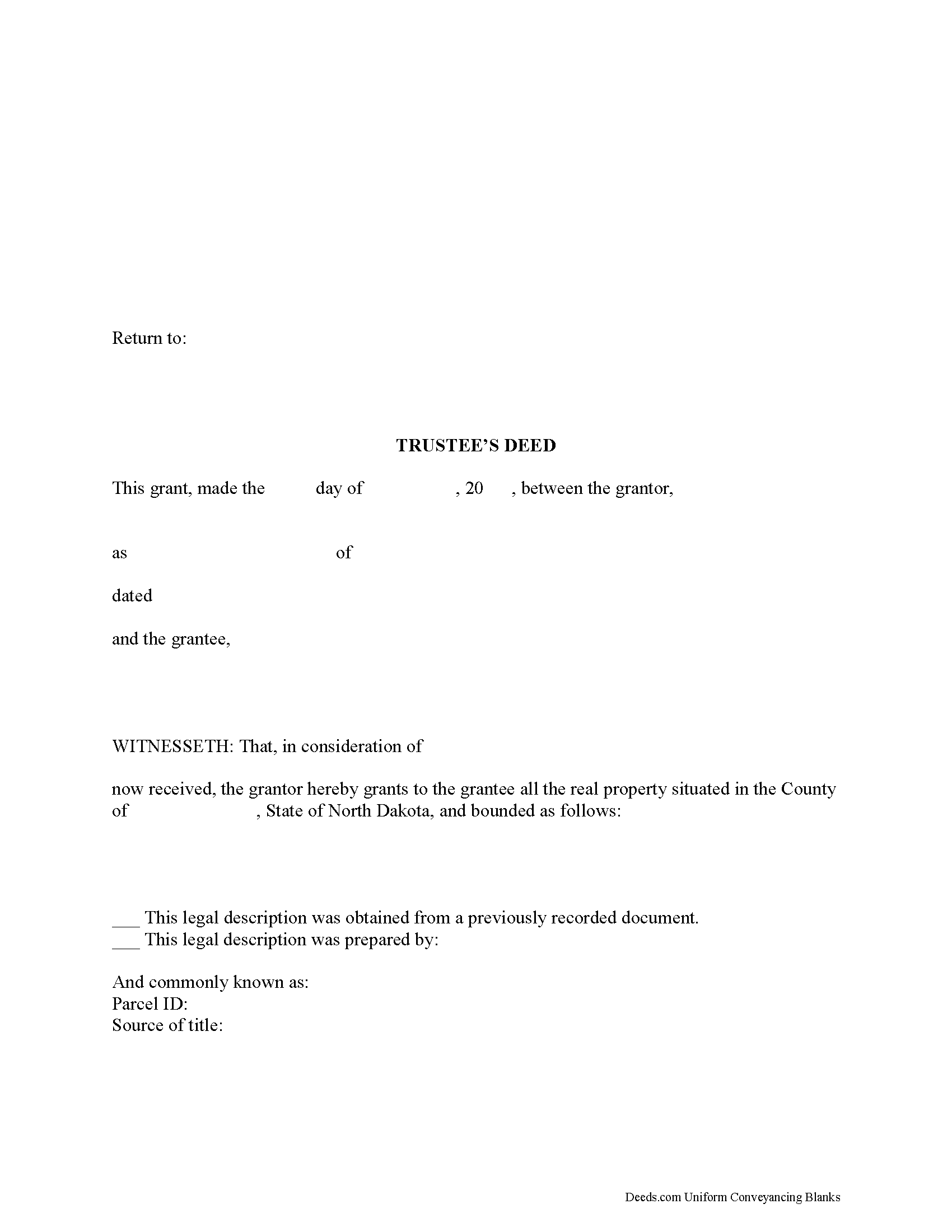

Golden Valley County Trustee Deed Form

Golden Valley County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

