Dunn County Transfer of Death Deed Form

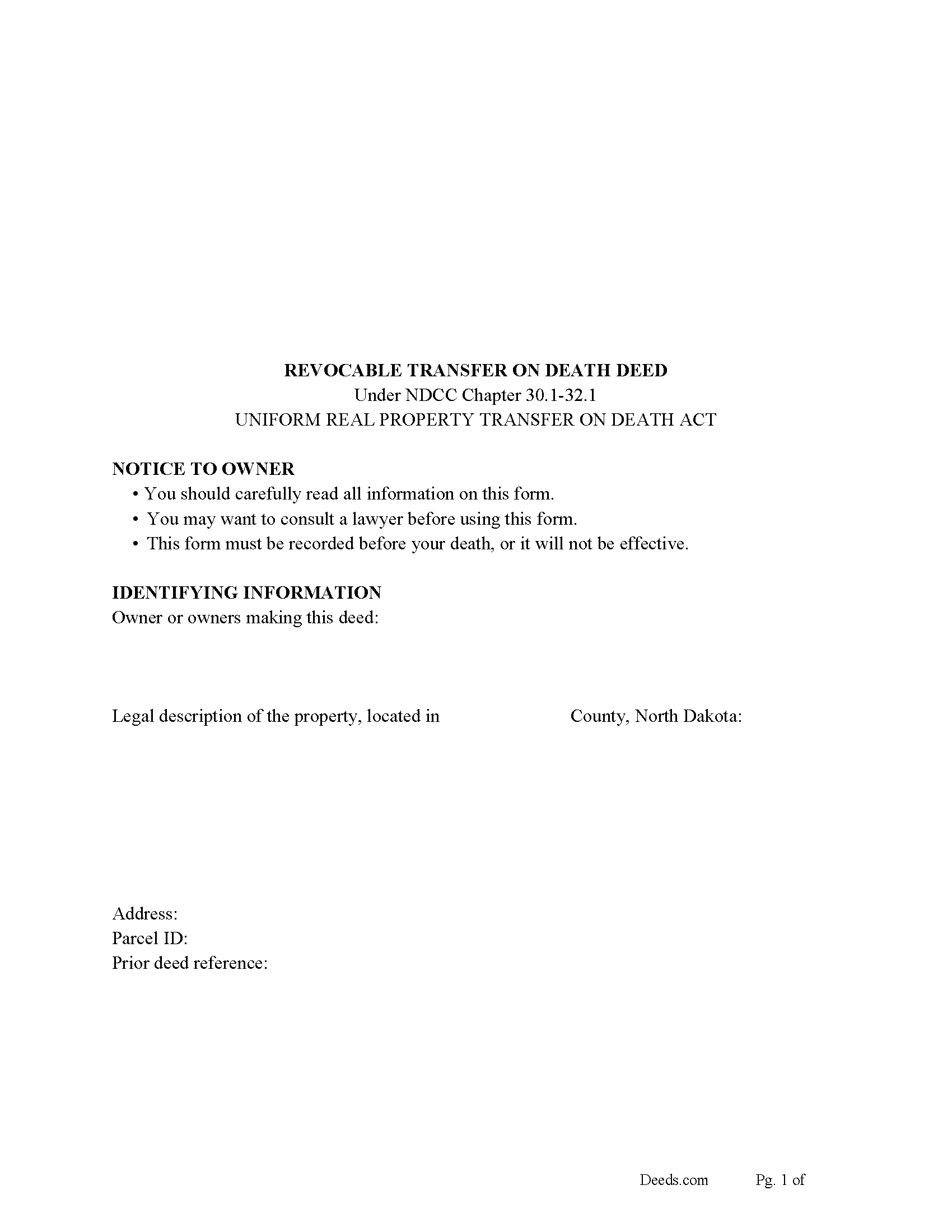

Dunn County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

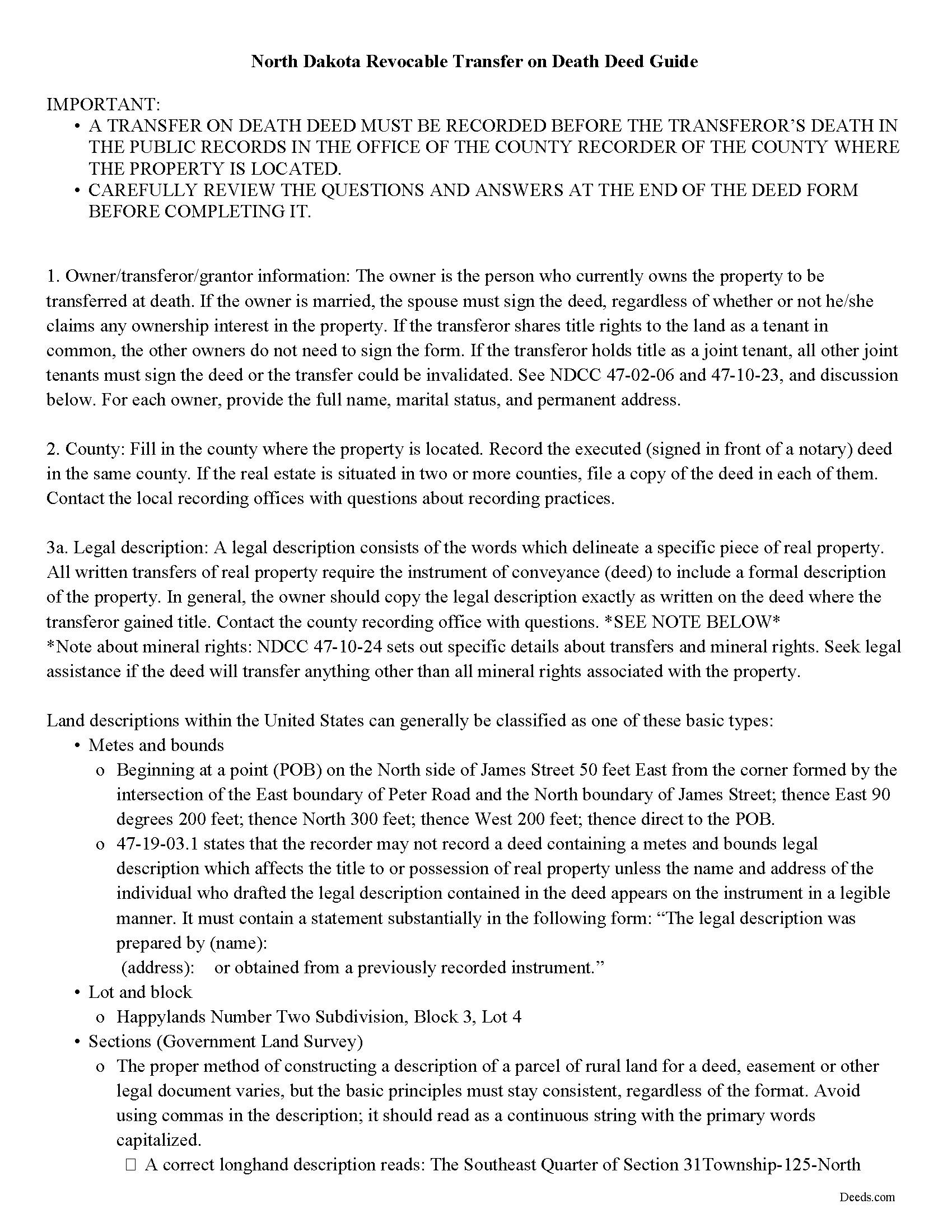

Dunn County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

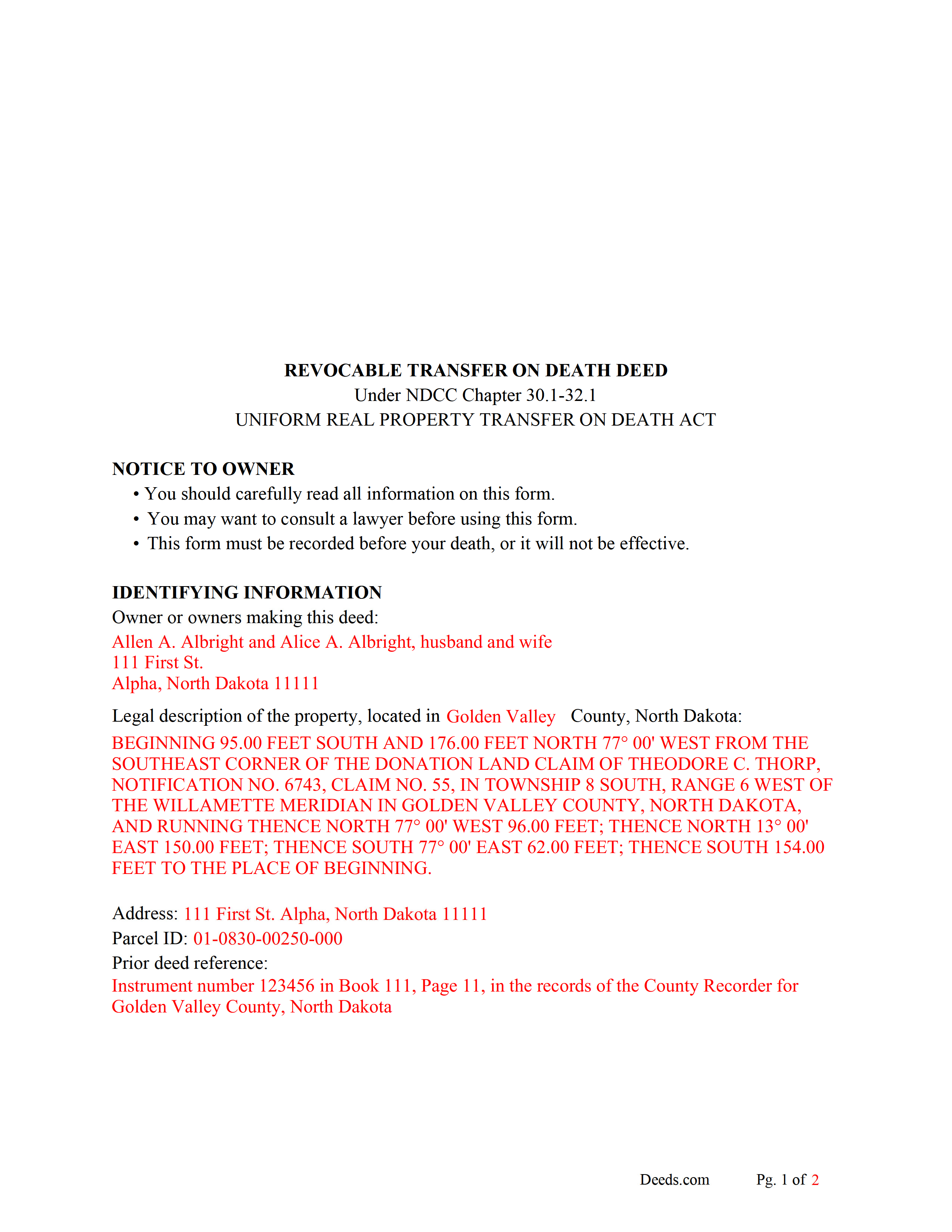

Dunn County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Dunn County documents included at no extra charge:

Where to Record Your Documents

Dunn County Recorder

Manning, North Dakota 58642

Hours: 8:00am to 12:00 & 12:30 to 4:30pm M-F (MT)

Phone: (701) 573-4447

Recording Tips for Dunn County:

- White-out or correction fluid may cause rejection

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Dunn County

Properties in any of these areas use Dunn County forms:

- Dodge

- Dunn Center

- Halliday

- Killdeer

- Manning

- Marshall

Hours, fees, requirements, and more for Dunn County

How do I get my forms?

Forms are available for immediate download after payment. The Dunn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dunn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dunn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dunn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dunn County?

