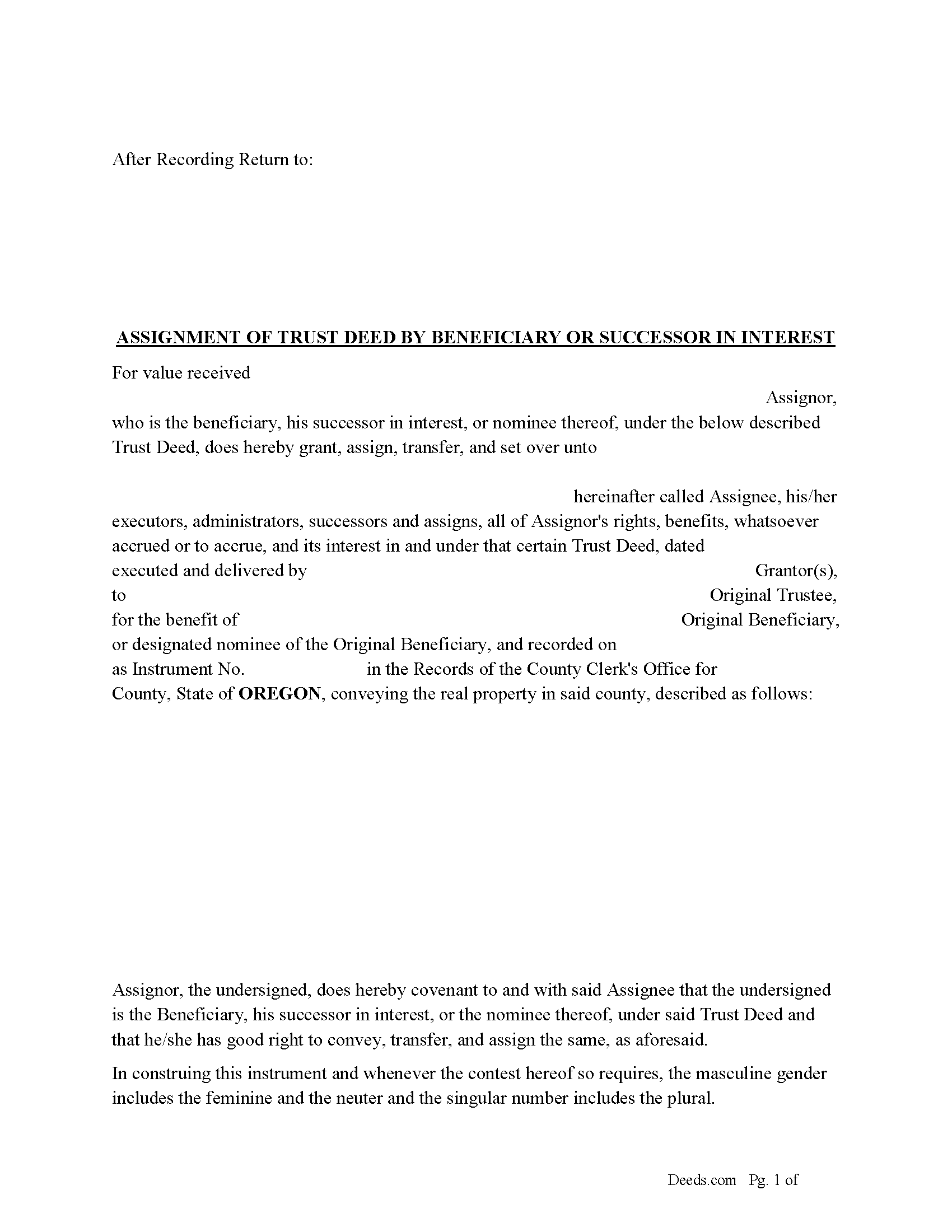

Marion County Assignment of Trust Deed by Beneficiary or Successor in Interest Form

Marion County Assignment of Trust Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