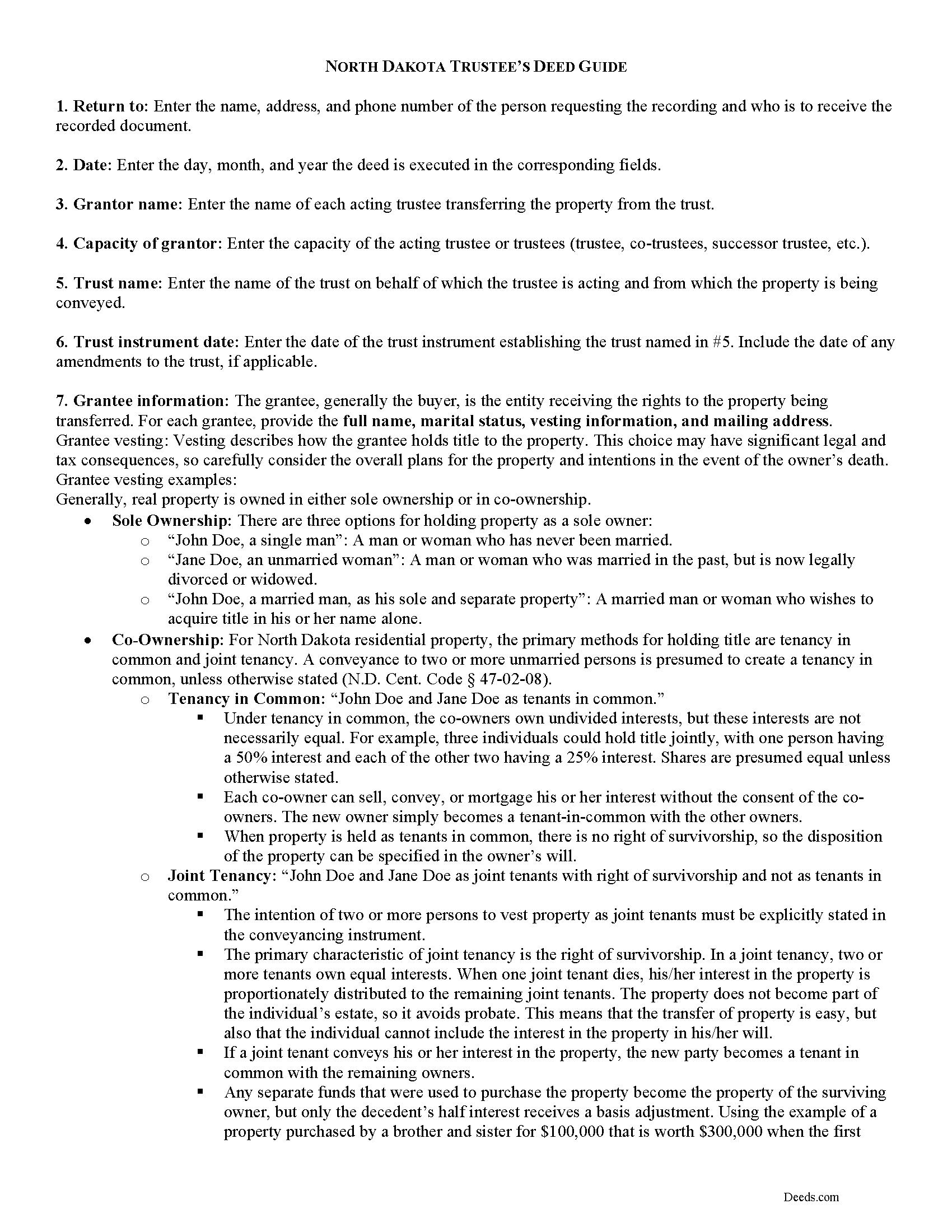

Golden Valley County Trustee Deed Guide

Line by line guide explaining every blank on the form.

