Eddy County Transfer on Death Deed Revocation Form

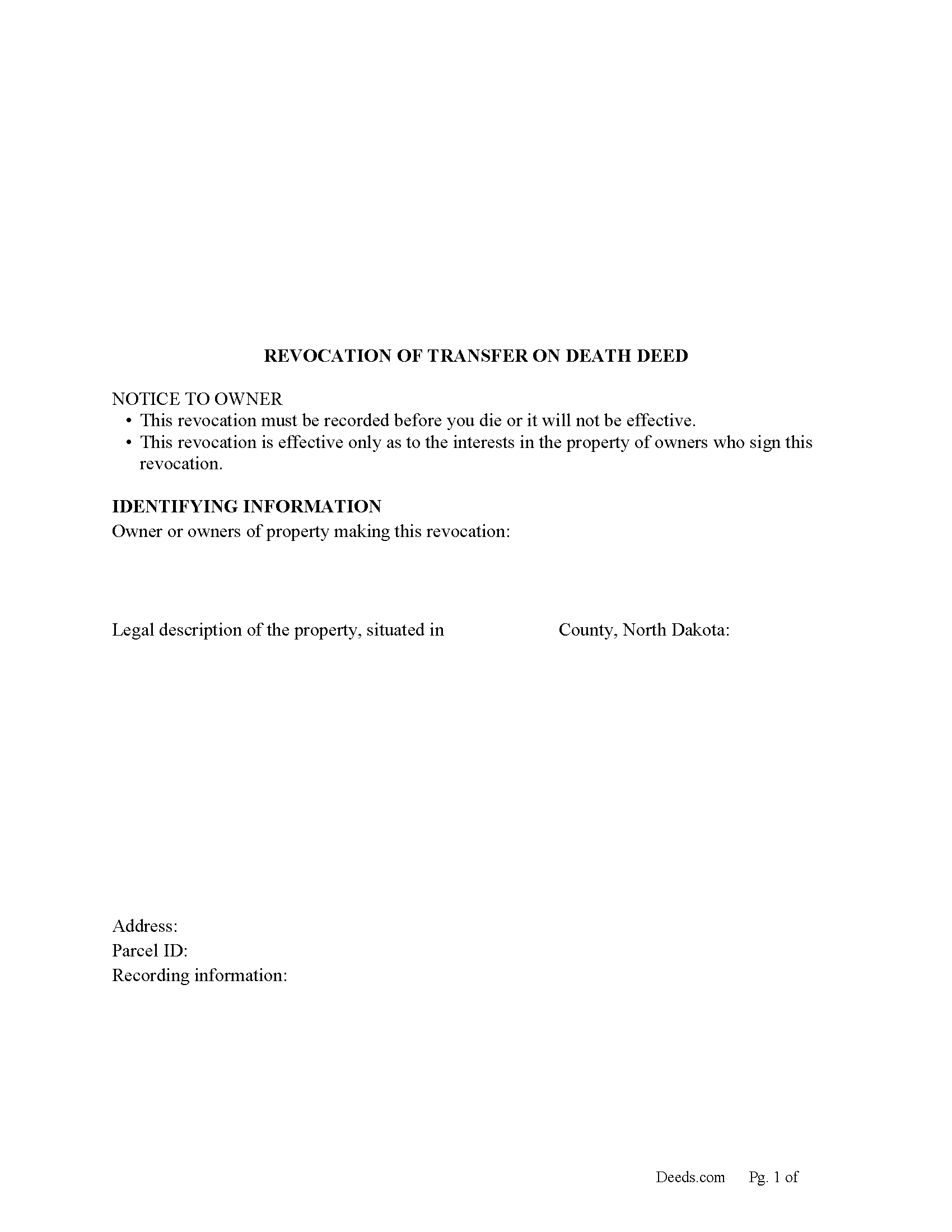

Eddy County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

