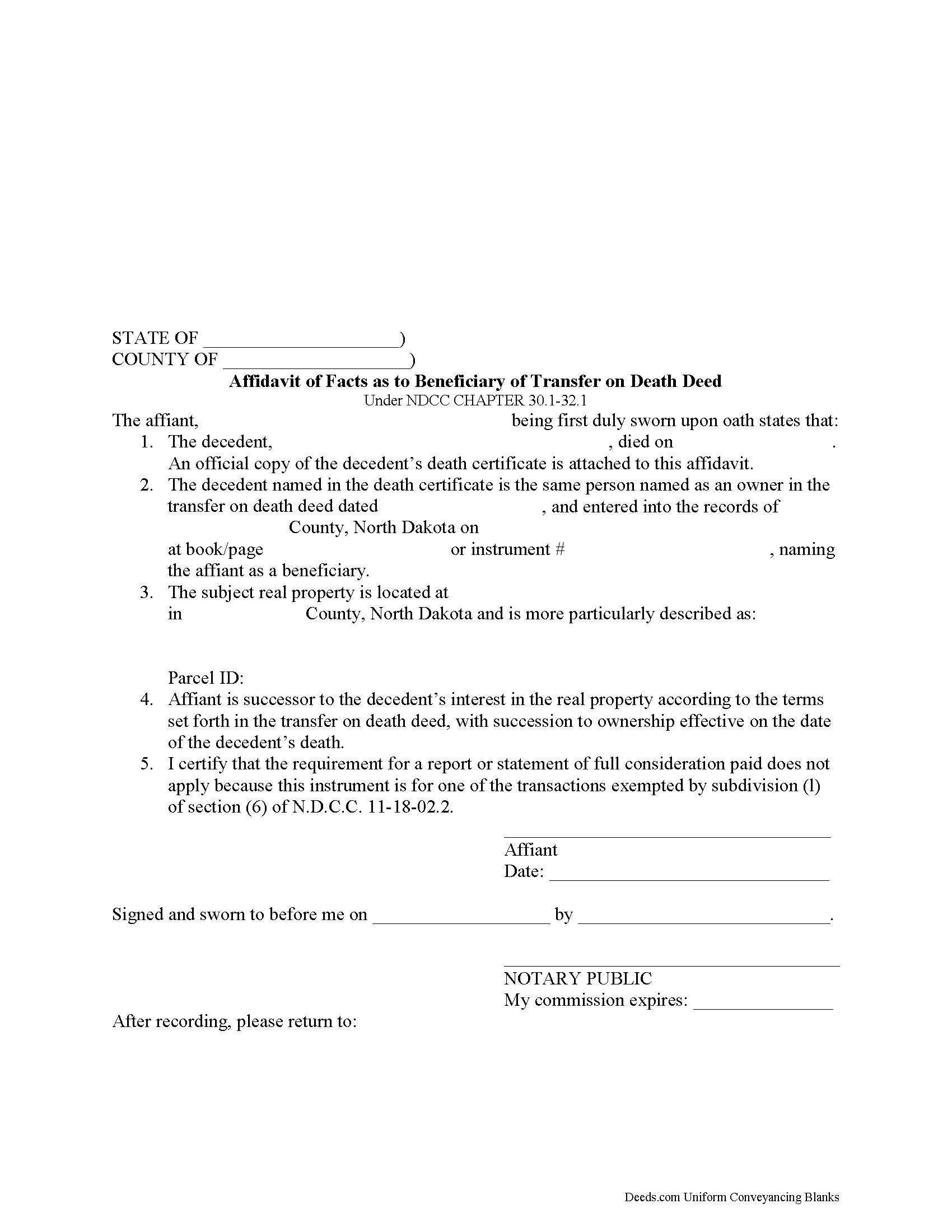

Sheridan County Transfer on Death Affidavit Form

Sheridan County Transfer on Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