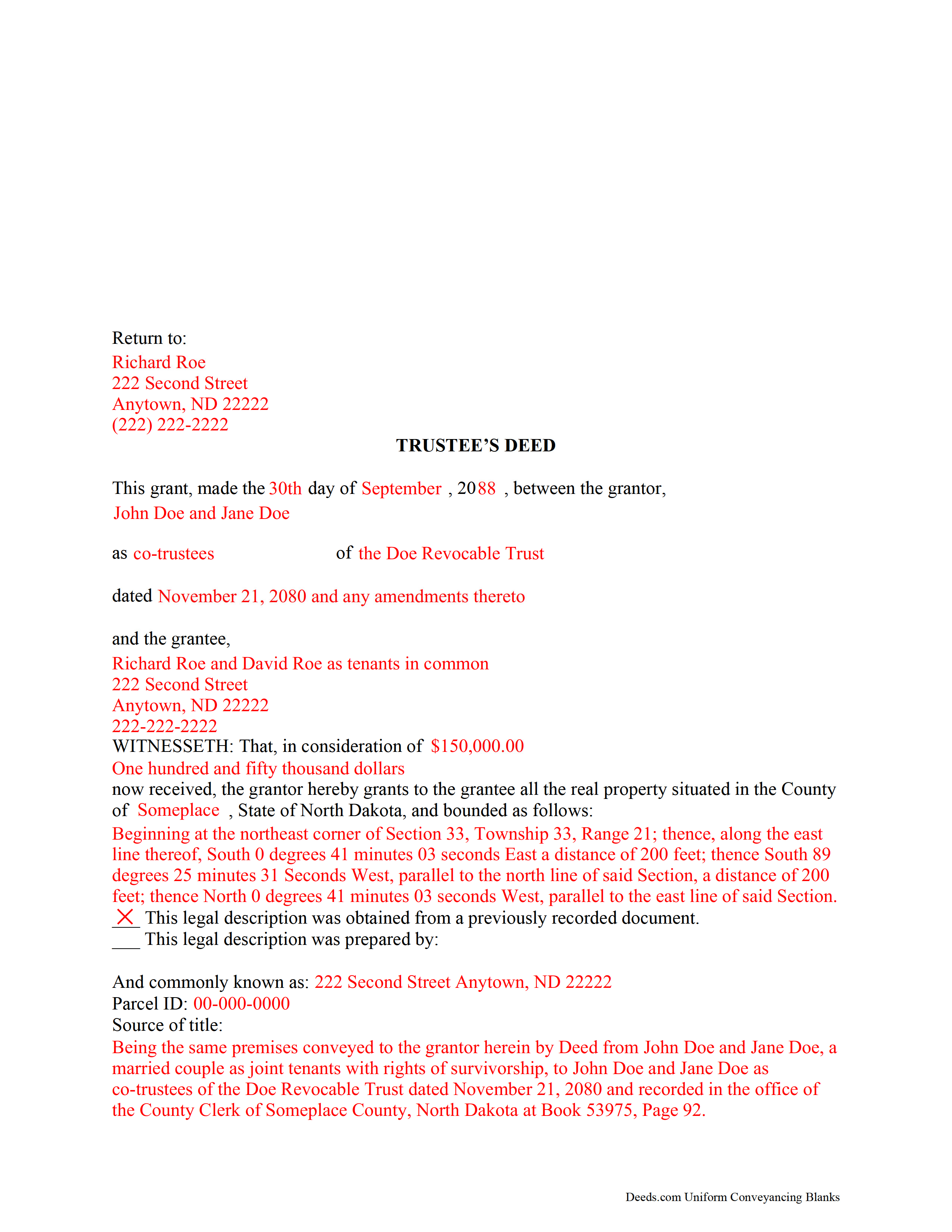

Golden Valley County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional North Dakota and Golden Valley County documents included at no extra charge:

Where to Record Your Documents

Golden Valley Recorder

Beach, North Dakota 58621-0067

Hours: 8:00am - 4:00pm M-F

Phone: (701) 872-3713

Recording Tips for Golden Valley County:

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Recorded documents become public record - avoid including SSNs

- Recording fees may differ from what's posted online - verify current rates

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Golden Valley County

Properties in any of these areas use Golden Valley County forms:

- Beach

- Golva

- Sentinel Butte

Hours, fees, requirements, and more for Golden Valley County

How do I get my forms?

Forms are available for immediate download after payment. The Golden Valley County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Golden Valley County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Golden Valley County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Golden Valley County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Golden Valley County?

Recording fees in Golden Valley County vary. Contact the recorder's office at (701) 872-3713 for current fees.

Questions answered? Let's get started!

Transferring Real Property from a Trust in North Dakota

A trust is an arrangement whereby a person (the grantor or settlor) transfers property to another (the trustee) for the benefit of a third (the beneficiary). In general, trusts in North Dakota are governed by Chapters 59-09 through 59-19 of the North Dakota Century Code as the North Dakota Uniform Trust Code.

To create a trust, the settlor transfers property to a trustee either during his lifetime (an inter vivos trust) or by will upon his death (a testamentary trust) (N. D. Cent. Code 59-12-01). It must be created for lawful purposes and have a definite beneficiary, or a person with "a present or future beneficial interest in a trust, vested or contingent, including the owner of an interest by assignment or transfer" ( 59-09-05, 59-12-04; 59-09-03(3)(a)).

