Texas County Personal Representative Deed Power of Sale Form

Texas County Personal Representative Deed Power of Sale Form

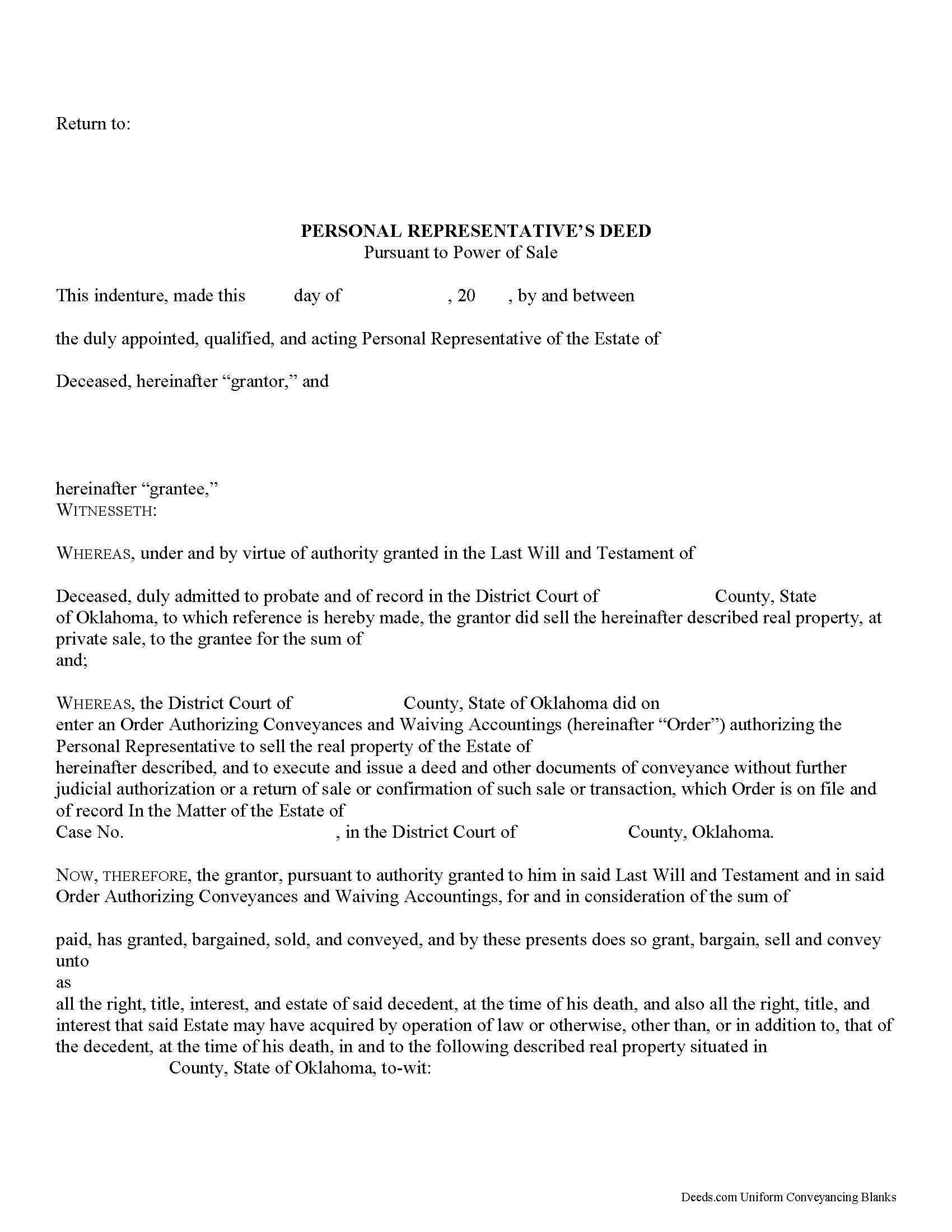

Fill in the blank form formatted to comply with all recording and content requirements.

Texas County Personal Representative Deed Power of Sale Guide

Line by line guide explaining every blank on the form.

