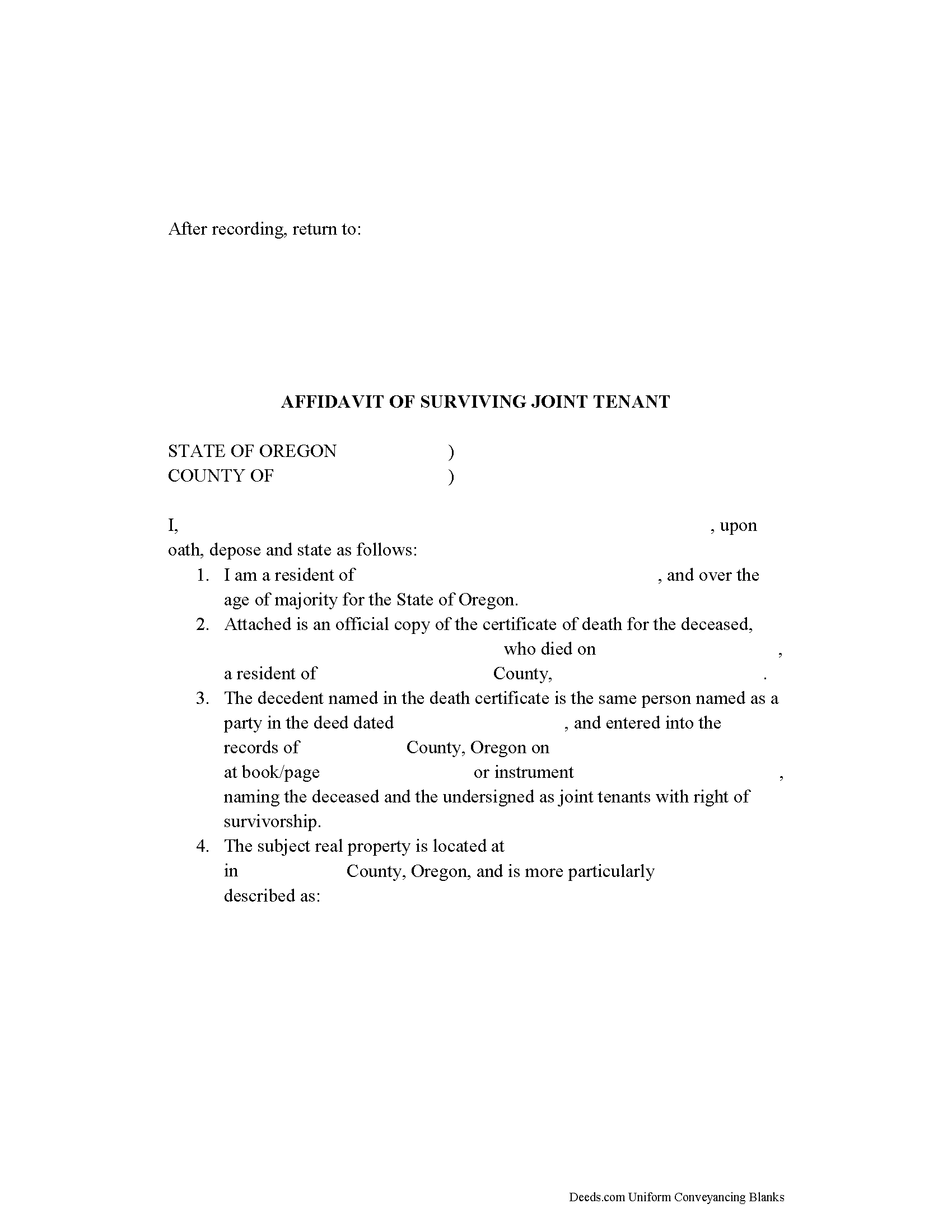

Jackson County Affidavit of Surviving Joint Tenant Form

Jackson County Affidavit of Surviving Joint Tenant Form

Fill in the blank form formatted to comply with all recording and content requirements.

