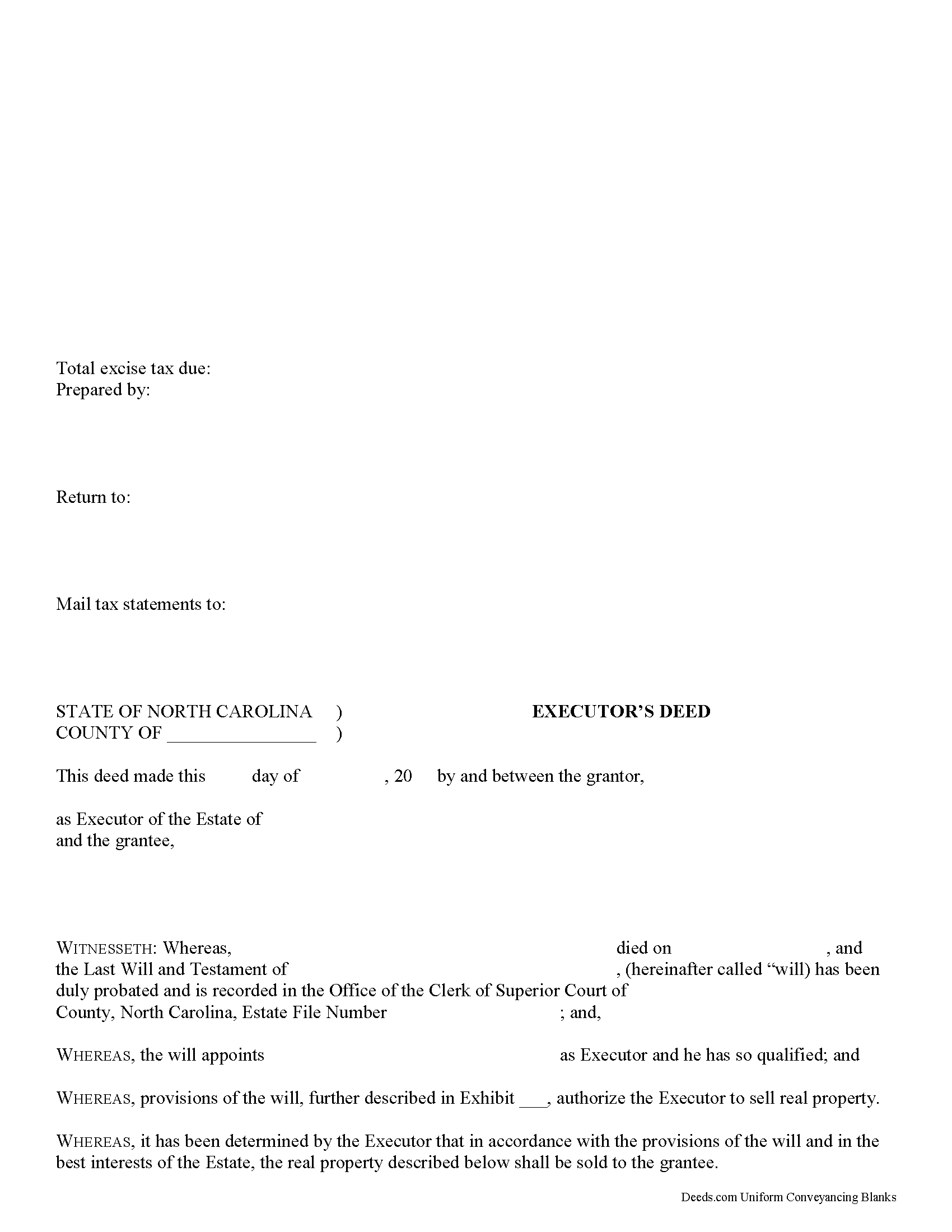

Watauga County Executor Deed Form

Watauga County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

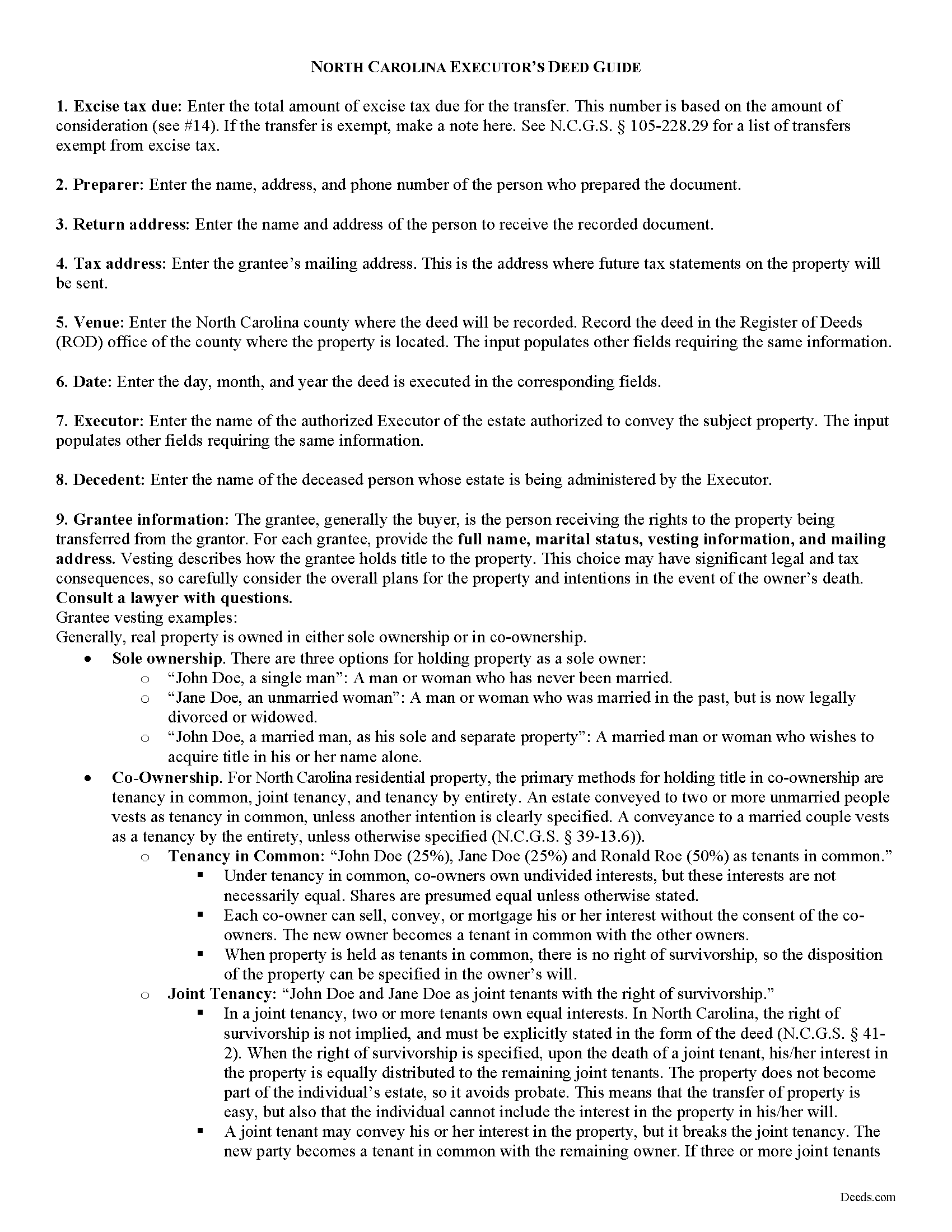

Watauga County Executor Deed Guide

Line by line guide explaining every blank on the form.

Watauga County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Carolina and Watauga County documents included at no extra charge:

Where to Record Your Documents

Watauga County Register of Deeds

Boone, North Carolina 28607

Hours: 8:00 to 5:00 M-F

Phone: (828) 265-8052

Recording Tips for Watauga County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Watauga County

Properties in any of these areas use Watauga County forms:

- Blowing Rock

- Boone

- Deep Gap

- Sugar Grove

- Valle Crucis

- Vilas

- Zionville

Hours, fees, requirements, and more for Watauga County

How do I get my forms?

Forms are available for immediate download after payment. The Watauga County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Watauga County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Watauga County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Watauga County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Watauga County?

Recording fees in Watauga County vary. Contact the recorder's office at (828) 265-8052 for current fees.

Questions answered? Let's get started!