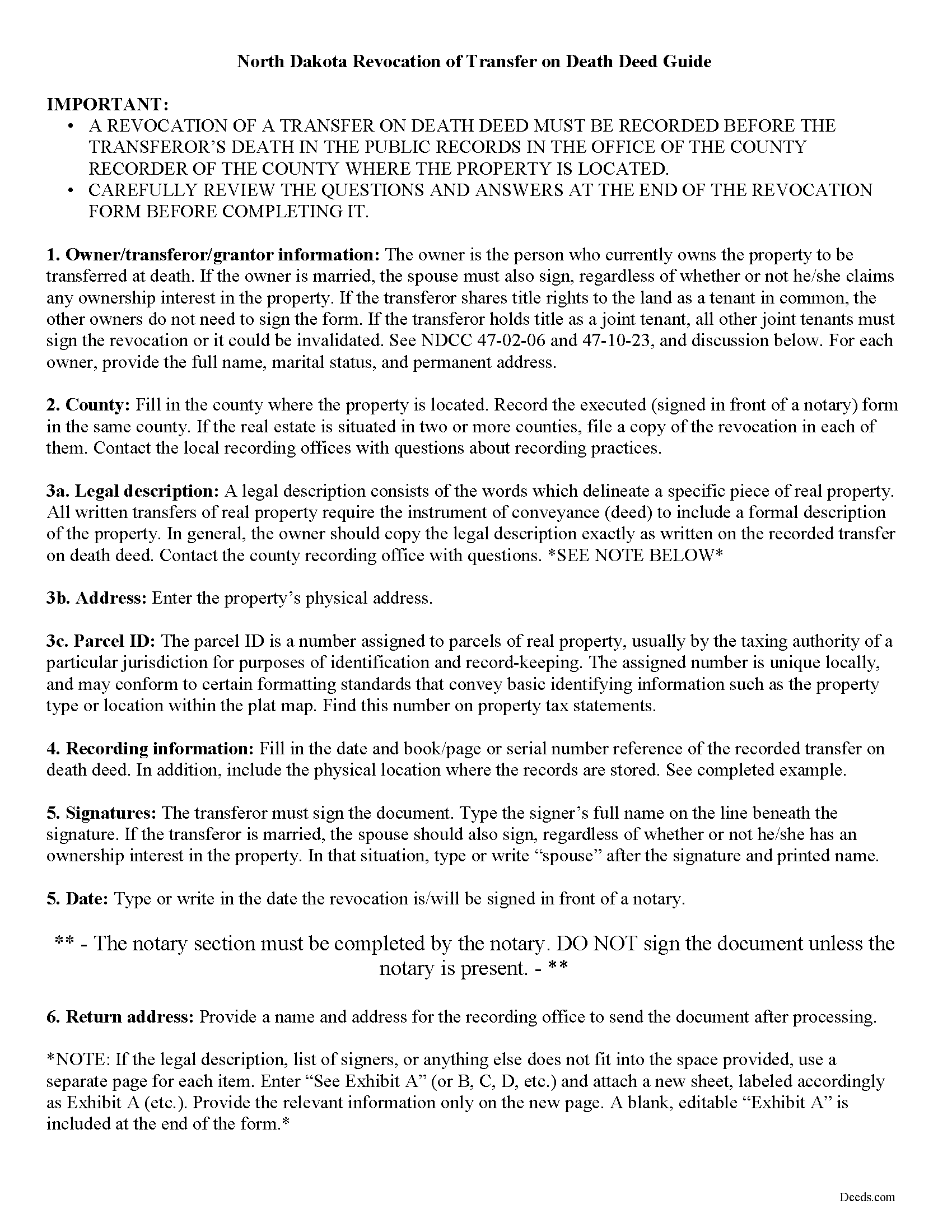

Eddy County Transfer of Death Revocation Guide

Line by line guide explaining every blank on the form.

