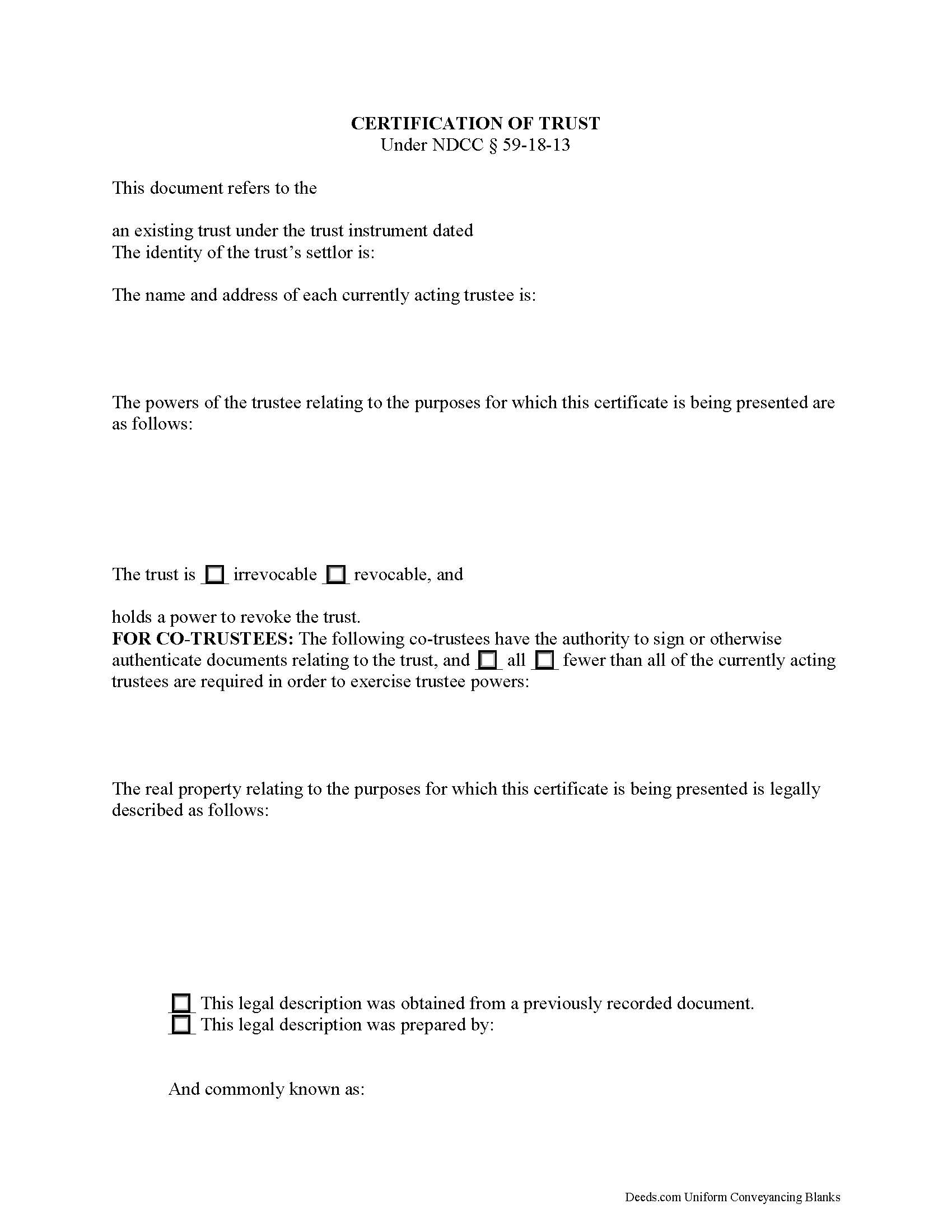

Eddy County Certificate of Trust Form

Eddy County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

