. Very dissapointed.

Sorry to hear that. We do hope you found what you were looking for elsewhere.

Edith T.

August 20th, 2021

this was wonderful. I found everything very easy to understand. And great examples.

Thank you!

Nancy C.

January 15th, 2021

Simple and easy to download. After reading the instructions/sample pages I did still have some questions regarding the beneficiary deed for the state of MO.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ming W.

December 22nd, 2020

couldn't believe how efficient and perfect job you have done!! I will recommend your website to all friends.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott D.

March 31st, 2025

I am very satisfied with the quality of the product I ordered. I have done similar property transfers/recording in the past on my own but paying for the forms and guidance is well worth it. The AI question area is extremely helpful. The example for the forms is perfect (as it has to be). I will absolutely use Deeds.com in the future for any related property needs. A+

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph R.

August 22nd, 2025

The form and instructions were easy enough to follow if you had all the information.rnThe only drawback to the form was the length of text allowed for the name of the document (#4). The form self populates in multiple locations but when printed truncated the name if too many characters were used. I kept having to update the name of the document to allow for proper printing.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Constance R.

July 13th, 2020

It was very easy to e-file. I liked it.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory J.

March 6th, 2019

Ordered two separate forms for two separate states at two differnt times and couldn't be happier with my purchase. When compared to the cost of having two different attorneys prepare the forms I needed, the value of deeds.com couldn't be beat!

Thank you Gregory. We appreciate you taking the time to leave your feedback. Have a great day!