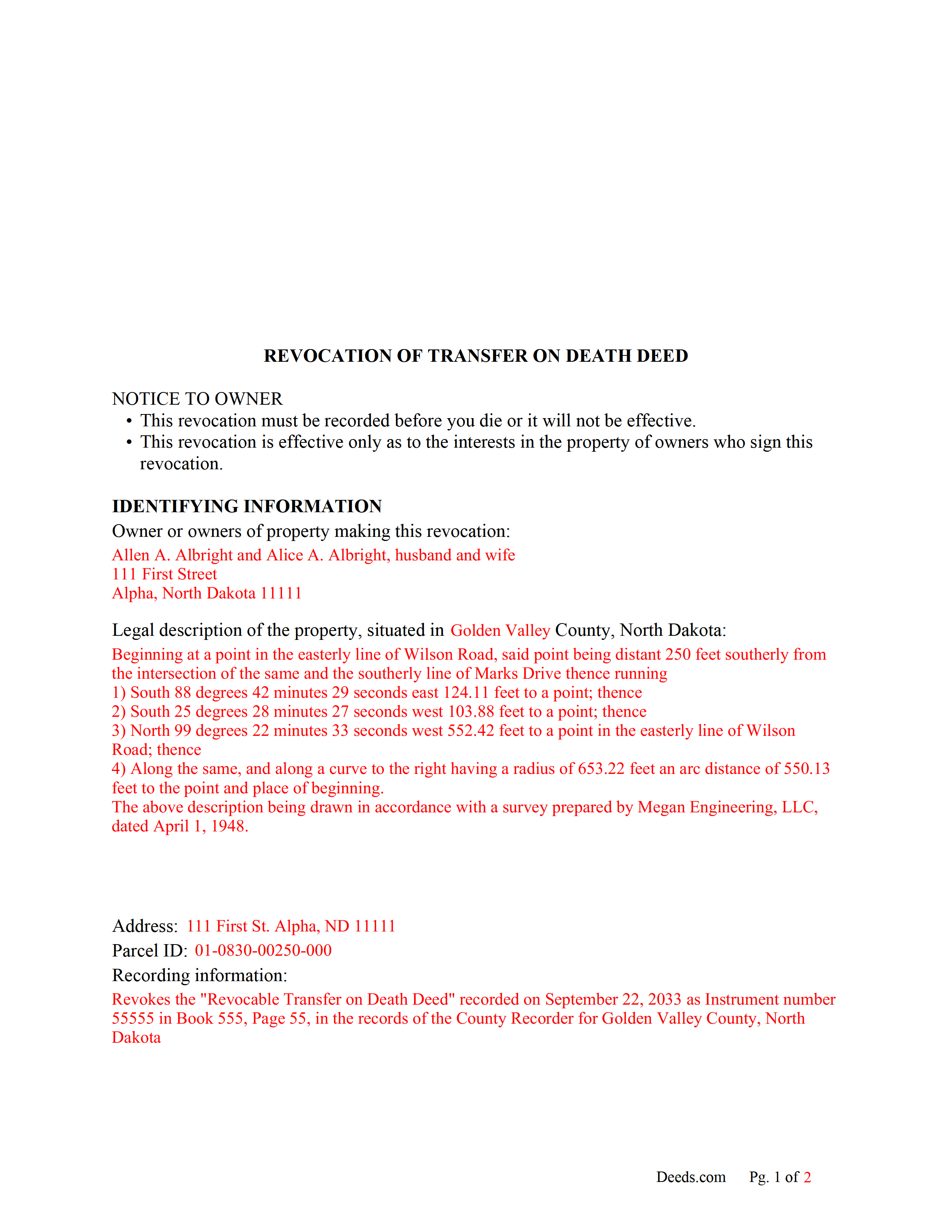

Eddy County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Eddy County documents included at no extra charge:

Where to Record Your Documents

Eddy County Recorder / Clerk of Court

New Rockford, North Dakota 58356-1652

Hours: 8:00 to 4:00 Monday through Friday CT

Phone: 701-947-2434 Ext 2013 (o)

Recording Tips for Eddy County:

- Ensure all signatures are in blue or black ink

- Verify all names are spelled correctly before recording

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Eddy County

Properties in any of these areas use Eddy County forms:

- New Rockford

- Sheyenne

Hours, fees, requirements, and more for Eddy County

How do I get my forms?

Forms are available for immediate download after payment. The Eddy County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Eddy County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Eddy County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Eddy County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Eddy County?

Recording fees in Eddy County vary. Contact the recorder's office at 701-947-2434 Ext 2013 (o) for current fees.