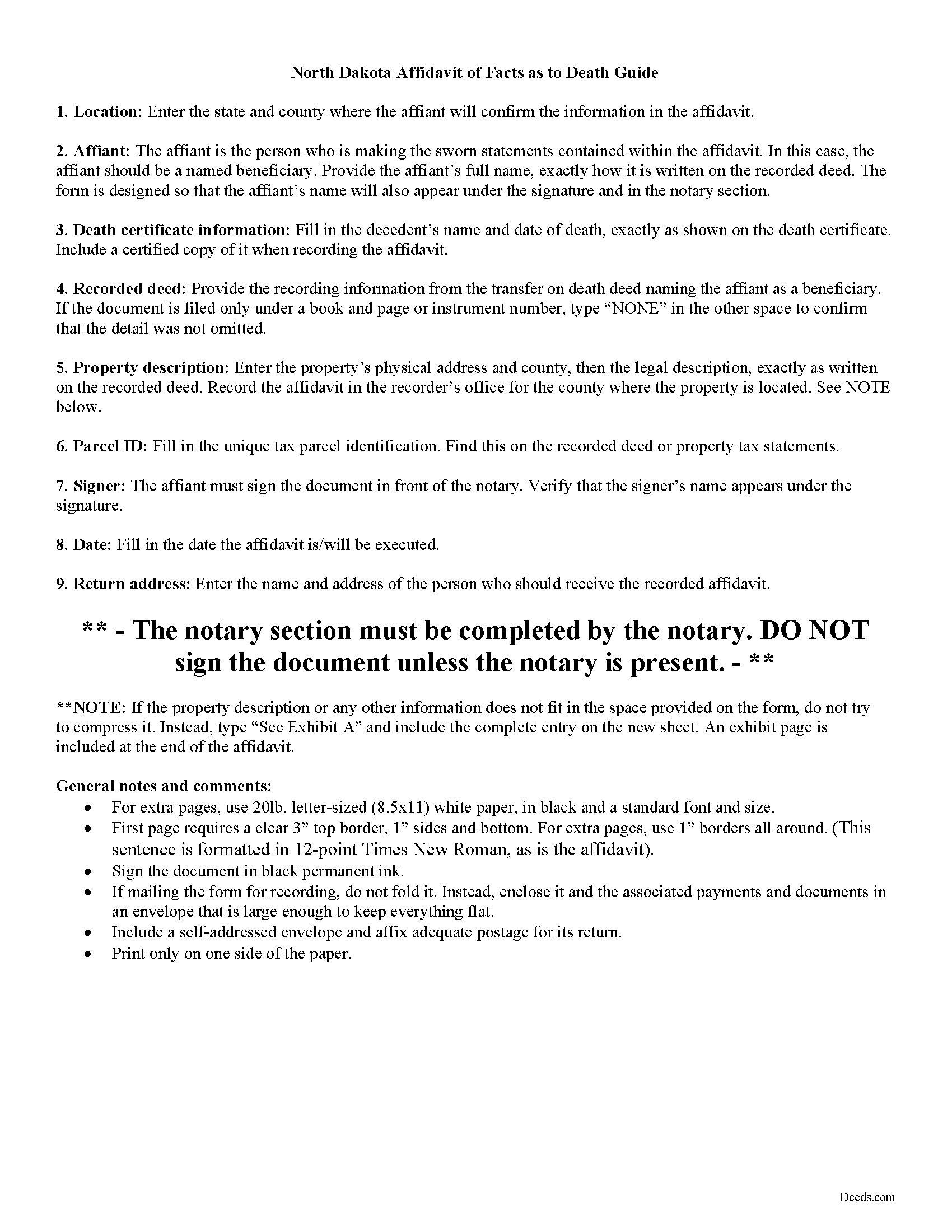

Sheridan County Transfer on Death Affidavit Guide

Line by line guide explaining every blank on the form.