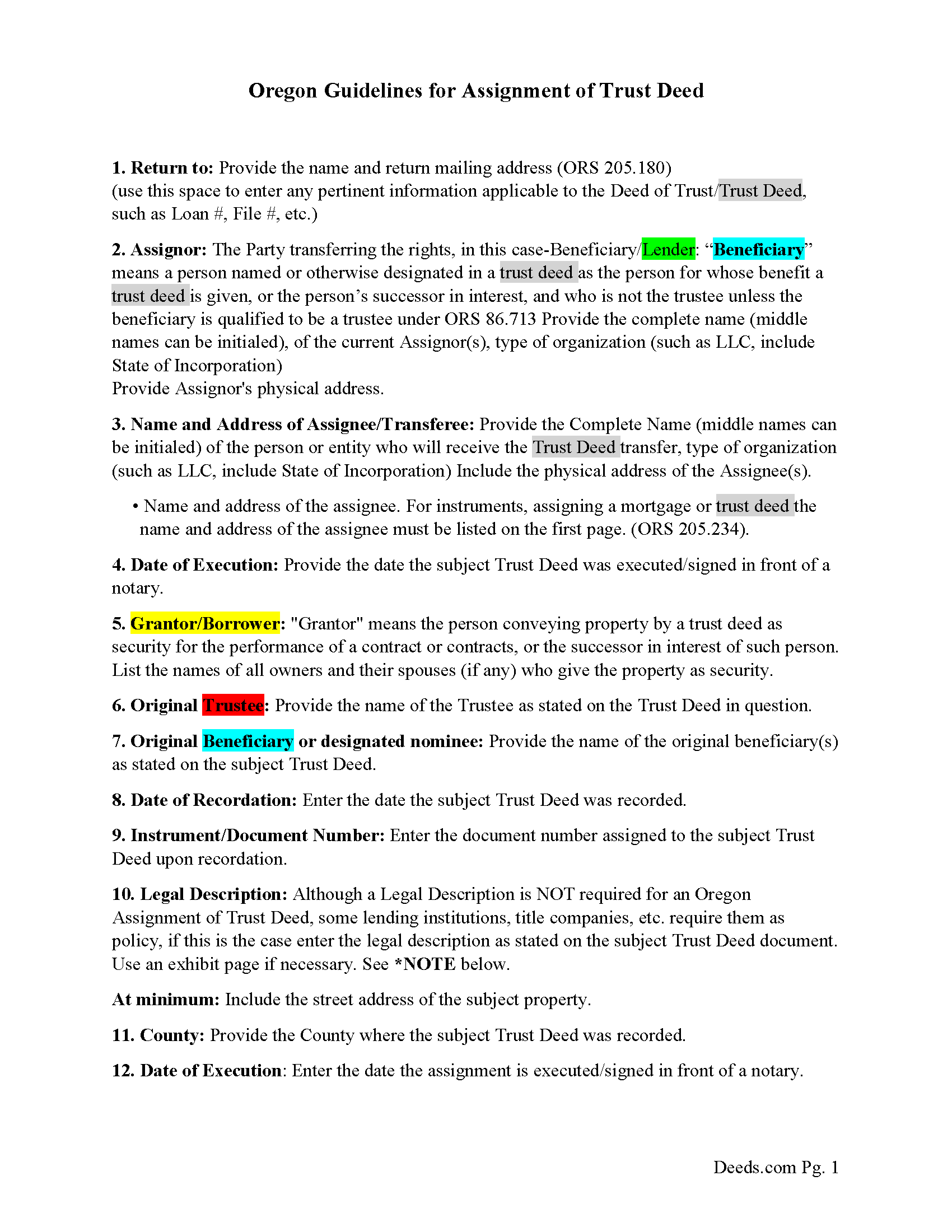

Marion County Assignment of Trust Deed Guidelines

Line by line guide explaining every blank on the form.