Probate is the legal process of proving a decedent's (deceased person's) will, if any, valid and settling his or her estate. An executor is the personal representative named in the decedent's will to administer his or her estate.

When the estate's assets are not sufficient to pay debts, the executor may need to sell the decedent's real property. In North Carolina, title to real property vests in the decedent's heirs upon death, and a special proceeding is typically required to bring the property into the estate.

Under N.C.G.S. 28A-15-1(c), a special proceeding before the clerk of superior court is not required for a sale by a personal representative made pursuant to authority given by a will, which permission may include a general provision granting authority to the personal representative to sell the testator's real property, or incorporation by reference of the provisions of N.C.G.S. 32-27(2).

An executor's deed is an instrument executed by the executor of the decedent's will to convey an interest in real property from a testate estate (so called when the decedent leaves a will) to a purchaser. Personal representatives' deeds typically carry limited warranties of title, commensurate with the office of a fiduciary. This means that the executor covenants that he has not placed or suffered to be placed any presently existing liens or encumbrances on the property conveyed, and warrants and defends the title against the lawful claims of all persons claiming by, through, under, or on account of decedent's estate, insofar as it is the executor's duty to do by virtue of his office, but no further.

Recitals of an executor's deed include information regarding the probated will, including the date of death, the county of probate, and the file number assigned to the decedent's estate by the clerk of superior court. In addition, the deed contains a statement that the executor named within was appointed by the decedent's will and is duly qualified to administer the estate; an explanation of the provisions of the will that authorize the executor to sell real property; and a statement that such sale is within the best interests of the estate.

A lawful deed in North Carolina states the consideration made for the transfer of title, contains an accurate legal description of the subject parcel, and recites the grantor's source of title. When properly executed and recorded, the executor's deed vests title to the within-described property in the named grantee(s). Any restrictions to the transfer should be noted in the body of the deed.

The executor's signature must be acknowledged in the presence of a notarial official before the deed can be recorded in the county where the subject property is located. An affidavit of consideration or value may be required.

Opinions differ in North Carolina on best practices when executing a fiduciary deed. Some buyers may be hesitant to accept a deed executed by the PR without court authority or without execution by the decedent's heirs. Consult a lawyer for guidance when conveying a decedent's real property. Consult an attorney licensed in the State of North Carolina with questions regarding executor's deeds, as each situation is unique.

(North Carolina ED Package includes form, guidelines, and completed example)

Important: Your property must be located in Watauga County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Watauga County.

Our Promise

The documents you receive here will meet, or exceed, the Watauga County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Watauga County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4606 Reviews )

sandra f.

December 9th, 2020

excellent transaction...very informative prior to purchase..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gerry A.

September 6th, 2019

It was easy, affordable and I appreciate this service.

Thank you!

lorali V.

February 12th, 2020

Not easy to fill in and the finished product looked awful when printed.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary G.

November 4th, 2020

I'm glad I found this service . Very useful. Time saving

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory N.

September 10th, 2020

Good information guiding through filling out the product. Would like form to be more flexible in terms of spacing, but otherwise excellent.

Thank you for your feedback. We really appreciate it. Have a great day!

John Z.

November 5th, 2021

Very easy to use. Straight forward. Am glad I found the tools to process an important document of property ownership. Thanks much. Will recommend to friends and family.

Thank you!

Melanie N.

October 12th, 2019

I'm happy with the forms, thank you.

Thank you!

Dorothea H.

November 23rd, 2020

I am so glad I chose Deeds.com for my forms! The directions were clear and comprehensive, and the form allowed for customization far beyond the free forms I had looked at before. I highly recommend this site!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael L.

June 15th, 2022

Very helpful and efficient

Thank you!

Elango R.

November 9th, 2020

It was so easy to use the site and got recording done in a day. Very happy with experience.

Thank you!

David G.

February 27th, 2025

Very easy to fill out and understand. Thank You!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amanda W.

August 18th, 2020

Very helpful.

Thank you!

Stephen N.

February 11th, 2021

Excellent service.

Thank you!

Kristi T.

October 16th, 2020

This was so very easy and fast! Well worth the small fee. I will use this again if I have a need. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gina B.

June 26th, 2019

Super easy to use! Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!