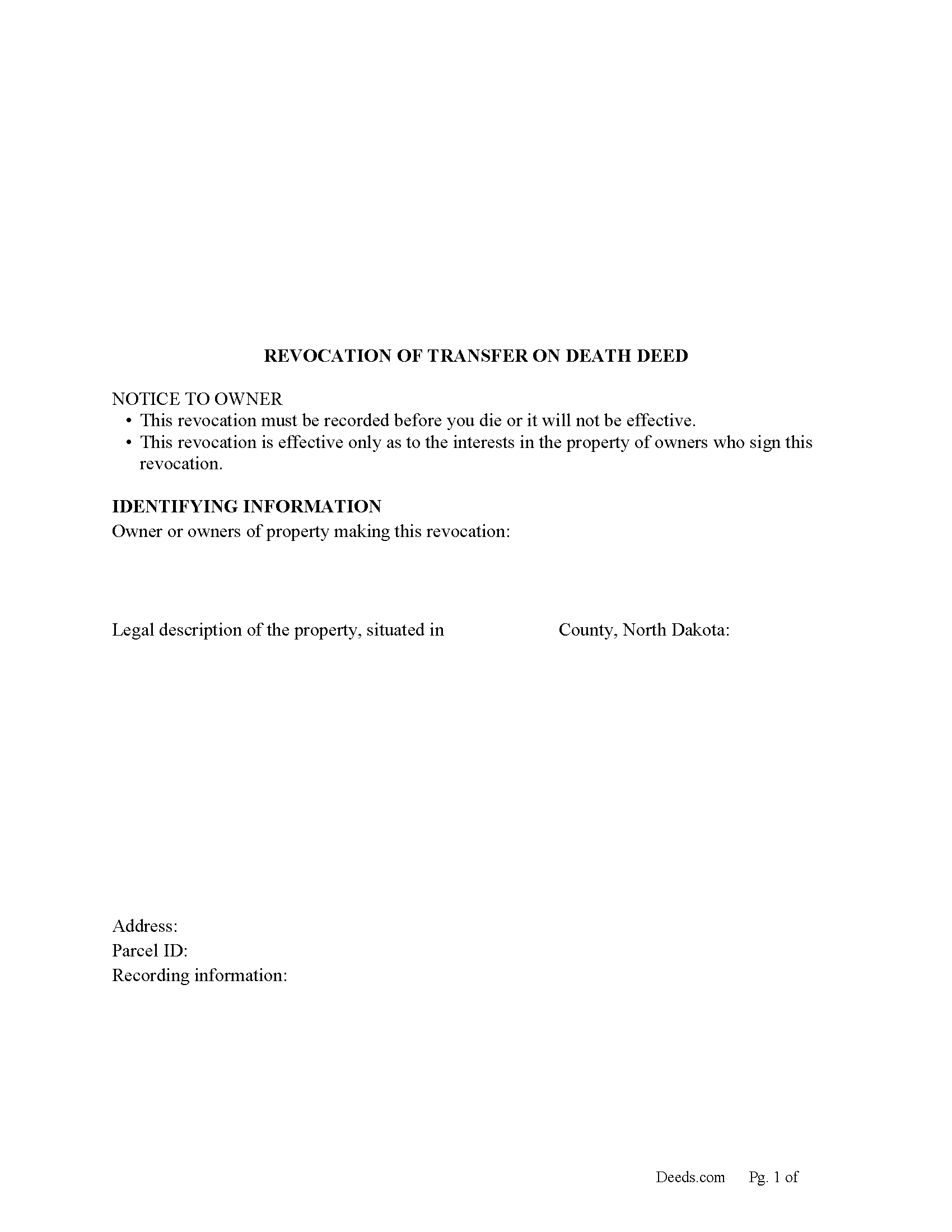

Stark County Transfer on Death Deed Revocation Form

Stark County Transfer on Death Revocation Form

Fill in the blank form formatted to comply with all recording and content requirements.