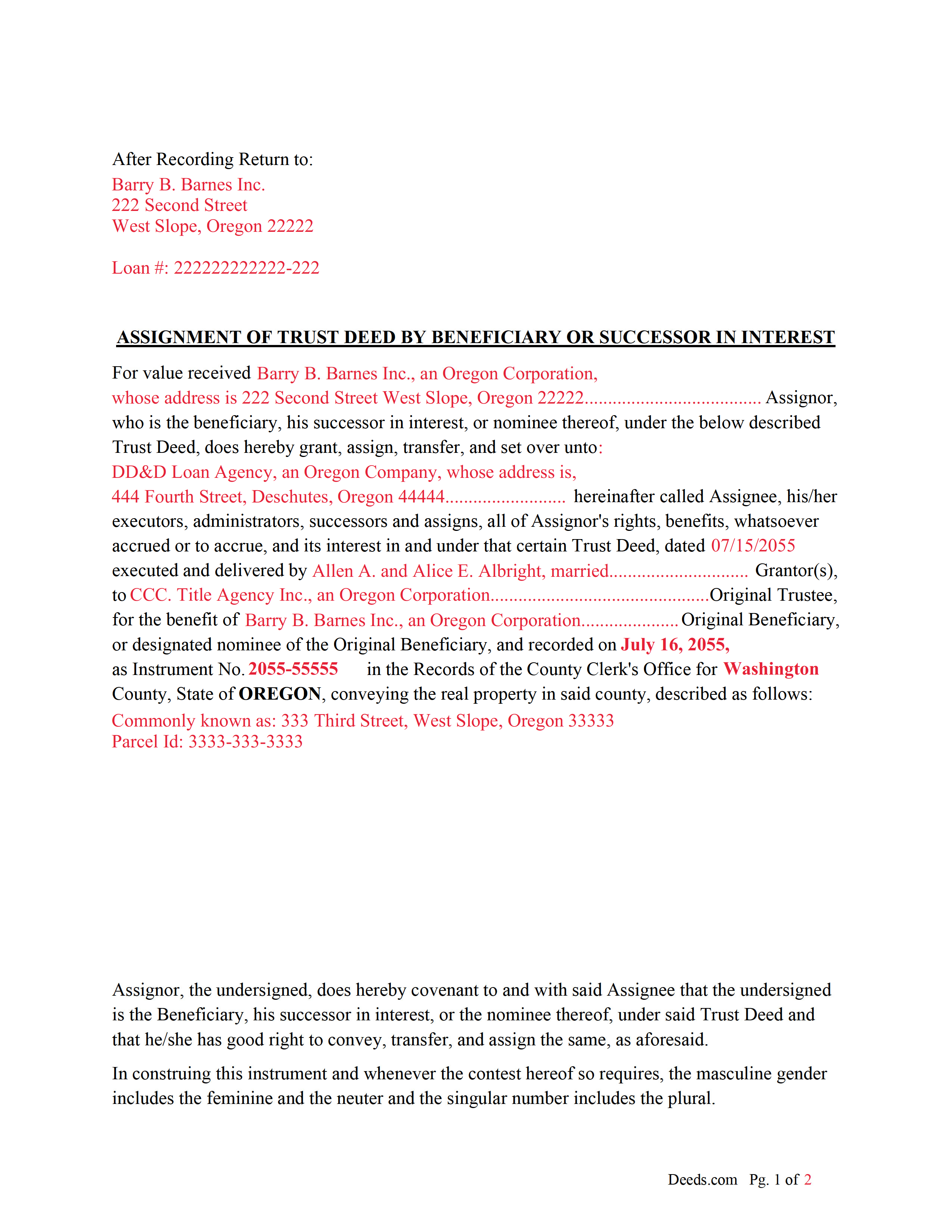

Marion County Completed Example of Assignment of Trust Deed Document

Example of a properly completed form for reference.