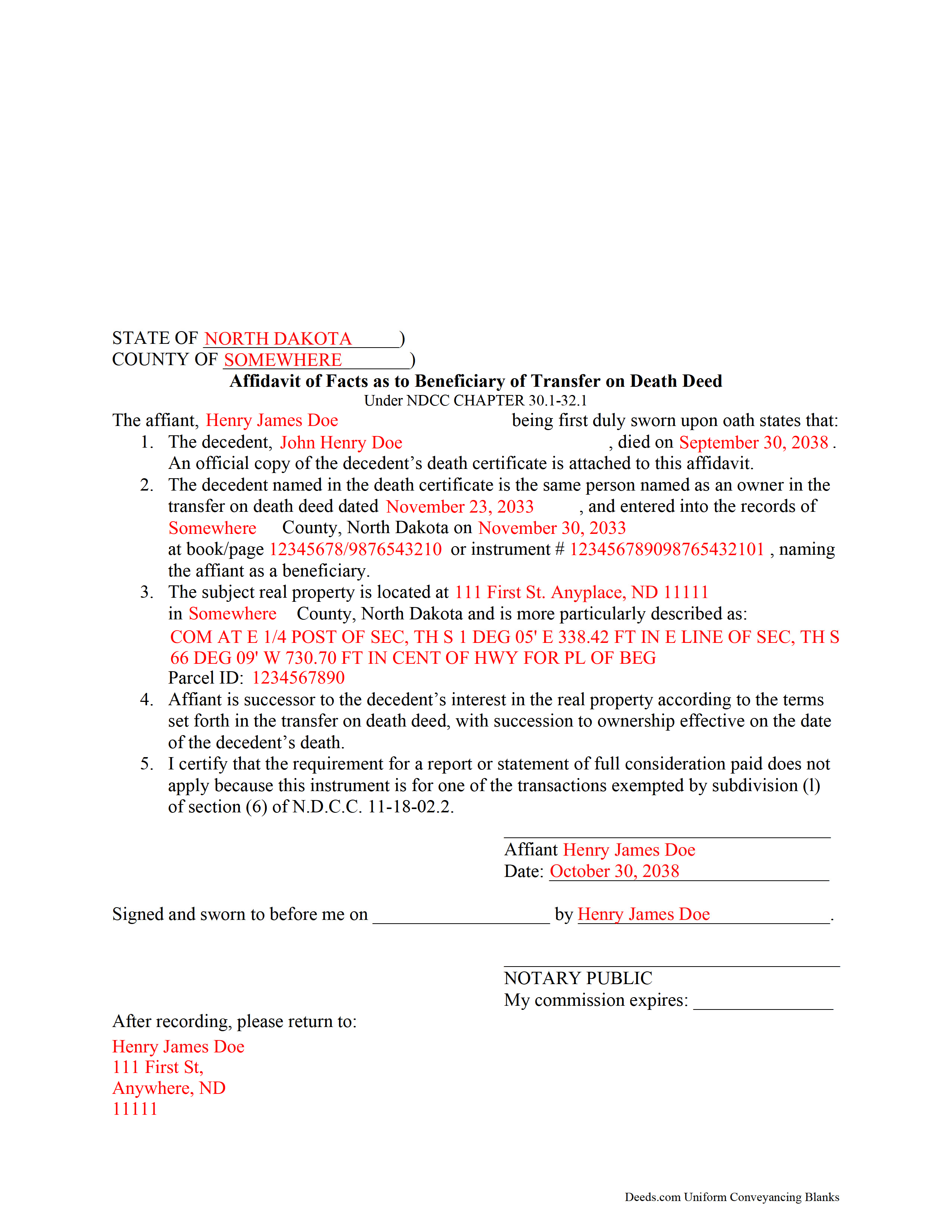

Sheridan County Completed Example of the Transfer on Death Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Sheridan County documents included at no extra charge:

Where to Record Your Documents

Sheridan County Recorder

McClusky, North Dakota 58463

Hours: 9:00 a.m. to 12:00 p.m., and 1:00 p.m. to 5:00 p.m

Phone: (701) 363-2207

Recording Tips for Sheridan County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Sheridan County

Properties in any of these areas use Sheridan County forms:

- Denhoff

- Goodrich

- Martin

- Mcclusky

Hours, fees, requirements, and more for Sheridan County

How do I get my forms?

Forms are available for immediate download after payment. The Sheridan County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Sheridan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Sheridan County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Sheridan County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Sheridan County?

Recording fees in Sheridan County vary. Contact the recorder's office at (701) 363-2207 for current fees.

Questions answered? Let's get started!

Taking Ownership of Property from a North Dakota Transfer on Death Deed

In 2011, North Dakota enacted the Uniform Real Property Transfer on Death Act, found in the North Dakota Century Code (NDCC) at Chapter 30.1-32.1.