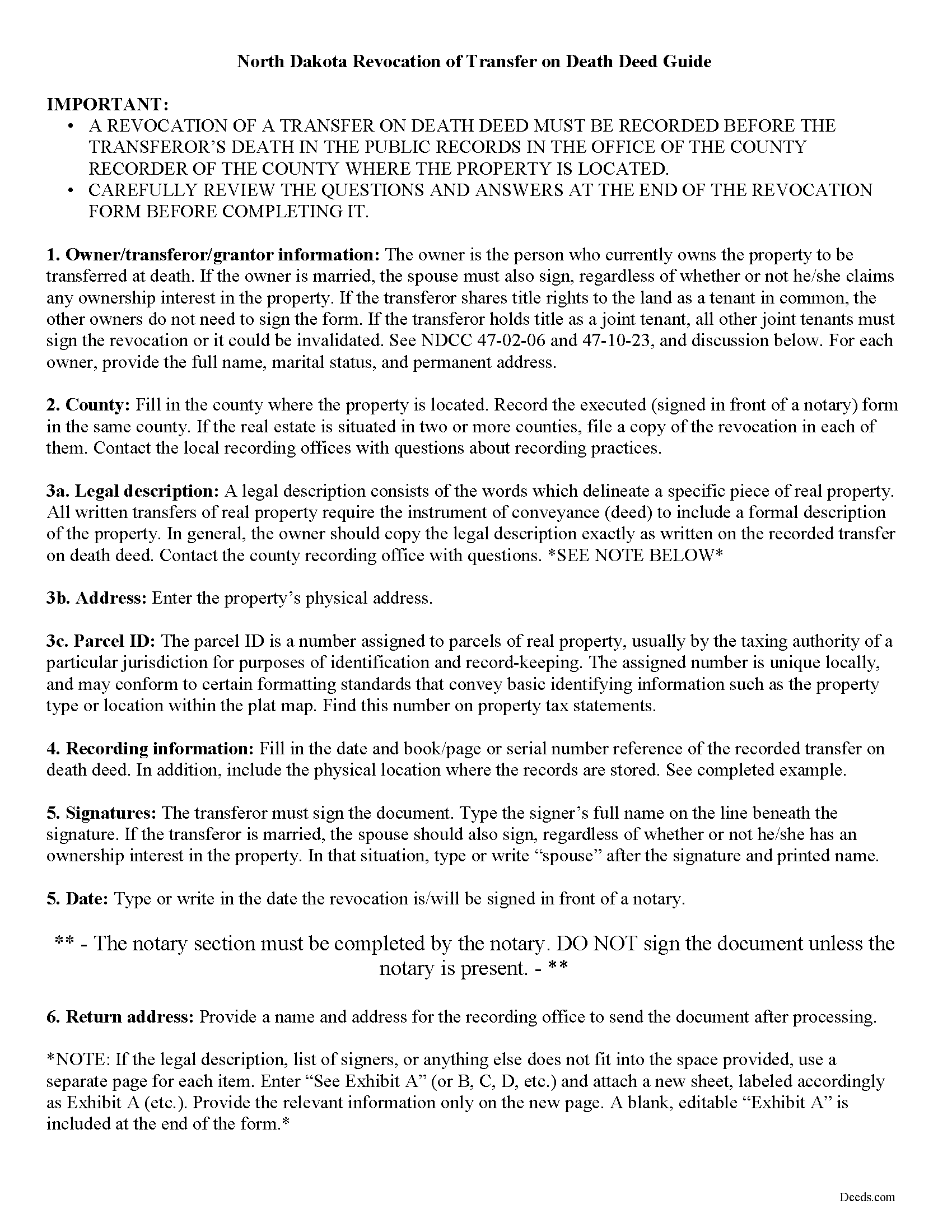

Stark County Transfer of Death Revocation Guide

Line by line guide explaining every blank on the form.