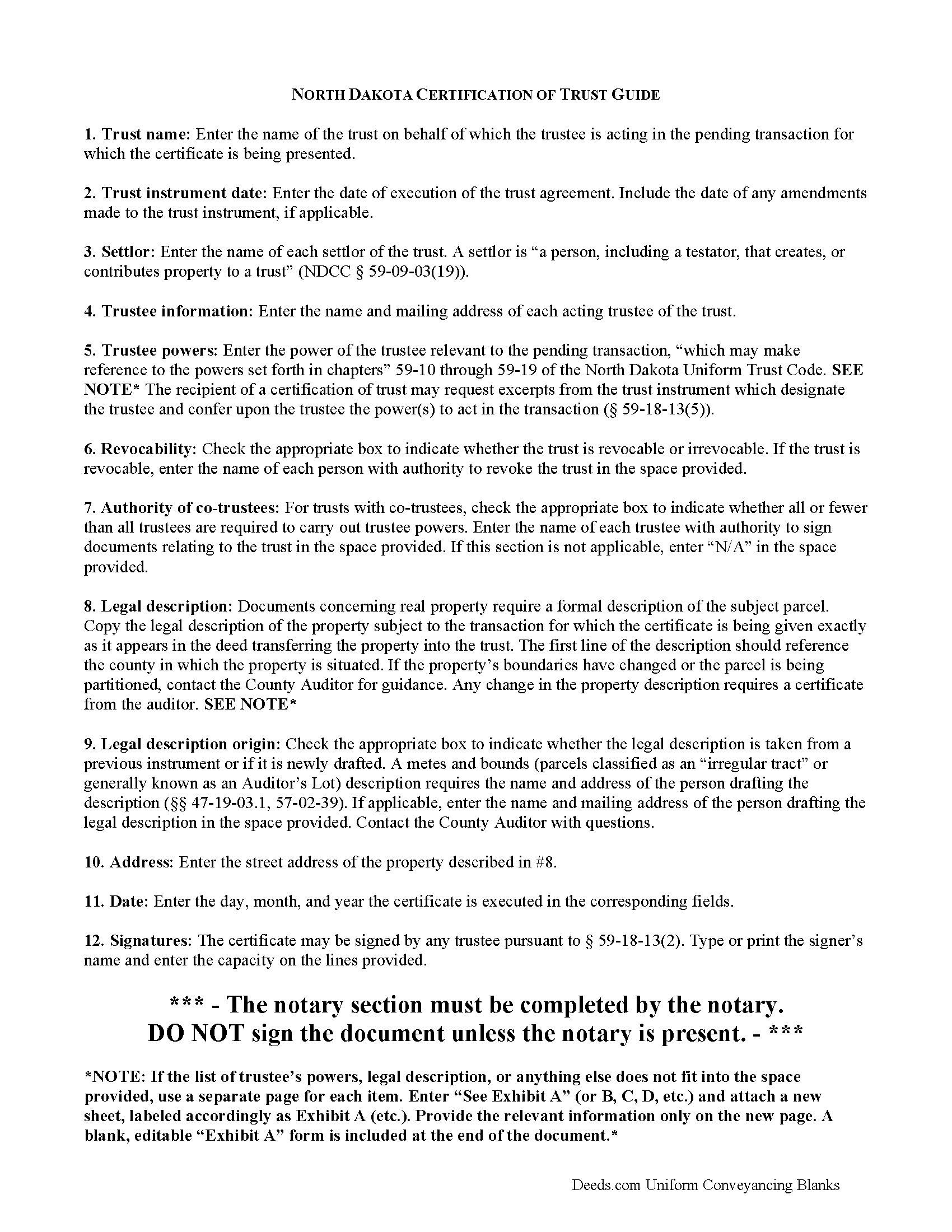

Eddy County Certificate of Trust Guide

Line by line guide explaining every blank on the form.