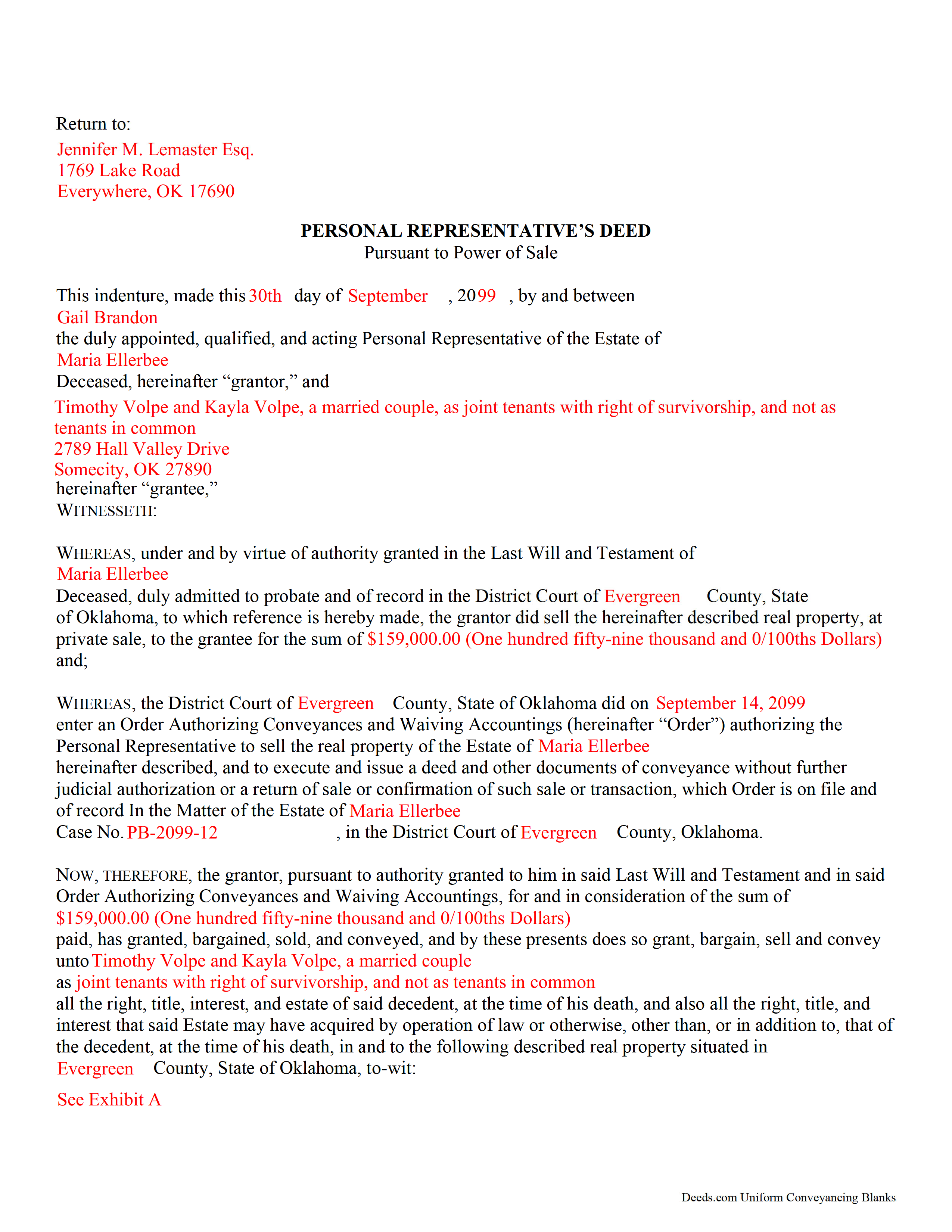

Texas County Completed Example of the Personal Representative Deed Power of Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oklahoma and Texas County documents included at no extra charge:

Where to Record Your Documents

Texas County Clerk

Guymon, Oklahoma 73942

Hours: 8:00am to 5:00pm M-F

Phone: (580) 338-3141

Recording Tips for Texas County:

- Double-check legal descriptions match your existing deed

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Texas County

Properties in any of these areas use Texas County forms:

- Adams

- Goodwell

- Guymon

- Hardesty

- Hooker

- Texhoma

- Tyrone

Hours, fees, requirements, and more for Texas County

How do I get my forms?

Forms are available for immediate download after payment. The Texas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Texas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Texas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Texas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Texas County?

Recording fees in Texas County vary. Contact the recorder's office at (580) 338-3141 for current fees.

Questions answered? Let's get started!