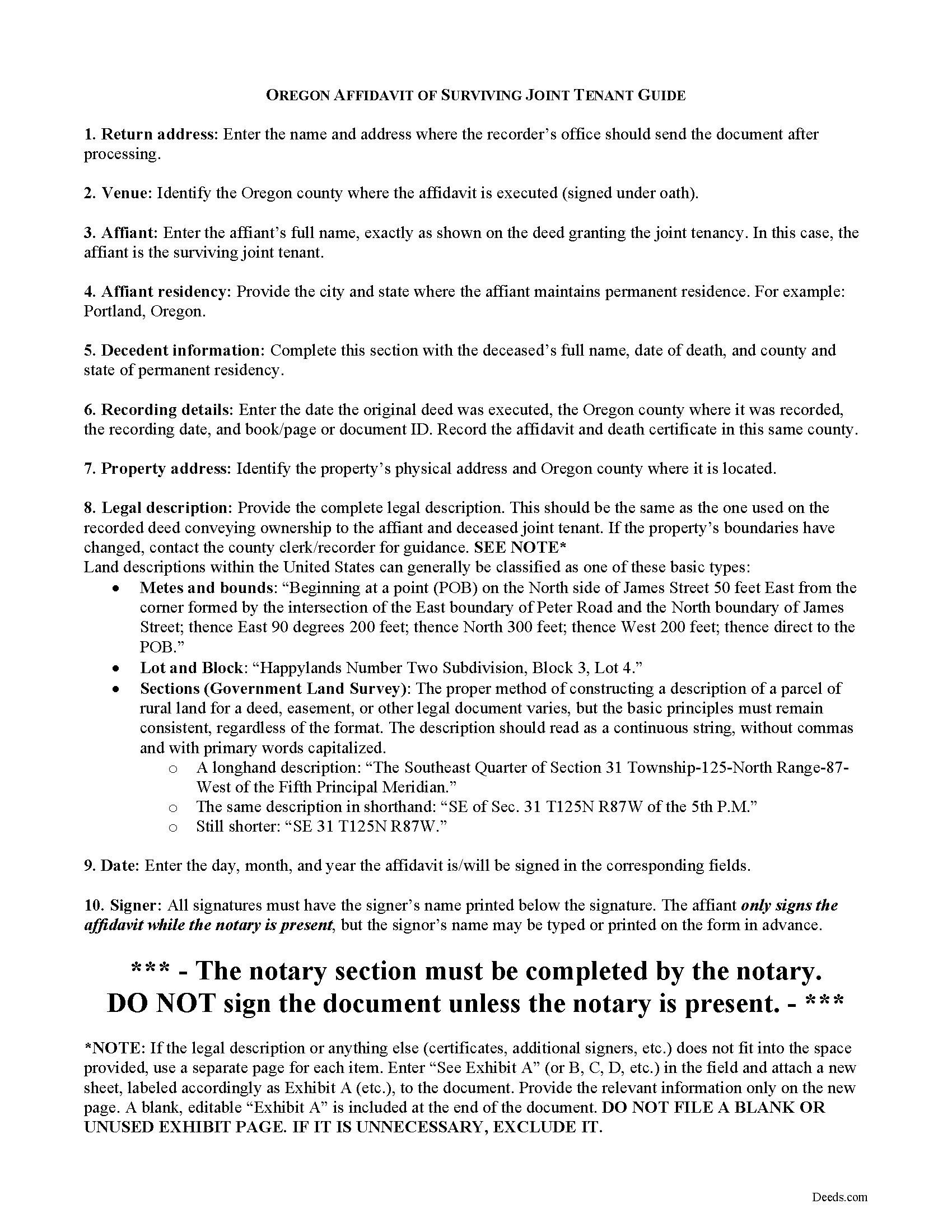

Jackson County Affidavit of Surviving Joint Tenant Guide

Line by line guide explaining every blank on the form.

