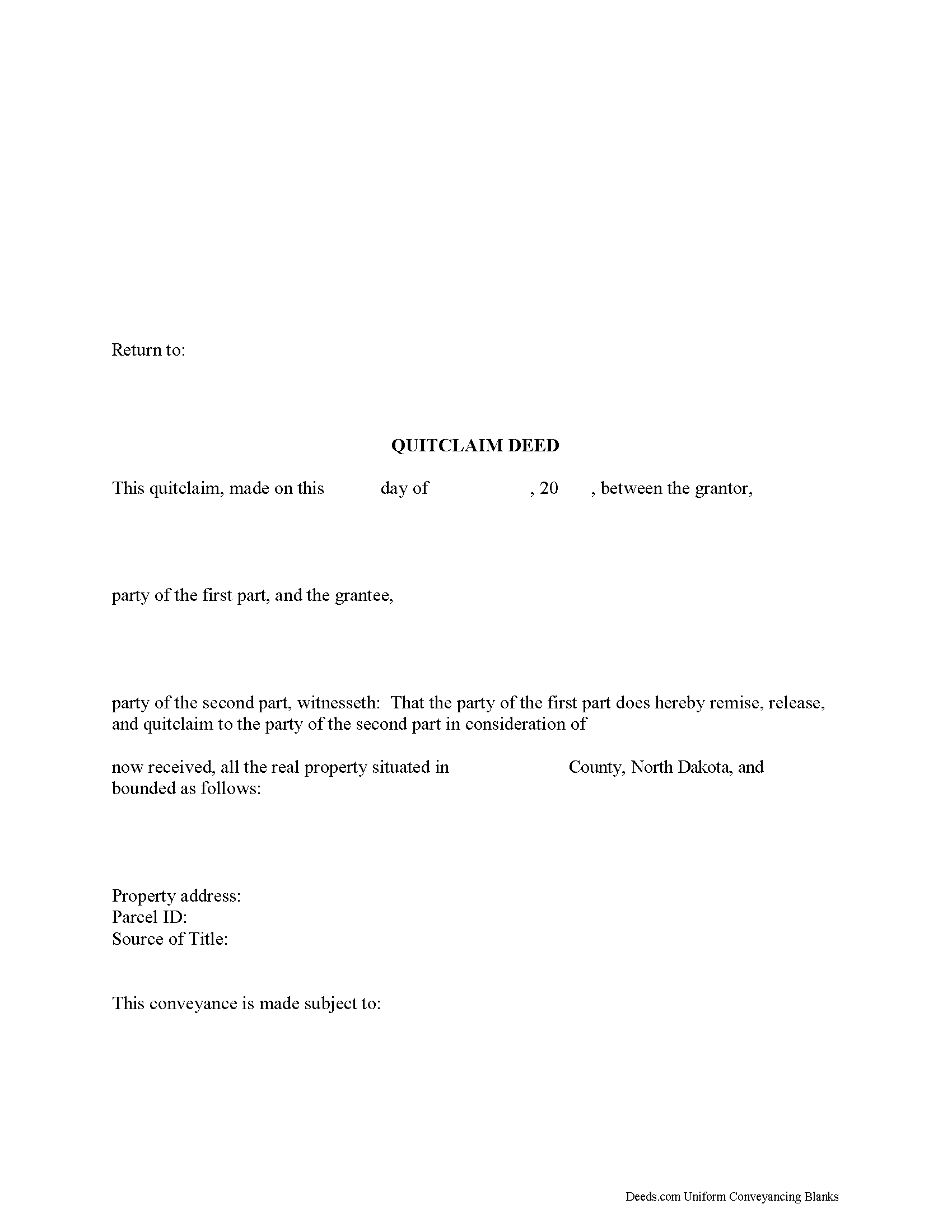

Adams County Quitclaim Deed Form

Adams County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all North Dakota recording and content requirements.