Questions answered? Let's get started!

Revoking North Dakota's Transfer on Death Deeds

Note that revocations of transfer on death deeds must be recorded during the owner's life or they have no effect.

In 2011, North Dakota enacted the Uniform Real Property Transfer on Death Act, found in the North Dakota Century Code (NDCC) at Chapter 30.1-32.1.

According to this statute, owners of North Dakota real property may transfer property to one or more beneficiaries effective, at the transferor's death, by lawfully executing and recording a transfer on death deed (TODD) in the county or counties where the property is located (NDCC 32.1-02). The instruments must contain all the information required for traditional deeds, as well as a statement that the transfer will occur at the owner's death (30.1-32.1-06).

This transfer is nontestamentary, meaning it is not included in the owner's will (30.1-32.1-04). As a result, it does not require probate distribution. Even so, best practices dictate that the will and any other transfers should not contain any conflicting instructions.

Deeds under this law allow the owners to retain absolute ownership of and control over the land until death, including the ability to cancel or change the beneficiary designation, and to sell the property outright to someone else (30.1-32.1-09). Because the transfer is revocable (30.1-32.1-03), there is no obligation to notify the beneficiary or to collect consideration (money) for the potential future interest (30.1-32.1-07).

Revocability is one of the unique features of TODDs. It gives property owners the flexibility to adapt to changing circumstances by modifying or cancelling future transfers with relative ease. In addition, if the owner decides to sell the real estate to someone else, executing and recording a revocation provides a firm end point for a recorded TODD. This action reduces the potential for confusion about the title, and contributes to the property's clear chain of title (ownership history).

Section 30.1-32.1-08 provides the rules for revoking a recorded TODD. There are three main options, all of which must be executed and recorded while the owner is still alive:

- a new transfer on death deed that revokes all or part of the earlier deed

- an instrument of revocation that specifically revokes the earlier deed

- a tradition deed, such as a warranty or quitclaim deed, that conveys all the owner's interest in the property.

(North Dakota TODD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Eddy County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Eddy County.

Our Promise

The documents you receive here will meet, or exceed, the Eddy County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Eddy County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

James G.

November 18th, 2019

Deed.com had some hard to find mineral interest deeds for Oklahoma.I'm an attorney in Texas with no Ok experience. The examples on Deed.com were very useful and saved me lots of time. James G.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew S.

October 14th, 2020

This is fast and easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas B.

May 29th, 2020

My deeds were filed with Pinellas County Florida with a simple process and with no problems. 5 star for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

carrie m.

March 3rd, 2020

I was excited because I really wanted to see and get a copy of the Deed to my property. The personal/Staff responsible for setting up that plan did an excellent/outstanding job. Thanks so much and keep up the great work. Carrie

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin C.

August 22nd, 2021

Easy to use but the quit claim deep looked old and dated. The example of how to fill out should have asterisks stating what is need and what can be skipped

Thank you for your feedback. We really appreciate it. Have a great day!

William B.

October 22nd, 2023

The forms, and other information, are all excellent. I would be giving a 5-star review if it were not for the fact that downloading a "bundle" about quitclaim deeds required I download every single file independently (15 files). I would far prefer a zip file, or one click to download the whole pile of independent files.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Eric S.

August 11th, 2020

Very easy and efficient to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stefan L.

May 5th, 2022

Great templates and very efficient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debby P.

April 2nd, 2020

First time user and the service was great.. I typically go to recording kiosk at the libraries. This was fast and easy.. I appreciate the great service

Thank you for your feedback. We really appreciate it. Have a great day!

KIMBERLY B.

September 29th, 2021

AWSOME!

Thank you!

SUSAN R.

March 15th, 2021

So easy to download and print. Also the examples are very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda D.

December 3rd, 2020

Very easy to use once I found it.

Thank you!

Connie C.

February 18th, 2021

I thought the process was fairly easy. The price was reasonable. I had a slight problem, some of the words were missing from one page of the documents when I printed it. However, after I saved it to my computer, I was able to print the page in full.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

edward m.

February 27th, 2019

I would rate it 5 stars also. Eddie M.

Thank you!