In North Dakota, trusts relating to real property are invalid without a written instrument signed by the trustee ( 59-12-18). The trust instrument is an unrecorded document executed by the settlor that "contains [the] terms of the trust, including any amendments to the record" ( 59-09-03(25)). In addition to designating the trustee (and successor, if the settlor also serves as the original trustee) and conferring specific powers upon the trustee, the trust instrument establishes the scope of trust's assets and identifies trust beneficiaries.

An inter vivos (living) trust is an alternate method of holding title to real property for estate planning purposes. The settlor transfers real property into the trust by executing a deed titling the property in the name of the trustee as representative of the trust. The trustee administers the trust according to the terms set forth in the trust instrument.

The trustee "is presumed to have the power to sell, convey, and encumber the real property unless restrictions on that power appear in the records of the county recorder" ( 47-140-26). The trustee's authority to convey property is further established by the statutory general power of trustees to exercise "all powers over the trust property which an unmarried owner, who is not an incapacitated person, has over individually owned property of the trustee" and the specific power to sell property, as established by the North Dakota Uniform Trust Code ( 59-16-15, 59-16-16(2)).

In order to convey real property out of the trust, the trustee executes a trustee's deed. The form of conveyance takes its name from the granting party rather than from the type of warranty of title given, as with a warranty deed or special warranty deed, for example.

In North Dakota, the trustee's deed is typically a special warranty deed passing fee simple title, containing the covenants that the grantor has not previously conveyed right, title, or interest to another person and that the property is free from encumbrances made by the grantor or persons claiming under the grantor. These covenants are implied unless explicitly stated otherwise in the form of the conveyance ( 47-10-19).

Because real property held in trust is titled in the name of the trustee on behalf of the trust, in addition to naming each acting trustee, the trustee's deed should reference the trust and date of execution of the instrument establishing the trust. A certificate of trust under 59-18-13 or trustee's affidavit is typically unnecessary, though in some cases is advisable. Consult a lawyer with questions.

Deeds executed by trustees must meet all the same requirements for form and content for documents affecting interests in real property, including a statement of full consideration and legal description of the property being conveyed. All acting trustee signatures, made before a notary public, should be present before the deed is recorded in the office of the recorder of the county in which the subject property is located.

(North Dakota TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Golden Valley County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Golden Valley County.

Our Promise

The documents you receive here will meet, or exceed, the Golden Valley County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Golden Valley County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Craig W.

August 18th, 2019

This is a great way to get paper work to the land love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robyn D.

July 28th, 2020

Excellent service, knowledgeable and helpful representatives via the messaging service. Reliable information provided by reps, overall excellent experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anna S.

July 17th, 2020

You guys are awesome, The service, expertise and quick communication were amazing. I think you guys are charging to little, but you didn't hear that from me. Thank you for making this process quick and easy.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa W.

December 19th, 2019

Great E-Service Provider!

Thank you!

Sally F.

January 22nd, 2020

Amazing forms, thanks so much for making these available.

Thank you!

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

marshall w.

September 24th, 2019

was not ready to pay for much needed forms but very important

Thank you for your feedback. We really appreciate it. Have a great day!

Janepher M.

January 27th, 2019

Easy and informative site. Helped me figure out what I was looking for.

Thank you Janepher, we appreciate your feedback!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David R A.

April 18th, 2023

Way overpriced But serves the Purpose.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda I.

August 16th, 2023

So far so good. It was reasonably easy to download and complete the form using information found in my closing paperwork. I haven't yet had my form notarized but plan to do so this week and submit the packet to my county auditor.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan P.

June 25th, 2020

Great service and well done forms thank you

Thank you!

Brian C.

April 1st, 2019

***** so easy thanks.

Thanks Brian, we appreciate your feedback.

Petti V.

February 15th, 2022

Your site was so easy to use. And I got the form and instructions I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

HEATHER M.

September 27th, 2024

The guide I needed was very easy to understand and the template was easy to complete. I had a property attorney review the deed before I had it registered and she was impressed. She said she couldn't have written it better herself! Definitely worth the money instead of paying high dollar attorney fees for a simple task.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!