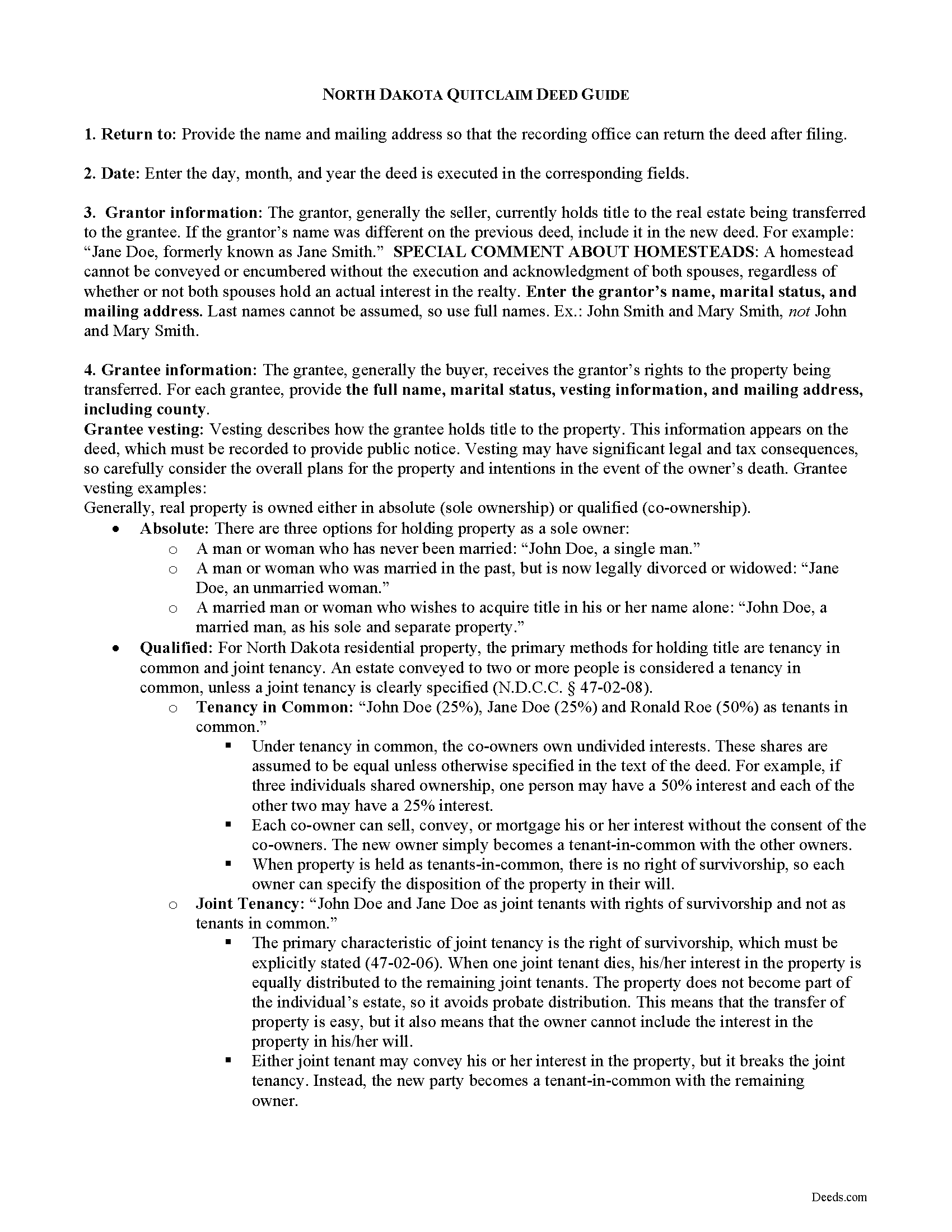

Adams County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

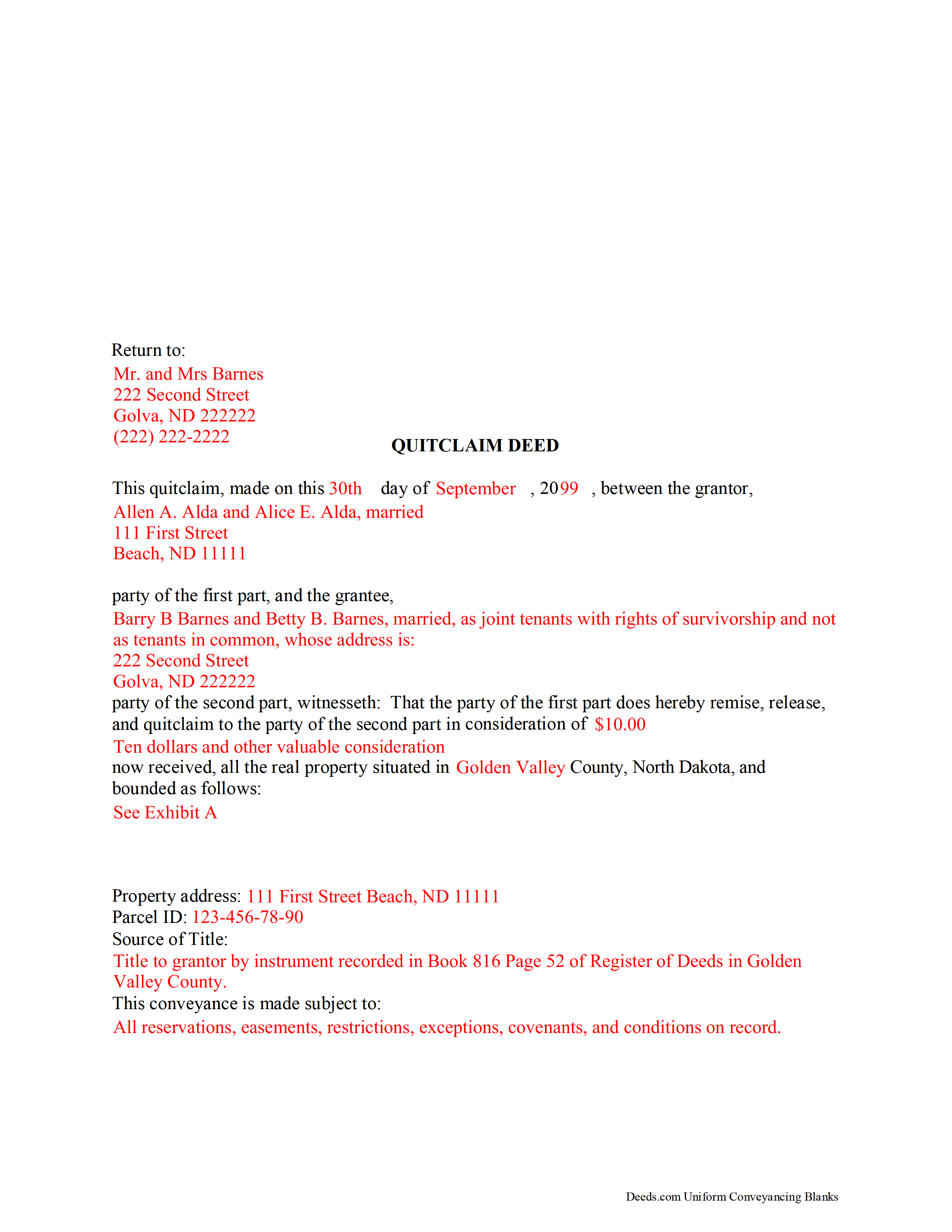

Adams County Completed Example of the Quitclaim Deed Document

Example of a properly completed North Dakota Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Adams County documents included at no extra charge:

Where to Record Your Documents

Adams County Recorder

Hettinger, North Dakota 58639

Hours: 7:30-12:00, 12:45-4:30 M-Th, 7:30-12:30 Fri

Phone: (701) 567-2460

Recording Tips for Adams County:

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Adams County

Properties in any of these areas use Adams County forms:

- Hettinger

- Reeder

Hours, fees, requirements, and more for Adams County

How do I get my forms?