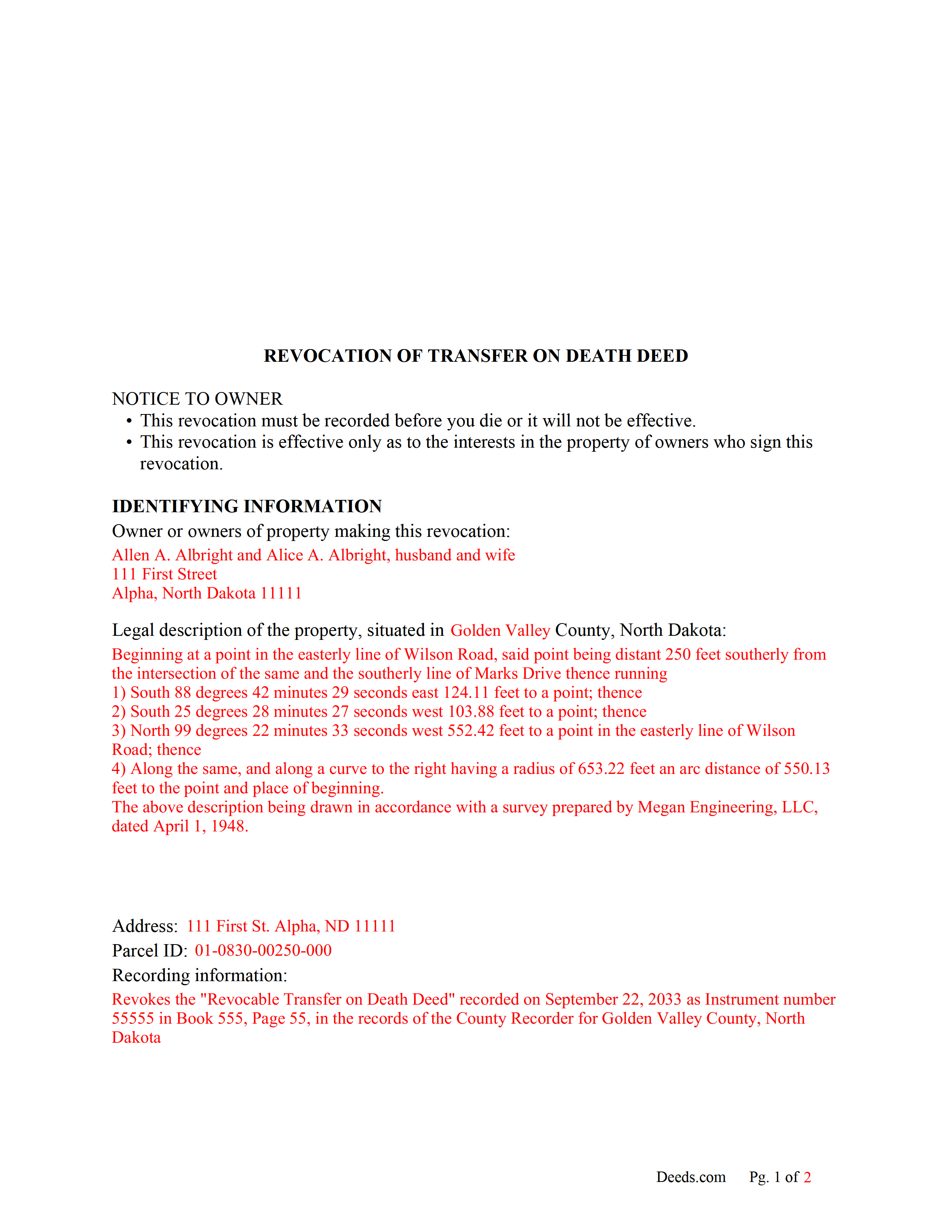

Stark County Completed Example of the Transfer on Death Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Stark County documents included at no extra charge:

Where to Record Your Documents

Stark County Recorder

Dickinson, North Dakota 58602-0130

Hours: 8:00 to 5:00 M-Th; Fr 8:00 to 12:00

Phone: (701) 456-7645

Recording Tips for Stark County:

- Documents must be on 8.5 x 11 inch white paper

- Recorded documents become public record - avoid including SSNs

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Stark County

Properties in any of these areas use Stark County forms:

- Belfield

- Dickinson

- Gladstone

- Lefor

- Richardton

- South Heart

- Taylor

Hours, fees, requirements, and more for Stark County

How do I get my forms?

Forms are available for immediate download after payment. The Stark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stark County?

Recording fees in Stark County vary. Contact the recorder's office at (701) 456-7645 for current fees.

Questions answered? Let's get started!

Revoking North Dakota's Transfer on Death Deeds

Note that revocations of transfer on death deeds must be recorded during the owner's life or they have no effect.

In 2011, North Dakota enacted the Uniform Real Property Transfer on Death Act, found in the North Dakota Century Code (NDCC) at Chapter 30.1-32.1.