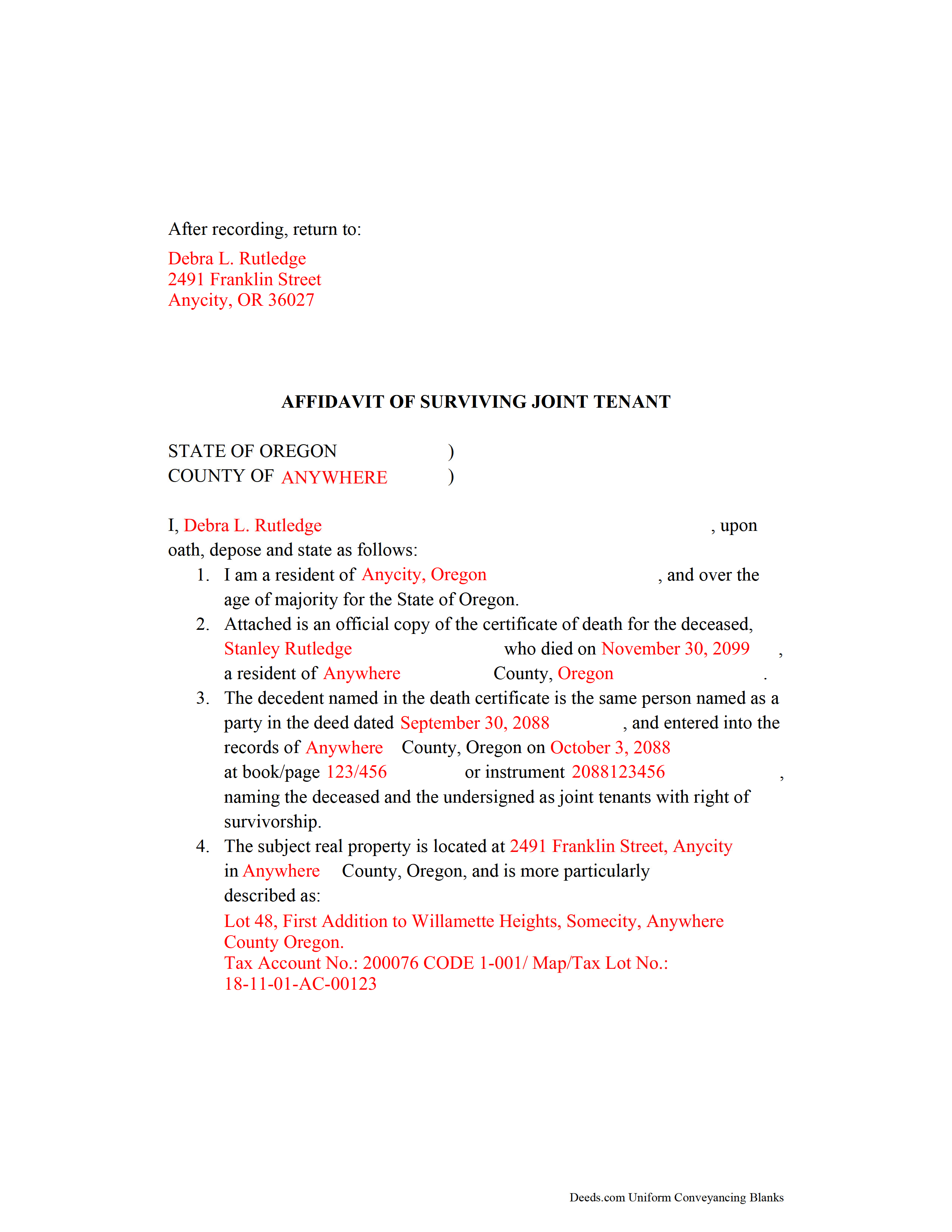

Jackson County Completed Example of the Affidavit of Surviving Joint Tenant Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Jackson County documents included at no extra charge:

Where to Record Your Documents

Recording Office

Medford, Oregon 97501

Hours: 8:30am–4pm M-F / Closed 11:15-12:30

Phone: (541) 774-6152

Recording Tips for Jackson County:

- Ensure all signatures are in blue or black ink

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

- Have the property address and parcel number ready

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Ashland

- Butte Falls

- Central Point

- Eagle Point

- Gold Hill

- Jacksonville

- Medford

- Phoenix

- Prospect

- Rogue River

- Shady Cove

- Talent

- Trail

- White City

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (541) 774-6152 for current fees.

Questions answered? Let's get started!