Forms are available for immediate download after payment. The Adams County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Adams County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Adams County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Adams County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Adams County?

Recording fees in Adams County vary. Contact the recorder's office at (701) 567-2460 for current fees.

Questions answered? Let's get started!

A quitclaim deed in North Dakota will take effect and will vest the interest intended to be transferred by the grantor to the grantee upon its delivery (47-09-06). The post office address of the grantee is a prerequisite to recording (47-10-07). Additional requirements, such as a Certificate of Real Estate Value, signature of the grantor, and an acknowledgment, can be found in the North Dakota information section.

Every grant of an estate in real property in North Dakota is conclusive against the grantor and everyone subsequently claiming under the grantor, except a good faith purchaser or encumbrancer who acquires a title or lien for valuable consideration by an instrument that first is duly recorded (47-10-08). Recording a North Dakota quitclaim deed provides notice of the contents to all persons (47-19-19). If a quitclaim deed is not recorded, it is void as against a subsequent good faith purchaser who purchases the same real estate for valuable consideration (or portion of it) whose conveyance, whether it is entitled to be recorded or not, is first duly recorded in the proper county in North Dakota. If a quitclaim deed is recorded first, this does not affect the question of the good faith of the subsequent purchaser (47-19-41). An unrecorded quitclaim deed is valid between the parties to it and those who have notice of it (47-19-46). However, having knowledge of a quitclaim deed that is outside the chain of title does not constitute notice (47-19-41).

(North Dakota QD Package includes form, guidelines, and completed example)

Important: Your property must be located in Adams County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Adams County.

Our Promise

The documents you receive here will meet, or exceed, the Adams County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Adams County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

XIN Y.

June 14th, 2022

Great e-Recording service. Fast and convenient! All done in the comfort of my home. Love it!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cathleen H.

January 25th, 2019

The pdf form is good; however, the input boxes merge into the line above so the text is hard to read when complete. I added a return before entering my data and this solved the problem.

Thank you for your feedback Cathleen. We will have staff take a look at the document for issues with the text fields. Have a great day!

Chris D.

December 10th, 2020

Easy and affordable. I would recommend deeds.com

Thank you!

Courtney V.

February 9th, 2021

I didn't have a chance to judge your services because I received a message saying that my requested title could not be searched. I will say, the website is easy to navigate. I'm not sure how many who use these services are laymen, but I would suggest adding a detailed explanation of each service. I had to Google the difference between each type of title search, but I might just be more uninformed than the average person, or I just didn't see it on your website

Thank you for your feedback. We really appreciate it. Have a great day!

Lana J.

March 4th, 2022

Very easy to use and the forms were perfectly formatted. Great value and service!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel D.

June 3rd, 2019

Easier than I expected. I followed the downloaded examples step by step, and before I knew it, the form was completed correctly and good to go. Thank you, Daniel D.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David S.

October 20th, 2020

I downloaded the quit claim deed form and saved it on my computer. I opened it with Adobe and filled it out. The space for the legal description was too small (2 lines only) which did not allow enough room for the long property description that I had.

Thank you for your feedback. We really appreciate it. Have a great day!

Arletta B.

September 16th, 2021

Fantastic service, saved me a ton of time and running around. Thanks!

Thank you!

Rose C.

September 12th, 2020

easy breezy *****

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald P.

November 12th, 2019

Very fast and efficient. Easy to fill out but was upset the latest tax exemptions ruled in 2014 did not seem to be included. Exclusion of sale to blood relatives, etc. _ the one I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Jason R.

April 28th, 2020

Very easy to use. Great examples.

Thank you for your feedback. We really appreciate it. Have a great day!

Frank H.

September 22nd, 2022

Form and instructions were useful. But I suggest creating a form for transferring a deed pursuant to a trust. The existing form is based on a will going through probate so it doesn't fit the trust situation in some respects.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!

Richard L.

December 17th, 2020

Service was very convenient; I received prompt assistance with my document - staff was very helpful.

Thank you!

Deborah A.

July 26th, 2022

Excellent,

Thank you!