Under this statute, owners of North Dakota real property may transfer title to one or more beneficiaries, effective at the transferor's death, by lawfully executing and recording a transfer on death deed in the county or counties where the property is located (NDCC 32.1-02).

This transfer is nontestamentary, meaning it is not included in the owner's will (30.1-32.1-04). As a result, it does not require probate distribution. Instead, the beneficiary gains ownership of the property when the transferor dies.

To formalize the change in ownership, beneficiaries complete and record an affidavit, confirming their acceptance of the transfer. Along with the affidavit, they must submit an official copy of the deceased owner's death certificate. This process enters the new information into public records and maintains a clear chain of title (ownership history).

Contact an attorney with specific questions or for complex situations.

(North Dakota TOD Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Sheridan County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Affidavit meets all recording requirements specific to Sheridan County.

Our Promise

The documents you receive here will meet, or exceed, the Sheridan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Sheridan County Transfer on Death Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Elaine S.

April 19th, 2021

Being new at this, the system was somewhat difficult to understand at first. It took a couple of tries before I got it. It seems to be somewhat slow as well. However, it's a wonderful idea to have documents recorded from the comfort of your home, especially in the times that we are in with COVID19. I definitely don't mind paying the fee which I thought was reasonable.

Thank you!

Loren H.

December 11th, 2022

I really appreciate your forms according to South Dakota laws and statues. Your forms allow me to effectively do estate planning without extensive legal expenses. The "Revocable Transfer of Death Deed" is perfect to protect against extensive probate problems for seniors in retirement. Thank you and May God Bless.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary G.

November 24th, 2020

Very easy process, handled quickly without complications. Excellent communication about status.

Thank you!

timothy s.

March 23rd, 2020

fine job, fellas, fine job

Thank you!

Beverly R.

February 2nd, 2022

This was a wonderful experience, easy fast and convenient. Thank you for all your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lloyd T.

September 13th, 2023

Example deed given did not apply to married couples as joint owners with both being grantors. The example and directions also did not show how to write more than one grantee as equal grantees. Both would have been helpful when husband and wife are granting their property to their children equally. Also when attaching the exhibit A with the property description the example did not say "see exhibit A"in the property description area, so I didn't write that. Luckily the recorder of deeds allowed me to write it in. I think directions and examples for multiple scenarios would be helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin R.

November 24th, 2022

So far so good. Had an issue and customer service responded very fast by email.

Thank you for your feedback. We really appreciate it. Have a great day!

Robin M.

November 22nd, 2019

Thank you for your services...Attny office quoted a very large fee for the "TOD DEED" process, so this is very helpful that I am able to take care of this myself. If I would have researched your link sooner, I could have saved my Dad a lot of money for the "SURVIVORSHIP DEED". Thanks again & have a wonderful day:)

Thank you for your feedback. We really appreciate it. Have a great day!

Rhonda H.

September 24th, 2020

Love the names on the example! thanks for the smiles!

Thank you for your feedback. We really appreciate it. Have a great day!

Ebony L.

July 14th, 2022

Very pleased with deeds.com. I highly recommend them to anyone, from clueless beginners like myself to the more advanced. Thank you for simplifying this process.

Thank you for your feedback. We really appreciate it. Have a great day!

CHERI I.

August 4th, 2021

I was so pleased with how easy this form was to download and print! Thank you and I am sure we will use you again in the future!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffrey G.

March 9th, 2023

Transaction went smoothly. The forms in the package were just what was needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Jann H.

July 18th, 2019

Was helpful information

Thank you!

Ed C.

June 16th, 2025

I purchased the DIY quitclaim deed forms for Florida and couldn’t be happier. The forms were clear, professional, and easy to follow. I had everything filled out and recorded without a single issue. Worth every penny — the site is great, and the forms are exactly what I needed. Highly recommend!

Thanks so much, Ed! We’re thrilled to hear that the Florida quitclaim deed forms worked perfectly for you and that the recording process went smoothly. We appreciate your trust and recommendation!

Carol H.

October 8th, 2022

Easy to understand, quick access, inexpensive, and I took it to my registrar's office and he said the warranty deed was good to go. Thanks for saving me a bundle in lawyer's fees.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!