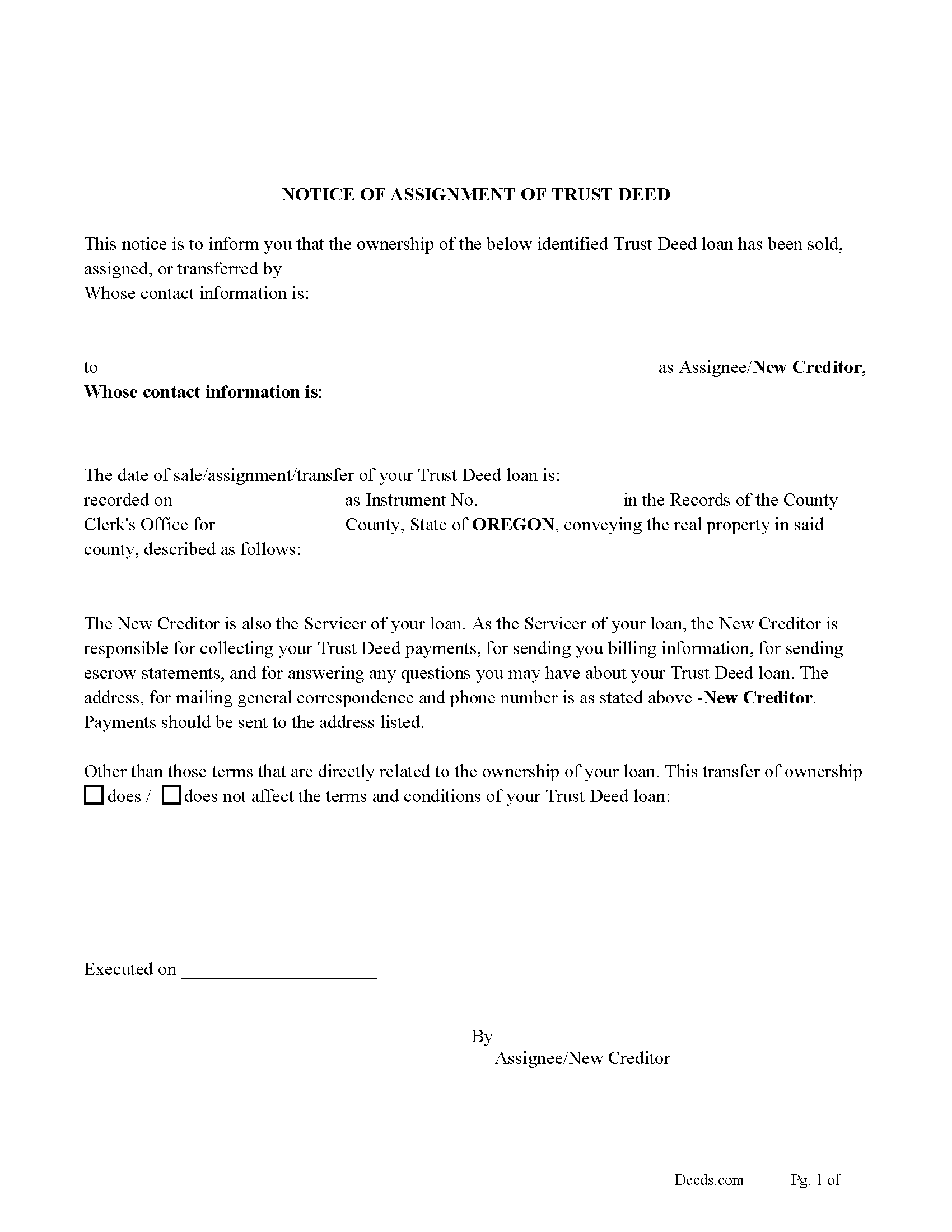

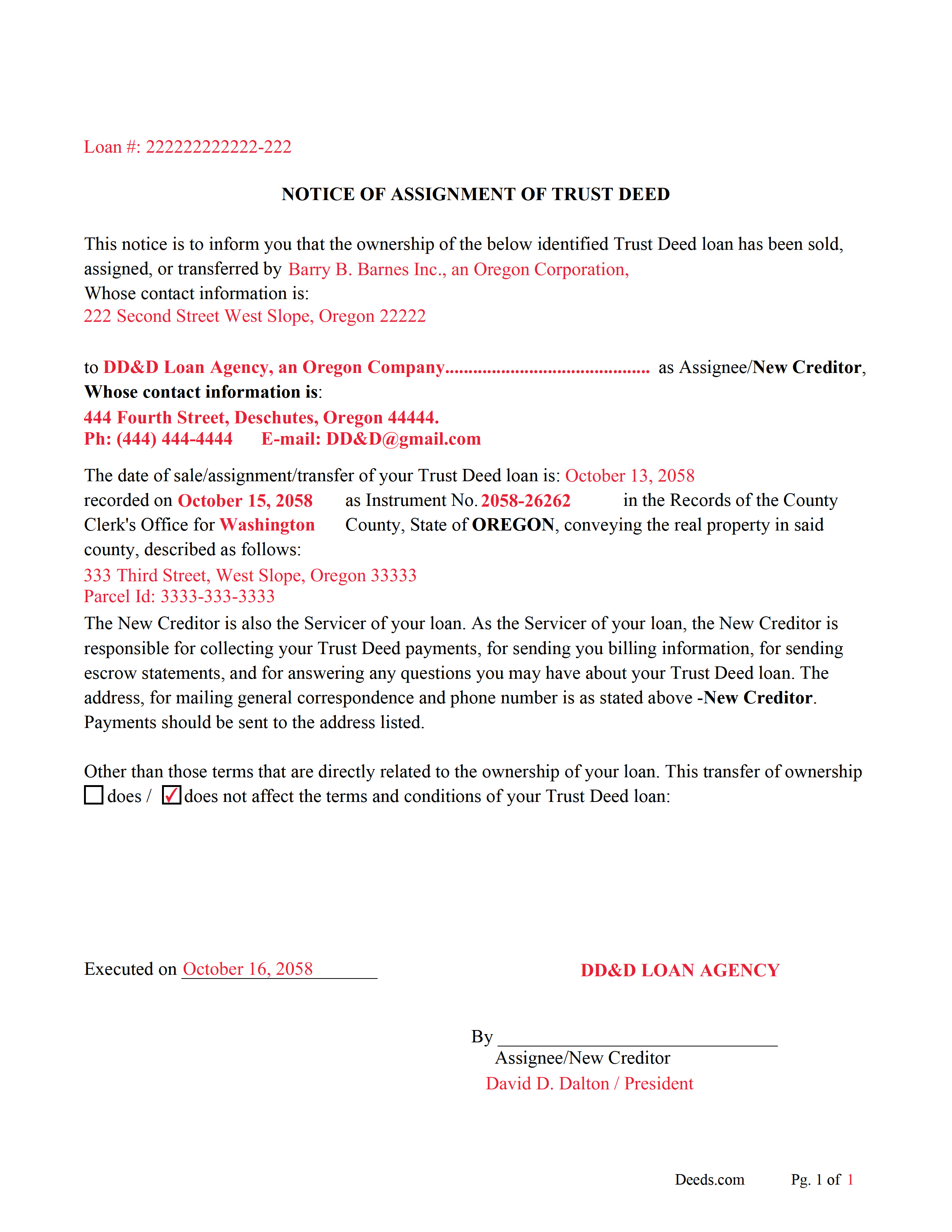

Marion County Notice of Assignment of Trust Deed Form

Fill in the blank form formatted to comply with content requirements.