A personal representative's deed given under the power of sale is a probate deed, and one of several fiduciary instruments that may be used in estate administration. This deed is required when the personal representative is directed to sell property by a decedent's will. It can only be used by PRs of a testate estate. The personal representative's (PR) deed is named after the capacity of the granting party.

In some cases, the decedent's will may have authorized or explicitly directed a sale of realty by granting the executor (the PR named in a decedent's will) a power of sale. Before a deed can be recorded, the district court must authorize the sale and conveyance. The PR must apply to the court for an Order Authorizing Conveyances and Waiving Accountings.

Following such an order from the district court, use a personal representative's deed to transfer an interest in real property from a probate estate to a purchaser at private sale. The deed conveys all the right, title, interest, and estate of the decedent at the time of his death.

In addition to meeting all state and local standards for recorded documents, components of a properly executed PR deed include the recital of probate details, including the name of the court-appointed personal representative, the decedent's name, the date of the order authorizing the conveyance, the case number assigned to the probate estate, and a statement that the sale is made under the authority granted by the decedent's last will and testament.

Other requirements for a lawful deed include the full legal description of the property and statement of consideration, reflecting the value exchanged for the transfer of title. In Oklahoma, deeds commonly recite a generic consideration of "Ten and No/100ths Dollars," with the true purchase price reflected on an Affidavit of Purchase Price. This affidavit is a tool for the register's office to calculate the documentary stamp tax, a tax levied on all transfers of real estate in Oklahoma. Note any exemption from the tax under 68 O.S. 3202 on the face of the instrument.

Record the completed, signed, and notarized deed, along with a certified copy of the order of sale, signed by a judge, in the office of the register of deeds in the county wherein the property is situated.

The information provided here is not a substitute for legal advice. Consult an attorney licensed in the State of Oklahoma with questions regarding personal representative's deeds, as each situation is unique.

(Oklahoma PRD Power of Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Texas County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed Power of Sale meets all recording requirements specific to Texas County.

Our Promise

The documents you receive here will meet, or exceed, the Texas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Texas County Personal Representative Deed Power of Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

MARCO G.

May 9th, 2019

Very easy to use. Got the emailed documents within minutes.

We appreciate your feedback Marco, thank you.

Susan R.

July 31st, 2020

I found the documents I needed on Deeds.com. It was so easy to use and I received the items I purchased FAST! I'll be using their service again.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

William C.

September 9th, 2020

Good service, great price, the website is a bit hard to maneuver in places.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna B.

January 10th, 2019

Really liked the quick access to documents. Great service, thanks.

Thank you Donna, we appreciate you taken the time to leave your feedback. Have a great day!

Carleton G.

August 8th, 2020

I found everything I needed. Very easy to use. I am very satisfied.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina W.

September 4th, 2019

I stand corrected. I received my report and it was exactly what I requested.

Thank you!

janice m.

August 1st, 2025

Great system!

Thank you!

milton m.

August 27th, 2021

good product easy to use, as advertised

Thank you for your feedback. We really appreciate it. Have a great day!

Raymond C.

August 31st, 2021

Very convenient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl C.

September 1st, 2021

Very pleased. I spent a fair amount of time chasing a blank form only to be told it couldn't be given to me - I had to go through my attorney. Going thru the deeds.com was a breeze; the blank form looked exactly like one I had filed before :-)

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gordon W.

April 7th, 2022

Nice forms but it sure would have been nice to be able to at least print the guide and the example so that I don't spend all of my time bouncing back and forth between windows on a laptop.

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki L.

July 4th, 2020

Quick results with accurate information and thorough information.

Thank you!

Jessi S.

March 4th, 2020

Delivery of documents was instantaneous once payment is received. Thank you for that. For future clarification to potential users, Deeds.com may want to categorize the type of easement documents that are available. I was needing a 'utility easement' form and received an 'ingress/egress' form. Had I known it was an ingress/egress document, I would not have made the purchase. Outside of this issue, this site is very helpful for the average layperson to hold guardianship over personal interests.

Thank you for your feedback. We really appreciate it. Have a great day!

Ralph H.

October 22nd, 2022

They must have busy when I applied. The screen said it should be done in under10 mins unless heavier traffic. I was a little nervous because of a time deadline. It was completed in 45 mins and for under $30 it was worth every penny to have my deed details at my fingertips. So I give it a 5 on ease of use and quick handling. You can get it done less expensively, but great in a time crunch.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!