In general, when one co-owner of real property held as joint tenants with right of survivorship dies, the living co-tenant gains the property rights of the deceased owner by function of law. As long as the remaining owner survives the deceased owner by at least 120 hours, the asset is not affected by the owner's will, and therefore does not pass through the estate and is not subject to probate distribution (112.582(5)).

Even though the transfer is supposed to be automatic, the Oregon statutes contain instructions for establishing death under the survivorship rules codified at ORS 112.570 to 112.590. Primarily, to prove that the deceased owner has actually died, the living co-owner should obtain "a certified or authenticated copy of a death certificate purporting to be issued by an official or agency of the place where the death is alleged to have occurred" (112.582(2)(a)).

Once the survivor has the death certificate, he/she should submit it for recording, along with an affidavit of surviving joint tenant, to the same office that recorded the deed granting the survivorship tenancy to the co-owners. An affidavit is a document containing statements made under oath, and is admissible as evidence. The affidavit is not explicitly required by Oregon law, but it helps to protect the survivor's interest in the real property by clarifying and formalizing the change. In addition, the affidavit includes details about the specific parcel(s) of land and recording information from the original deed.

Recording the affidavit of surviving joint tenant and official death certificate provides public notice of the change in ownership, which in turn maintains the chain of title (sequential list of owners). A clear chain of title, with no gaps, reversals, or other details out of order, makes it easier to acquire title insurance, which should simplify future sales or mortgages of the property.

(Oregon AOSJT Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Joint Tenant meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Affidavit of Surviving Joint Tenant form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Barbara R.

August 26th, 2020

Thank you for your services My first time to ever print anything from your service or print off of a computer like this so I'm praying that it works I'm doing this to my phone. Thank you

Thank you!

Marion R.

January 30th, 2019

YOU WERE NOT ABLE TO PROVIDE SERVICE IN THE COUNTY WE NEEDED IN NEW MEXICO. YOUR RESPONSE WAS QUICK SO I APPRECIATE THAT. THANK YOU

Thank you for your feedback Marion.

brian t.

December 19th, 2020

The docs were precise and accurate for my specific needs. I greatly appreciated the accompanying forms and instructional guidance to help make the use of the forms direct and easy to complete. Equally important, I was not suckered in to get a great price for the docs I needed only to be led to expensive subscriptions or additional fees. Very impressive and professional site.

Thank you for your feedback. We really appreciate it. Have a great day!

D. Jeffrey C.

June 10th, 2024

Generally I find the process works well, and the support personnel on the other end are usually fairly helpful.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Kelli W.

October 5th, 2022

Fantastic documents! Easy to complete, looked great after I filled them in and printed them. No problems with the notary or recorder (recorder clerk actually said they see deeds.com documents all the time and they love em cause it makes their job easier). Highly recommend!!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda W.

April 21st, 2020

The Quitclaim deed form was fine. Unfortunately, all I wanted to accomplish was to transfer property held in my name into my trust, but I could not any wording on the information you provided on how to accomplish this. It was not a sale, just a transfer from me to me as trustee.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark W.

December 19th, 2022

Great form and easy to complete. Sending a sample and instructions was very helpful. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald H.

November 5th, 2019

EXCELLENT,,super good. Quick & easy

Thank you!

Betty B.

August 2nd, 2021

So easy and convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

Kerrin S.

April 11th, 2020

Wow, this was so easy & helpful. I didn't get it finished in time for recording, so I'm still waiting on that part, but the rest was simple and straight-forward. Thanks!

Thank you!

IVAN G.

August 21st, 2020

THIS Guys Save YOU TIME , Efforts and MONEY!!! So easy and secured to use,,NOT to mention FAST!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

Jim B.

December 22nd, 2021

Would be great if you would just put all of these documents into ONE .pdf.

Thank you for your feedback. We really appreciate it. Have a great day!

LIDIA M.

February 3rd, 2021

excellent

Thank you!

Carol S.

February 18th, 2022

Unfortunately for me this website was of no help, due to the amount of paperwork that needed to be submitted. One thing I can say they responded with answer really quickly. If this is a website that only deals with quick and fast deed issues, then it should indicate what they can and cannot do.

Thank you for your feedback. We really appreciate it. Have a great day!