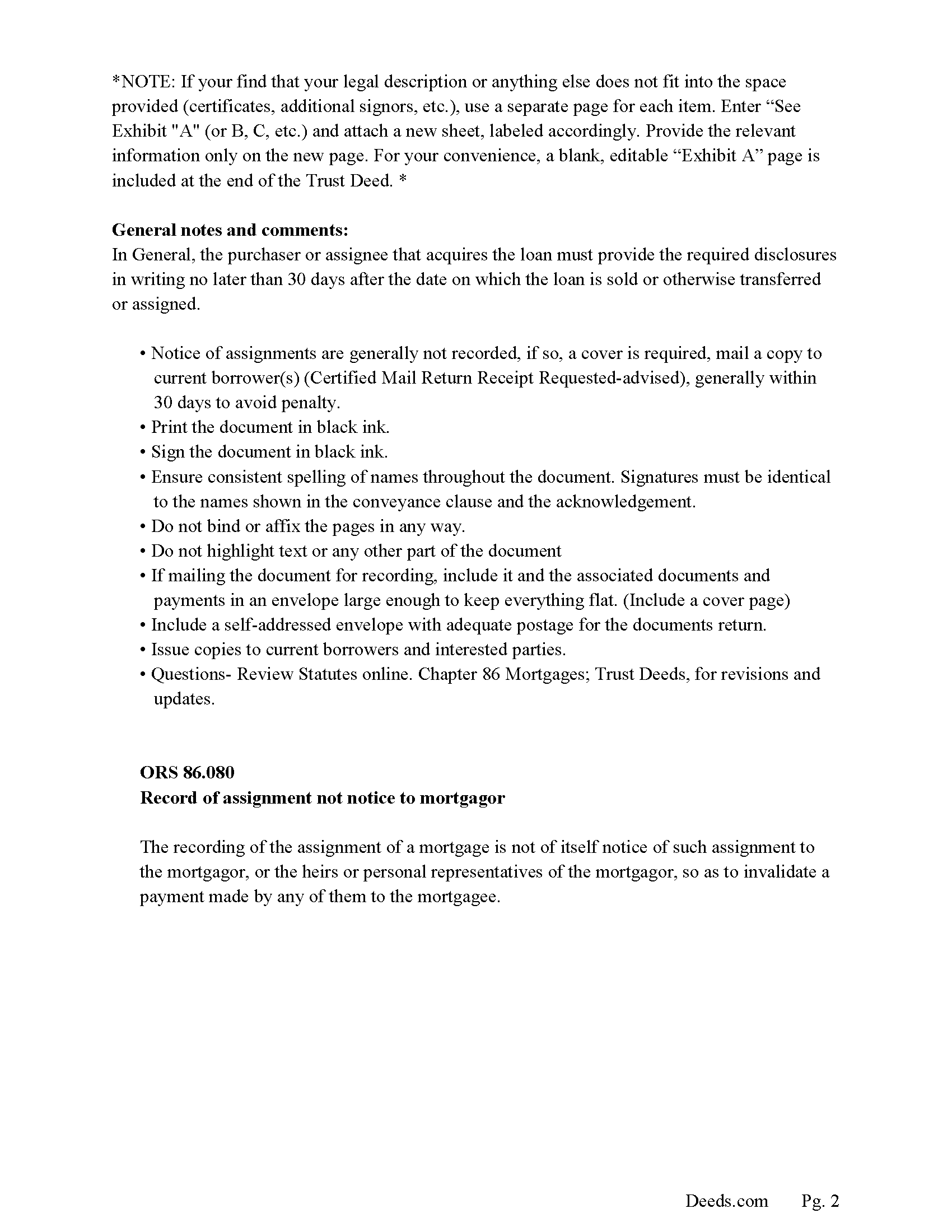

Marion County Notice of Assignment Guidelines

Line by line guide explaining every blank on the form.

Marion County Notice of Assignment-Completed Example

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Oregon and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion County Clerk

Salem, Oregon 97309

Hours: 8:30 to 5:00 M-F

Phone: (503) 588-5225

Recording Tips for Marion County:

- Ask if they accept credit cards - many offices are cash/check only

- Check margin requirements - usually 1-2 inches at top

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Aumsville

- Aurora

- Detroit

- Donald

- Gates

- Gervais

- Hubbard

- Idanha

- Jefferson

- Keizer

- Mehama

- Mount Angel

- Saint Benedict

- Saint Paul

- Salem

- Scotts Mills

- Silverton

- Stayton

- Sublimity

- Turner

- Woodburn

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (503) 588-5225 for current fees.

Questions answered? Let's get started!