According to this statute, owners of North Dakota real property may transfer property to one or more beneficiaries effective, at the transferor's death, by lawfully executing and recording a transfer on death deed (TODD) in the county or counties where the property is located (NDCC 32.1-02). The instruments must contain all the information required for traditional deeds, as well as a statement that the transfer will occur at the owner's death (30.1-32.1-06).

This transfer is nontestamentary, meaning it is not included in the owner's will (30.1-32.1-04). As a result, it does not require probate distribution. Even so, best practices dictate that the will and any other transfers should not contain any conflicting instructions.

Deeds under this law allow the owners to retain absolute ownership of and control over the land until death, including the ability to cancel or change the beneficiary designation, and to sell the property outright to someone else (30.1-32.1-09). Because the transfer is revocable (30.1-32.1-03), there is no obligation to notify the beneficiary or to collect consideration (money) for the potential future interest (30.1-32.1-07).

Revocability is one of the unique features of TODDs. It gives property owners the flexibility to adapt to changing circumstances by modifying or cancelling future transfers with relative ease. In addition, if the owner decides to sell the real estate to someone else, executing and recording a revocation provides a firm end point for a recorded TODD. This action reduces the potential for confusion about the title, and contributes to the property's clear chain of title (ownership history).

Section 30.1-32.1-08 provides the rules for revoking a recorded TODD. There are three main options, all of which must be executed and recorded while the owner is still alive:

- a new transfer on death deed that revokes all or part of the earlier deed

- an instrument of revocation that specifically revokes the earlier deed

- a tradition deed, such as a warranty or quitclaim deed, that conveys all the owner's interest in the property.

(North Dakota TODD Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Stark County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Revocation meets all recording requirements specific to Stark County.

Our Promise

The documents you receive here will meet, or exceed, the Stark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stark County Transfer on Death Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Lloyd F.

September 13th, 2019

We were very pleased at how quickly the forms showed up and the guide and copy of a sample filled in form was very helpful. We will defiantly use you again if the occasion arises, and will highly recommend your company to friends and family. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David Q.

April 14th, 2020

Very easy...great service.

Thank you!

Tonya B.

September 9th, 2021

Easy process. Thanks for making this resource available.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

wayne s.

March 25th, 2020

Wonderful forms! Thanks for making this available.

Thank you Wayne, have a great day!

Allen H.

April 30th, 2021

Your program was invaluable to us, I used it for my Mom's estate and when she passed the transition was seamless and no probate was involved. I am going to use this for myself to transfer my property over to my children in upon my death. Can't say enough positive things about it. Thanks, Allen

Thank you!

Michael H.

July 30th, 2019

Found documents I needed quickly and at a reasonable price. MH

Thank you for your feedback. We really appreciate it. Have a great day!

Warren R.

April 24th, 2020

Nice service at a fair price. Website is not very user oriented. Messages accumulate in the messages area but are not emailed to the client. If you used the service regularly, it would be more understandable but for a first time or occasional user, the site can be time consuming.

Thank you!

Melody P.

December 30th, 2020

5 Stars isn't enough! I worked with KVH today (12-30-20) to get some deeds filed in Dallas County before the end of the year. Timing was critical and I thought my only option was to record in person. Someone suggested I try Deeds.com, and I'm very glad I did. KVH provided excellent service. Everything was quick and efficient, and I highly recommend using this service. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARK S.

February 28th, 2020

I filed my beneficiary deed today and it went off without a hitch. I really appreciated the guidelines and the example that came with the form The guide lines cleared up some questions I had regarding tenancy by the entirety which I had been trying to figure out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamal .

July 29th, 2020

So far so good!

Thank you!

Candace K.

April 1st, 2021

I was able to find the Certificate of Trust after a little searching. Once found, the remainder of the process was easy. My task was done in no time. It's a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

LETICIA N.

August 23rd, 2022

I AM VERY PLEASED WITH YOUR WEBSITE. EASY AND I WAS GIVEN A SAMPLE OF THE FORM AND INSTRUCTIONS. I AM VERY PLEASED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janice m.

November 9th, 2022

was great!

Thank you!

Ted D.

August 17th, 2020

Very good/user friendly

Thank you!

Conrad N.

November 1st, 2021

It worked well for me.

Thank you!