Recording fees in Dunn County vary. Contact the recorder's office at (701) 573-4447 for current fees.

Questions answered? Let's get started!

Note that transfer on death deeds must be recorded during the owner's life or they have no effect.

In 2011, North Dakota enacted the Uniform Real Property Transfer on Death Act, found in the North Dakota Century Code (NDCC) at Chapter 30.1-32.1.

According to this statute, owners of North Dakota real property may transfer property to one or more beneficiaries effective, at the transferor's death, by lawfully executing and recording a transfer on death deed in the county or counties where the property is located (NDCC 32.1-02). The instruments must contain all the information required for traditional deeds, as well as a statement that the transfer will occur at the owner's death (30.1-32.1-06).

This transfer is nontestamentary, meaning it is not included in the owner's will (30.1-32.1-04). As a result, it does not require probate distribution. Even so, best practices dictate that the will and any other transfers should not contain any conflicting instructions.

Deeds under this law allow the owners to retain absolute ownership of and control over the land until death, including the ability to cancel or change the beneficiary designation, and to sell the property outright to someone else (30.1-32.1-09). Because the transfer is revocable (30.1-32.1-03), there is no obligation to notify the beneficiary or to collect consideration (money) for the potential future interest (30.1-32.1-07).

When the transferor dies, the beneficiary gains ownership of the property with no warranties of title, and subject to any mortgages, encumbrances, and agreements in place during the owner's life. (30.1-32.1-10).

Overall, transfer on death deeds are a convenient, flexible tool for a comprehensive estate plan.

(North Dakota TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Dunn County to use these forms. Documents should be recorded at the office below.

This Transfer of Death Deed meets all recording requirements specific to Dunn County.

Our Promise

The documents you receive here will meet, or exceed, the Dunn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dunn County Transfer of Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Karin G.

January 28th, 2021

All went well. Forms easy to download and instructions were super. Very pleased with the service.

Thank you!

Alison L.

February 16th, 2021

Wonderful and easy to use platform. I was using a more complicated platform that wouldn't load half the time. Makes for filing deeds in the pandemic quick and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Armando B.

October 23rd, 2021

This was so simple to get around your web site. Guide was easy to follow. Great experience. Would use again.

Thank you for your feedback. We really appreciate it. Have a great day!

Philip C.

July 2nd, 2019

The product I purchased looks great and I added Adobe to be able to copy it, but for some reason I can't,so I will delete Adobe and then try again to copy what i paid for. I have all the PDFS' and my computer and printer are fairly new (windows 10),I should have tried to copy it first, I'll get it! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

MANUEL O.

December 4th, 2020

great service Loved!

Thank you!

Daniel Z.

September 13th, 2022

All is well that ends well and this form service seemed to work quite smoothly, even though my printer gives me fits at times, having to hand feed the blank paper.

Thank you for your feedback. We really appreciate it. Have a great day!

Terri L.

January 31st, 2022

Great Tool! Very easy to complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

May 25th, 2021

So So

Thank you!

Lisa B.

July 15th, 2021

Very helpful and fast.

Thank you!

Joseph B.

September 8th, 2022

All very good

Thank you!

Donald S.

March 16th, 2021

Guidelines somewhat helpful. Forms fillable but not editable unless you buy an Adobe conversion service subscription. End product looks crude and amateurish. Fields can't be reduced or enlarged to accommodate unique data. Very disappointing.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert L.

May 10th, 2022

I did not use your service. $19 to upload a document to our local tax accessor office is a bit high. I drove the document to the office myself.

Thank you for your feedback Robert. Glad to hear that you got your document recorded. Sorry to hear that your time, fuel, and wear on your vehicle are valued at less than $19. Have a wonderful day.

Tim T.

August 24th, 2020

Fast and efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela P.

October 12th, 2019

I liked the speed and efficiency of your website.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia R.

March 2nd, 2025

Very helpful. Worth the cost. Hopefully we will be able to proceed without expense of an attorney.

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..