In this form the assignment/transfer of a Trust Deed/Deed of Trust is made by the beneficiary/lender or successor in interest.

("Trust deed" means a deed executed in conformity with ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) that conveys an interest in real property to a trustee in trust to secure the performance of an obligation the grantor or other person named in the deed owes to a beneficiary.) (ORS 86.705(8))

("Beneficiary" means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).) (ORS 86.705(2))

ORS 86.060 Assignment of mortgage Mortgages may be assigned by an instrument in writing, executed and acknowledged with the same formality as required in deeds and mortgages of real property, and recorded in the records of mortgages of the county where the land is situated.

ORS 86.715 Trust deed deemed to be mortgage on real property A trust deed is deemed to be a mortgage on real property and is subject to all laws relating to mortgages on real property except to the extent that such laws are inconsistent with the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced), in which event the provisions of ORS 86.705 (Definitions for ORS 86.705 to 86.815) to 86.815 (Time within which foreclosure must be commenced) shall control. For the purpose of applying the mortgage laws, the grantor in a trust deed is deemed the mortgagor and the beneficiary is deemed the mortgagee.

Included are "Notice of Assignment of Trust Deed" forms. The current Mortgagor/Borrower/Grantor must be notified of the assignment, generally within 30 days to avoid penalty.

ORS 86.080 Record of assignment not notice to mortgagor

The recording of the assignment of a mortgage is not of itself notice of such assignment to the mortgagor, or the heirs or personal representatives of the mortgagor, so as to invalidate a payment made by any of them to the mortgagee.

(Oregon Assignment Package includes form, guidelines, and completed example) For use in Oregon only.

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Assignment of Trust Deed by Beneficiary or Successor in Interest meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Assignment of Trust Deed by Beneficiary or Successor in Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4584 Reviews )

Cynthia H.

February 20th, 2023

The entire process was simple and easy, from purchasing, downloading and saving the documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tonya B.

September 9th, 2021

Easy process. Thanks for making this resource available.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William U.

December 1st, 2020

Prompt service, reasonable price.

Thank you!

Jamal .

July 29th, 2020

So far so good!

Thank you!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Ernest B.

June 6th, 2021

Forms were perfect, recorded quickly with no issue.

Thank you!

Ronald C.

January 31st, 2019

My goal was to find the Covenant, Conditions, and Restrictions for my HOA. From what I can read, these documents should be attached to our Deed (single family, patio home in New Hanover County). I am not sure if I have a copy of my Deed. I would need to check my Safe Deposit Box. Unfortunately, I was not successful at finding these documents from your Website. If you can help me find them, I would appreciate that.

It is most common to obtain a copy of CC&Rs directly from the HOA. Alternatively, they are also usually a matter of public record recorded with the local recorder and you can obtain a copy there.

Munir S.

August 2nd, 2024

Good service. Easy to use, responsive, fast, and fairly priced. First time user, will continue to use it for future needs. Recommend.

Thank you for your positive words! We’re thrilled to hear about your experience.

jerry k.

May 27th, 2021

very easy to download, works great

Thank you for your feedback. We really appreciate it. Have a great day!

Larry J.

May 20th, 2019

we are hoping this is what we need. Thanks

Thank you!

Mike H.

February 11th, 2021

Great

Thank you!

Melanie K.

December 27th, 2019

Great service! Super easy to use! I used the service to download a deed notice to do a TOD on a property in Fairfax County, VA. Just a heads up that Fairfax County required me to add the last deed book and page # onto the deed notice but otherwise all was just as they required!

Thank you!

Georgia R.

March 29th, 2023

Great experience, fast and efficient, no hassle. Will use again!

Thank you for your feedback. We really appreciate it. Have a great day!

Edward O.

January 28th, 2020

east too do.. hope it works thanks

Thank you!

Karen S.

October 19th, 2021

Deeds.com made everything easy, with instructions and samples it was simple to fill out the forms. I loved that it was county specific.

Thank you for your feedback. We really appreciate it. Have a great day!