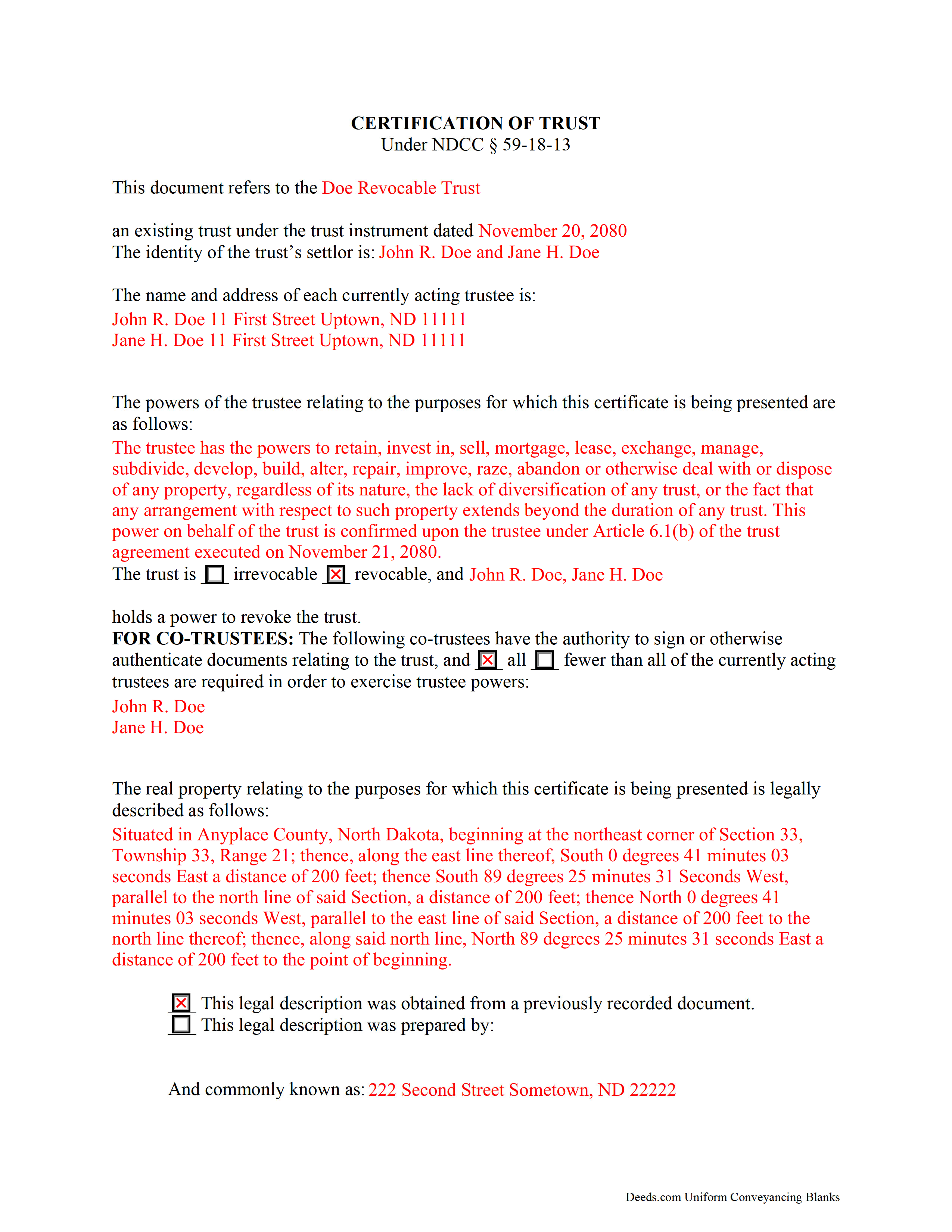

Eddy County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Eddy County documents included at no extra charge:

Where to Record Your Documents

Eddy County Recorder / Clerk of Court

New Rockford, North Dakota 58356-1652

Hours: 8:00 to 4:00 Monday through Friday CT

Phone: 701-947-2434 Ext 2013 (o)

Recording Tips for Eddy County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Eddy County

Properties in any of these areas use Eddy County forms:

- New Rockford

- Sheyenne

Hours, fees, requirements, and more for Eddy County

How do I get my forms?

Forms are available for immediate download after payment. The Eddy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Eddy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Eddy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Eddy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Eddy County?

Recording fees in Eddy County vary. Contact the recorder's office at 701-947-2434 Ext 2013 (o) for current fees.

Questions answered? Let's get started!

Codified at N. D. Cent. Code 59-18-13 as part of the North Dakota Uniform Trust Code, the certification of trust is a document containing essential information about a trust. A trustee can present a certificate when entering transactions on behalf of a trust. As the name suggests, the form certifies the trust's existence and the trustee's authority to conduct business in the trust's name, and its recipient may rely upon the facts contained within it without further inquiry ( 59-18-13(6)).

A trust is an arrangement whereby a settlor (or grantor) transfers property to another person (trustee) to be held for the benefit of third (beneficiary). The trust is governed by the terms expressed in the trust instrument, a (generally) unrecorded document that designates the trustee, contains the scope of the trust's assets, and identifies the trust's beneficiaries. Some types of trust take effect during the settlor's lifetime (inter vivos trust), and others take effect upon the death of the settlor (testator), as provided for by a will (testamentary trust).

In North Dakota, the certification states that the trust exists and provides the trust's name and effective date of the trust instrument. In addition, it identifies each person who has contributed property to the trust as a settlor and gives the name and address of the currently acting trustee. The trustee's powers relevant to the pending transaction are enumerated; reference may be made to the statutory trustee powers codified at chapters 59-09 through 59-19 of the North Dakota Uniform Trust Code. The recipient of a certification of trust can request copies of excerpts from the trust instrument designating the trustee and conferring the power to act in the business at hand ( 59-18-13(5)).

The certificate also defines the trust as either irrevocable or revocable, and names who, if any, holds a power to revoke the trust. If the trust has co-trustees, the certificate states whether or not all trustees are required in order to carry out trustee powers. It also specifies, by name, which trustees can authorize trust documents. Finally, the document contains a statement that the trust has not been revoked, modified, or amended in any way that would falsify the statements made within.

Generally, it is unnecessary to provide a certificate of trust alongside conveyances of property from trustees in North Dakota, as the "trustee of a trust that holds title to real property is presumed to have the power to sell, convey, and encumber the real property unless restrictions on that power appear in the records of the county recorder" ( 47-10-26).

However, some situations may warrant an accompanying certificate, such as when a trustee is incorrectly identified on the deed into trust, or the trustee named on the current deed has been replaced [1]. When property deeded into a trust is erroneously titled in the name of the trust rather than the trustee of the trust, the subsequent conveyance out of the trust may be validated if the trustee's identity "is reasonably ascertainable from the conveyance or from other information of public record," such as a certification of trust ( 47-19-42.1). When used in transactions involving real property, the certificate should provide a legal description of the subject property.

The certificate must be signed by a trustee in the presence of a notary public. If recording is applicable to the situation, the certificate may be recorded through the recorder's office. Consult a lawyer with any questions.

(North Dakota COT Package includes form, guidelines, and completed example)

Important: Your property must be located in Eddy County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Eddy County.

Our Promise

The documents you receive here will meet, or exceed, the Eddy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Eddy County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Patricia K.

August 8th, 2019

Able to find the information that I needed.

Thank you!

Renata L.

July 30th, 2019

Was a bit difficult to navigate. I feel a fee to access the site and a fee to print is a bit much. I am in the real estate business and find the deeds very useful

Thank you for your feedback. We really appreciate it. Have a great day!

Sean D.

September 13th, 2022

I am new to needing this type of service, and the Deeds.Com team has been fantastic. Responsive, professional, and thorough are the first 3 words that come to mind. Deeds.Com will be my first choice for all of our county recorder needs.

Thank you!

ralph m.

March 1st, 2019

Overall the experience was pleasant and the services were delivered In a timely fashion

Thank you Ralph. Have a great day!

Patsy H.

January 10th, 2022

I had trouble at first printing out the forms but once I figured out what to do, all went well. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

HELEN F.

July 12th, 2019

Was straight to the point... Easy to read instructions... smooth process

Thank you for your feedback. We really appreciate it. Have a great day!

Janalee T.

April 17th, 2020

Fast, easy. quickly accepted by county recorder.

Thank you!

A. S.

February 27th, 2019

First, I am glad that you gave a blank copy, an example copy, and a 'guide'. It made it much easier to do. Overall I was very happy with your products and organization... however, things got pretty confusing and I have a pretty 'serious' law background in Real Estate and Civil law. With that said, I spent about 10+ hours getting my work done, using the Deed of Trust and Promissory note from you and there were a few problems: First, it would be FANTASTIC if you actually aligned your guide to actually match the Deed or Promissory Note. What I mean is that if the Deed says 'section (E)' then your guide shouldn't be 'randomly' numbered as 1,2,3, for advice/instructions, but should EXACTLY match 'section (E)'. Some places you have to 'hunt' for what you are looking for, and if you did it based on my suggestion, you wouldn't need to 'hunt' and it would avoid confusion. 2nd: This one really 'hurt'... you had something called the 'Deed of Trust Master Form' yet you had basically no information on what it was or how to use it. The only information you had was a small section at the top of the 'Short Form Deed of Trust Guide'. Holy Cow, was that 'section' super confusing. I still don't know if I did it correctly, but your guide says only put a return address on it and leave the rest of the 16 or so page Deed of Trust beneath it blank... and then include your 'Deed of Trust' (I had to assume the short form deed that I had just created) as part of it. I had to assume that I had to print off the entire 17 page or so title page and blank deed. I also had to assume that the promissory note was supposed to be EXHIBIT A or B on the Short Form Deed. It would be great if someone would take a serious look at that short section in your 'Short Form Deed of Trust Guide' and realize that those of us using your products are seriously turning this into a county clerk to file and that most of us, probably already have a property that has an existing Deed... or at least can find one in the county records if necessary... and make sure that you make a distinction between the Deed for the property that already exists, versus the Deed of Trust and Promissory note that we are trying to file. Thanks.

Thank you for your feedback. We'll have staff review the document for clarity. Have a great day!

Theresa M.

August 12th, 2023

Simple and quick service!!

Thank you!

Susan P.

May 25th, 2021

Very easy to use, responsive help when the document was initially rejected and very fast service (recorded the deed within 24 hours).

Thank you for your feedback. We really appreciate it. Have a great day!

Sheri L.

July 9th, 2019

Very helpful even though what I'm looking for hasnt updated yet. I'll use you again.

Thank you!

Doreen P.

December 13th, 2018

I have uploaded 2 documents for E recording, I have searched thinking it would prompt me to a business customer service contact info tel no. ? I am concerned as to the fees related to the recording of both instruments? please advise? thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

Nanc T.

October 3rd, 2024

Great experience, highly recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.